South Carolina Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Selecting the appropriate legal document format can be challenging. It is clear that there are numerous templates available online, but how can you find the legal form you desire? Utilize the US Legal Forms website.

The service provides thousands of templates, such as the South Carolina Separation Notice for 1099 Employee, which can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and meet federal and state requirements.

If you are already a member, Log In to your account and click the Download button to obtain the South Carolina Separation Notice for 1099 Employee. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents tab in your account to download another copy of the document you need.

Finally, complete, edit, and print, then sign the acquired South Carolina Separation Notice for 1099 Employee. US Legal Forms is the largest library of legal forms where you can find various document templates. Take advantage of the service to obtain professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

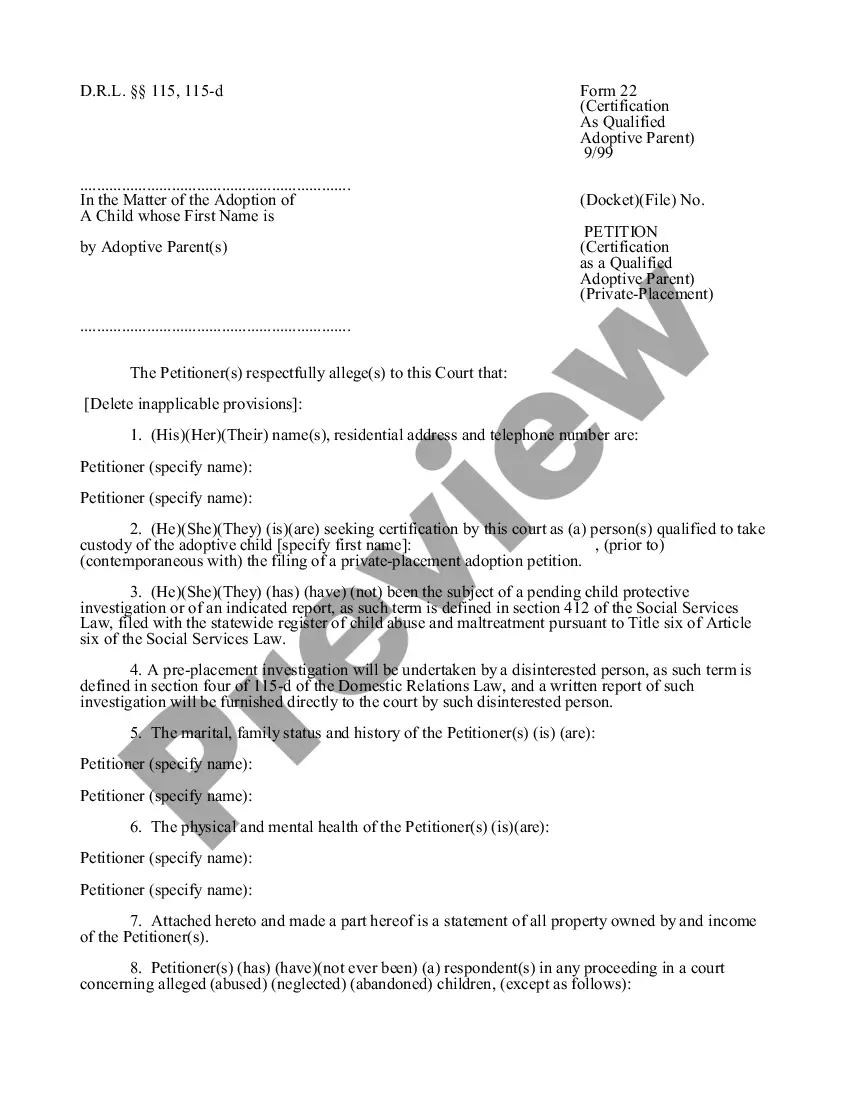

- First, make sure you have chosen the correct form for your city/county. You can preview the form using the Review button and read the form description to ensure this is the right one for you.

- If the form does not meet your requirements, use the Search box to find the appropriate form.

- Once you confirm that the form is correct, click the Buy now button to obtain the form.

- Select the pricing plan you want and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document format to your device.

Form popularity

FAQ

Because independent contractors pay self-employment tax, employers typically do not have to withhold taxes from their wages. There is, however, an exception known as backup withholding.

If an independent contractor can show that his employer's negligence caused his injuries, he would be entitled to the same compensation as an employee working for the non-subscriber employer. This includes damages for his medical bills, lost wages, and pain and suffering.

The Pandemic Unemployment Assistance (PUA) applications began Friday. This is for the self-employed, gig-workers, contractors, 1099s, and individuals not eligible for regular unemployment or the first program of the CARES Act. South Carolina is one of the first wave of states to offer these resources.

How do I write a termination letter to an employee?Add the employee name, ID number, position, and department.Add the name of manager or supervisor handling termination.Include any severance, benefits, and compensation the employee is entitled to.Detail any company property employee is expected to return.More items...

South Carolina's Department of Employment and Workforce (DEW) issued a notice effective April 16, 2020, requiring all employers to provide employees with a Notification of the Availability of Unemployment Insurance Benefits upon separation of employment.

How Long Does An Employer Have To Provide A Separation Certificate? An employer has to provide a Separation Certification within 14 days of the Employee or Centrelink requesting it.

In South Carolina, businesses with four or more employees are required to carry workers' compensation insurance. That includes full-time employees, part-time employees, and family members. This is true for nonprofit organizations as well.

As an employer, you have legal obligations when you terminate an employee. For example, if you are an employer terminating an employee, you must complete an employment separation certificate upon request. Indeed, it is important that as an employer you take such obligations seriously to avoid issues in the future.

An independent contractor in South Carolina is typically not required to purchase worker's compensation insurance for themselves. However, independent contractors may be required to have a workers' comp insurance policy if they have four or more employees of their own.

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.