South Carolina Assignment of Interest in Trust

Description

How to fill out Assignment Of Interest In Trust?

Are you currently in a situation where you require documents for both organization or distinct tasks on a daily basis.

There are numerous legitimate document templates available online, but locating ones you can rely on isn't easy.

US Legal Forms offers thousands of form templates, including the South Carolina Assignment of Interest in Trust, designed to meet federal and state guidelines.

If you locate the correct template, simply click Get now.

Choose the payment plan you desire, fill in the necessary information to create your account, and place an order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Assignment of Interest in Trust template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Retrieve the template you need and ensure it is for the correct city/county.

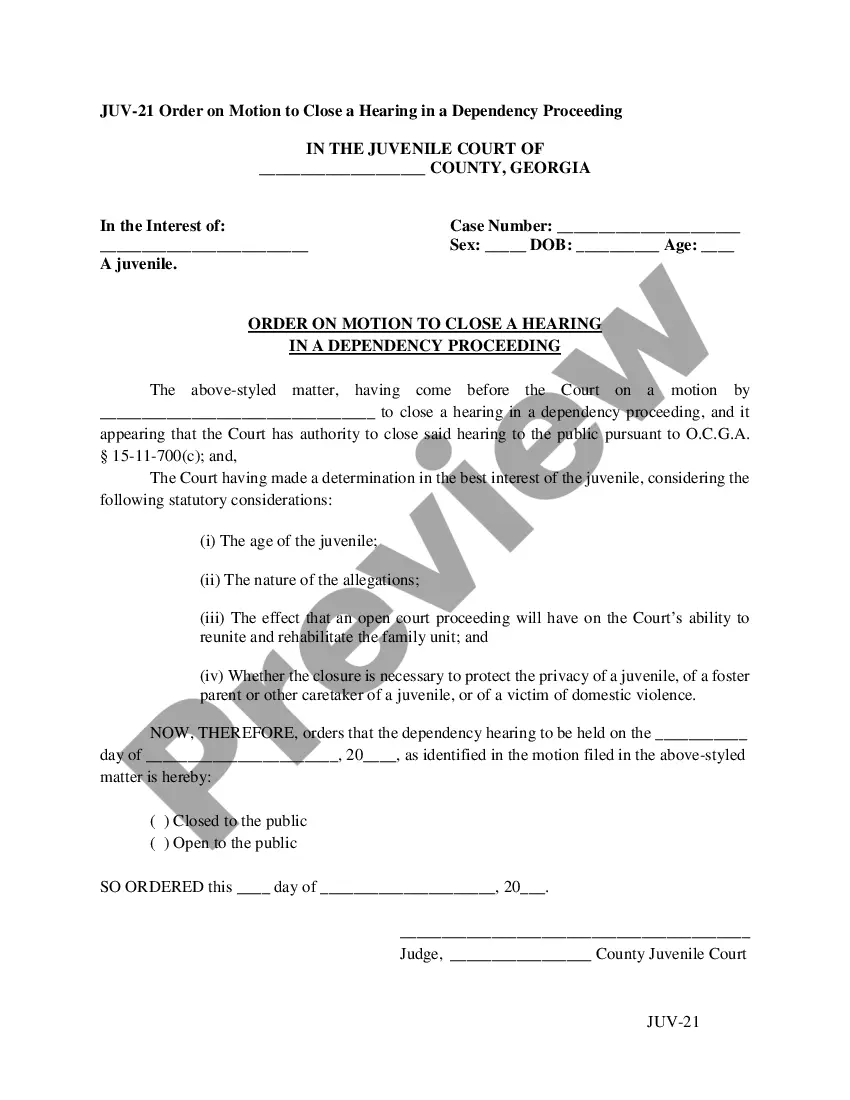

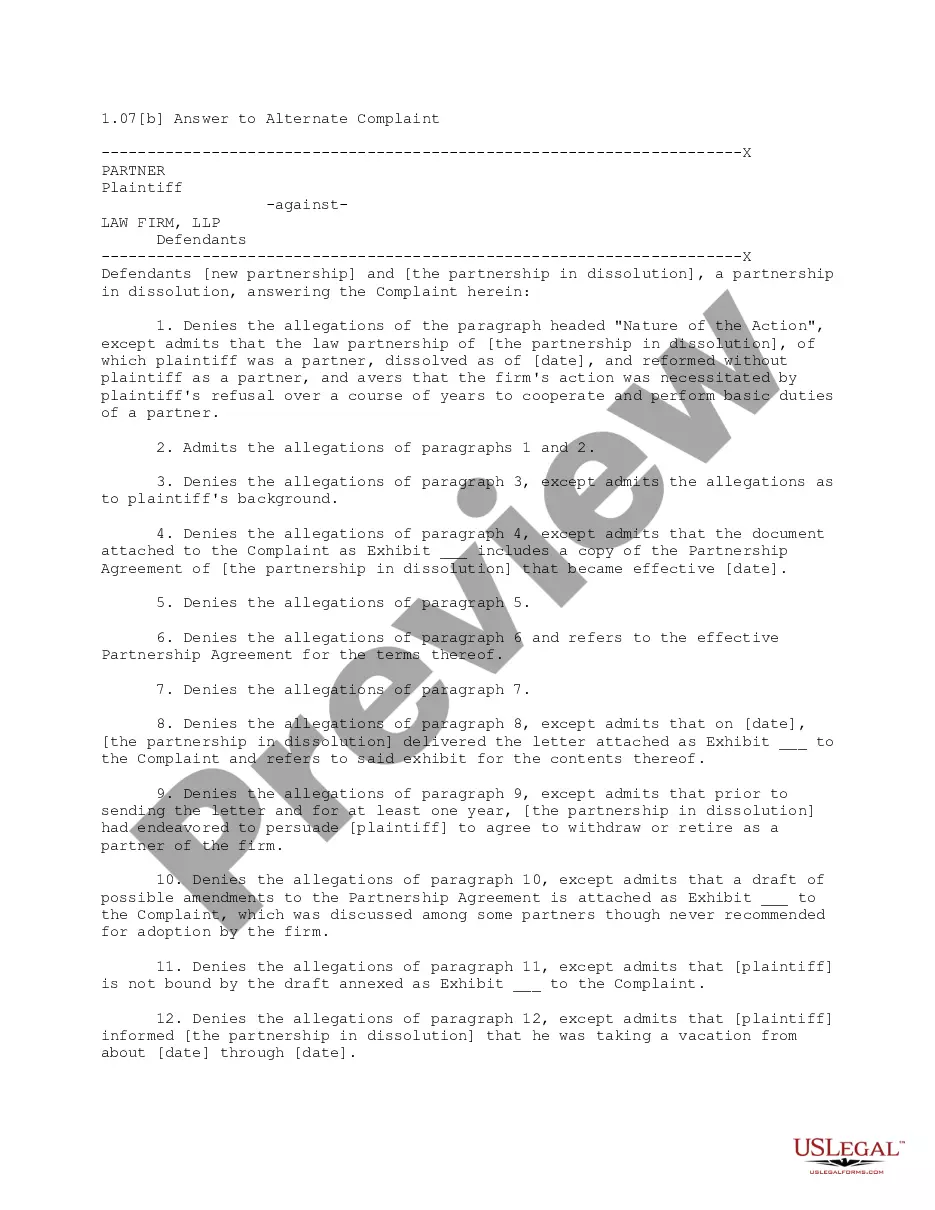

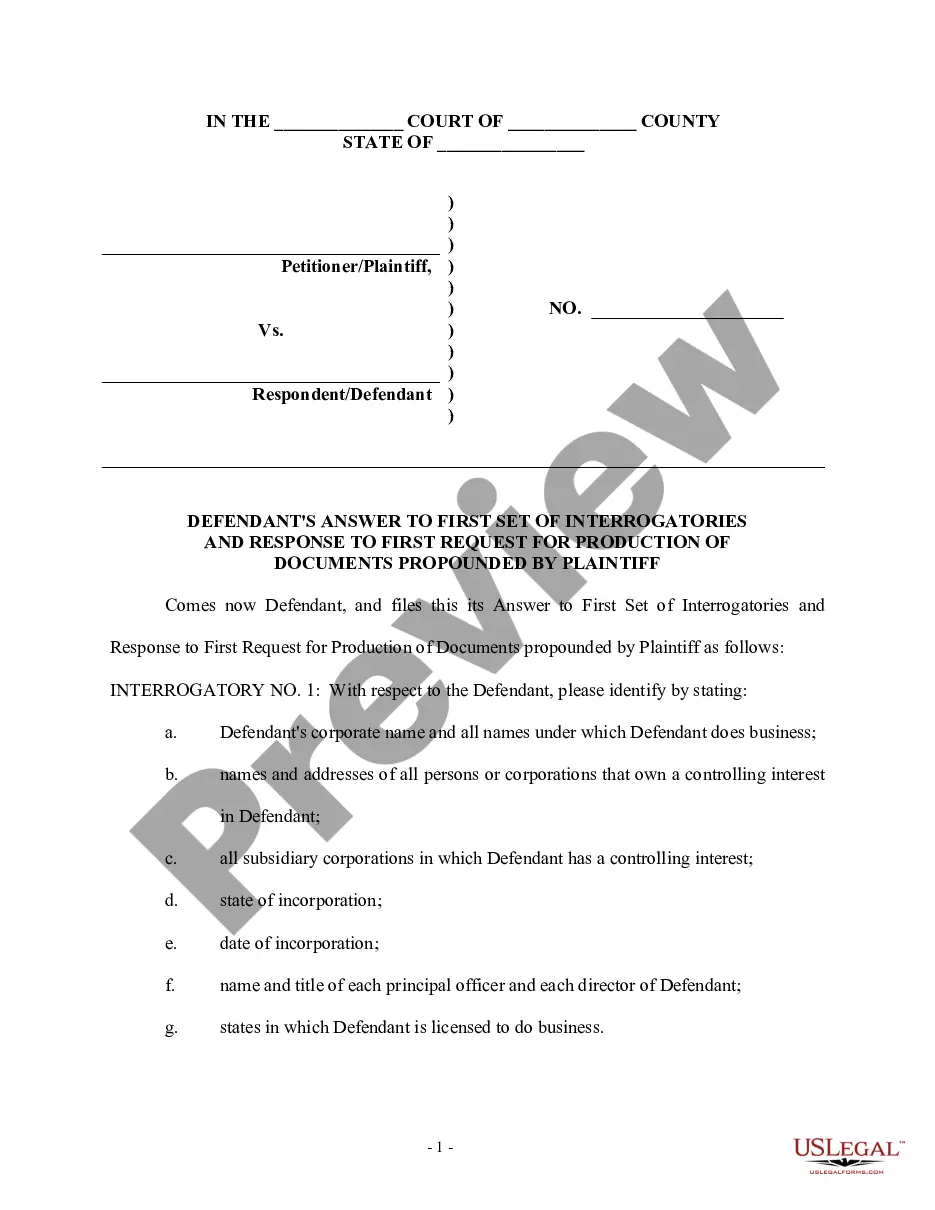

- Utilize the Preview feature to review the form.

- Verify the description to confirm that you have chosen the right document.

- If the form isn't what you're looking for, use the Search section to find the document that fits your needs.

Form popularity

FAQ

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust.

A conflict of interest for a trustee occurs when the trustee's personal interests potentially conflict with their responsibilities to the trust beneficiaries.

Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

Yes, all money deposited in a trust account is invested and earns interest or yield returns, or both.

The South Carolina living trust is a legal instrument used to avoid probate during the disposition of an estate. The Settlor will place their property into the trust and assign a Trustee to manage it (the Settlor can put themselves as Trustee during their lifetime).

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

A beneficiary typically has a future interest in the trust's assets meaning they might access funds at a determined time, such as when the recipient reaches a certain age.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors. Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance.