South Carolina Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Worksheet Analyzing A Self-Employed Independent Contractor?

US Legal Forms - one of the largest libraries of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. In moments, you can find the most recent forms like the South Carolina Worksheet Evaluating a Self-Employed Independent Contractor.

If you already have a subscription, Log In to download the South Carolina Worksheet Evaluating a Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded South Carolina Worksheet Evaluating a Self-Employed Independent Contractor. Every template you have added to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the desired form. Access the South Carolina Worksheet Evaluating a Self-Employed Independent Contractor through US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

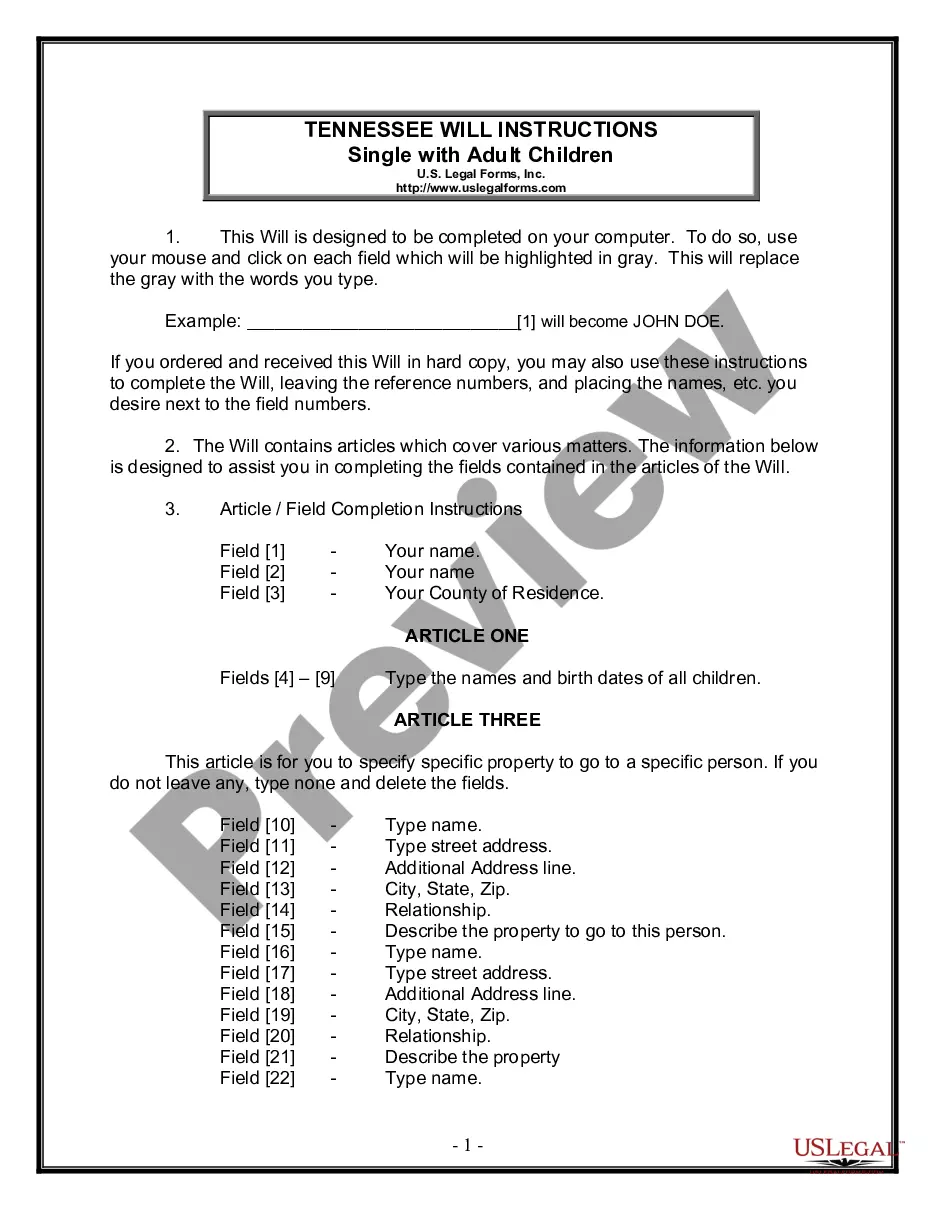

- To use US Legal Forms for the first time, follow these simple instructions to get started.

- Ensure you have selected the correct form for your state/region. Choose the Preview option to view the form's details.

- Review the form description to make sure that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

Self-employment taxes for independent contractors are calculated based on your net earnings, which you find on Schedule C. Typically, this includes both Social Security and Medicare taxes. Use the South Carolina Worksheet Analyzing a Self-Employed Independent Contractor to aid in estimating these taxes accurately and help you understand your obligations.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Here is a list of some of the things you can write off on your 1099 if you are self-employed:Mileage and Car Expenses.Home Office Deductions.Internet and Phone Bills.Health Insurance.Travel Expenses.Meals.Interest on Loans.Subscriptions.More items...?

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Accrual Method Accounting When you operate a business providing services as an independent contractor, you have the option of using the accrual method of accounting for your contractor earnings and expenses while reporting your personal income and deductions using the cash method.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

To calculate gross income, add up your total sales revenue, then subtract any refunds and the cost of goods sold. Add in any extra income such as interest on loans, and you have your gross income for the business year.

Accrual. Choosing between cash basis and accrual basis accounting should be a non-issue for many construction companies given that any firm that needs to produce GAAP financial statements must use accrual.