South Carolina Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Are you presently inside a situation in which you need to have files for either business or individual functions just about every time? There are tons of legal record web templates available online, but getting ones you can rely is not effortless. US Legal Forms provides a huge number of develop web templates, such as the South Carolina Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, which can be composed to fulfill state and federal needs.

Should you be presently knowledgeable about US Legal Forms web site and possess an account, simply log in. Next, you may acquire the South Carolina Sample Letter to City Clerk regarding Ad Valorem Tax Exemption template.

If you do not provide an profile and need to begin to use US Legal Forms, adopt these measures:

- Get the develop you want and ensure it is to the right area/state.

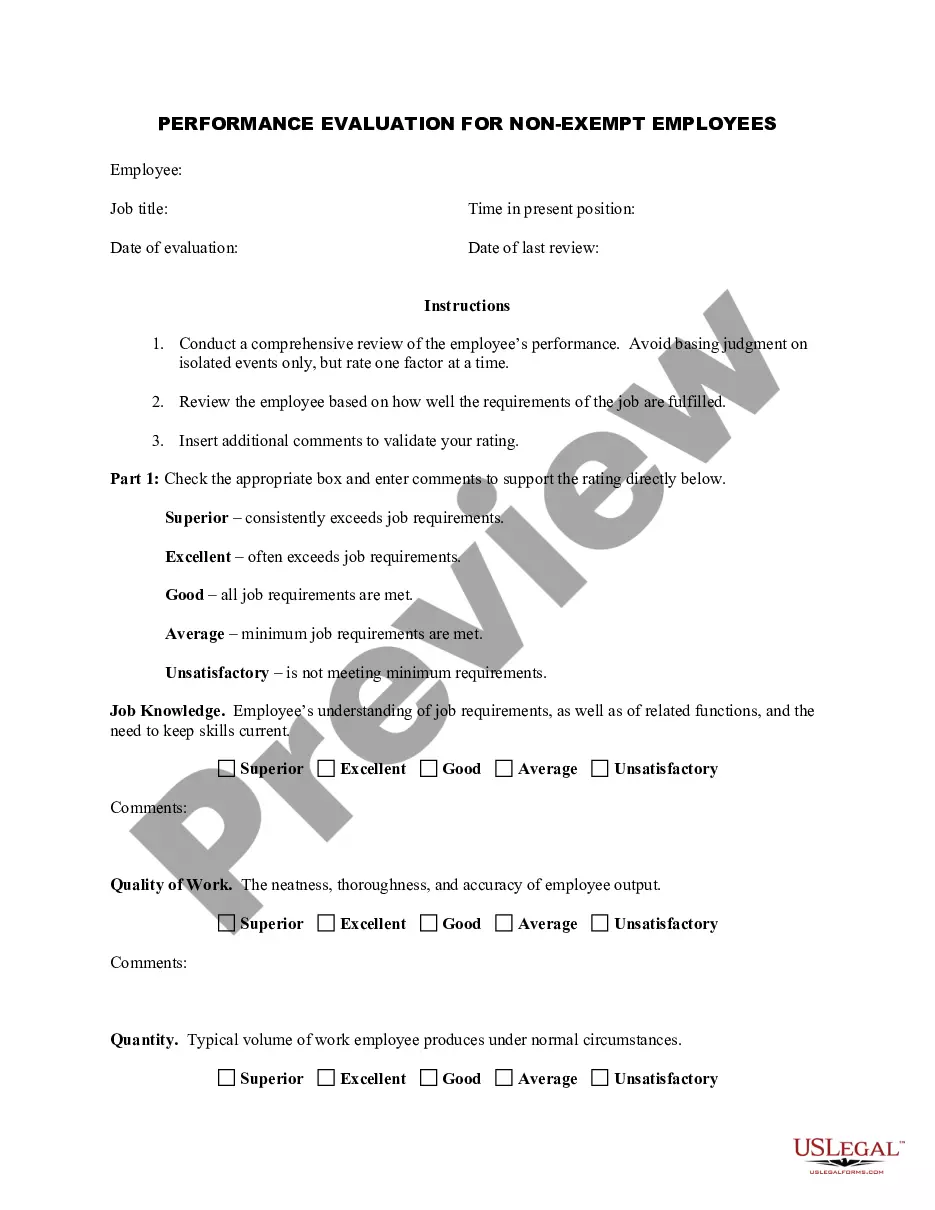

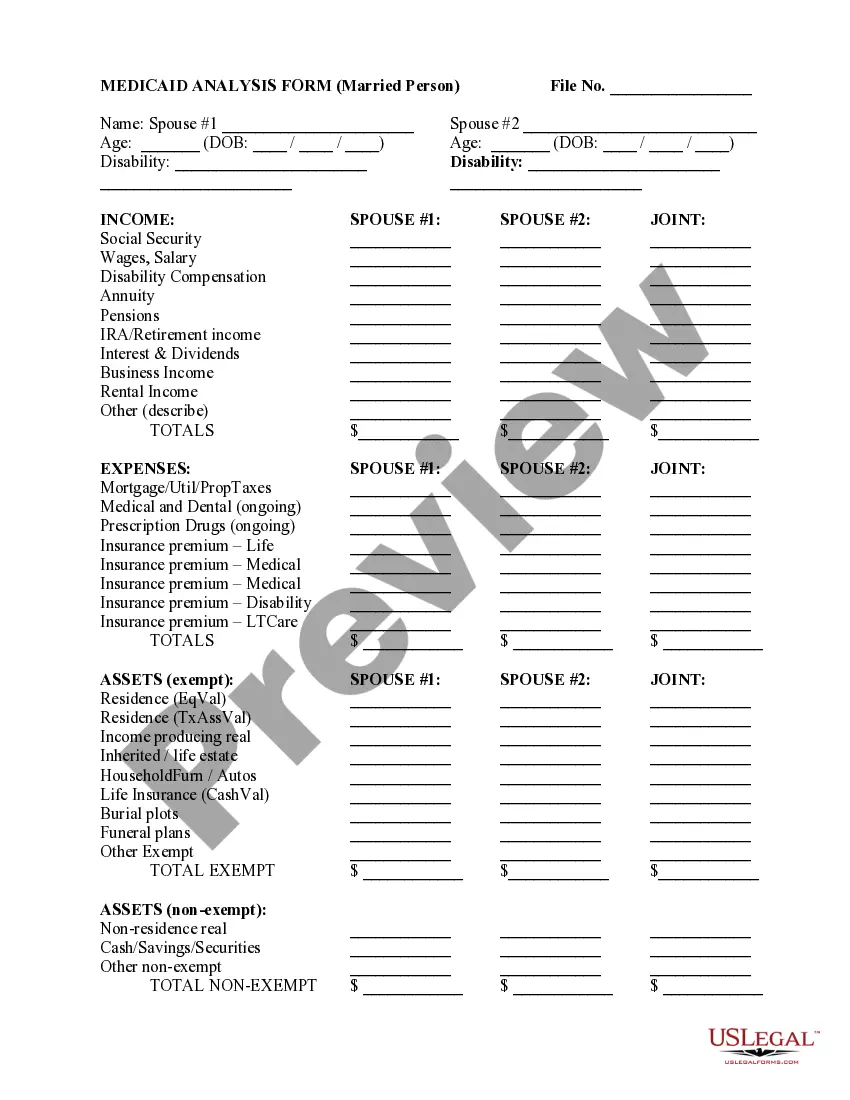

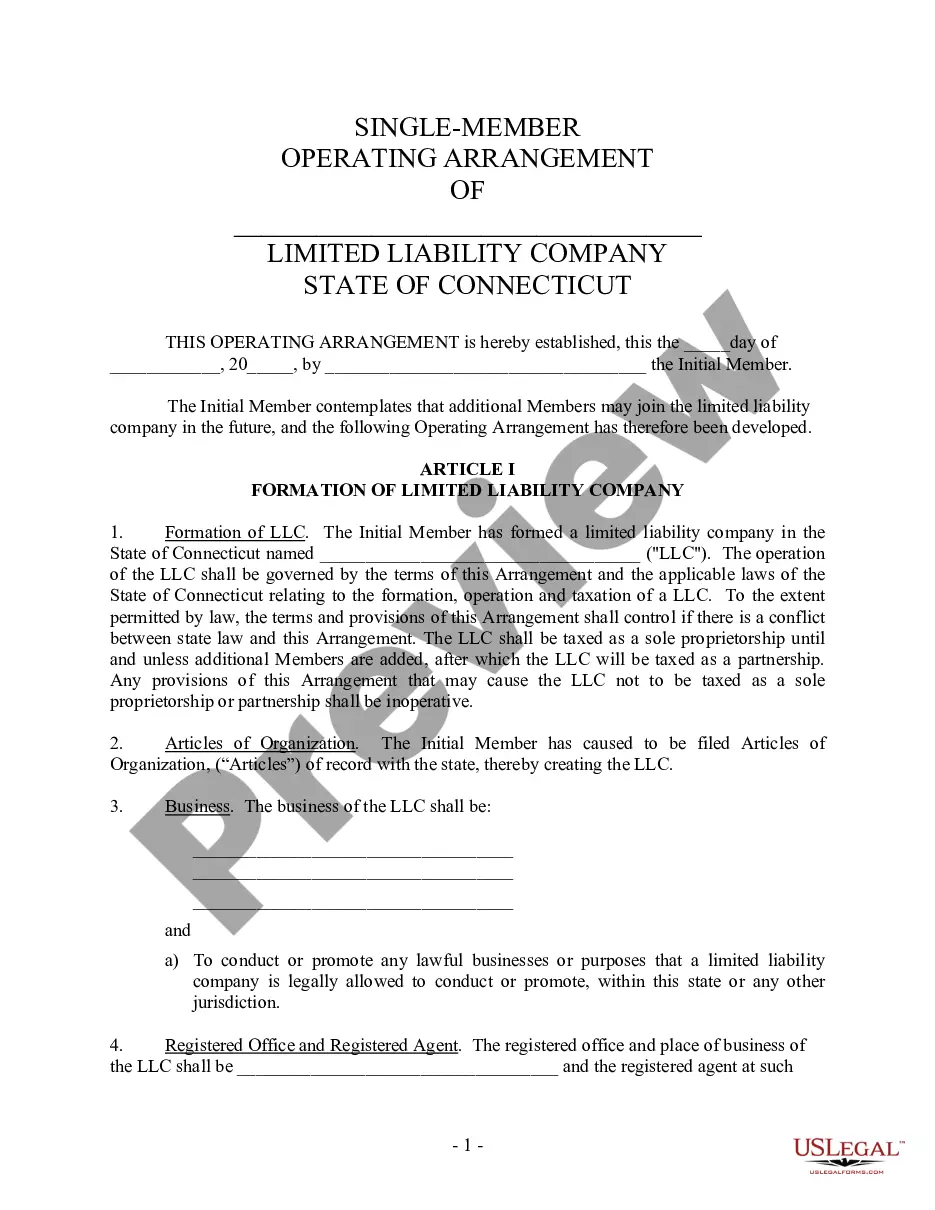

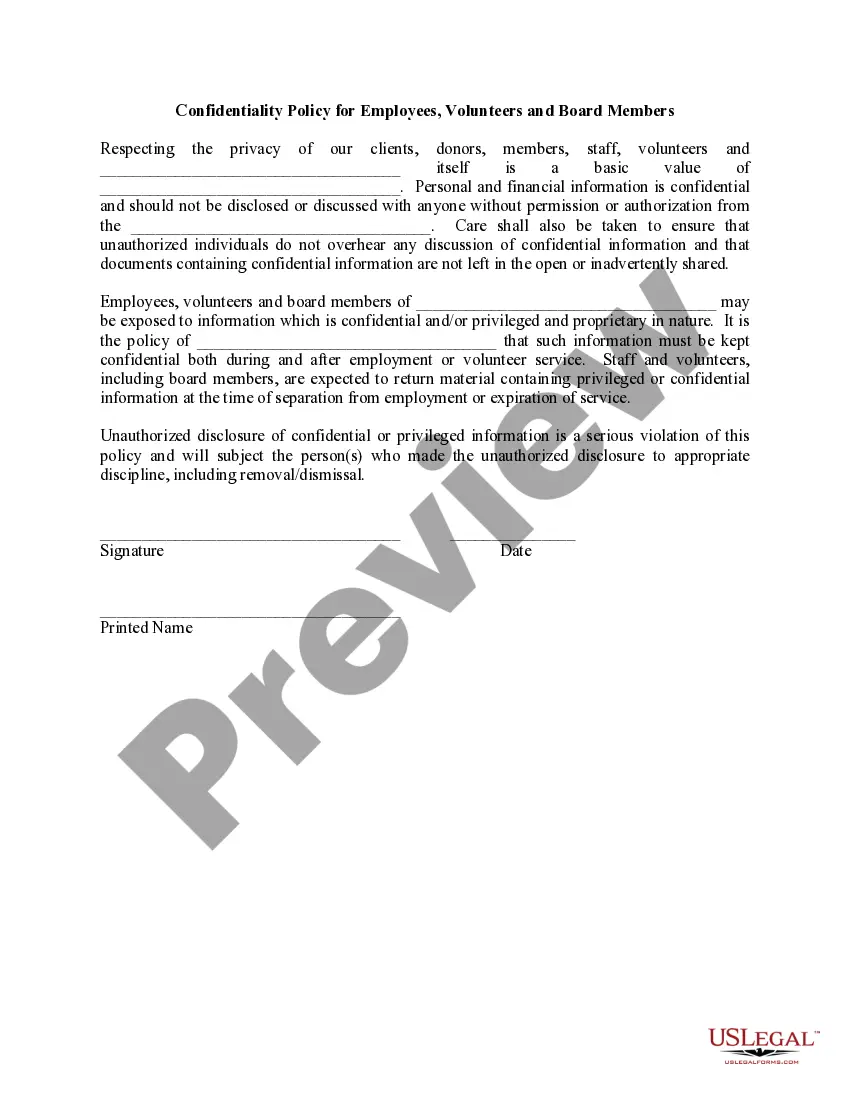

- Utilize the Review option to analyze the form.

- Browse the explanation to ensure that you have selected the appropriate develop.

- If the develop is not what you`re searching for, take advantage of the Research industry to obtain the develop that fits your needs and needs.

- Whenever you find the right develop, click Acquire now.

- Opt for the costs strategy you would like, complete the specified information to make your money, and pay money for an order with your PayPal or Visa or Mastercard.

- Choose a handy file structure and acquire your backup.

Get each of the record web templates you have bought in the My Forms menu. You can aquire a extra backup of South Carolina Sample Letter to City Clerk regarding Ad Valorem Tax Exemption at any time, if necessary. Just go through the essential develop to acquire or produce the record template.

Use US Legal Forms, probably the most comprehensive collection of legal forms, to conserve time as well as avoid errors. The assistance provides professionally produced legal record web templates that can be used for a selection of functions. Produce an account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

If your deed is in your name and your spouse's name, you will receive the full $50,000 exemption as long as one of you meets the eligibility requirements.

MyDORWAY is the fastest, easiest way to apply for Property Tax Exemptions. If you apply for a Property Tax Exemption on MyDORWAY, you do not need to submit a paper copy of the PT-401-I. Visit MyDORWAY.dor.sc.gov to get started.

In 1972, the S.C. General Assembly passed the Homestead Exemption Law which provides real estate property tax relief for South Carolinians who are age 65 and over, totally and permanently disabled, or legally blind. The exemption excludes the first $50,000 from the fair market value of your legal residence.

Some customers are exempt from paying sales tax under South Carolina law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

South Carolina's ?property tax relief? law means the homeowner (Owner Occupied) will be exempt from paying school operations taxes. The state in Act 388 increased sales tax by one-cent to fund the school operating exemption. The amount of the exemption is based on individual county budgets.

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

5-Year Property Tax Abatement. By law, manufacturers (investing $50,000 or more) and distribution or corporate headquarters facilities (investing $50,000 or more and creating 75 new jobs in year 1) are entitled to a five-year property tax abatement from county operating taxes.

The Homestead Exemption is a program designed to help the elderly, blind, and disabled. This program exempts the first $50,000 value of your primary home.