This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

South Carolina Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description

How to fill out Spouses' Mutual Disclaimer Of Interest In Each Other's Property With Provision For Use Of Family Residence By One Spouse?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the South Carolina Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse in just seconds.

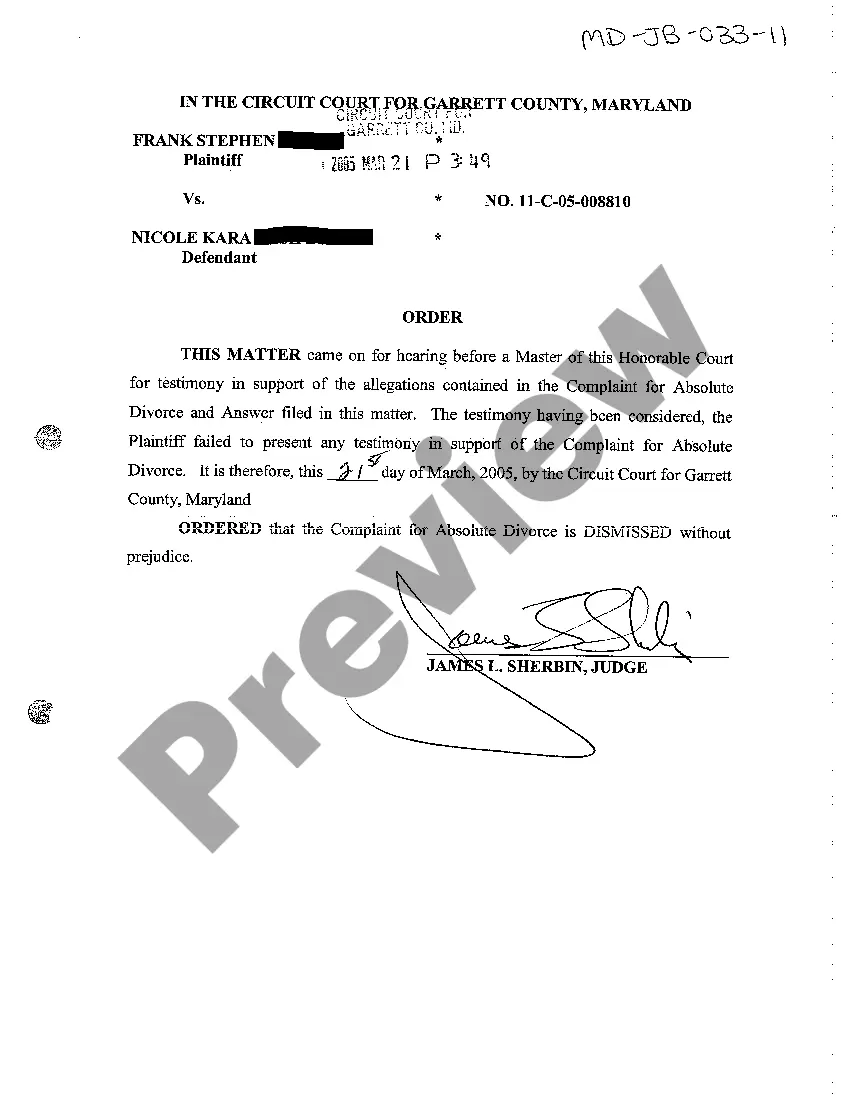

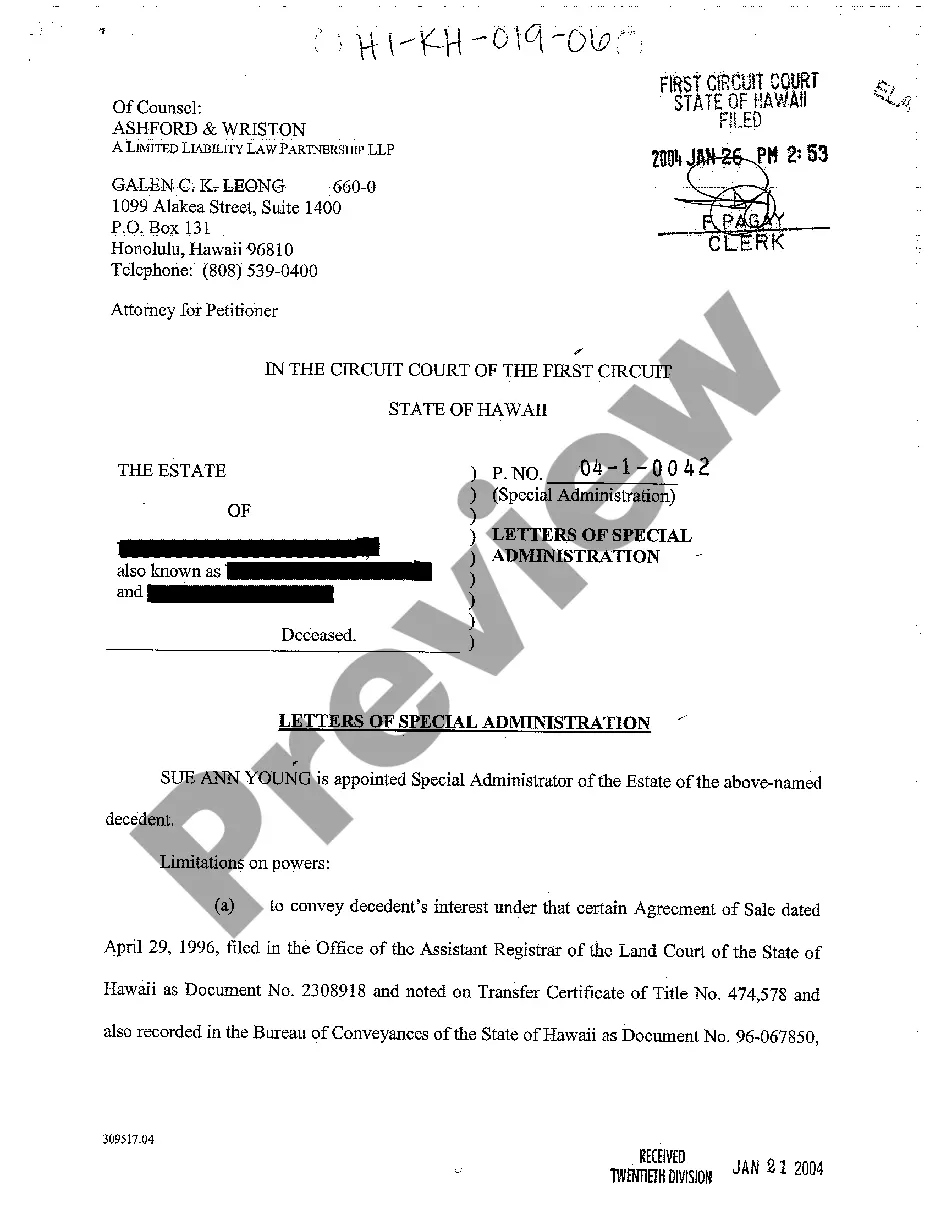

Check the description of the form to ensure you have chosen the correct one.

If the form doesn't meet your needs, use the Search area at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the South Carolina Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your city/county.

- Use the Preview button to review the form's content.

Form popularity

FAQ

It really depends on the size of the marital estate. If the marital estate is large enough, then the court can award the house and its equity to one spouse while the other makes up for it by receiving other assets. Family court judges have a ton of discretion in making their decisions.

Matrimonial property is defined as all the assets belonging to the parties (whether jointly or solely) at the relevant date (see below) which were acquired during the marriage but before the relevant date.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (S.C. Code Ann. 62-2-801 (c) (3)).

While you can disinherit your children, in South Carolina you cannot completely disinherit your spouse. This is to protect the surviving spouse from being left destitute and a burden on the state.

How to Make a DisclaimerPut the disclaimer in writing.Deliver the disclaimer to the person in control of the estateusually the executor or trustee.Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

Unlike many other states, South Carolina is not a community property state. In our state, the marital property in a divorce is not divided 50/50. Instead, it is distributed in a manner that is fair and equitable to both parties, which may not necessarily be an equal distribution.

South Carolina is not a community property state, which means that property is not automatically divided 50/50 between the spouses. The Palmetto State divides property in a divorce based on equitable distribution laws. This means that marital property is to be divided in a fair and equitable way.

Marital property is all the real and personal property acquired by the parties during the marriage and owned at the date of filing for divorce. It doesn't matter if the family home bought during the marriage in only one spouse's name; the other spouse also has a right to it.

Unlike many other states, South Carolina is not a community property state. In our state, the marital property in a divorce is not divided 50/50. Instead, it is distributed in a manner that is fair and equitable to both parties, which may not necessarily be an equal distribution.