South Carolina Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained

Description

How to fill out Agreement To Form Partnership In The Future In Order To Carry Out A Contract To Be Obtained?

If you require complete, download, or print authentic document templates, utilize US Legal Forms, the premier collection of official forms, available online.

Employ the website's straightforward and convenient search to find the documents you need.

Various templates for professional and personal use are organized by categories and states, or keywords.

Step 4. Once you have located the form you require, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the South Carolina Agreement to Form Partnership in the Future in Order to Execute a Contract with just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to retrieve the South Carolina Agreement to Form Partnership in the Future in Order to Execute a Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the appropriate city/state.

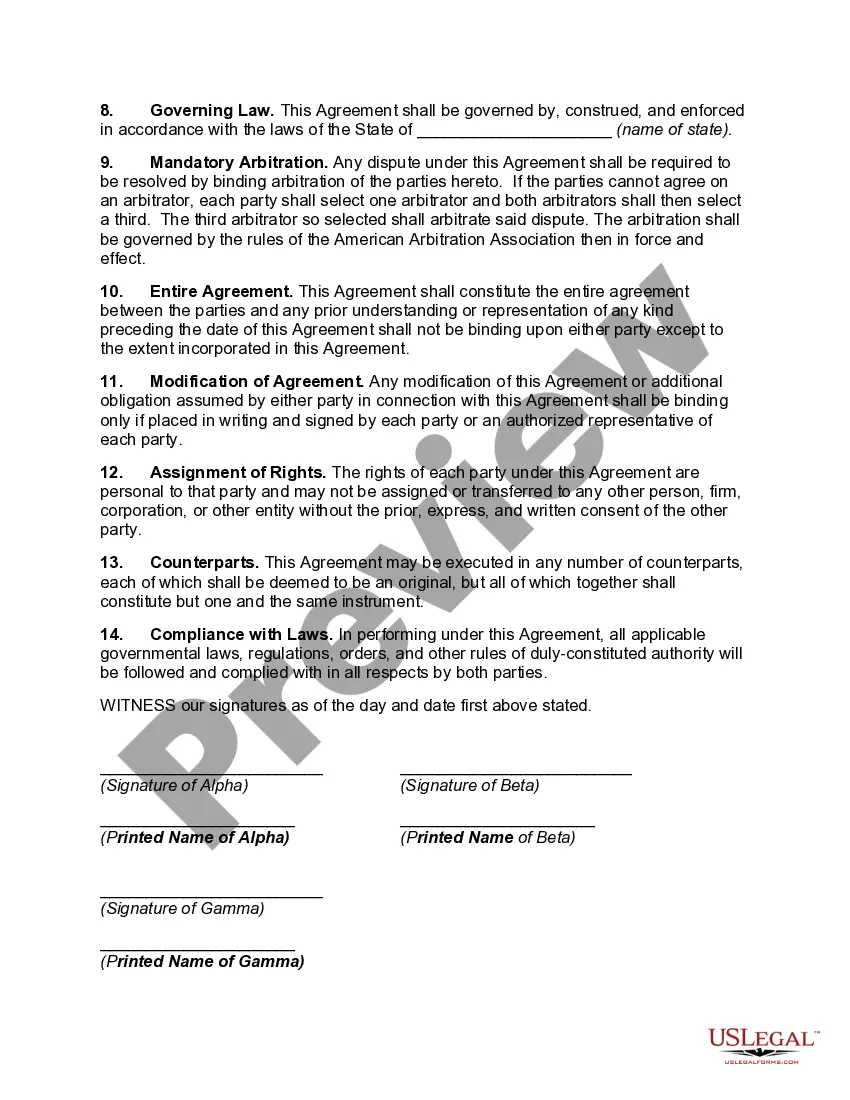

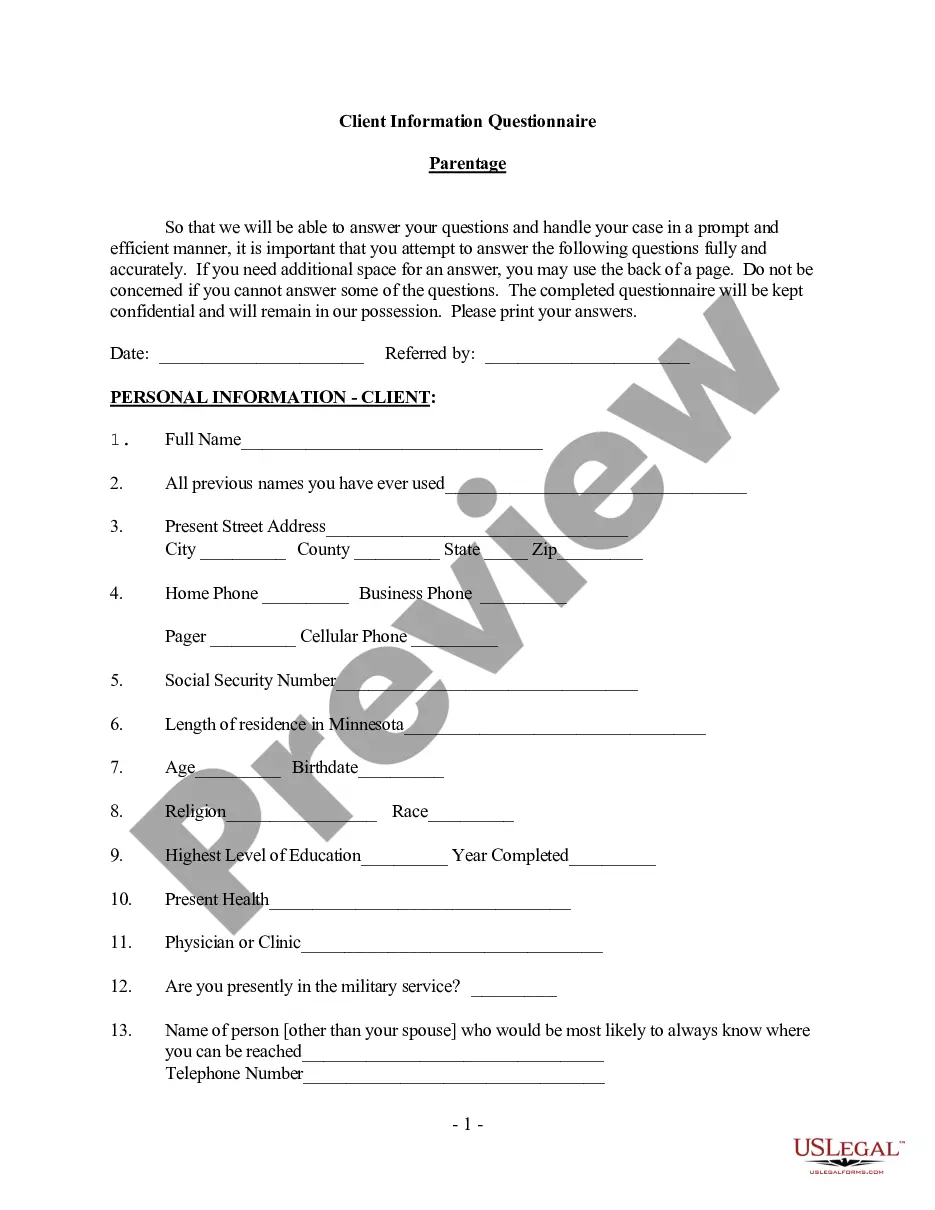

- Step 2. Make use of the Preview feature to review the document's provisions. Be sure to read the summary.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

To set up a partnership agreement, begin by discussing the key terms with your partners, including roles, contributions, and profit sharing. Document these agreements in writing, using a clear format to avoid misunderstandings. You might find it helpful to utilize templates for the South Carolina Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained available through trusted legal platforms.

Unlike a corporation that must be set up by filing articles of incorporation with a state agency, you can form a partnership without following any formalities at all. As long as both parties intend to work together for profit, any act in furtherance of the relationship is enough to solidify the partnership.

Without a written agreement in place, the partnership will be governed by the default rules of the state where it's based. Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary.

A partnership is formed by 'persons carrying on a business in common with a view of profit' and as such the partners in a partnership can be individuals, corporations, other partnerships or a combination of these. This means, for example, that a joint venture of corporations can be carried on by way of a partnership.

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.

A partnership enters into an agreement in the name of its partners. Usually each partner is jointly liable for the obligations under the agreement.

What Constitutes a Legally Binding Business Partnership?All partners must hold up their side of the business responsibilities, financial payments, and guidelines set when the partnership was created.Both partners are responsible for their share fair of the investment.More items...

Ease of formationA general partnership may be formed with or without a partnership agreement. All you need is to have two or more individuals operating as co-owners and sharing profits. Pass-through taxationWith a general partnership, there's no income tax at the business level.

There are three types of partnerships -- general partnerships, joint ventures, and limited partnerships. In a general partnership, the partners equally divide management responsibilities, as well as profits.

The importance of having a partnership agreement. A partnership agreement is a foundational document for a business partnership and is legally binding on all partners. It sets up the partnership for success by clearly outlining the business's day-to-day operations and the rights and responsibilities of each partner.