South Carolina Sample Letter for Claim to Funds

Description

How to fill out Sample Letter For Claim To Funds?

Choosing the right legitimate record template can be a struggle. Obviously, there are tons of templates accessible on the Internet, but how would you obtain the legitimate form you need? Take advantage of the US Legal Forms site. The assistance provides 1000s of templates, like the South Carolina Sample Letter for Claim to Funds, that can be used for company and private requirements. All of the forms are inspected by professionals and meet up with state and federal demands.

When you are currently listed, log in to the account and click the Down load key to obtain the South Carolina Sample Letter for Claim to Funds. Use your account to search with the legitimate forms you might have ordered formerly. Go to the My Forms tab of your own account and get one more copy in the record you need.

When you are a fresh user of US Legal Forms, allow me to share basic guidelines that you should follow:

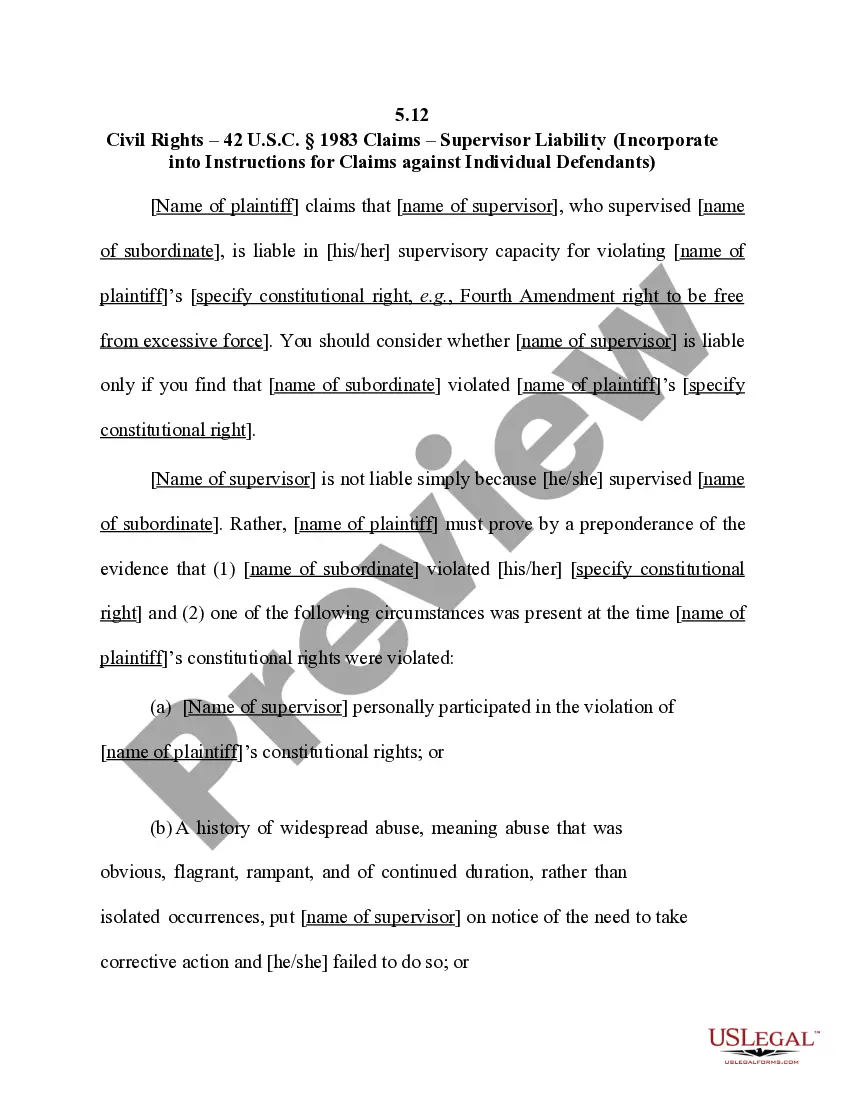

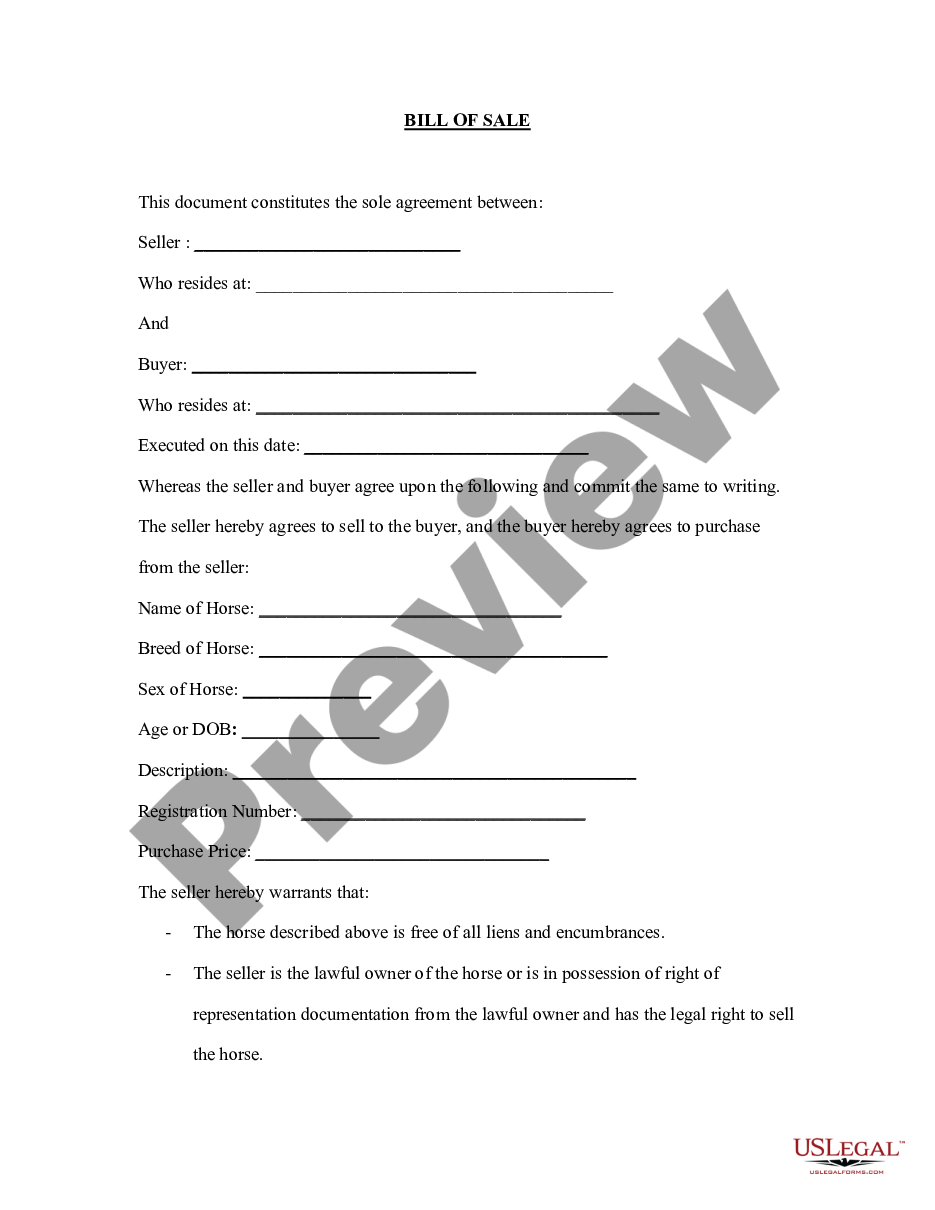

- Initially, make sure you have chosen the correct form for the city/county. You can look through the form while using Preview key and study the form information to guarantee this is the right one for you.

- When the form does not meet up with your preferences, take advantage of the Seach field to find the proper form.

- When you are certain the form would work, select the Buy now key to obtain the form.

- Choose the costs strategy you want and type in the required information and facts. Make your account and purchase the order using your PayPal account or Visa or Mastercard.

- Pick the submit formatting and acquire the legitimate record template to the gadget.

- Total, change and print and indication the acquired South Carolina Sample Letter for Claim to Funds.

US Legal Forms may be the greatest local library of legitimate forms where you can discover various record templates. Take advantage of the service to acquire skillfully-produced documents that follow state demands.

Form popularity

FAQ

The South Carolina Unclaimed Property Act requires any person who is in possession of property belonging to another; a trustee; or indebted to another on an obligation, to report unclaimed property by November 1 each year.

What Does It Mean When an Account Is Escheat? An account is in escheat when there are no identifiable heirs to an account, or no one claims it. The government then takes ownership of the account. If a legal owner is identified, it can be reclaimed.

Go to ucp.dor.wa.gov click File your Unclaimed Property Report, then click Submit under Electronic reporting. To log in, use your SecureAccess Washington (SAW) User ID and password. Select 'File your report(s)' and click Next.

7 Preparing a report with no property: If you do not have any property to report, you must file a negative (no property) report. See instructions on page 6. File your report to Washington State Department of Revenue using one of the following: 7 Department of Revenue website.

Unclaimed property is not taxed while it is filed as unclaimed; however, when it is reclaimed, the property may be officially recognized as taxable income. Some unclaimed funds such as investments from a 401(k) or an IRA can be reclaimed tax-free.

Claiming property (searchers, owners, or claimants) Any individual or business can search our UCP system for unclaimed property that we are holding in their name. If they find property in their name, the owner or claimant can file to get their property back.