South Carolina Consumer Loan Application - Personal Loan Agreement

Description

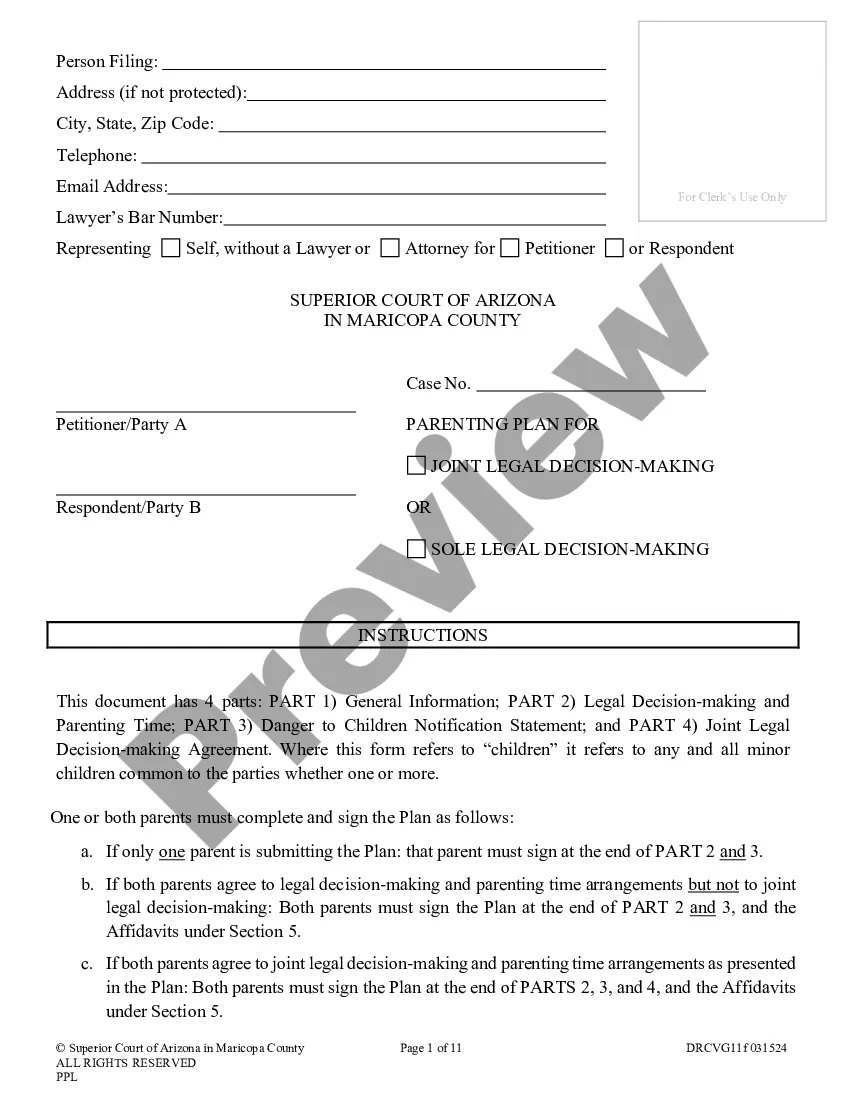

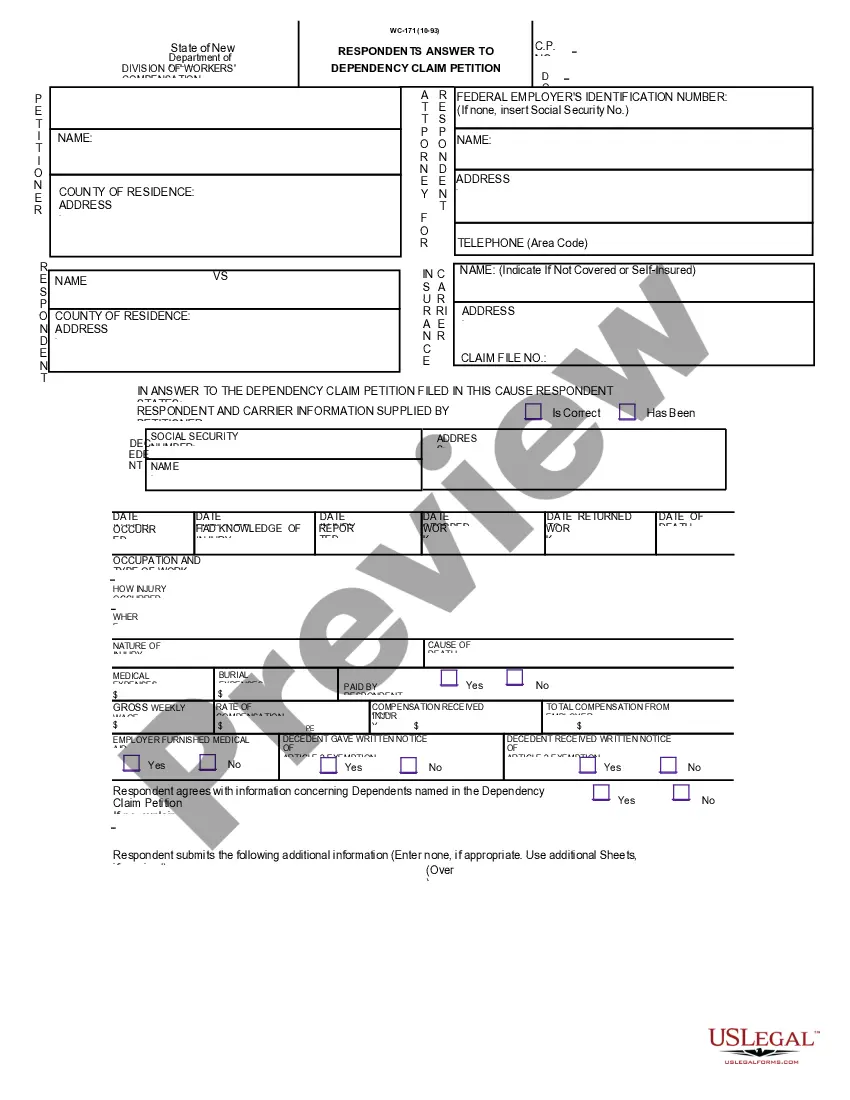

How to fill out Consumer Loan Application - Personal Loan Agreement?

Are you in a location where you frequently require documents for either business or particular tasks? There are many legal document templates available online, but finding forms you can trust isn’t easy. US Legal Forms provides a vast array of form templates, such as the South Carolina Consumer Loan Application - Personal Loan Agreement, that are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the South Carolina Consumer Loan Application - Personal Loan Agreement template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the document you require and ensure it is for your correct area/state. Use the Review button to examine the form. Verify the details to confirm you have selected the correct document. If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs and requirements. If you locate the appropriate form, click on Buy now. Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or Visa or Mastercard. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the South Carolina Consumer Loan Application - Personal Loan Agreement at any time, if needed. Click the required form to download or print the document template.

- Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service offers professionally drafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

37-23-80: Prohibits prepayment penalties for loans less than $150,000.

No mortgage or deed having the effect of a mortgage or other lien shall constitute a lien upon any real estate after the lapse of twenty years from the date for the maturity of the lien.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

Chapter 23 - High-cost And Consumer Home Loans. Section 37-23-70. Prohibited acts; complaints; penalties; statute of limitations; enforcement; costs. (A) A lender may not engage knowingly or intentionally in the unfair act or practice of "flipping" a consumer home loan.

?There is no statute of limitation on the foreclosure of a mortgage. It is only when the mortgage debt has been due after maturity for a time sufficient to raise a presumption that the same has been satisfied that mere delay will furnish a defense to foreclosure.

(B) As used in this section "continuous breach of the peace" means a pattern of repeated acts or conduct which either (1) directly disturbs the public peace or (2) disturbs the public peace by inciting or tending to incite violence.