Most debt counselors say that it is a good idea to talk to the people to whom you owe money. If you ignore the problem it will only get worse. You may find that you are paying extra interest and your debts are just getting bigger every day. Many creditors try to be understanding and if you tell them why you are unable to pay, then they will sometimes be willing to reach a compromise.

South Carolina Letter to Creditors Informing Them of Fixed Income and Financial Hardship

Description

How to fill out Letter To Creditors Informing Them Of Fixed Income And Financial Hardship?

Are you within a place where you need files for both organization or personal functions almost every time? There are a variety of legitimate file layouts available on the Internet, but discovering types you can rely is not straightforward. US Legal Forms provides a large number of form layouts, such as the South Carolina Letter to Creditors Informing Them of Fixed Income and Financial Hardship, that are created to satisfy federal and state requirements.

In case you are presently acquainted with US Legal Forms web site and also have a free account, basically log in. After that, you can download the South Carolina Letter to Creditors Informing Them of Fixed Income and Financial Hardship design.

Should you not have an account and need to begin using US Legal Forms, abide by these steps:

- Get the form you need and ensure it is for the appropriate area/region.

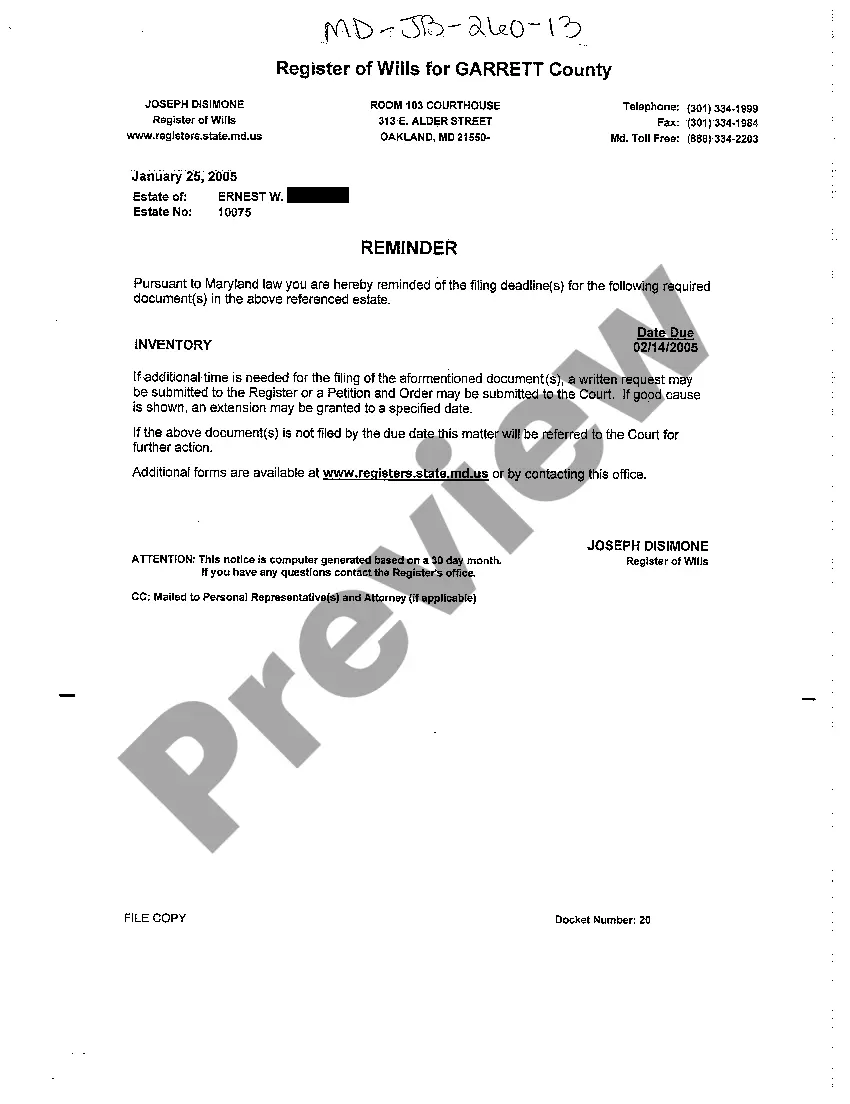

- Use the Preview switch to examine the form.

- Look at the description to actually have selected the appropriate form.

- When the form is not what you`re trying to find, utilize the Lookup area to get the form that meets your needs and requirements.

- If you find the appropriate form, simply click Get now.

- Choose the prices program you desire, submit the required information and facts to create your bank account, and purchase an order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file structure and download your duplicate.

Discover all the file layouts you possess bought in the My Forms food list. You can obtain a more duplicate of South Carolina Letter to Creditors Informing Them of Fixed Income and Financial Hardship at any time, if required. Just go through the necessary form to download or print the file design.

Use US Legal Forms, one of the most comprehensive assortment of legitimate kinds, to save lots of time as well as avoid errors. The assistance provides appropriately manufactured legitimate file layouts which can be used for a range of functions. Produce a free account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

In a straightforward manner, explain what caused your current financial struggles, whether it is a job loss, divorce, medical emergency or another unexpected hardship. Highlight how you're being proactive about your financial situation.

To Whom It May Concern: I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet but unfortunately we have fallen short and would like you to consider working with us to modify our loan.

When you write the hardship letter, don't include anything that would hurt your situation. Here are some examples of things you shouldn't say in the letter: Don't say that your situation is your lender's fault or that their employees are jerks. Don't state that things will likely turn around for you.

Example of a hardship letter I am writing to request financial hardship assistance with my credit card account. This letter gives you an overview of my financial hardship and the assistance I am requesting from your organization. I am also enclosing relevant documentation to support my request.

To Whom It May Concern: I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet but unfortunately we have fallen short and would like you to consider working with us to modify our loan.

You can call, write to or email the creditor letting it know you cannot afford your repayments and that you want to make a repayment arrangement. If possible, contact your creditor 's hardship department . This is called a hardship notice.

Lenders may use them to determine whether or not to offer relief through reduced, deferred, or suspended payments. Hardship Examples. ... Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan.