South Carolina Guide for Protecting Deceased Persons from Identity Theft

Description

How to fill out Guide For Protecting Deceased Persons From Identity Theft?

If you wish to complete, obtain, or create authentic document templates, utilize US Legal Forms, the largest selection of official forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the South Carolina Guide for Safeguarding Deceased Individuals from Identity Theft in just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the South Carolina Guide for Safeguarding Deceased Individuals from Identity Theft. You can also access forms you have previously obtained from the My documents section of your account.

If you are utilizing US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct area/state. Step 2. Use the Preview option to review the form's content. Don't forget to read the description. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other models in the legal form template. Step 4. Once you have found the form you need, click the Buy now button. Choose the payment method you prefer and enter your details to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the South Carolina Guide for Safeguarding Deceased Individuals from Identity Theft.

- Every legal document template you obtain is yours permanently.

- You can access every form you acquired through your account.

- Click on the My documents section and select a form to print or download again.

- Be proactive and obtain, and print the South Carolina Guide for Safeguarding Deceased Individuals from Identity Theft with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

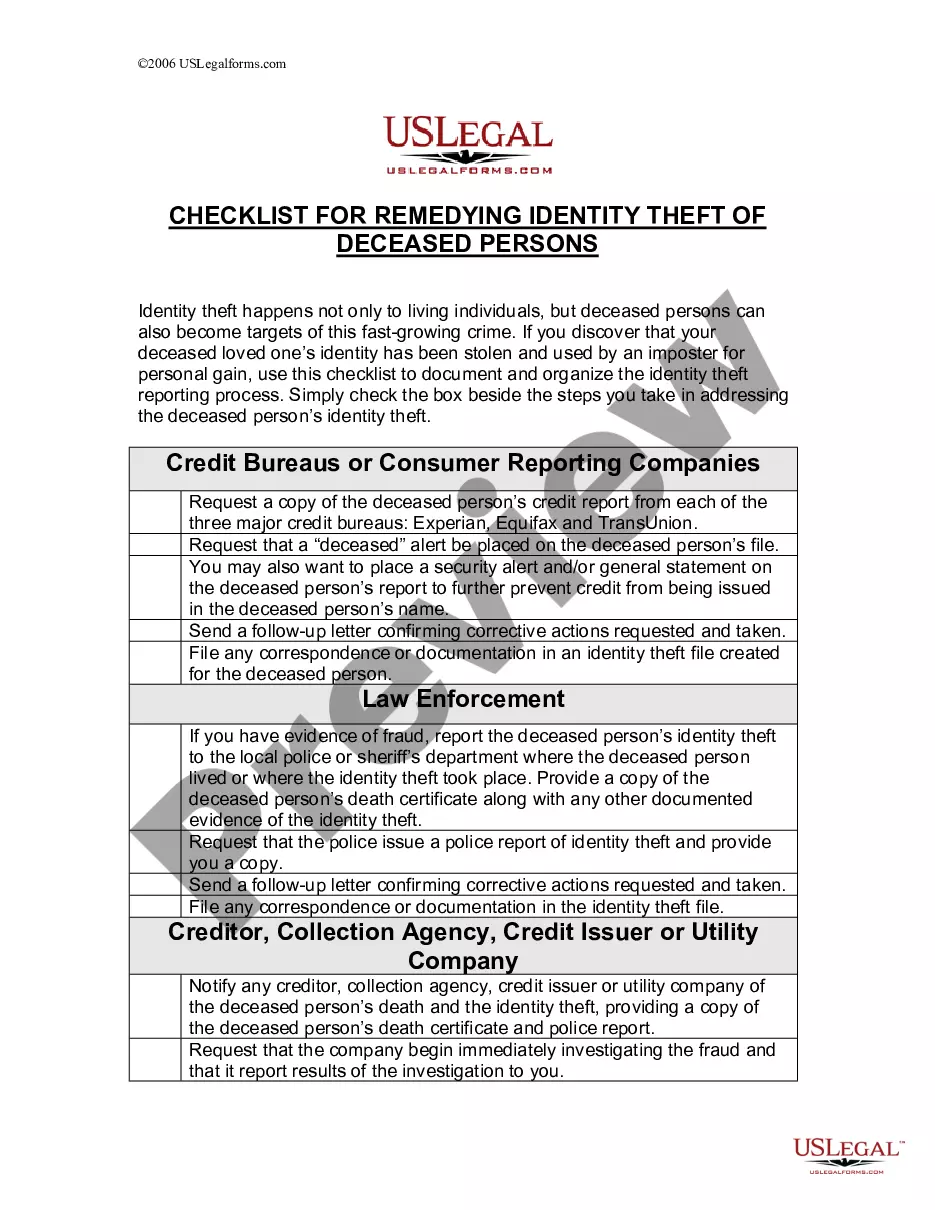

Follow these tips to reduce the risk of a deceased person from having their identity stolen: Send copies of the death certificate to each credit reporting bureau, asking them to put a ?deceased alert? on the credit reports. Review the deceased taxpayer's credit report for questionable credit card activity.

Taking Advantage of the Protected Consumer Freeze (PDF) - A free protected consumer freeze allows the parent, guardian or representative to create a credit file in a protected consumer's name and place a freeze on it, helping to deter identity theft.

Follow these tips to reduce the risk of a deceased person from having their identity stolen: Send copies of the death certificate to each credit reporting bureau, asking them to put a ?deceased alert? on the credit reports. Review the deceased taxpayer's credit report for questionable credit card activity.

Even after someone dies, it's still possible for criminals to use their information to illegally open credit cards, apply for loans, file fraudulent tax returns, and buy goods and services. In some cases, thieves intentionally steal the identity of someone who has died ? a practice known as ghosting.

Deceased family member identity theft, also known as ghosting, occurs when someone uses the personal information of a deceased person to commit fraud. This can include opening new credit accounts, applying for loans or making other financial transactions in the deceased person's name.

Identity theft is when one person uses the identifying information of another for financial gain, and the more we use our private identifying information in public ways, the more prevalent identity theft scams become. Under South Carolina law, identity theft is a felony punishable by up to 10 years in prison.

The IRS doesn't need a copy of the death certificate or other proof of death. Usually, the representative filing the final tax return is named in the person's will or appointed by a court.