South Carolina Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

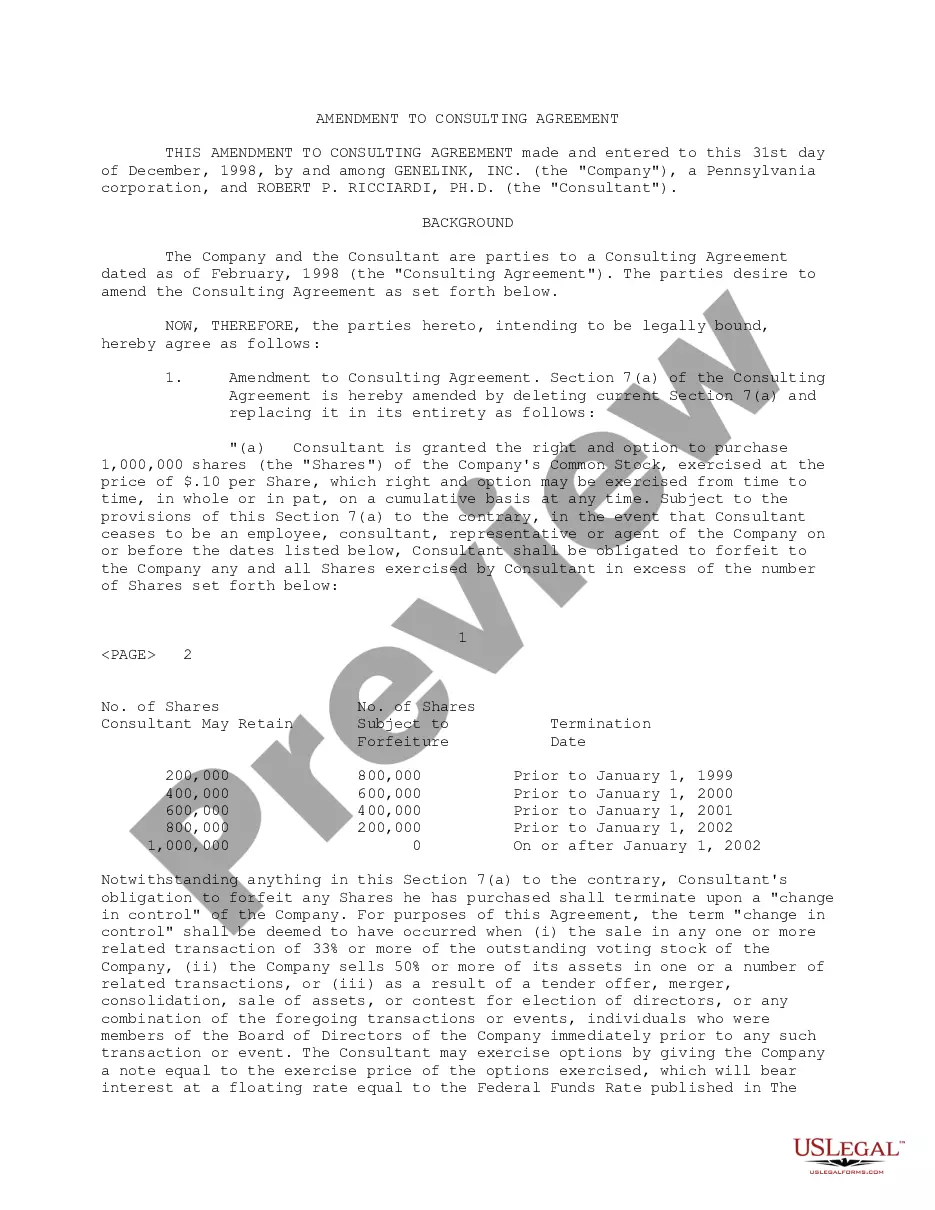

US Legal Forms - among the biggest libraries of authorized kinds in the USA - gives a wide array of authorized record layouts you can download or print. Using the website, you will get a large number of kinds for enterprise and individual functions, categorized by classes, says, or keywords.You can get the latest variations of kinds just like the South Carolina Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) in seconds.

If you already possess a registration, log in and download South Carolina Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) through the US Legal Forms catalogue. The Down load option will show up on every single develop you see. You have accessibility to all in the past saved kinds from the My Forms tab of the accounts.

In order to use US Legal Forms the very first time, allow me to share easy guidelines to help you started:

- Be sure to have selected the best develop for your city/county. Go through the Preview option to examine the form`s information. Look at the develop outline to ensure that you have selected the right develop.

- In case the develop doesn`t fit your demands, utilize the Lookup area towards the top of the monitor to find the one which does.

- If you are happy with the shape, validate your option by visiting the Acquire now option. Then, select the rates plan you like and give your credentials to register for the accounts.

- Procedure the transaction. Make use of your credit card or PayPal accounts to perform the transaction.

- Select the formatting and download the shape on the product.

- Make modifications. Load, change and print and sign the saved South Carolina Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

Each web template you put into your money does not have an expiration day and it is yours forever. So, if you wish to download or print another backup, just visit the My Forms area and click on about the develop you will need.

Get access to the South Carolina Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) with US Legal Forms, probably the most comprehensive catalogue of authorized record layouts. Use a large number of specialist and condition-distinct layouts that fulfill your organization or individual requirements and demands.

Form popularity

FAQ

Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. You should check your deposit account agreement for information on the bank's policies regarding fraudulent checks. Fraudulent checks may be part of an overpayment/money order scam.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

When you write a check and there's not enough funds in your account when it's presented, this is considered non-sufficient funds (NSF). When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank.

It is also a crime to forge a check or write a check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

A bounced check occurs when the writer of the check has insufficient funds available to fulfill the payment amount on the check to the payee. When a check bounces, it is not honored by the depositor's bank and may result in overdraft fees and banking restrictions.

Key takeaways A bounced check penalty from a bank can cost around $35 in the form of a nonsufficient funds fee. Merchants can also charge a bounced check fee; they typically cost $20 to $40.

To criminally prosecute a bad check, South Carolina law states a check must be deposited within 10 days of receipt, the check cannot be postdated, that there was no agreement to hold the check, and a warrant must be obtained within 180 days from the date the check was received.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.