South Carolina Cash Disbursements and Receipts

Description

How to fill out Cash Disbursements And Receipts?

Have you ever been in a situation where you required documentation for either professional or personal reasons almost constantly.

There are numerous authentic document templates available online, but locating forms that you can trust is challenging.

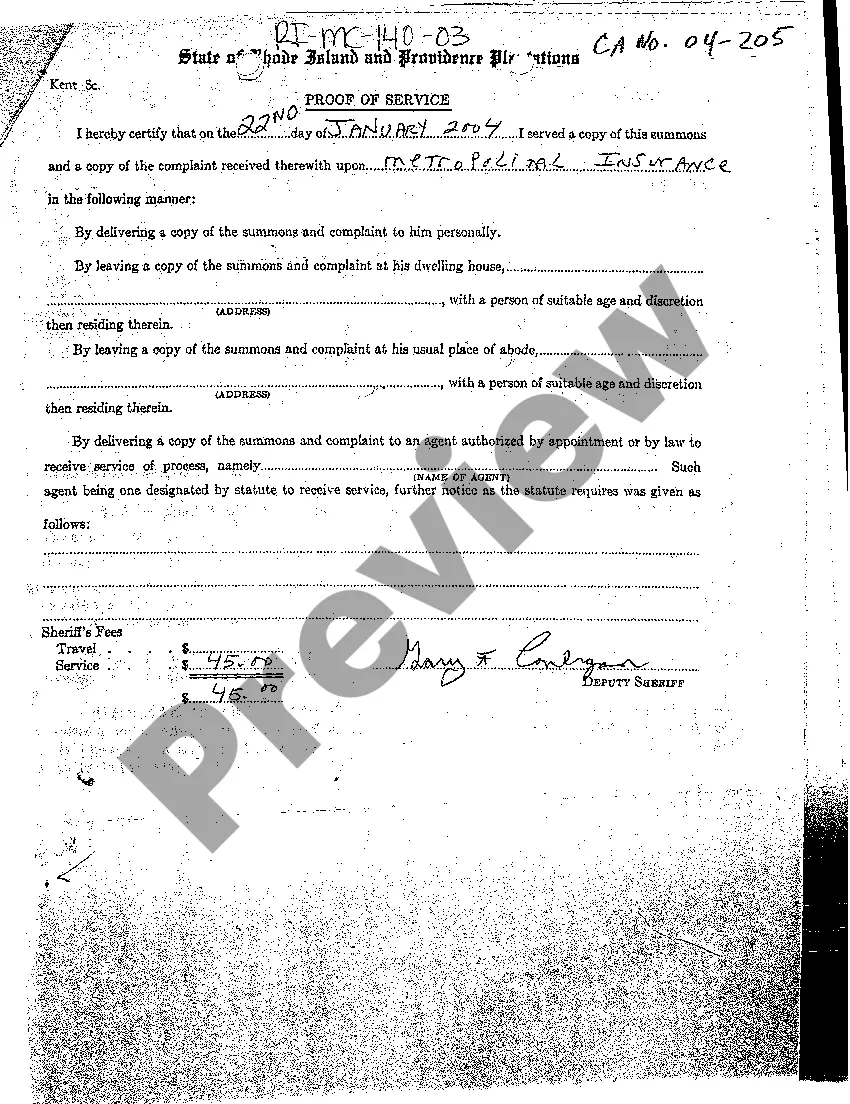

US Legal Forms offers a wide array of form templates, including the South Carolina Cash Disbursements and Receipts, which can be generated to comply with state and federal regulations.

Choose the payment plan you prefer, complete the required information to create your account, and pay for the order using your PayPal, Visa, or Mastercard.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Cash Disbursements and Receipts template.

- If you do not have an account and want to start utilizing US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/county.

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form does not match your needs, take advantage of the Search box to find the form that fits your requirements.

- Once you find the suitable form, click Get now.

Form popularity

FAQ

Yes, South Carolina requires some taxpayers to make estimated tax payments. This typically applies if you expect to owe $1,000 or more in taxes when you file your return. Understanding the implications on your budget, especially in relation to South Carolina Cash Disbursements and Receipts, is crucial. For assistance with tracking your obligations, explore the tools available at uslegalforms.

As of now, South Carolina is not eliminating state income tax. However, discussions about tax reform are ongoing, and changes may occur in the future. It is important to stay informed about South Carolina Cash Disbursements and Receipts to manage your financial obligations effectively. For further guidance on state taxes, consider using resources from uslegalforms.

In South Carolina Cash Disbursements and Receipts, CRJ refers to the Cash Receipts Journal, while CPJ stands for the Cash Payments Journal. The CRJ records all cash inflows, which include payments received from customers or clients. Conversely, the CPJ documents cash outflows, such as payments made to suppliers or for operational expenses. Understanding the distinction between these journals is crucial for accurate financial tracking and reporting.

The SC 1065 form is required for partnerships conducting business in South Carolina. All partnership entities must file, even if they do not owe taxes or have no taxable income. Filing SC 1065 accurately is essential for proper management of South Carolina Cash Disbursements and Receipts, and resources like UsLegalForms can streamline this process.

Income tax rates in South Carolina can vary from 0% to 7%, depending on your income level. It's important to understand these rates when calculating your obligations as they directly affect your South Carolina Cash Disbursements and Receipts. Utilizing resources such as UsLegalForms can help you accurately estimate your tax liability and ensure compliance.

In South Carolina, these income types are typically not taxable: Social Security benefits, child support payments, and certain veterans' benefits. Knowing what constitutes non-taxable income can help you better plan your finances and manage cash flow regarding South Carolina Cash Disbursements and Receipts. For more detailed guidelines on taxable income, we recommend consulting UsLegalForms.

Certain types of income are not included in taxable income in South Carolina. This includes gifts, inheritances, and certain types of life insurance benefits. Understanding what qualifies as non-taxable income can be beneficial when preparing your financial plans and managing your South Carolina Cash Disbursements and Receipts effectively. Resources like UsLegalForms can assist you in determining taxable versus non-taxable income.

In South Carolina, the deadline to file your taxes typically falls on April 15. However, if that date lands on a weekend or holiday, you may file your taxes the following business day. It's crucial to remain aware of these dates to stay compliant with South Carolina Cash Disbursements and Receipts regulations, avoiding any potential penalties. Consider using UsLegalForms to ensure timely submissions.

MyDORWAY SC is an online portal that allows South Carolinians to access various services provided by the Department of Revenue, including child support information. Users can manage their cases, make payments, and track their financial activities through this platform. Utilizing MyDORWAY SC can greatly enhance your experience with South Carolina Cash Disbursements and Receipts.

SDU stands for State Disbursement Unit, which plays a pivotal role in the management of child support payments in South Carolina. The SDU ensures that payments are collected from non-custodial parents and accurately distributed to custodial parents. Familiarity with the SDU is key for understanding the processes associated with South Carolina Cash Disbursements and Receipts.