South Carolina Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

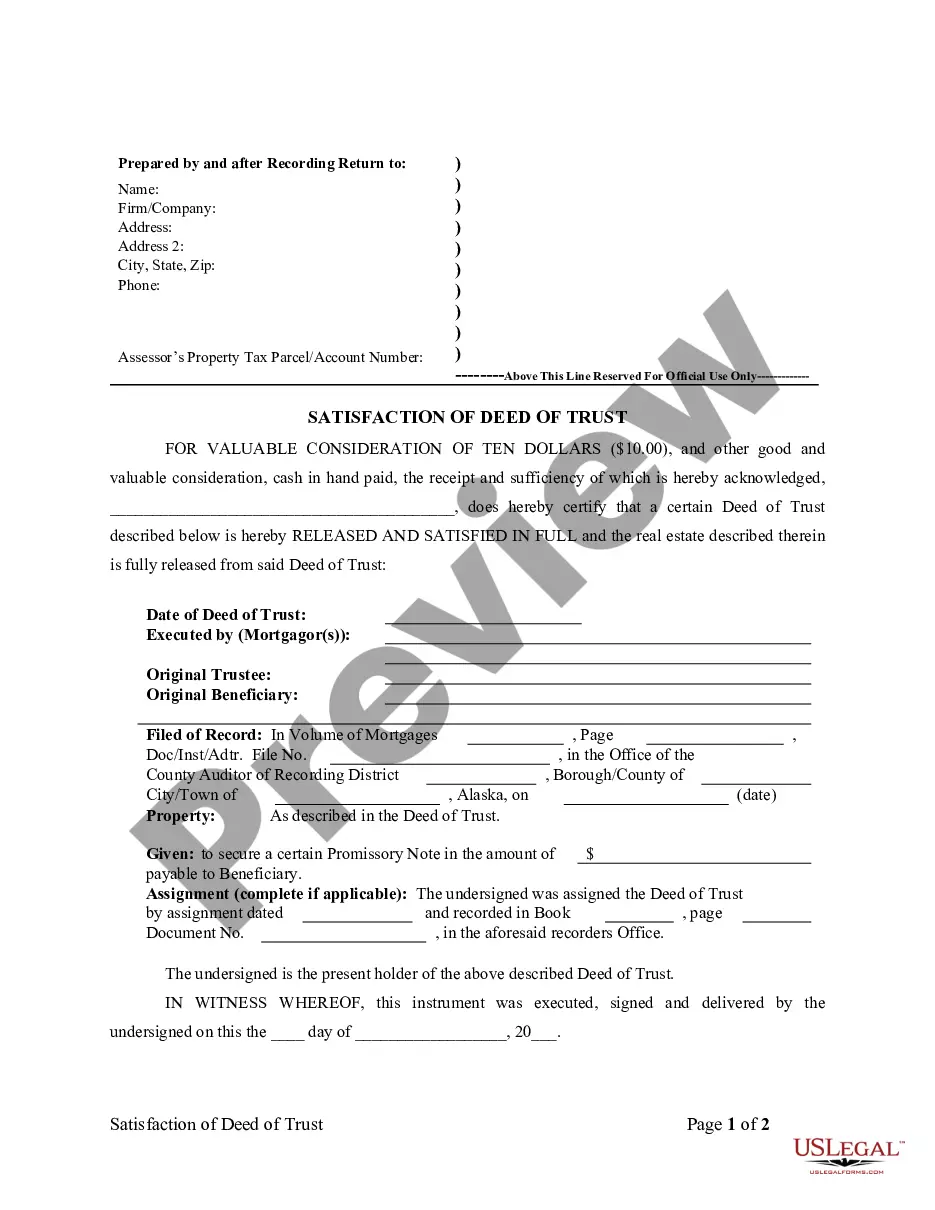

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

If you wish to thorough, acquire, or create legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Utilize the site’s straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. After discovering the form you need, click the Buy now button. Choose your preferred pricing plan and provide your information to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the South Carolina Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the South Carolina Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview feature to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find additional types of your legal document template.

Form popularity

FAQ

The main purpose of a life insurance trust is to decrease the value of an individual's estate in order to reduce the estate tax paid on the life insurance benefits passed from the grantor to the beneficiary. Trusts also protect assets from creditors.

A grantor trust is considered a disregarded entity for income tax purposes. Therefore, any taxable income or deduction earned by the trust will be taxed on the grantor's tax return.

Life Insurance BeneficiariesTrusts are not considered individuals; therefore, life insurance proceeds paid to trusts are generally subjected to estate tax. Also, the proceeds payable to a trust may not qualify for the inheritance tax exemption provided by some states for insurance payable to a named beneficiary.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

If a trust is a grantor trust, then the grantor is treated as the owner of the assets, the trust is disregarded as a separate tax entity, and all income is taxed to the grantor.

An irrevocable trust or a revocable trust can both be listed your life insurance beneficiary, and they each come with their own set of pros and cons. Most young families (including my own) have a revocable trust.

Is an irrevocable life insurance trust (ILIT) a grantor trust? A13. Usually, yes. Most ILITs are grantor trusts since these trust instruments typically provide that income may be applied toward the payment of premiums on policies insuring the grantor's life (or the grantor's spouse's life).

Trusts are not considered individuals; therefore, life insurance proceeds paid to trusts are generally subjected to estate tax. Also, the proceeds payable to a trust may not qualify for the inheritance tax exemption provided by some states for insurance payable to a named beneficiary.

(a) A noncharitable irrevocable trust may be modified or terminated with court approval upon consent of the settlor and all beneficiaries, even if the modification or termination is inconsistent with a material purpose of the trust.

However, payout on a life insurance policy may not be exempt from estate tax, which is why planners often recommend that a trust own your life insurance policy instead of you owning it.