South Carolina Warranty Agreement as to Web Site Software

Description

How to fill out Warranty Agreement As To Web Site Software?

You can invest time online attempting to discover the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the South Carolina Warranty Agreement concerning Web Site Software from our service.

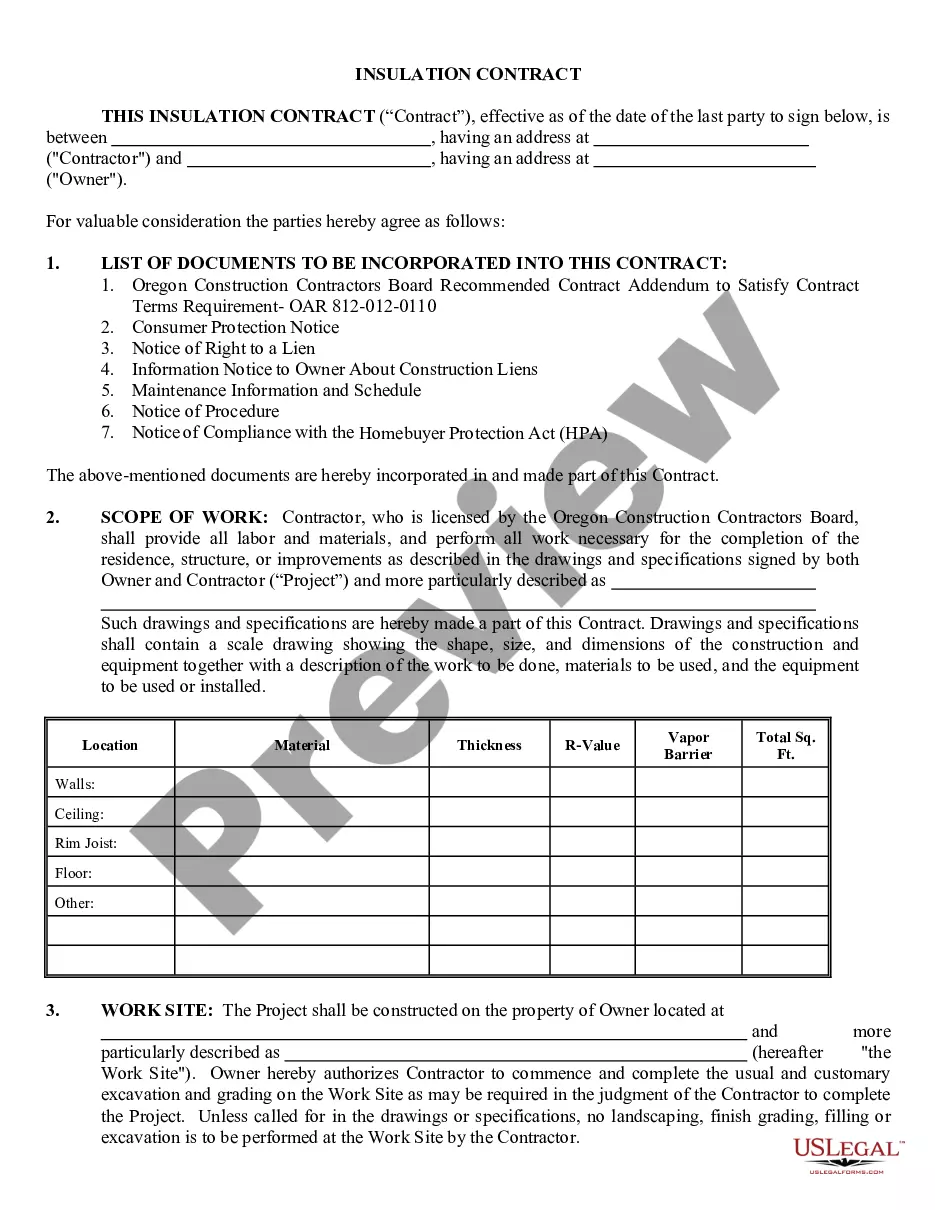

If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the South Carolina Warranty Agreement regarding Web Site Software.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/region of your preference.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

Requirements for prewritten software are still subject to sales and use tax regardless of the method of delivery (whether with a physical medium, downloadable or accessed via the Internet) or if possession or control is given.

The majority of states which have addressed the issue and have concluded that software (at least unbundled software) is not tangible personal property for ad valorem tax purposes and therefore is generally not taxable.

Any custom software that is delivered through electronic means or via the load and leave method is not considered tangible personal property nor subject to sales tax. However, it is only tax-exempt if separately stated on the invoice from charges for manuals, disks, CDs or other tangible property, which is taxable.

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

In the state of South Carolina, any modifications that are made to canned software that are prepared exclusively for a specific customer are considered to be taxable custom programs, not exempt. Sales of digital products are exempt from the sales tax in South Carolina.

Subscriptions to use online-hosted software are not taxable. Charges for maintenance or upgrades to online hosting software are not taxable, even if separately stated. Digital products are products provided to a customer electronically. Usually, a customer is given access to the product through the Internet or email.

In a recent private letter ruling, the South Carolina Department of Revenue held that software subscription services are tangible personal property subject to sales and use taxes.

Software sold and delivered to a purchaser electronically is not subject to the sales and use tax.

In a recent private letter ruling, the South Carolina Department of Revenue held that software subscription services are tangible personal property subject to sales and use taxes.

Sales of digital products are exempt from the sales tax in South Carolina.