South Carolina Indemnification Agreement for a Trust

Description

How to fill out Indemnification Agreement For A Trust?

US Legal Forms - one of the most prominent collections of legal forms in the United States - offers a wide variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the South Carolina Indemnification Agreement for a Trust in just seconds.

If you have a monthly subscription, Log In and download the South Carolina Indemnification Agreement for a Trust from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Make changes. Fill out, modify, and print and sign the saved South Carolina Indemnification Agreement for a Trust.

Every template you add to your account has no expiration date, so it is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Carolina Indemnification Agreement for a Trust with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you want to utilize US Legal Forms for the first time, here are simple instructions to help you get started.

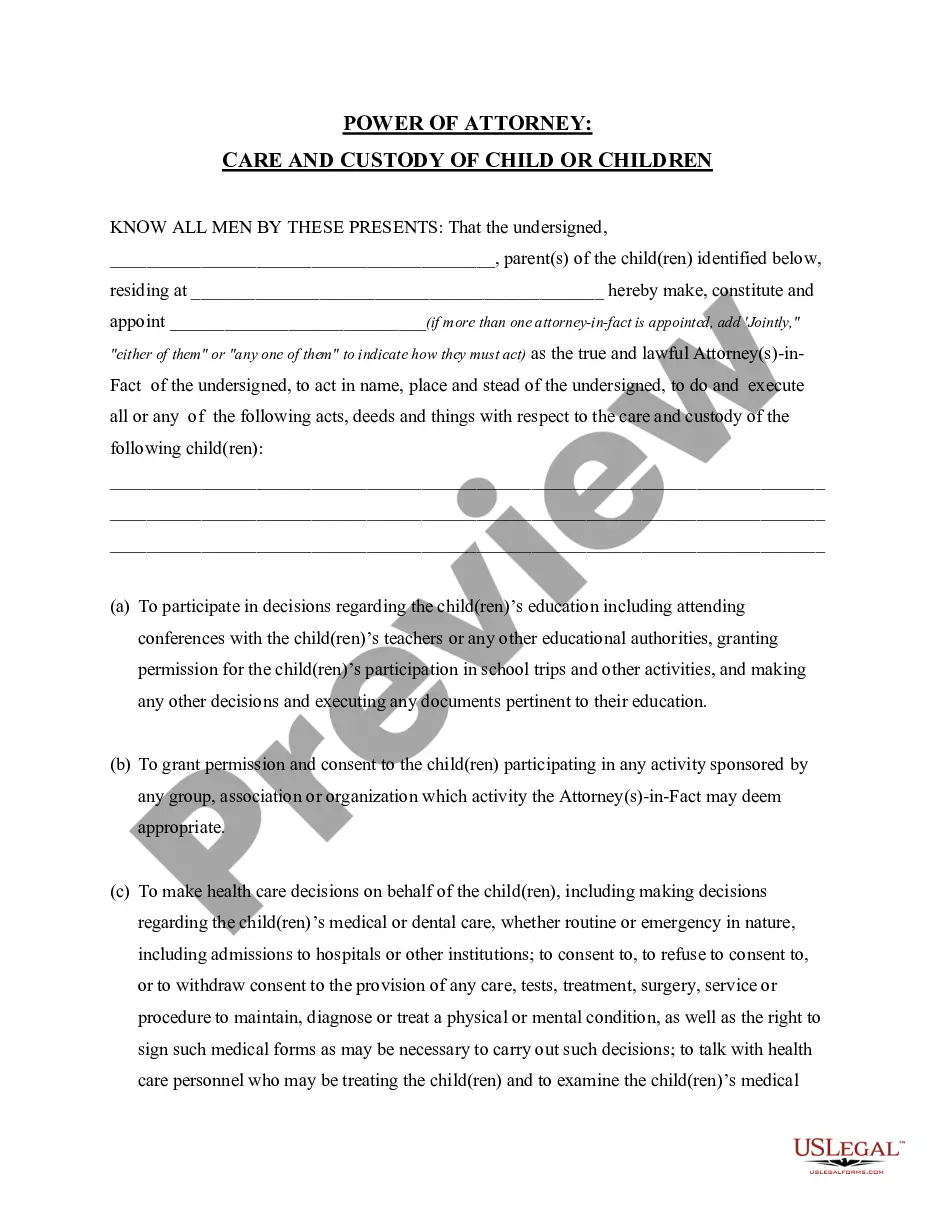

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content. Check the form description to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- When you are happy with the form, confirm your choice by clicking the Buy Now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

A release and indemnity agreement, also called an indemnity agreement or a hold harmless agreement, is a legal contract that releases a party from specific liabilities. Essentially, one party in the contract agrees to pay for all potential losses or damages caused by the other party.

An agreement to compensate for a loss or damage incurred by an individual or business.

Indemnification provisions are generally enforceable. There are certain exceptions however. Indemnifications that require a party to indemnify another party for any claim irrespective of fault ('broad form' or 'no fault' indemnities) generally have been found to violate public policy.

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

Protection of Loss: A contract of indemnity is entered into for the purpose of protecting the promisee from the loss. The loss may be caused due to the conduct of the promisor or any other person.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

To indemnify means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

Indemnification clauses are clauses in contracts that set out to protect one party from liability if a third-party or third entity is harmed in any way. It's a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,