South Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

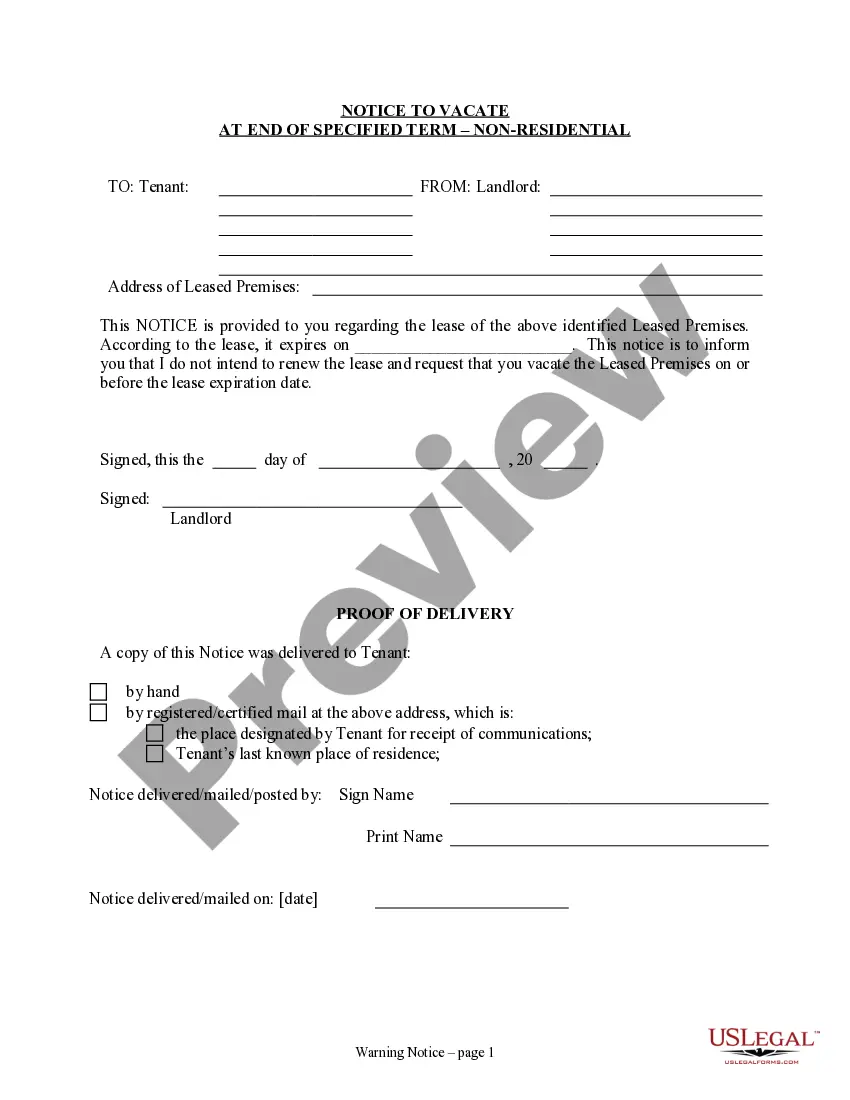

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

If you need to full, down load, or print lawful document web templates, use US Legal Forms, the greatest variety of lawful types, that can be found on-line. Use the site`s simple and easy handy research to discover the files you need. Numerous web templates for company and individual reasons are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the South Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax in just a couple of click throughs.

Should you be presently a US Legal Forms customer, log in to the profile and click on the Down load option to get the South Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Also you can access types you earlier downloaded from the My Forms tab of the profile.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form to the proper city/region.

- Step 2. Make use of the Preview choice to examine the form`s articles. Never forget about to read through the outline.

- Step 3. Should you be not satisfied together with the kind, take advantage of the Research field on top of the screen to locate other variations of your lawful kind web template.

- Step 4. After you have identified the form you need, click on the Get now option. Pick the rates plan you choose and add your references to register for the profile.

- Step 5. Method the deal. You should use your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Select the file format of your lawful kind and down load it in your gadget.

- Step 7. Complete, revise and print or signal the South Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

Every single lawful document web template you acquire is your own property eternally. You possess acces to each and every kind you downloaded within your acccount. Click the My Forms portion and decide on a kind to print or down load again.

Remain competitive and down load, and print the South Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax with US Legal Forms. There are millions of specialist and express-distinct types you can use for the company or individual requirements.

Form popularity

FAQ

You have rights under federal law if this happens to you. The Fair Credit Reporting Act (FCRA) is the federal law that, among other rights, gives you the right to dispute incomplete or inaccurate information. The credit reporting company must take certain steps when you notify them of an error.

What do I do if I see an inquiry I don't recognize on my credit report? Contact the lender directly to ask them about the inquiry. If they find it was made in error, ask them to inform the credit reporting agencies. If the lender finds the inquiry was made fraudulently, report it to the FTC.

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if you're willing, you can spend big bucks on templates for these magical dispute letters.

If you have a document that you would like to submit to substantiate a dispute regarding the information on your personal credit report, you can mail it to Experian's National Consumer Assistance Center at P.O. Box 4500, Allen, TX 75013, or upload your document at experian.com/upload to submit it online.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus ? Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Credit Bureau Used by State Cardholders in Alabama, Colorado, Georgia and South Carolina saw TransUnion reports receive a hard inquiry more than they saw the other bureaus' reports see one.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.