The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a the person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation. This form is a sample of a rejection of such a tender.

South Carolina Letter Rejecting Tender of Check

Description

How to fill out Letter Rejecting Tender Of Check?

In case you need to acquire, obtain, or create valid document formats, utilize US Legal Forms, the largest assortment of legal templates, accessible online.

Employ the site's user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are categorized by types and conditions, or keywords.

Step 4. Once you have found the form you require, click the Buy now button. Choose the payment plan you prefer and enter your details to register for your account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment. Step 6. Locate the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the South Carolina Letter Refusing Tender of Check.

Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded within your account. Select the My documents section and choose a form to print or download again.

Compete and acquire, and print the South Carolina Letter Refusing Tender of Check with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to discover the South Carolina Letter Refusing Tender of Check with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the South Carolina Letter Refusing Tender of Check.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

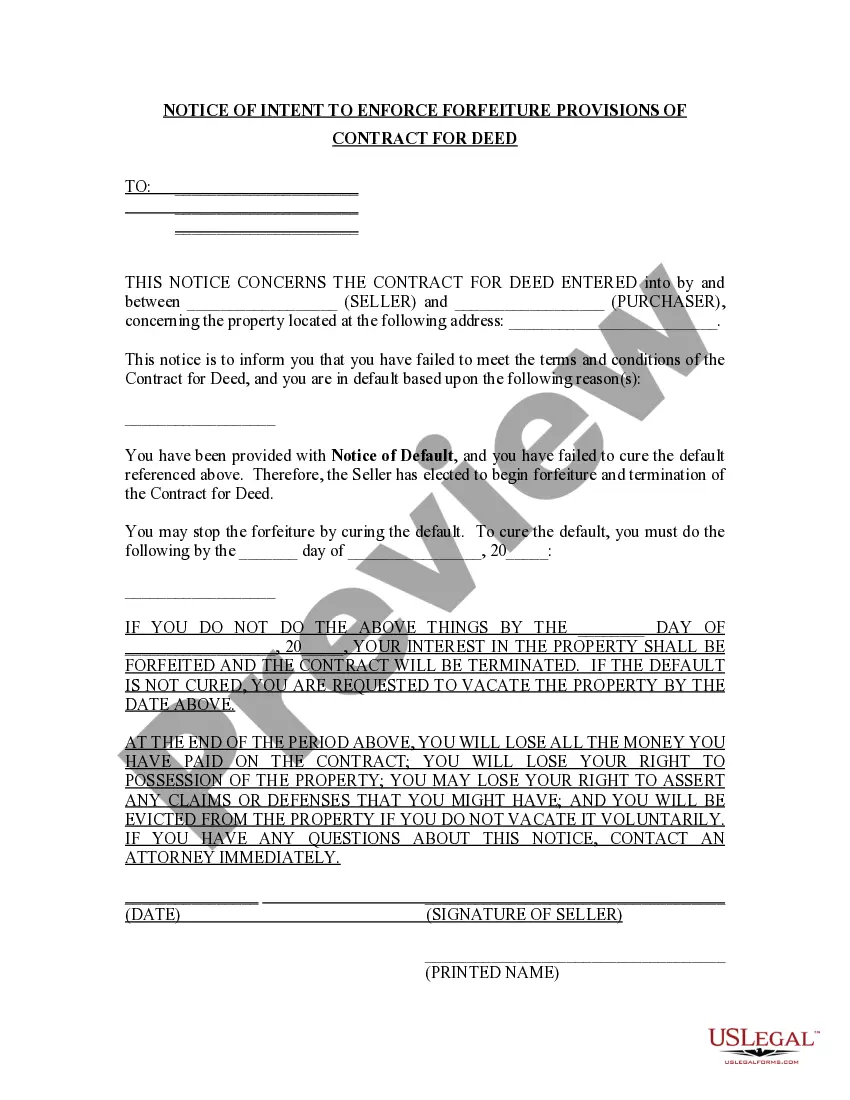

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The legislation concerning tenders in India ensures transparency and fairness in public procurement processes. These laws dictate how tenders should be called, evaluated, and awarded. For businesses engaged in transactions, knowledge of these laws is vital, especially when responding to concerns highlighted in documents like the South Carolina Letter Rejecting Tender of Check.

The law of tender in India governs the requirements and guidelines for making a valid tender. This law stipulates that the tender must be made in accordance with the terms set out in the contract and offer the correct amount or performance. If a tender is not valid, such as being rejected by a South Carolina Letter Rejecting Tender of Check, it can lead to contract disputes.

In India, the legal tender refers to currency that must be accepted for the payment of debts. The Reserve Bank of India issues these notes and coins, making them acceptable in all monetary transactions. Understanding legal tender as it relates to checks is crucial, especially when dealing with issues like a South Carolina Letter Rejecting Tender of Check.

A contract becomes legally binding in South Carolina when it includes mutual assent, a lawful object, and consideration. All parties must agree to the terms willingly and understand their obligations. Additionally, a South Carolina Letter Rejecting Tender of Check can highlight issues with a contract that appears binding but was breached or not honored by one party.

In South Carolina, breach of contract law requires that the aggrieved party shows the existence of a valid contract, the breach by the other party, and resulting damages. The law protects parties from unfair practices and often allows for legal remedies. A South Carolina Letter Rejecting Tender of Check can be an essential document in these legal actions, providing notice of the breach.

A breach of contract occurs when one party fails to perform their obligations as outlined in the agreement. This can involve not completing the work, not making payments, or not adhering to the terms of the contract. When dealing with a South Carolina Letter Rejecting Tender of Check, it is important to identify whether the tendering party is not honoring their responsibilities under the contract.

The four types of breach of contract include complete, material, minor, and anticipatory breaches. Each type varies in its severity and implications. For instance, a material breach may significantly affect the contract's purpose, often leading to a South Carolina Letter Rejecting Tender of Check as a formal response to the breach. Understanding these types can help you determine your next steps.

To prove a breach of contract, you must show that a valid contract existed, the other party failed to fulfill their obligations, and you suffered damages as a result. Specifically, in the context of a South Carolina Letter Rejecting Tender of Check, it's crucial to establish that the tender was improperly rejected, leading to a breach. Clear documentation and evidence will strengthen your case.

SC Code 11-35-710 deals with the duties of public procurement officers in South Carolina. It lays out ethical guidelines and responsibilities that these officials must uphold. Understanding this code can provide insight for businesses facing challenges related to a South Carolina Letter Rejecting Tender of Check.

SC Code 16-11-523 relates to the issuance of worthless checks, setting out both criminal and civil penalties for such actions. This legislation is essential for those who want to avoid legal issues arising from bad checks. Being informed about this code can help individuals navigate a South Carolina Letter Rejecting Tender of Check.