South Carolina Notice of Disputed Account

Description

How to fill out Notice Of Disputed Account?

It is feasible to spend multiple hours online searching for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal documents that are reviewed by professionals.

You can obtain or create the South Carolina Notice of Disputed Account from my services.

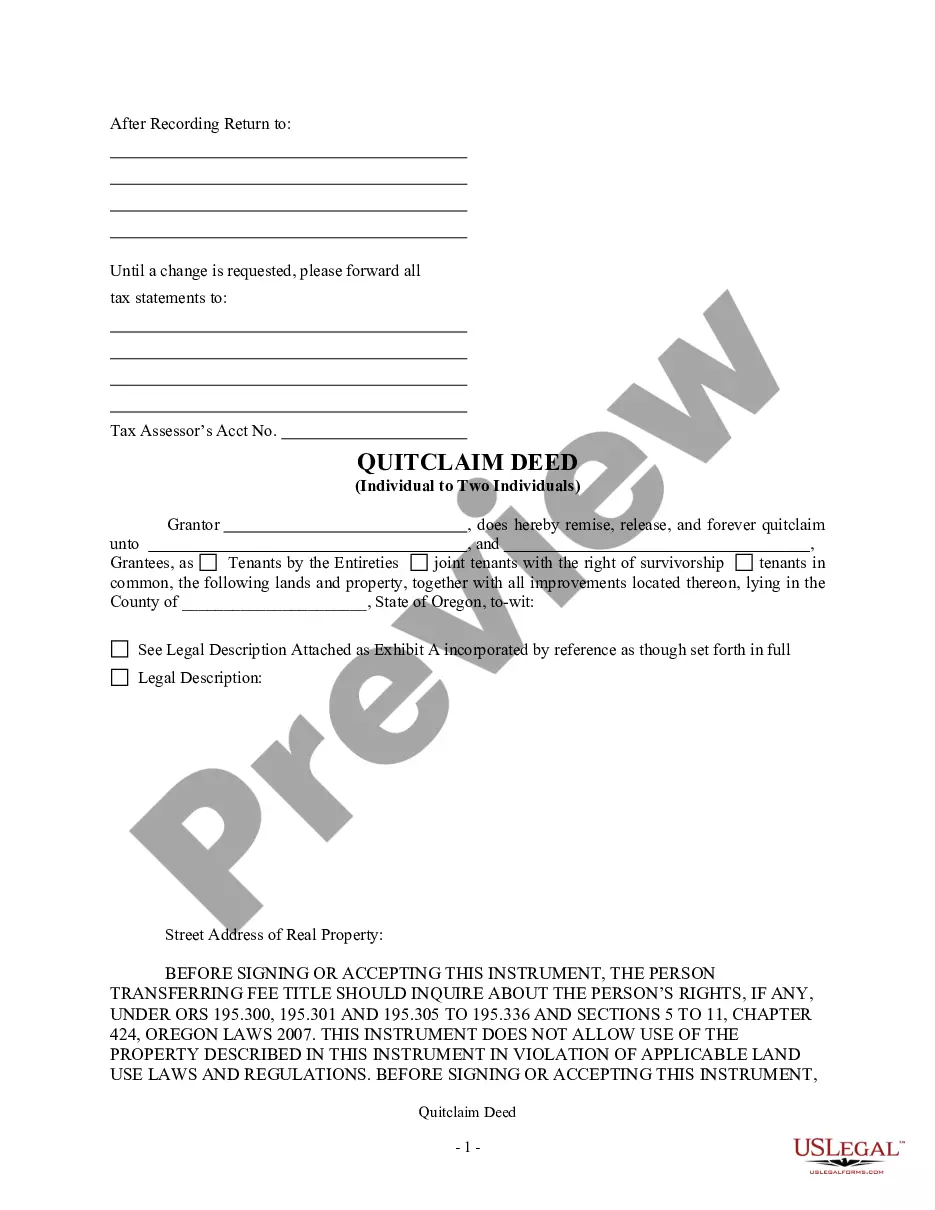

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can fill out, modify, create, or sign the South Carolina Notice of Disputed Account.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Review the form details to confirm that you have selected the right document.

Form popularity

FAQ

yearold debt can still be collected, but it depends on the type of debt and if legal action has begun. While most debts become uncollectible after three years in South Carolina, collectors sometimes still attempt to pursue old debts. Understanding your rights is crucial, and a South Carolina Notice of Disputed Account helps you assert your position regarding any outdated claims.

Creditors can potentially seek to foreclose on your home if you default on specific secured debts, such as mortgages. However, they must follow legal procedures and obtain a court order. If you face this threat, it is wise to consider filing a South Carolina Notice of Disputed Account to dispute the debt or negotiate a resolution.

Creditors in South Carolina generally have three years to initiate legal action for debt collection. This timeframe begins from the last payment or acknowledgment of the debt. If this period passes, filing a South Carolina Notice of Disputed Account can help protect your rights and clarify any lingering obligations.

In South Carolina, the statute of limitations for most debts is three years. This means that after three years, creditors typically cannot enforce the collection of debts in court. However, understanding how this affects your South Carolina Notice of Disputed Account is vital, as some debts may still be pursued by collectors despite being past the deadline.

South Carolina law on debt collection emphasizes fair treatment for consumers. Debt collectors must follow specific guidelines, ensuring that they do not engage in misleading practices. If you believe your debt is incorrect, you may file a South Carolina Notice of Disputed Account to challenge the claim.

To respond to a credit card judgment, first, comprehend the specific terms and implications of the judgment issued against you. You can challenge the judgment if you believe it is unjust or based on inaccurate information. The South Carolina Notice of Disputed Account can guide you through potential disputes. Seeking assistance from an experienced attorney or USLegalForms may enhance your chances of resolving the issue favorably.

Responding to a credit card judgment in South Carolina requires you to file a notice of appeal or a motion to contest the judgment promptly. Review the judgment details carefully, identifying any errors or disputes. The South Carolina Notice of Disputed Account can serve as a helpful resource in crafting your response. Having the right legal support, such as USLegalForms, can simplify this process.

To get out of a credit card judgment, you may file a motion to vacate the judgment in court, arguing valid reasons why the judgment should be set aside. Evidence such as proof of payment or a dispute can be crucial in your defense. Utilizing the South Carolina Notice of Disputed Account can support your case. Always consider consulting a legal expert to explore your options.

Filing a rule to show cause in South Carolina involves submitting a written motion to the court, explaining your request and the grounds for it. Make sure to include relevant evidence and documentation. The process can be complex, so referencing the South Carolina Notice of Disputed Account can provide you with essential information. Legal platforms like USLegalForms can assist with the necessary forms and procedures.

In South Carolina, a credit card judgment remains valid for ten years from the date it is entered by the court. After this period, the creditor must renew the judgment to continue enforcement. Understanding the implications of the South Carolina Notice of Disputed Account can help you manage this process. It’s advisable to stay informed about your rights regarding judgments.