South Carolina Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

US Legal Forms - one of the largest collections of legal documents in the country - offers a variety of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents, such as the South Carolina Sample Letter for Compromise on a Debt, in just minutes.

If you already have an account, Log In and download the South Carolina Sample Letter for Compromise on a Debt from the US Legal Forms repository. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded South Carolina Sample Letter for Compromise on a Debt. Every template added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or create another copy, simply navigate to the My documents section and click on the form you need. Access the South Carolina Sample Letter for Compromise on a Debt with US Legal Forms, the most extensive database of legal document templates. Utilize a vast array of professionally prepared and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Make sure to select the correct form for your city/state.

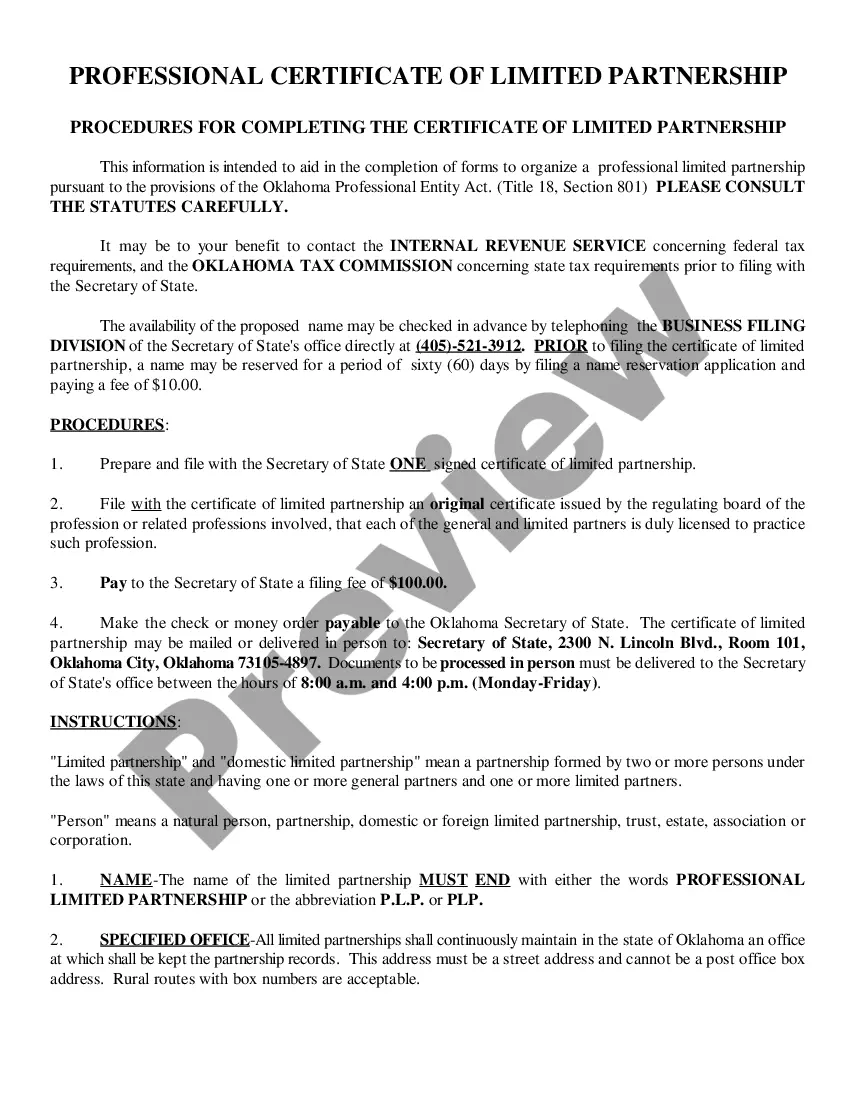

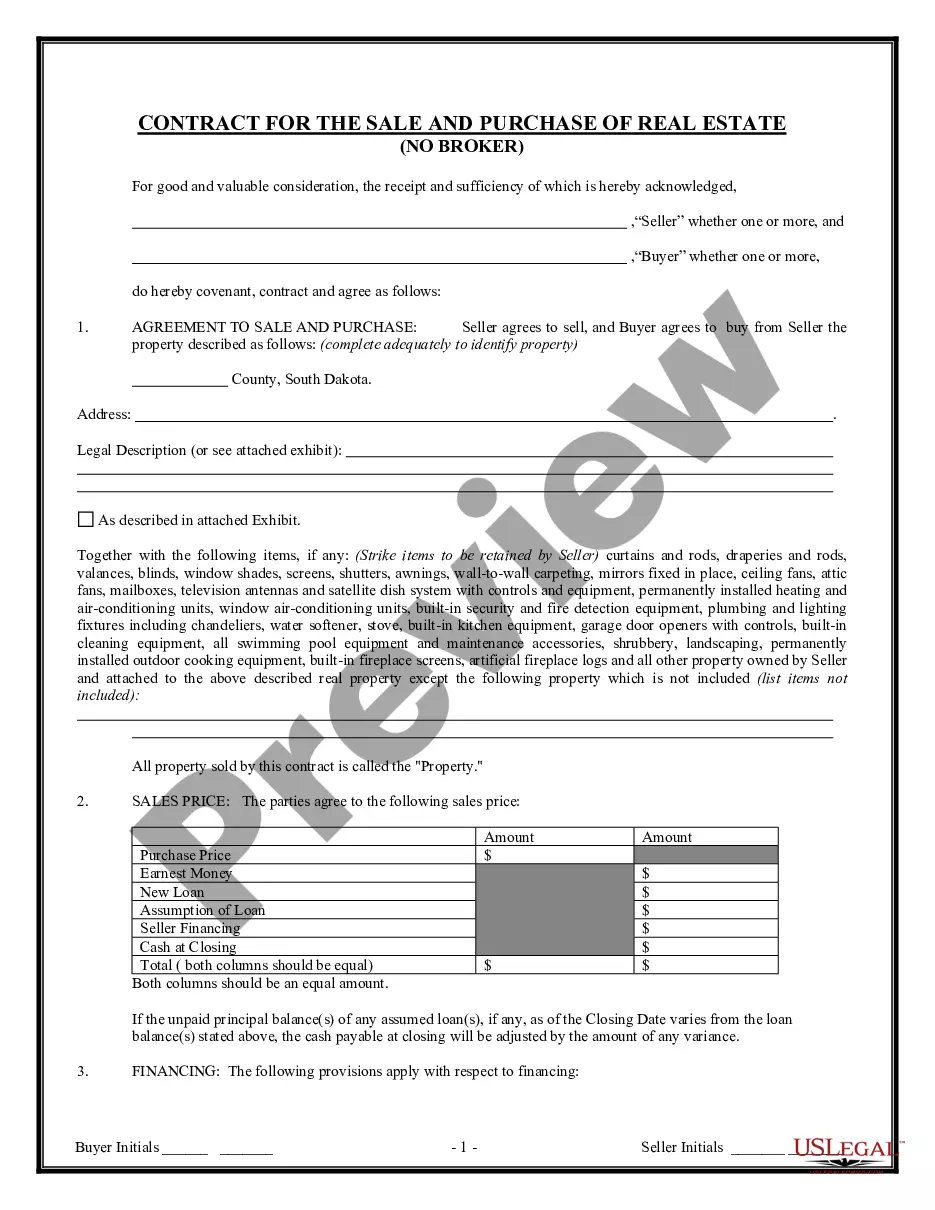

- Use the Preview function to check the content of the form.

- Read the form description to ensure you have selected the appropriate document.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment method and provide your information to create an account.

Form popularity

FAQ

The downside of an Offer in Compromise can include potential tax implications, as forgiven debt may be considered taxable income. Additionally, it may negatively affect your credit score. However, when managed properly, using resources like a South Carolina Sample Letter for Compromise on a Debt can help navigate these challenges and make the process smoother.

In South Carolina, the statute of limitations for most debts is three years. This means creditors typically have three years from the last payment or acknowledgment of the debt to file a lawsuit. It is essential to be proactive and understand your rights to use this timeframe to your advantage, particularly when considering a South Carolina Sample Letter for Compromise on a Debt.

A dispute letter for a debt serves as a formal method to challenge inaccuracies in your debt records. It should include your personal details, account information, and state your reasons for disputing the debt. If you're unsure how to format this letter, you may find a South Carolina Sample Letter for Compromise on a Debt particularly beneficial as it can guide you through the process and increase your chances of success.

The 777 rule is a guideline that outlines the practices debt collectors must follow. It generally prohibits them from contacting you after you've requested that they stop, particularly regarding communications about the debt. If you need assistance managing your debts, a South Carolina Sample Letter for Compromise on a Debt can help you negotiate with creditors effectively.

To write a letter requesting proof of debt, start by clearly stating your request for verification of the debt owed. Include your personal details, the account information, and a polite yet firm request for documentation. The South Carolina Sample Letter for Compromise on a Debt serves as a useful reference to create your own document requesting proof of debt.

A sample letter for a settlement offer typically includes an introduction stating your intention to settle, along with the specifics of the debt and your settlement proposal. It should also discuss your reasons for requesting the compromise while maintaining a polite tone. You can find a practical example in the South Carolina Sample Letter for Compromise on a Debt to assist you in writing your own.

To write a good debt settlement letter, begin with a clear statement of your intention to settle the debt. Include the debt details, your proposed settlement amount, and any supporting information about your financial situation. A well-structured South Carolina Sample Letter for Compromise on a Debt can guide you through creating an effective letter.

A reasonable offer to settle a debt typically ranges from 30% to 70% of the total owed amount, depending on your financial situation and the collector's willingness to negotiate. You can gauge the amount by reviewing your budget and considering how much you can afford. The South Carolina Sample Letter for Compromise on a Debt can help you frame your offer appropriately.

A debt settlement letter should include your intent to settle, details of the debt, and your proposed settlement amount. Clearly outline your reasons for the offer and specify the terms you seek. Referencing the South Carolina Sample Letter for Compromise on a Debt can provide you with a suitable template to craft a professional letter.

The 777 rule is an informal guideline that suggests you should aim to offer 70% of your total debt, while the collector may settle for 50% or even less. This rule provides a framework for negotiation, allowing both parties to reach a fair compromise. Using the South Carolina Sample Letter for Compromise on a Debt can help you structure your offer effectively.