US Legal Forms - one of several greatest libraries of authorized varieties in America - gives a variety of authorized file templates you may obtain or print. Utilizing the web site, you may get a large number of varieties for enterprise and specific purposes, categorized by types, says, or keywords.You will discover the most recent models of varieties just like the South Carolina Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act in seconds.

If you already have a membership, log in and obtain South Carolina Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act in the US Legal Forms library. The Download key can look on every develop you look at. You get access to all earlier delivered electronically varieties from the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, allow me to share simple directions to get you started:

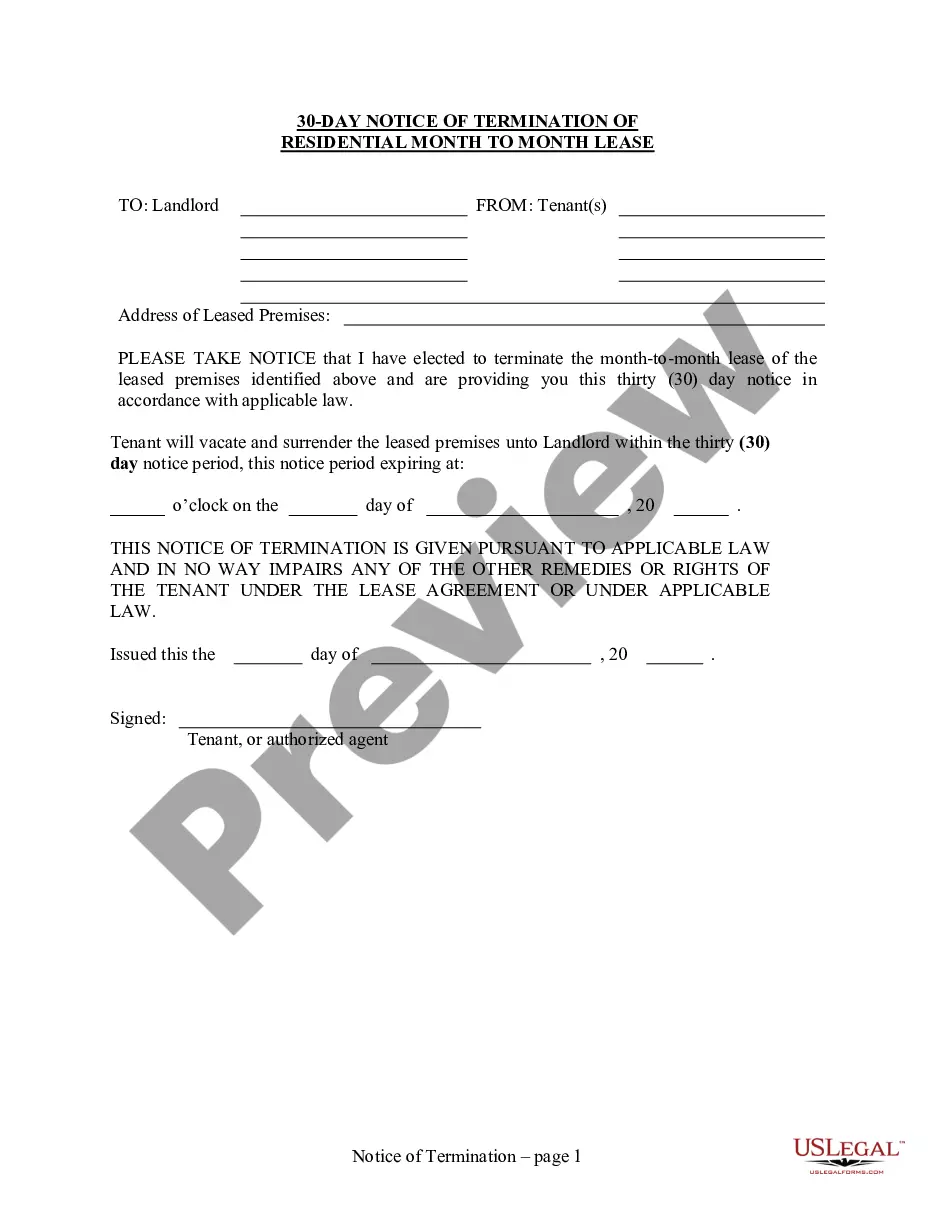

- Be sure you have picked out the right develop for the town/area. Go through the Review key to analyze the form`s content. Browse the develop information to ensure that you have chosen the proper develop.

- If the develop does not suit your demands, utilize the Lookup field near the top of the display to obtain the the one that does.

- Should you be content with the shape, confirm your choice by simply clicking the Get now key. Then, opt for the pricing prepare you prefer and supply your references to sign up on an profile.

- Procedure the financial transaction. Make use of your credit card or PayPal profile to accomplish the financial transaction.

- Find the structure and obtain the shape in your system.

- Make adjustments. Load, change and print and signal the delivered electronically South Carolina Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Every template you added to your account lacks an expiry day and is also yours for a long time. So, in order to obtain or print another copy, just check out the My Forms section and click on on the develop you will need.

Get access to the South Carolina Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms, the most comprehensive library of authorized file templates. Use a large number of professional and status-specific templates that meet up with your company or specific requirements and demands.