South Carolina Personal Guaranty - Guarantee of Lease to Corporation

Description

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

Selecting the appropriate licensed document format may be a challenge. It goes without saying that there is an array of templates accessible on the internet, but how will you find the licensed version you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the South Carolina Personal Guaranty - Guarantee of Lease to Corporation, suitable for both business and personal purposes. All the documents are reviewed by professionals and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Acquire button to obtain the South Carolina Personal Guaranty - Guarantee of Lease to Corporation. Use your account to browse the legal documents you may have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

Complete, modify, print, and sign the obtained South Carolina Personal Guaranty - Guarantee of Lease to Corporation. US Legal Forms is the largest repository of legal documents where you can find various file templates. Take advantage of the service to acquire correctly crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are easy steps for you to follow.

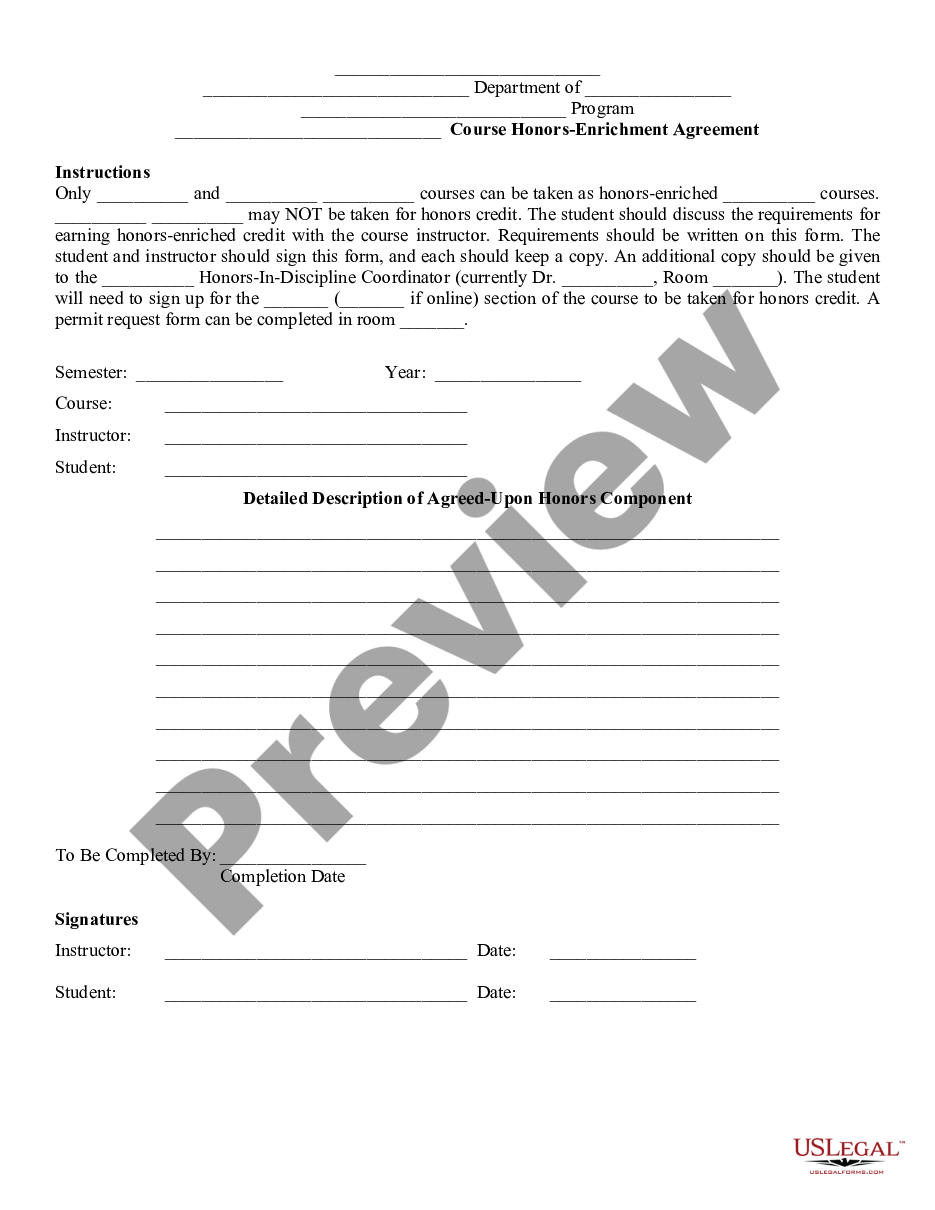

- First, ensure you have chosen the correct document for your city/state. You can review the template using the Review button and examine the document details to confirm it’s right for you.

- If the template does not meet your requirements, use the Search box to find the appropriate document.

- Once you are confident that the template is suitable, click the Get now button to acquire the document.

- Select the pricing plan you wish and enter the required details. Create your account and finalize your purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

When a personal guarantee is given, the principals of the company pledge their own assets and agree to repay a debt from personal capital in case the company defaults. In short, the business owner or principal becomes a cosigner on the credit application.