South Carolina Retirement Cash Flow

Description

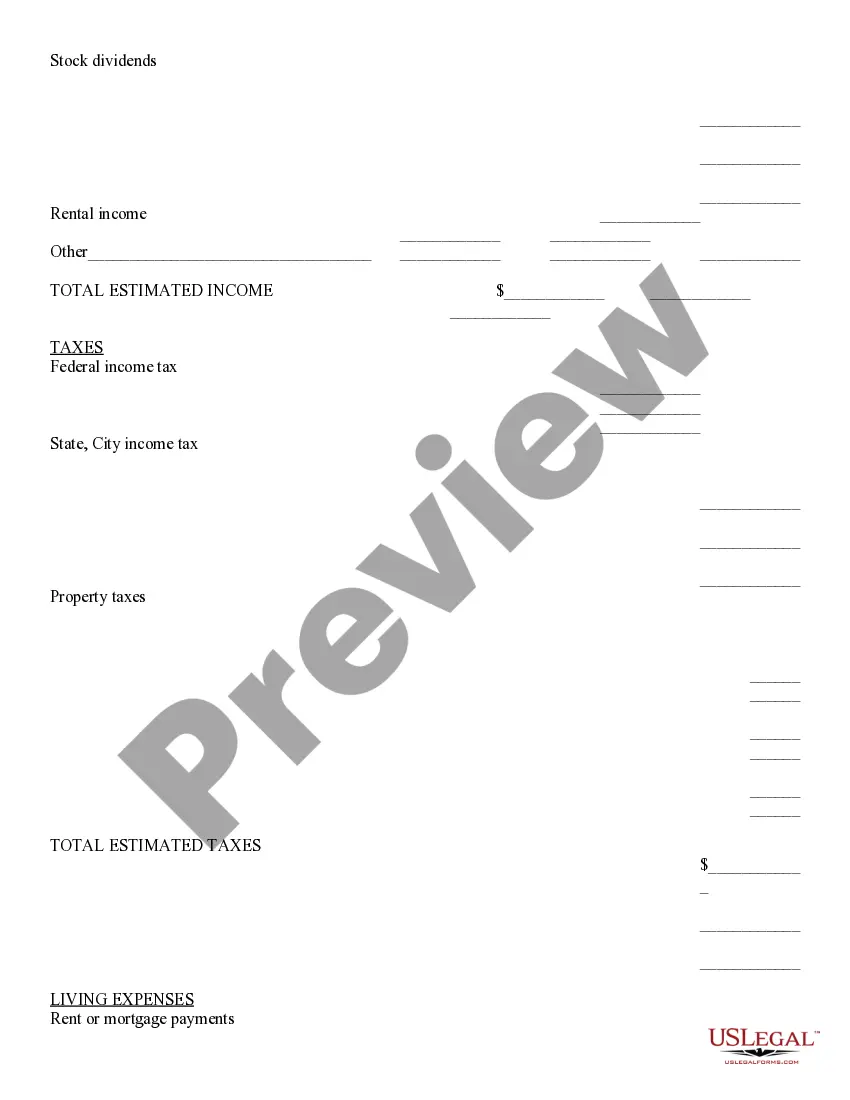

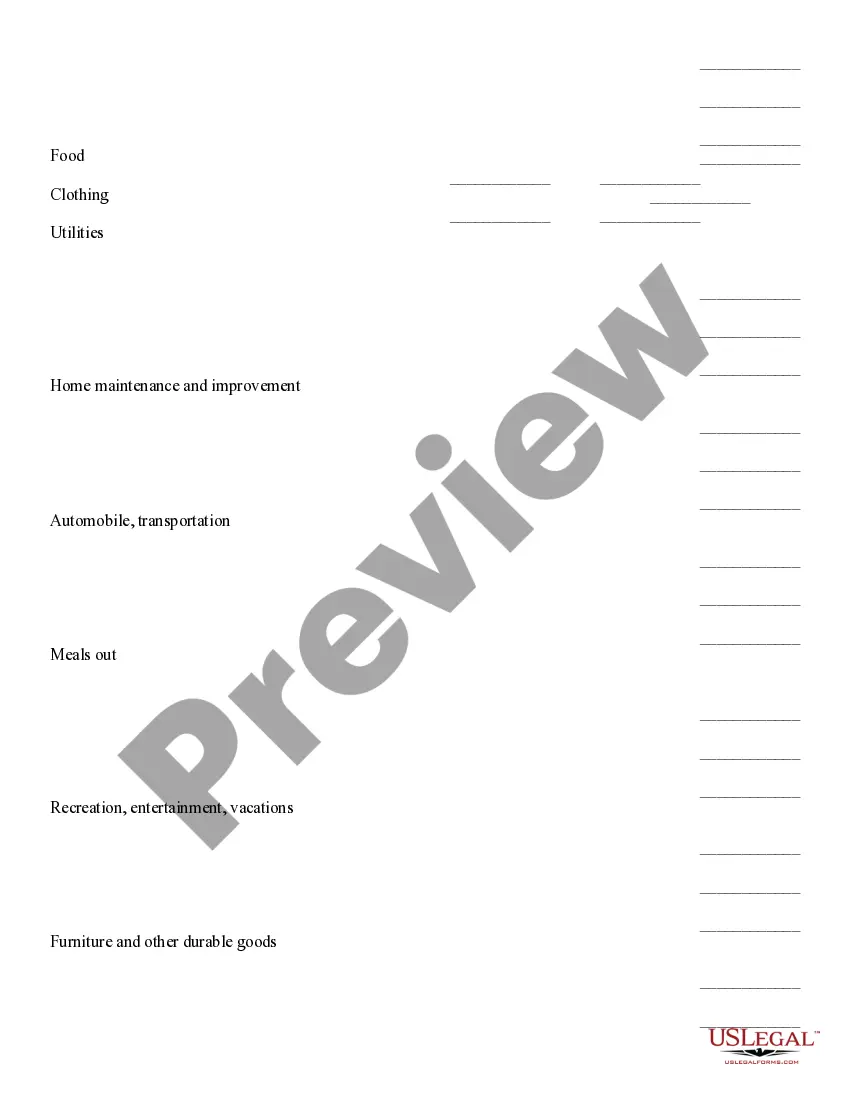

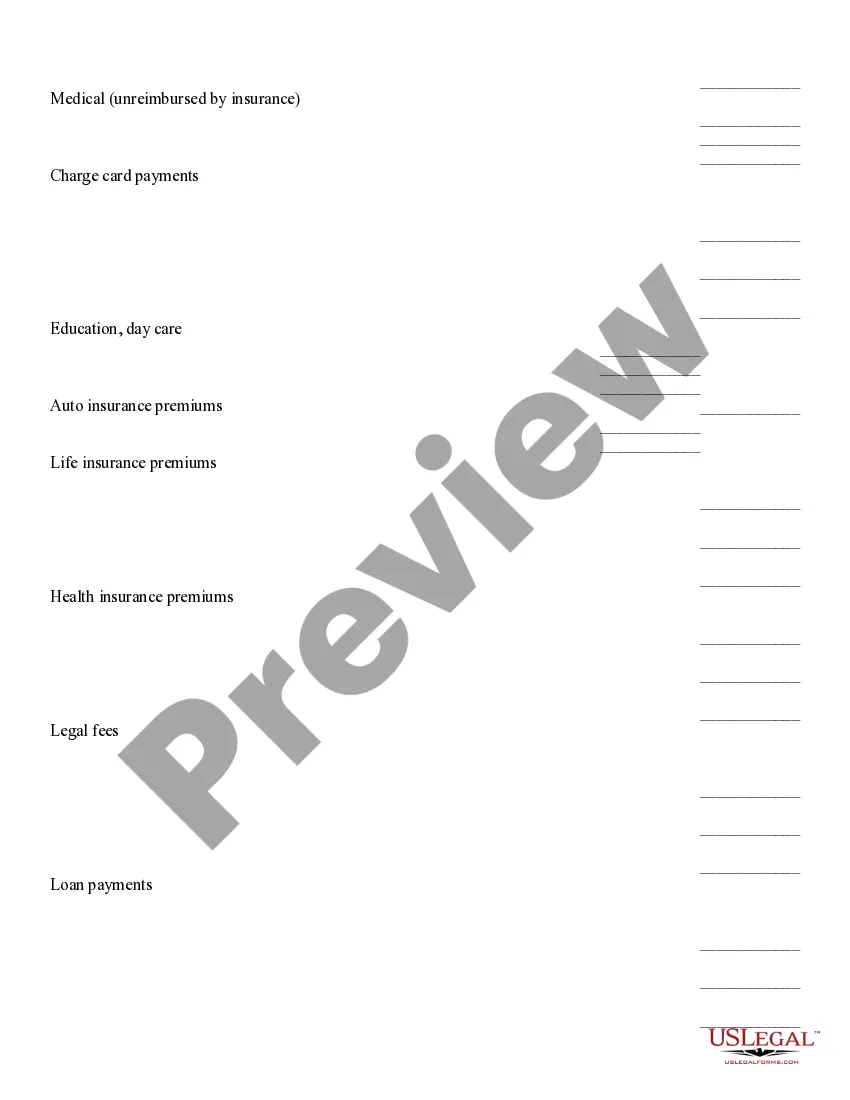

How to fill out Retirement Cash Flow?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Through the site, you can access thousands of forms for both business and personal needs, organized by categories, states, or keywords. You can find the latest editions of forms like the South Carolina Retirement Cash Flow in moments.

If you already have a subscription, Log In and obtain the South Carolina Retirement Cash Flow from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Proceed with the transaction. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the saved South Carolina Retirement Cash Flow.

Every template you add to your account does not have an expiration date and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

Access the South Carolina Retirement Cash Flow with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are some simple guidelines to get started.

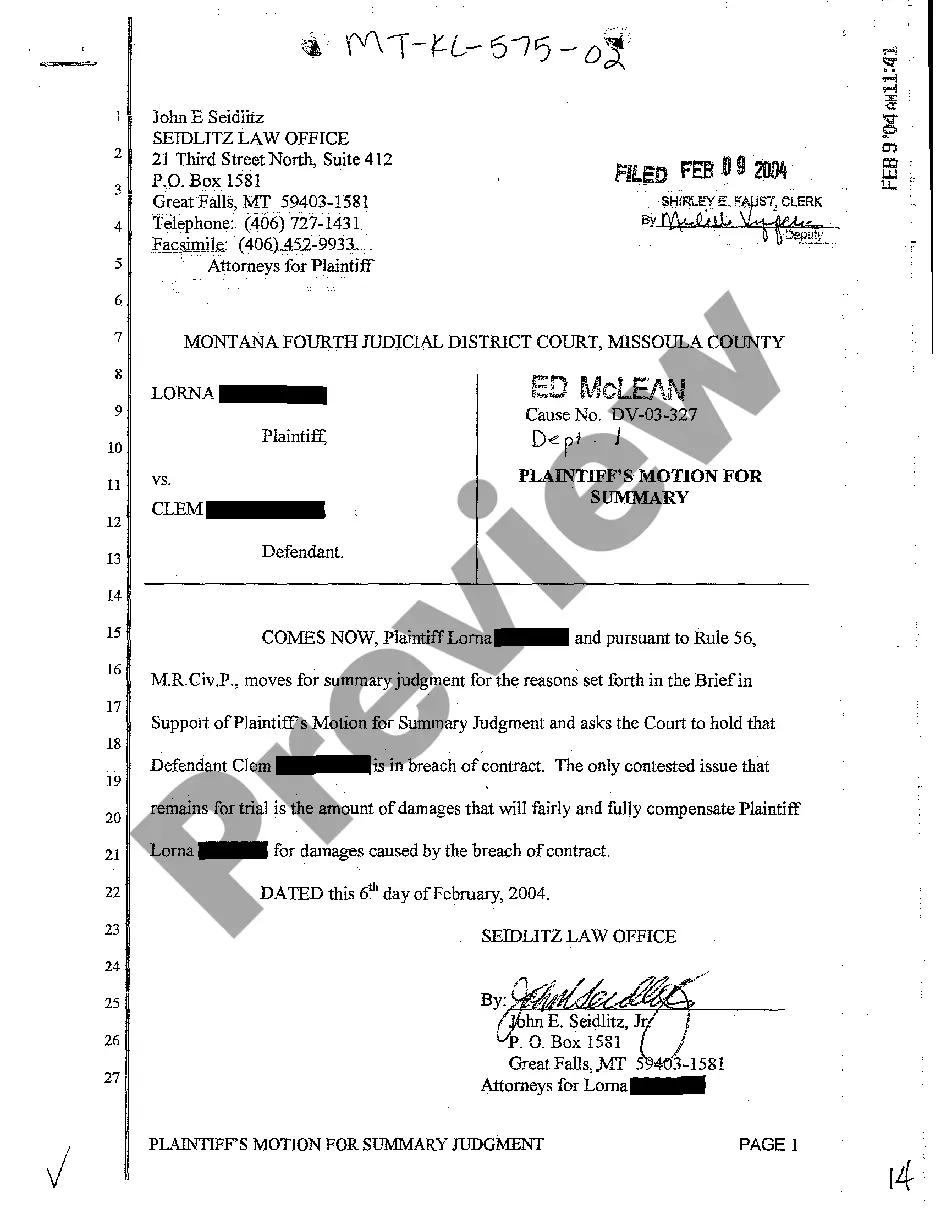

- Ensure you have selected the correct form for your area/county. Click the Preview button to review the content of the form.

- Read the form description to make sure you have chosen the right one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

You must have at least eight years of earned service to receive a benefit.

Monthly retirement benefit is based on a formula (1.82 percent of average final compensation multiplied by years of service), not on your account balance at retirement. Current state law provides for an annual benefit adjustment of 1 percent of your annual benefit up to a maximum of $500 per year.

You can retire and receive an unreduced monthly retirement benefit after 28 years of service or at age 65 or older. You can retire early, at age 60, or at age 55 with 25 years of service, and receive a reduced monthly retirement benefit. You must have at least five years of earned service to receive a benefit.

With respect to area agencies on aging funded by the Department on Aging, compensation shall be increased by five percent effective on the first pay date that occurs on or after July 1, 2021.

Like most states, teachers need to serve a number of years before qualifying for a pension. South Carolina has a 8 year vesting period. While educators qualify for a pension after 8 years of service, the pension may not be worth all that much.

SCRS and PORS offer lifetime monthly benefits for retirees. On average, employees who reach full retirement eligibility can expect to receive a benefit equal to approximately 50 percent of their salary. Data from the Actuarial Valuation Reports as of July 1, 2021.

On average, retirement beneficiaries receive 40% of their pre-retirement income from Social Security. As you make your retirement plan, knowing the approximate amount you will receive in Social Security benefits can help you determine how much other retirement income you'll need to reach your goals.

On average, S.C. public employees receive an annual pension benefit of $21,013 a modest sum that will help support my family and me in retirement. Teachers and other public retirees contribute greatly to our local economies.

Retirement benefit Under SCRS, you are eligible to retire with an unreduced benefit if you have at least eight years of earned service credit and: Met the Rule of 90 requirement; or 2022 Reached age 65.

Kiplinger ranks South Carolina as one of the most-friendly states for taxes on retirees. As in North Carolina, South Carolina does not tax Social Security benefits. The state also offers other generous exemptions on other types of retirement income.