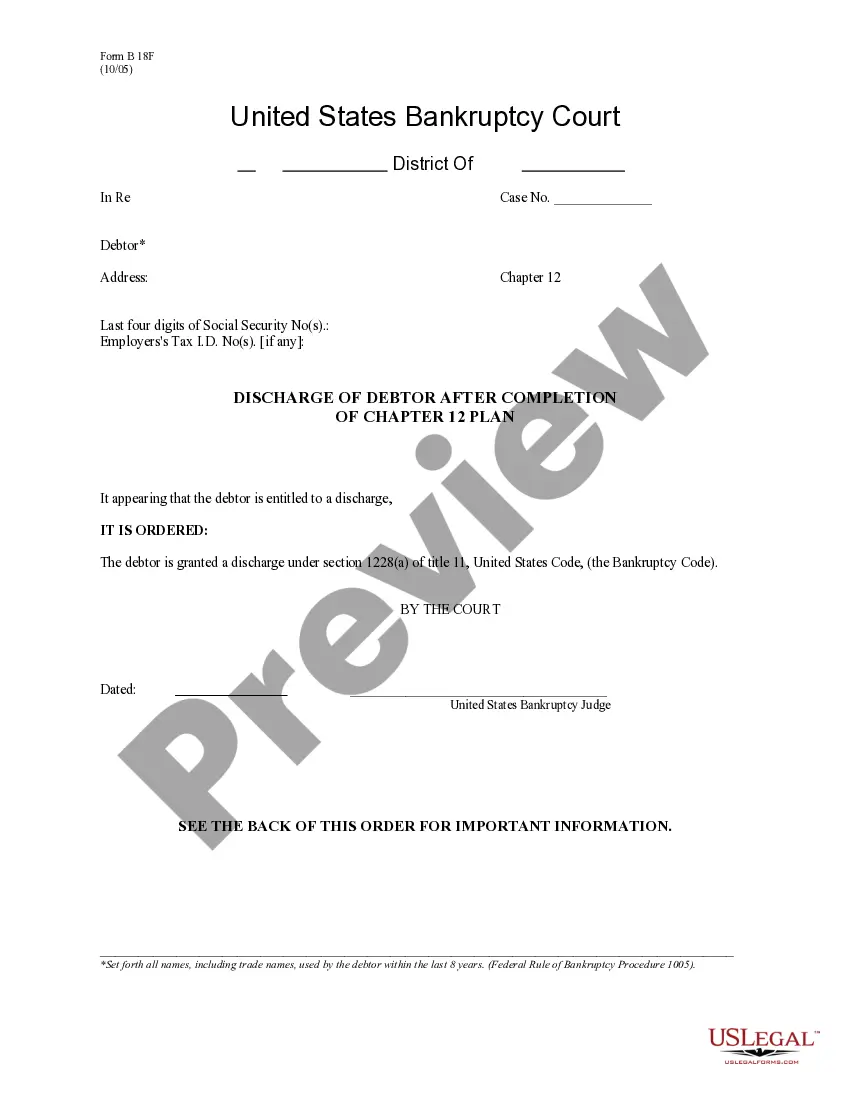

South Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

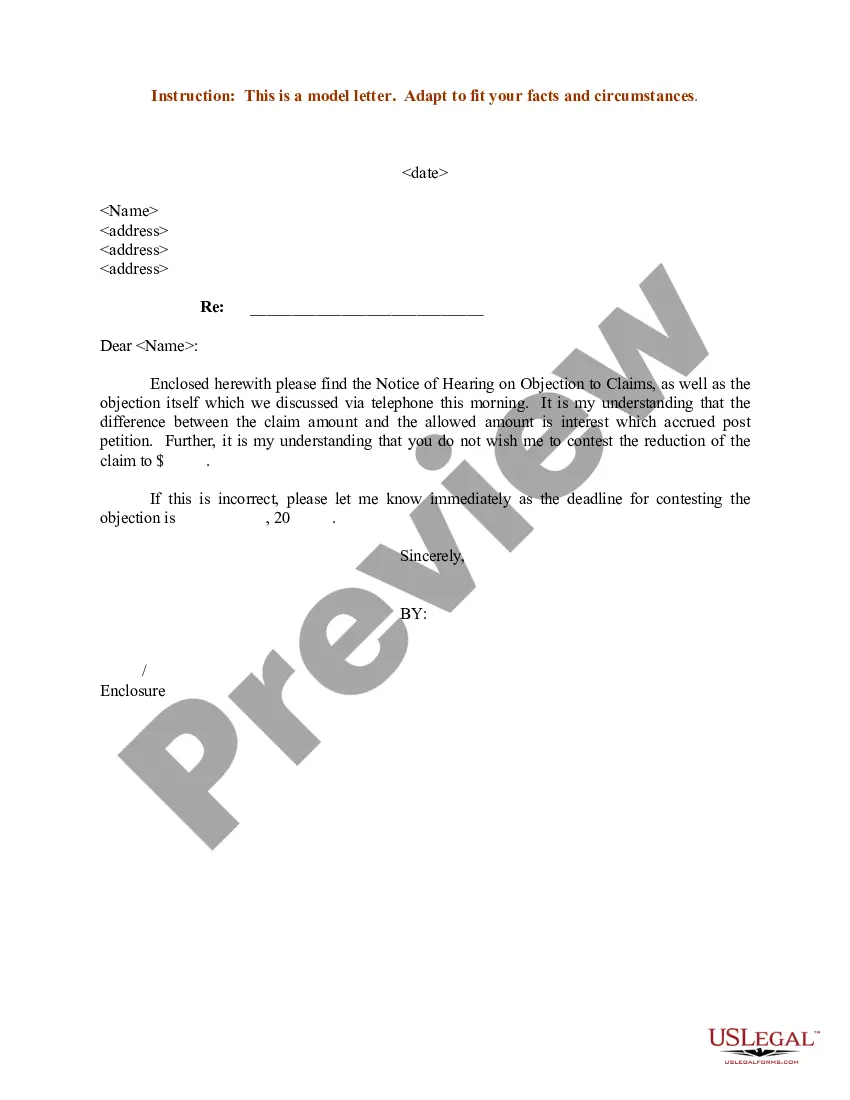

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

If you have to total, download, or print out lawful record web templates, use US Legal Forms, the biggest selection of lawful kinds, that can be found on-line. Use the site`s basic and hassle-free lookup to get the documents you want. Numerous web templates for business and specific uses are categorized by groups and states, or keywords. Use US Legal Forms to get the South Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form with a few mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your bank account and then click the Down load switch to have the South Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. You may also entry kinds you in the past acquired from the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for the correct metropolis/land.

- Step 2. Make use of the Review method to check out the form`s articles. Do not overlook to read through the description.

- Step 3. Should you be unsatisfied with the form, make use of the Look for industry towards the top of the display to find other variations in the lawful form template.

- Step 4. When you have identified the shape you want, select the Buy now switch. Pick the costs strategy you favor and add your references to sign up on an bank account.

- Step 5. Approach the transaction. You should use your charge card or PayPal bank account to finish the transaction.

- Step 6. Select the file format in the lawful form and download it on your gadget.

- Step 7. Complete, change and print out or signal the South Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

Every lawful record template you buy is the one you have permanently. You possess acces to every form you acquired inside your acccount. Click on the My Forms section and choose a form to print out or download once more.

Contend and download, and print out the South Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form with US Legal Forms. There are many professional and express-specific kinds you may use for your personal business or specific requires.

Form popularity

FAQ

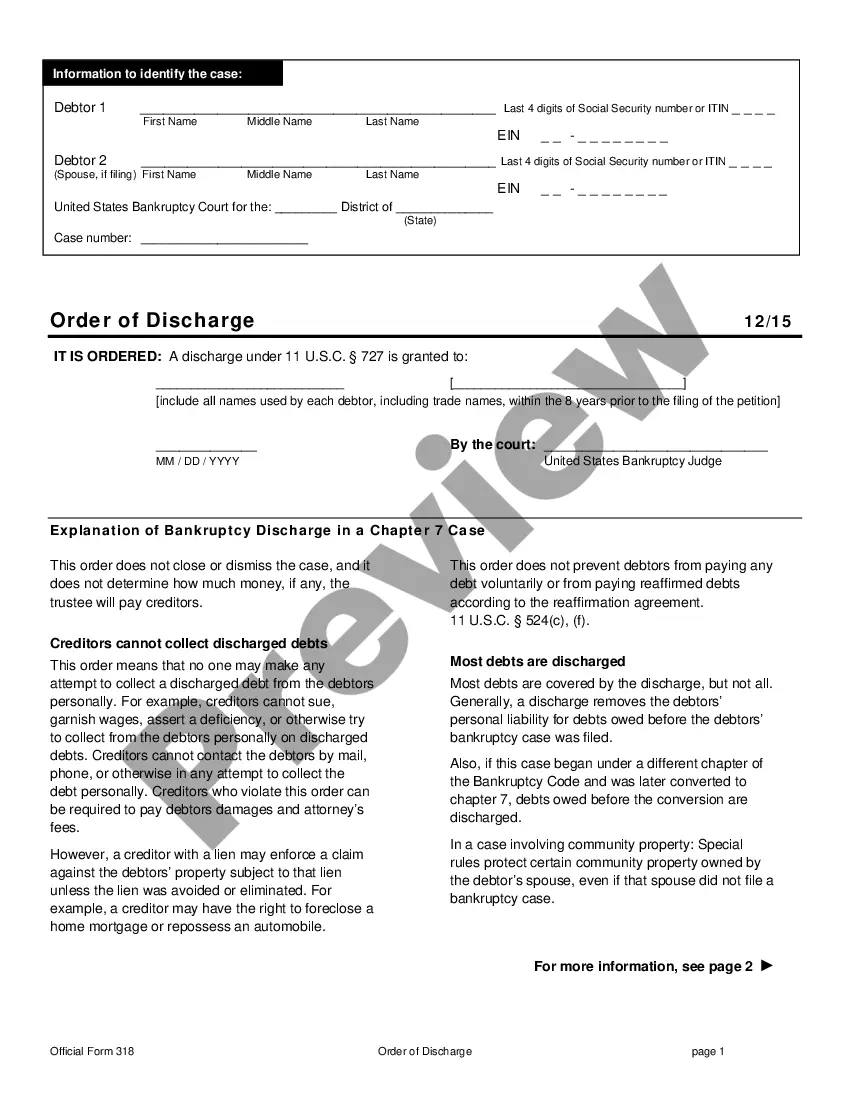

One of the primary purposes of bankruptcy is to discharge certain debts to give an honest individual debtor a "fresh start." The debtor has no liability for discharged debts. In a chapter 7 case, however, a discharge is only available to individual debtors, not to partnerships or corporations. 11 U.S.C. § 727(a)(1).

A Chapter 7 bankruptcy can take four to six months to do, from the time you file to when you receive a final discharge ? meaning you no longer have to repay your debt. Various factors shape how long it takes to complete your bankruptcy case. You will have to take care of some tasks before you file.

CHAPTER 7 BANKRUPTCY TIMELINE Day 1: File Bankruptcy Petition with Court & Pay Filing Fees. Day 13 to 33: (7 Days BEFORE Meeting of Creditors) Deadline to Provide Tax Returns to Trustee. Day 20 to 40: Meeting of Creditors - also called 341(a) Meeting. Day 80 to 100: (60 Days AFTER First Date Set. ... DISCHARGE GRANTED.

The Court enters an order discharging individual Debtors after all requirements are met, but no sooner than the last day to object to the Debtor's Discharge. This is usually 60 days after the 1st setting of the 341 Meeting of Creditors unless a motion is filed with the court to extend that time.

Subsection (b) specifies that the discharge granted under this section discharges the debtor from all debts that arose before the date of the order for relief. It is irrelevant whether or not a proof of claim was filed with respect to the debt, and whether or not the claim based on the debt was allowed.

In most cases, a Chapter 7 bankruptcy can stay on your credit reports for up to 10 years from the date you file bankruptcy. Once the 10-year period ends, the bankruptcy should fall off your credit reports automatically.

A Chapter 7 bankruptcy discharge releases individuals from personal liability for most of their outstanding debts. It also shields them from creditor collection actions. This can be a complicated process. So, it's important to seek professional legal guidance before commencing the bankruptcy proceedings.

Chapter 7 Doesn't Wipe Out Mortgage Liens Even though a Chapter 7 bankruptcy discharge wipes out your obligation to pay back the loan, it doesn't eliminate the mortgage lien. If it did, everyone could file bankruptcy and own their homes free and clear.