South Carolina Receipt for Down Payment for Real Estate

Description

How to fill out Receipt For Down Payment For Real Estate?

If you wish to compile, obtain, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

A selection of templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Select the pricing strategy you prefer and provide your details to register for an account.

Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the South Carolina Receipt for Down Payment for Real Estate. Each legal document template you purchase is yours indefinitely. You have access to every form you obtained within your account. Navigate to the My documents section and select a form to print or download again. Stay competitive and acquire, and print the South Carolina Receipt for Down Payment for Real Estate with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal requirements.

- Utilize US Legal Forms to secure the South Carolina Receipt for Down Payment for Real Estate in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to access the South Carolina Receipt for Down Payment for Real Estate.

- You can also retrieve forms you have previously obtained in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review function to assess the form’s content. Be sure to read the description.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

For a $300,000 house in South Carolina, the minimum down payment would be around $9,000 if you opt for a 3% down payment option. However, if you qualify for specific programs, your minimum could be less. It’s crucial to understand the financial implications of your down payment choice. Securing a South Carolina Receipt for Down Payment for Real Estate will help you keep track of this critical aspect.

Indeed, a 10% down payment is generally considered acceptable when buying a home in South Carolina. This amount can help you secure favorable mortgage terms and reduce monthly payments. Keep in mind that putting down more than the minimum can also eliminate the need for private mortgage insurance. A well-documented South Carolina Receipt for Down Payment for Real Estate can enhance your lender's confidence in your financial commitment.

The minimum down payment for a house in South Carolina usually starts at 3% for conventional loans. However, specific programs may offer assistance for first-time homebuyers, making it easier to manage initial costs. Utilizing a South Carolina Receipt for Down Payment for Real Estate can facilitate your financial planning. Consider all your options to find a plan that fits your situation.

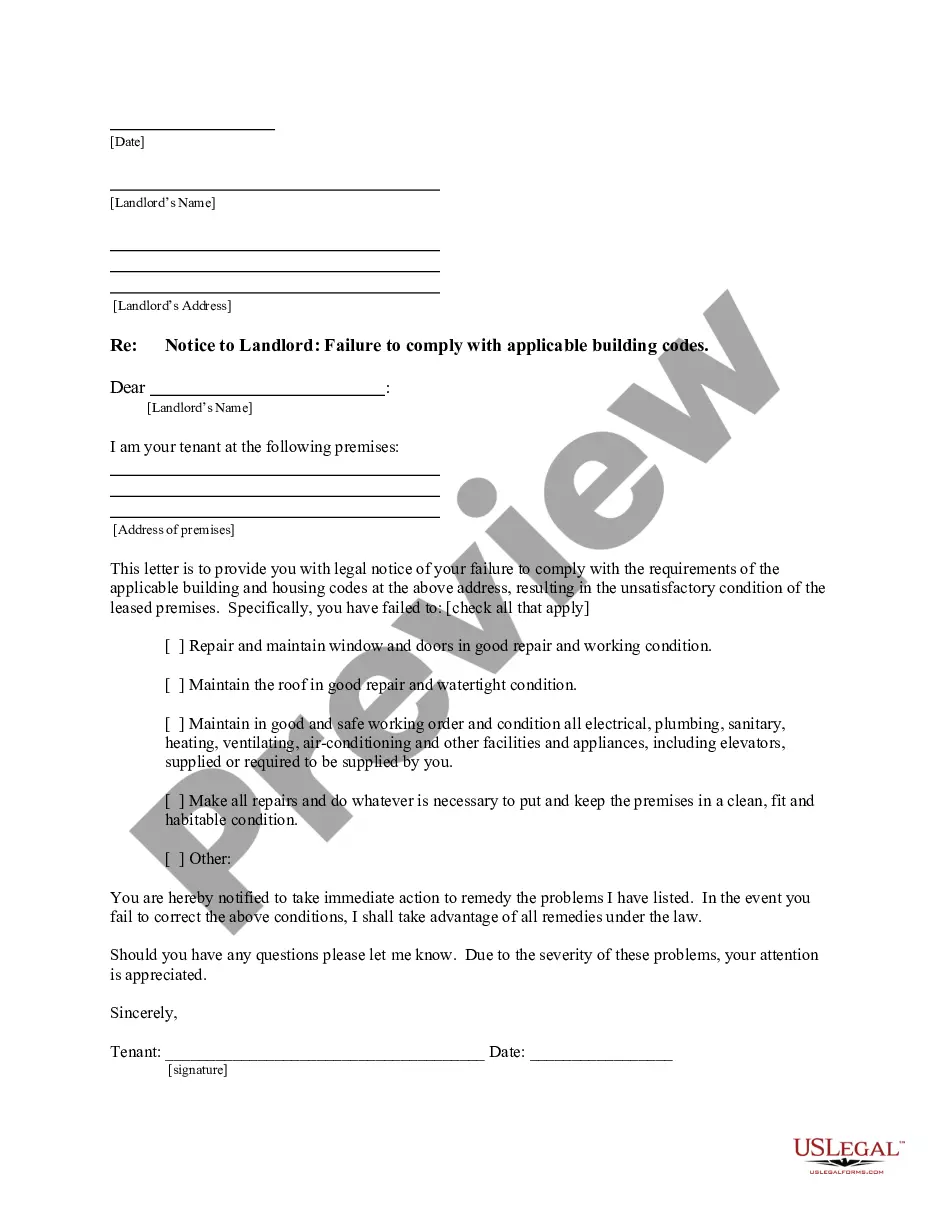

To write a deposit receipt, start by stating your business information. Next, include the payer's name, the amount deposited, and the property involved, if applicable. Clearly indicate that this is a deposit and provide the date. A South Carolina Receipt for Down Payment for Real Estate can simplify this process, ensuring all necessary information is included.

A receipt for payment should clearly convey all essential transaction details. Begin with your business information, followed by the details of the payer and a description of the payment. Include the amount, date, and any relevant notes. Utilizing a South Carolina Receipt for Down Payment for Real Estate ensures you follow best practices in providing clear documentation.

To draft proof of payment, write a document that includes your name, the payee's name, and the payment amount. Date the document and specify the reason for the payment, such as a down payment for real estate. This document can be a formal receipt, like a South Carolina Receipt for Down Payment for Real Estate, which provides clear evidence of the transaction.

Writing a receipt for payment is straightforward. Include your business details at the top, followed by the customer's information. Clearly state the amount received, date of payment, and any relevant transaction details. A South Carolina Receipt for Down Payment for Real Estate can serve as an ideal framework to ensure you capture all necessary elements.

Writing a receipt for a down payment in South Carolina requires including essential details such as the date, the amount received, the purpose of the payment, and both parties' names. Ensure you reference the South Carolina Receipt for Down Payment for Real Estate to make it clear this payment is related to property. This document serves as essential evidence for both the buyer and seller and should be stored safely.

In South Carolina, pulling out after signing contracts can be complicated. Without contingencies written into your contract, you might face forfeiting your South Carolina Receipt for Down Payment for Real Estate. Always review your contract’s terms and conditions with an attorney or real estate professional to fully understand your rights before deciding to exit.

A buyer may back out of a deal close to closing if there are contingencies included in the contract that allow for it. If contingencies are not present or if they have expired, you risk losing your South Carolina Receipt for Down Payment for Real Estate. It is crucial to understand your contract's timing and limitations to avoid potential financial repercussions.