South Carolina Manufacturer Analysis Checklist

Description

How to fill out Manufacturer Analysis Checklist?

Locating the appropriate authentic document template can be challenging. Obviously, there is an abundance of templates available online, but how can you determine the genuine document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Carolina Manufacturer Evaluation Checklist, suitable for business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already a member, sign in to your account and click the Download button to access the South Carolina Manufacturer Evaluation Checklist. Use your account to browse through the official documents you have previously purchased. Navigate to the My Documents tab of your account and download another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired South Carolina Manufacturer Evaluation Checklist. US Legal Forms is the largest repository of legal documents where you can find diverse document templates. Leverage this service to access professionally crafted papers that adhere to state requirements.

- First, ensure that you have selected the correct document for your city/county.

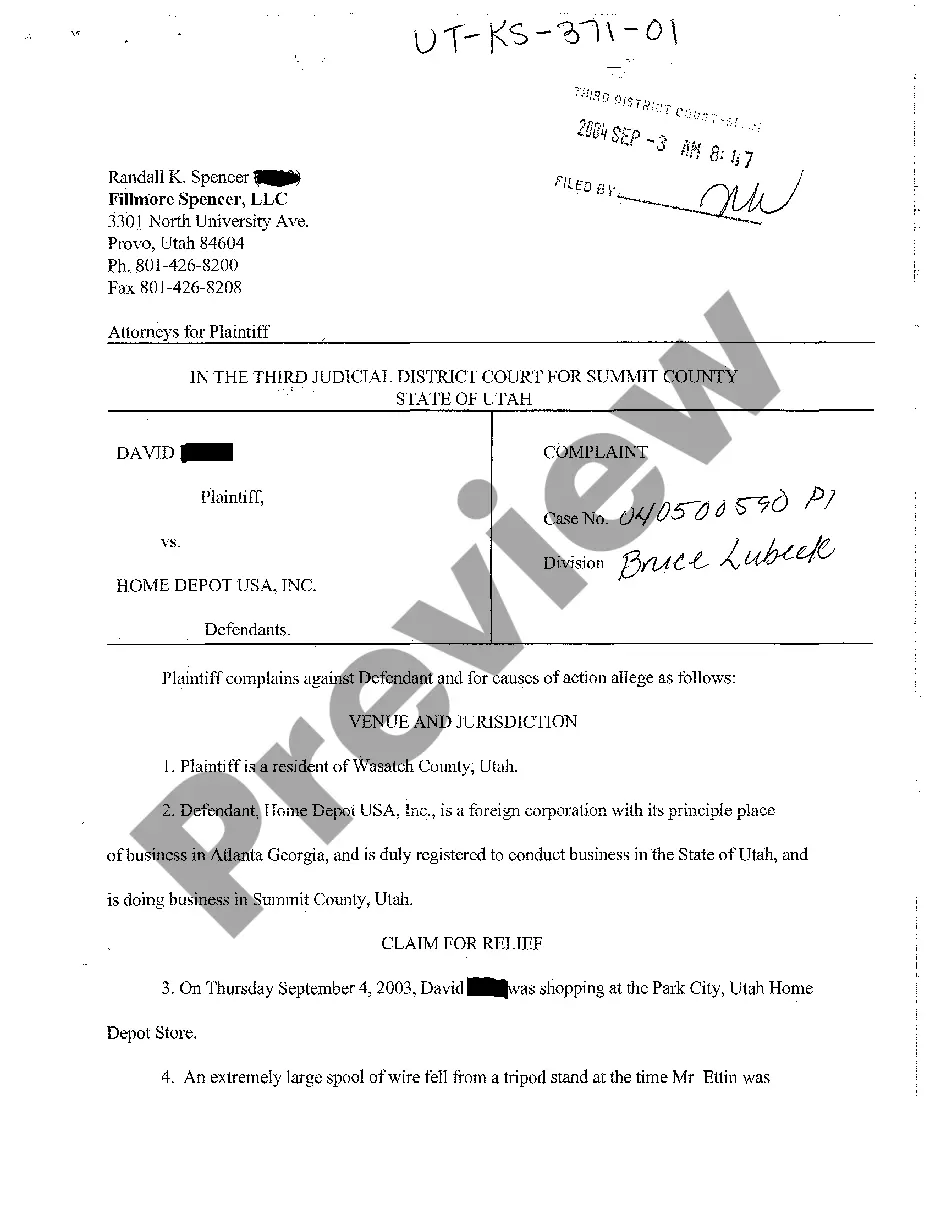

- You can preview the document using the Preview button and review the document description to ensure it is appropriate for you.

- If the document does not meet your requirements, utilize the Search field to locate the suitable document.

- Once you are confident that the document is right, click the Buy Now button to obtain the document.

- Select the pricing plan you want and enter the required information.

- Create your account and pay for the purchase using your PayPal account or credit card.

Form popularity

FAQ

Whether you need to register for sales tax in every state depends on your business's sales activities and nexus in those states. If your products are sold in multiple states, understanding the registration requirements is essential. The South Carolina Manufacturer Analysis Checklist can assist you in identifying where to register and how to manage your sales tax obligations properly.

MyDORWAY SC is South Carolina's online portal for managing various tax-related transactions, including sales tax. It allows businesses to file returns, make payments, and maintain their tax accounts conveniently online. Manufacturers can benefit from this platform, especially when applying insights from the South Carolina Manufacturer Analysis Checklist for efficient tax compliance.

To file a PT-100 form in South Carolina, you will need specific information about your business property. This form reports personal property to the appropriate tax authorities. For manufacturers, accurately completing the PT-100 is crucial, and the South Carolina Manufacturer Analysis Checklist can help ensure you do not miss any important steps.

Sales tax filing frequency in South Carolina depends on your business's average monthly tax liability. Businesses with higher liability may need to file monthly, while others can file quarterly or annually. The South Carolina Manufacturer Analysis Checklist can guide you in choosing the appropriate filing schedule to align with your business activities.

Filing sales tax late in South Carolina results in penalties and interest accrued from the due date. Typically, the penalty is 5% of the unpaid tax amount, increasing if the delay extends beyond a certain period. To avoid such penalties, manufacturers can refer to the South Carolina Manufacturer Analysis Checklist for timely filing practices and ensure compliance.

In South Carolina, sales tax is applied to the sale of tangible personal property and certain services. The statewide base rate is 6%, but local jurisdictions can add additional taxes, affecting the total rate you collect. Understanding this structure is vital for manufacturers, and utilizing the South Carolina Manufacturer Analysis Checklist can help ensure proper sales tax management.

In Richland County, SC, the business personal property tax is assessed on various types of tangible personal property owned by businesses. The rate is determined by the county's assessment guidelines, which consider the type of property and its value. It is important for manufacturers to stay informed about these tax responsibilities, especially when using the South Carolina Manufacturer Analysis Checklist for compliance.

In South Carolina, several items related to manufacturing are tax-exempt, including certain machinery, equipment, and materials. These exemptions are designed to promote growth and competitiveness in the manufacturing sector. By utilizing the South Carolina Manufacturer Analysis Checklist, you can identify all applicable exemptions and optimize your tax strategy effectively.

Yes, South Carolina is recognized as a significant manufacturing state, contributing substantially to the national economy. With a diverse range of industries, from automotive to aerospace, the state fosters a supportive environment for manufacturers. Exploring this aspect in your South Carolina Manufacturer Analysis Checklist offers insights into trends and opportunities within the manufacturing sector.

To qualify for the manufacturing exemption in South Carolina, specific criteria must be met. The equipment must be essential to the manufacturing process and used directly in production. By understanding these conditions, you can better navigate your tax obligations, making the South Carolina Manufacturer Analysis Checklist an invaluable tool for manufacturers.