South Carolina Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

Are you in a place that you require documents for possibly enterprise or specific functions just about every working day? There are a variety of lawful record templates available on the Internet, but finding types you can trust is not easy. US Legal Forms provides a huge number of form templates, such as the South Carolina Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, which are published in order to meet state and federal specifications.

Should you be already knowledgeable about US Legal Forms site and also have a merchant account, simply log in. Next, it is possible to obtain the South Carolina Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers format.

Should you not offer an bank account and wish to begin using US Legal Forms, follow these steps:

- Get the form you will need and make sure it is for the right town/state.

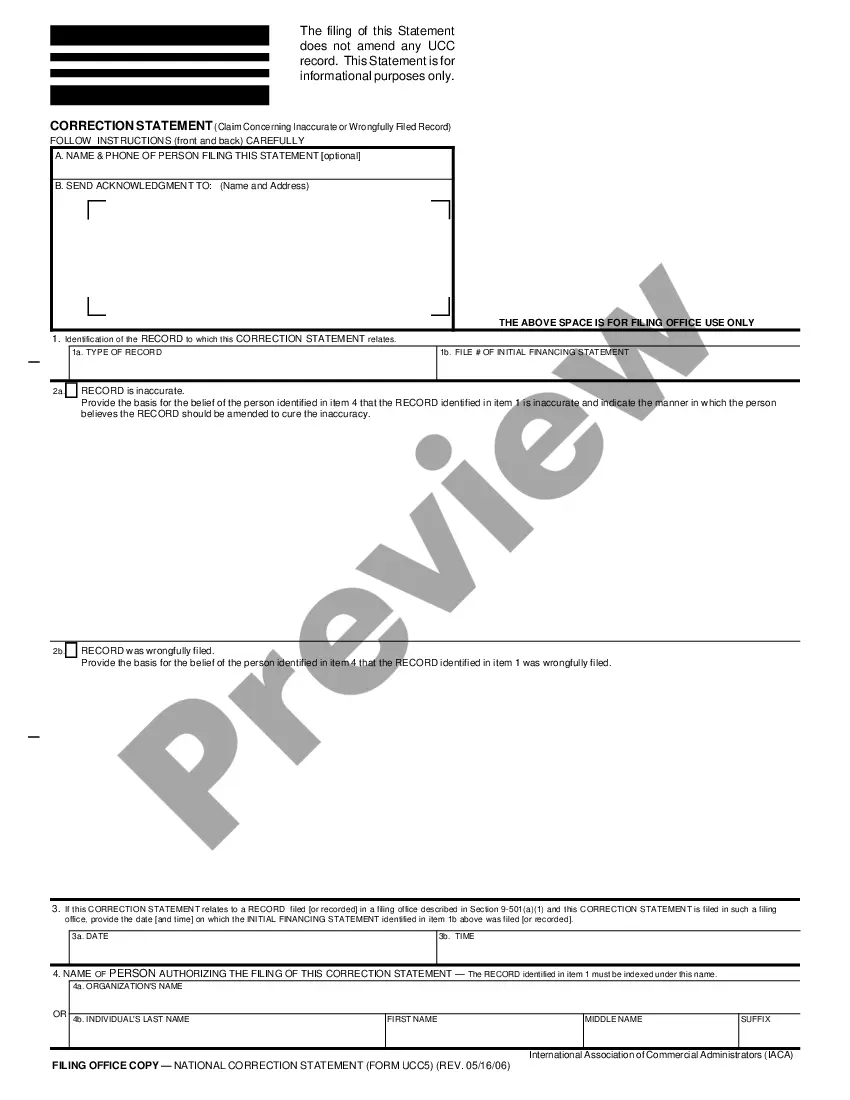

- Make use of the Preview button to examine the form.

- Browse the explanation to actually have chosen the right form.

- In the event the form is not what you`re searching for, use the Look for discipline to obtain the form that meets your needs and specifications.

- When you discover the right form, click Acquire now.

- Choose the prices prepare you desire, submit the desired info to produce your account, and purchase an order utilizing your PayPal or charge card.

- Decide on a hassle-free document format and obtain your version.

Locate each of the record templates you may have bought in the My Forms food list. You may get a additional version of South Carolina Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers whenever, if required. Just click on the essential form to obtain or print out the record format.

Use US Legal Forms, probably the most comprehensive variety of lawful kinds, to save time and prevent faults. The service provides expertly made lawful record templates that can be used for an array of functions. Generate a merchant account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

ESO taxation begins when the options are exercised, and taxes are calculated based on the spread between the current Fair Market Value (FMV) and the strike price. Taxes are also paid when the resulting shares are sold (whether through an IPO, M&A, or private market secondary sale).

Stock options grant employees the right to purchase shares, but it's not an obligation for them to do so. ISOs have the potential for favorable tax treatment. If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Summary of ISO vs. NSO Differences Incentive Stock Options (ISOs)Non-Qualified Stock Options (NSOs)Eligible RecipientsEmployees onlyAny service provider (e.g. employees, advisors, consultants, directors)Tax at GrantNo tax eventNo tax event10 more rows

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.