A bailee is a person who receives possession of a property or goods through a contract of bailment. Unlike a contract of sale, the bailee has to return the goods or property to the bailor, under a contract of bailment. A bailee is responsible for the safekeeping and return of the property to the bailor or otherwise disposing it off according to the contract of bailment.

A bailor is a person who transfers possession of property or goods to the custody of another (bailee), usually under a contract of bailment. A bailment is an act of transferring/placing property or goods in the custody and control of another. A bailment is created by the voluntary taking into custody or possession of goods or property which belongs to another.

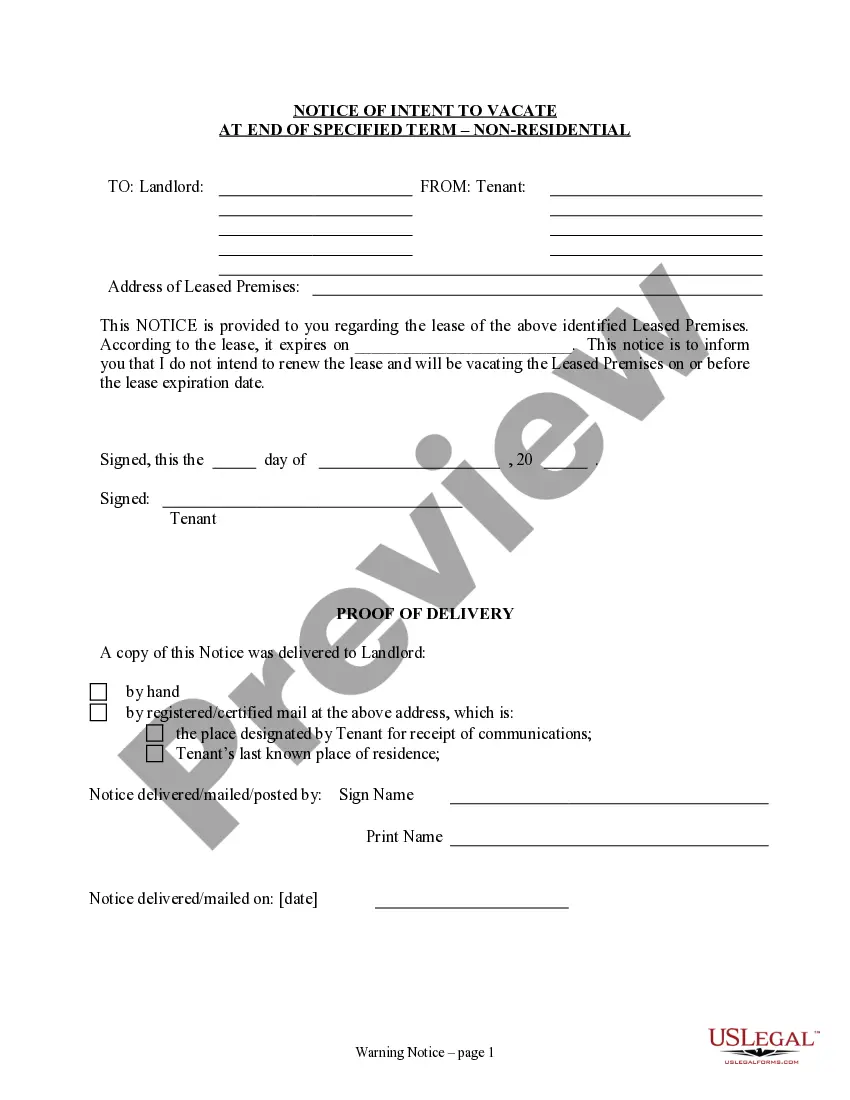

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.