South Carolina Worksheet for Location of Important Documents

Description

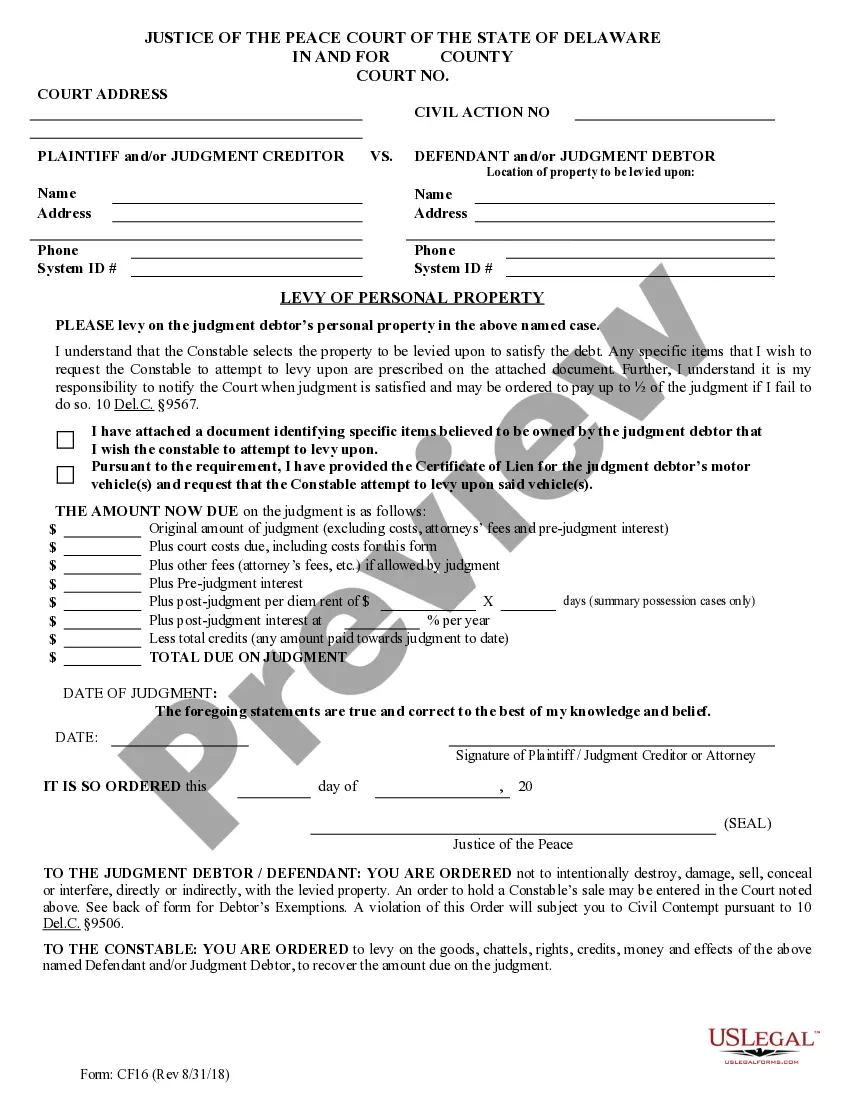

How to fill out Worksheet For Location Of Important Documents?

Are you presently in a scenario where you frequently require paperwork for either business or personal purposes.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the South Carolina Worksheet for Location of Important Documents, designed to comply with federal and state regulations.

If you locate the appropriate form, click on Buy now.

Select the pricing plan you prefer, provide the required information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the South Carolina Worksheet for Location of Important Documents template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Examine the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that fits your requirements.

Form popularity

FAQ

South Carolina residents should file an SC1040. A part-year resident or nonresident of South Carolina should file an SC1040 with a completed Schedule NR (Nonresident Schedule) attached. You can file your South Carolina tax return using one of the following methods: Electronic filing using a professional tax preparer.

South Carolina does not tax Social Security retirement benefits. It also provides a $15,000 taxable income deduction for seniors receiving any other type of retirement income. The state has some of the lowest property taxes in the country.

When mailing your return: You must include a copy of your federal income tax return (including schedules) and any income tax returns you filed with other states. Be sure to include enough postage to avoid having your mail carrier return your forms.

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return. 2022

Qualified retirement income is income from plans defined in IRC 401, 403, 408, and 457, and all public employee retirement plans of the federal, state, and local governments, including individual retirement plans, Keogh plans, and military retirement.

YES. State of Wisconsin requires it.

Instructions - 2020 SC1040 - South Carolina Individual Income Tax Return. Line p-4 through line p-6: Military retirement deduction. An individual with military retirement income included in their South Carolina taxable income may take a deduction up to the amount of military retirement income.

Common reasons the SCDOR may send you a notice: You have a balance due. You are due a larger or smaller refund. We have a question about your return or need additional information or documents.

If you have an approved Federal tax extension (IRS Form 4868) and you're due a South Carolina tax refund, you will automatically be granted a South Carolina extension. In this case, you do not need to file Form SC4868.

If you do not anticipate an Income Tax liability and you have been granted a federal extension of time to file a federal Income Tax return, the SCDOR will accept a copy of the federal extension. In this case, you do not need to send South Carolina a copy of the federal form by the due date of the tax return.