South Carolina Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

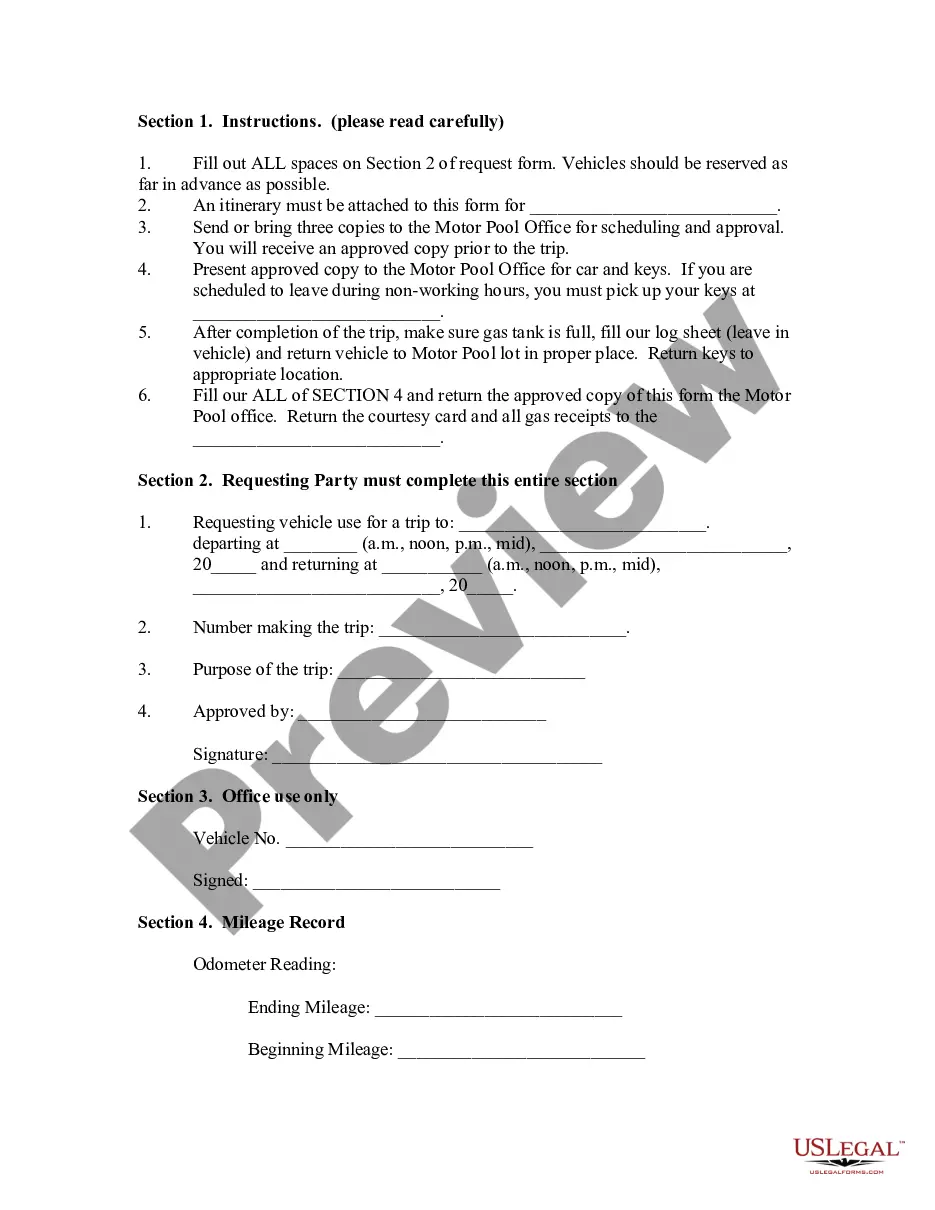

Choosing the right legitimate document design might be a battle. Of course, there are plenty of themes available on the Internet, but how do you get the legitimate develop you require? Make use of the US Legal Forms internet site. The service provides 1000s of themes, including the South Carolina Unrestricted Charitable Contribution of Cash, that you can use for company and personal requires. All the varieties are checked by specialists and fulfill state and federal specifications.

Should you be presently listed, log in for your bank account and then click the Acquire key to obtain the South Carolina Unrestricted Charitable Contribution of Cash. Use your bank account to appear throughout the legitimate varieties you have bought formerly. Visit the My Forms tab of your own bank account and obtain an additional version in the document you require.

Should you be a fresh customer of US Legal Forms, listed here are basic directions that you can comply with:

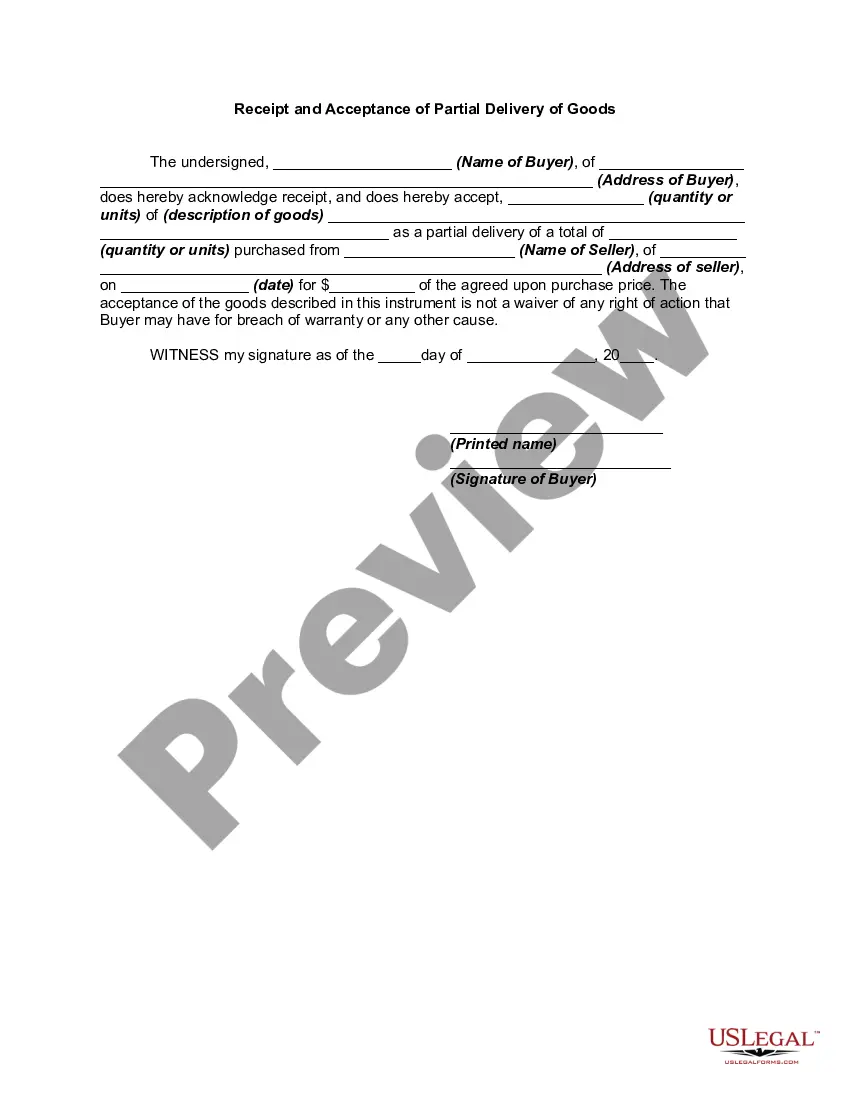

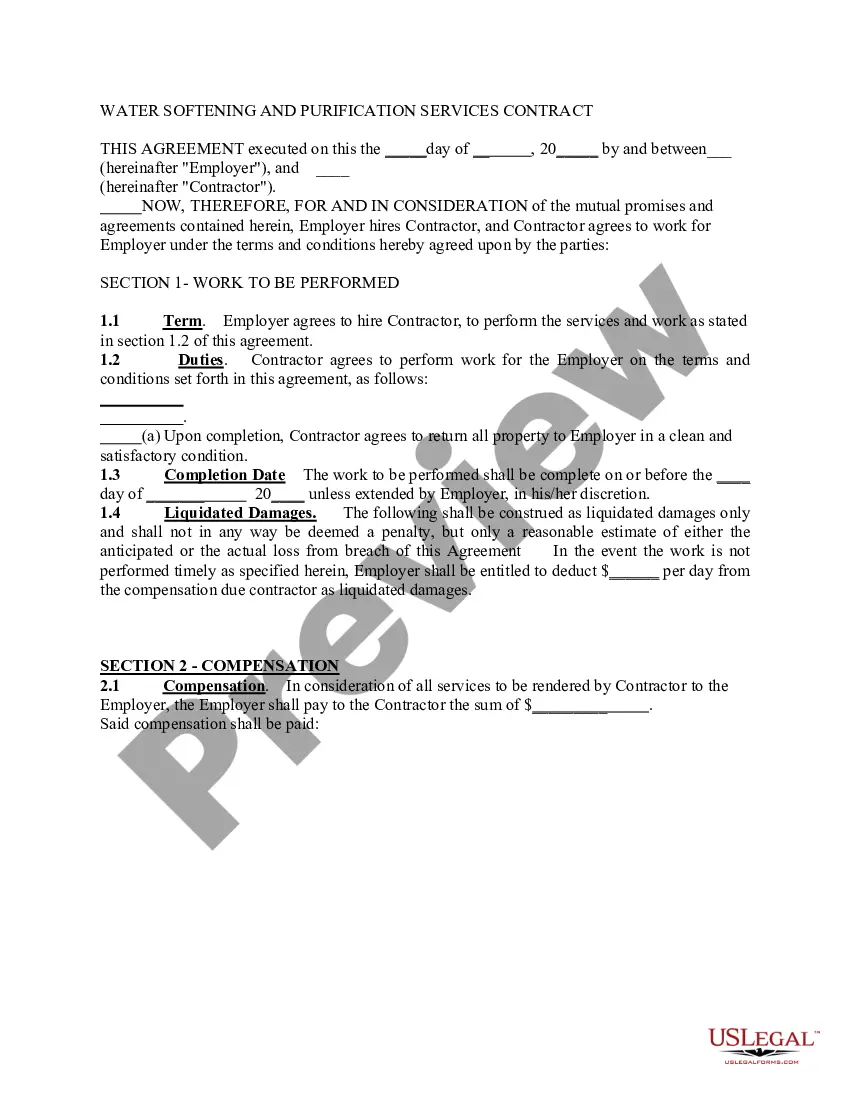

- First, make sure you have selected the proper develop for the area/region. You are able to look over the shape making use of the Review key and study the shape explanation to ensure this is basically the best for you.

- When the develop is not going to fulfill your requirements, use the Seach field to find the correct develop.

- When you are certain the shape is suitable, select the Buy now key to obtain the develop.

- Select the pricing plan you want and type in the needed information and facts. Create your bank account and purchase your order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the data file format and download the legitimate document design for your gadget.

- Full, edit and print and indication the received South Carolina Unrestricted Charitable Contribution of Cash.

US Legal Forms may be the biggest local library of legitimate varieties that you will find a variety of document themes. Make use of the service to download appropriately-manufactured documents that comply with status specifications.

Form popularity

FAQ

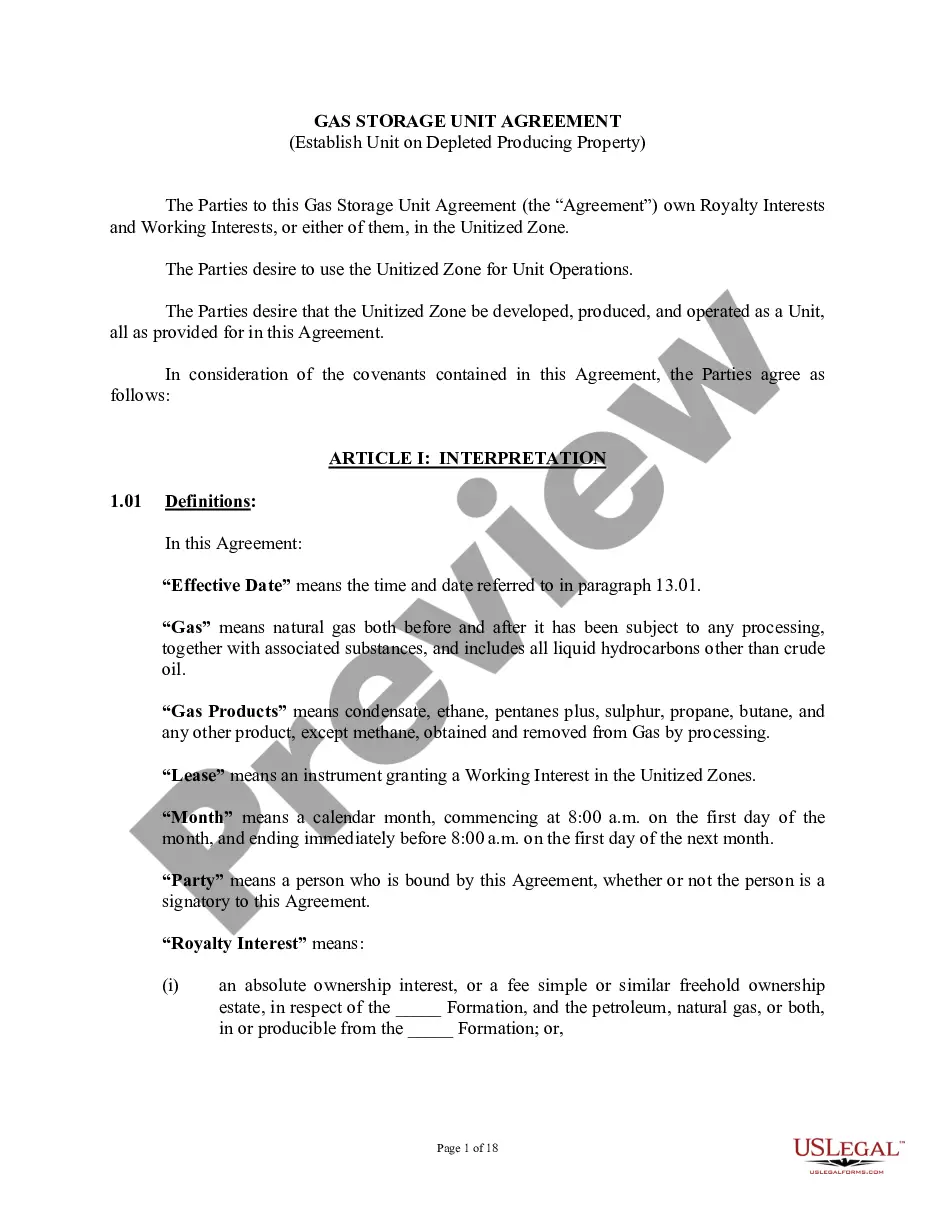

A donor can deduct a charitable contribution of $250 or more only if the donor has a written acknowledgment from the charitable organization. The donor must get the acknowledgement by the earlier of: The date the donor files the original return for the year the contribution is made, or.

Donate to a qualifying organization Your charitable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by section 501(c)(3) of the Internal Revenue Code. Before you donate, ask the charity how much of your contribution will be tax deductible. Internal Revenue Service. Tax Deductible Donations: Rules for Giving to Charity - NerdWallet nerdwallet.com ? article ? taxes ? tax-deduct... nerdwallet.com ? article ? taxes ? tax-deduct...

The new threshold is 60 percent of AGI for cash contributions held for over a year, and 30 percent of AGI for non-cash assets. The good news is that the standard deduction is now higher to account for inflation, rising to $12,950 for people who file individually and $25,900 for married couples who file joint returns. 2023 Tax Rules and Tips for Easier, Cost-Effective Charitable Giving unicefusa.org ? stories ? 2023-tax-rules-and... unicefusa.org ? stories ? 2023-tax-rules-and...

The availability of charitable and other allowable itemized deductions is limited to resident taxpayers who itemize their federal income tax deductions in DC, GA, ID, KS, ME, MD, MO, NE, NM, ND, OK, SC and VA; other states permit resident taxpayers to itemize state income tax deductions and deduct qualified charitable ... State and Local Tax Treatment of Charitable Contributions uscharitablegifttrust.org ? tax-treatment-o... uscharitablegifttrust.org ? tax-treatment-o...

In 2022, if you itemize your deductions, you can deduct cash gifts to qualifying charitable contributions up to 100 percent of your income (up from 60 percent).

Age 65 The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind. Learn About Homestead Exemption - SC Department of Revenue sc.gov ? lgs ? homestead-exemption sc.gov ? lgs ? homestead-exemption

Non-cash items are furniture, clothing, home appliances, sporting goods, artwork and any item you contribute other than cash, checks, or by credit card. Generally, you can deduct your cash contributions and the Fair Market Value (FMV) of most property you donate to a qualified charitable organization.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.