South Carolina Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

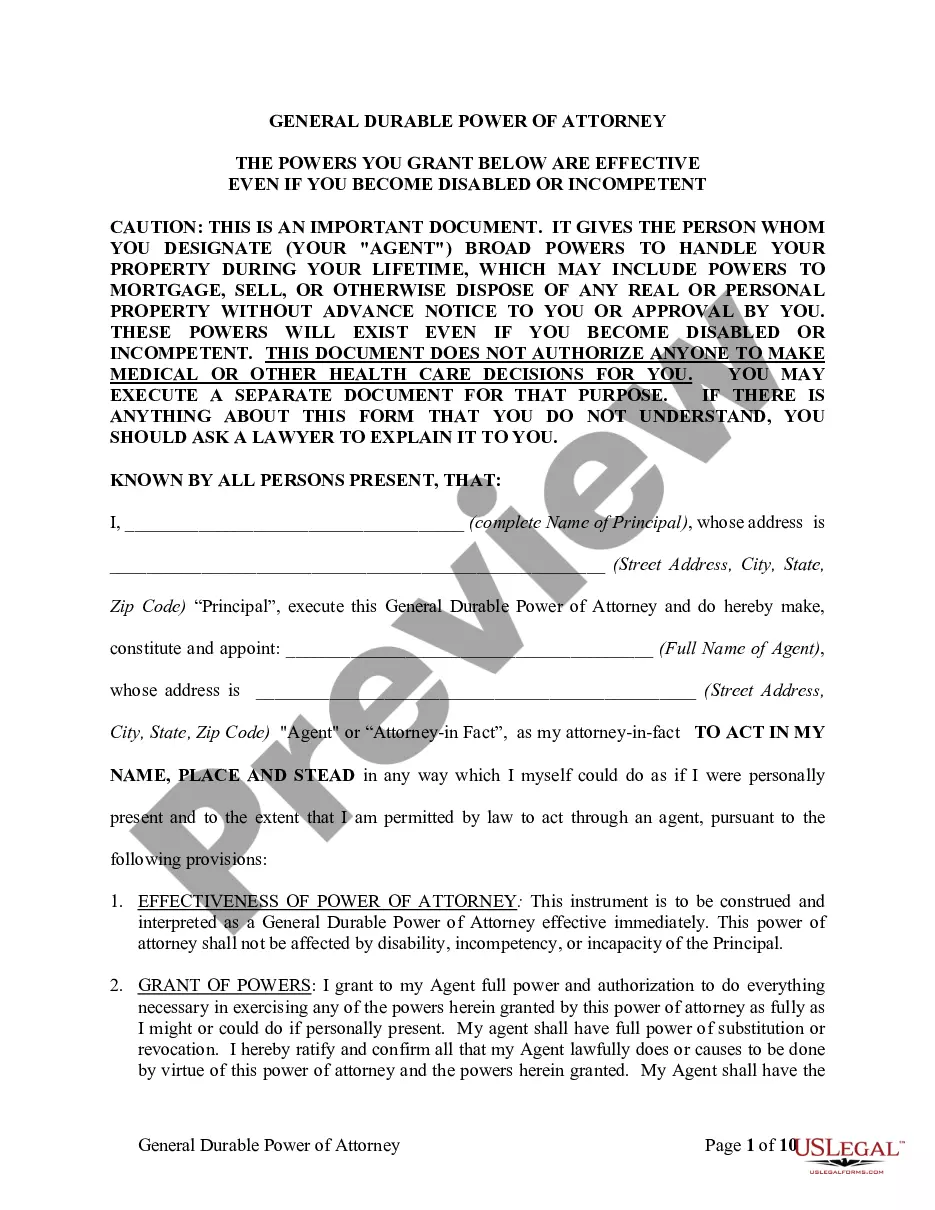

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

US Legal Forms - one of many most significant libraries of legitimate forms in America - provides a wide array of legitimate document web templates you may obtain or print out. While using internet site, you can get 1000s of forms for enterprise and person reasons, categorized by categories, says, or keywords and phrases.You will find the newest versions of forms much like the South Carolina Self-Employed Independent Contractor Employment Agreement - commission for new business in seconds.

If you have a subscription, log in and obtain South Carolina Self-Employed Independent Contractor Employment Agreement - commission for new business through the US Legal Forms collection. The Obtain option can look on every single type you view. You have access to all in the past saved forms from the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, listed here are easy recommendations to obtain started off:

- Make sure you have picked the proper type for your personal town/county. Go through the Preview option to check the form`s content. Look at the type explanation to actually have selected the proper type.

- In case the type doesn`t suit your demands, utilize the Research field near the top of the display to obtain the one which does.

- When you are happy with the form, affirm your choice by simply clicking the Get now option. Then, opt for the rates program you prefer and provide your qualifications to register on an accounts.

- Approach the deal. Make use of your credit card or PayPal accounts to complete the deal.

- Pick the format and obtain the form in your gadget.

- Make alterations. Complete, change and print out and indication the saved South Carolina Self-Employed Independent Contractor Employment Agreement - commission for new business.

Each and every web template you included with your money lacks an expiration date and is your own permanently. So, if you want to obtain or print out another copy, just visit the My Forms portion and click in the type you need.

Get access to the South Carolina Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms, one of the most comprehensive collection of legitimate document web templates. Use 1000s of specialist and status-specific web templates that satisfy your company or person requires and demands.

Form popularity

FAQ

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.