Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust without the necessity of court supervision in the event of the trustor's incapacity or death. Other provisions of the trust document include: trust assets, disposition of income and principal, and administration of the trust assets after the death of the trustor.

South Carolina Living Trust - Revocable

Description

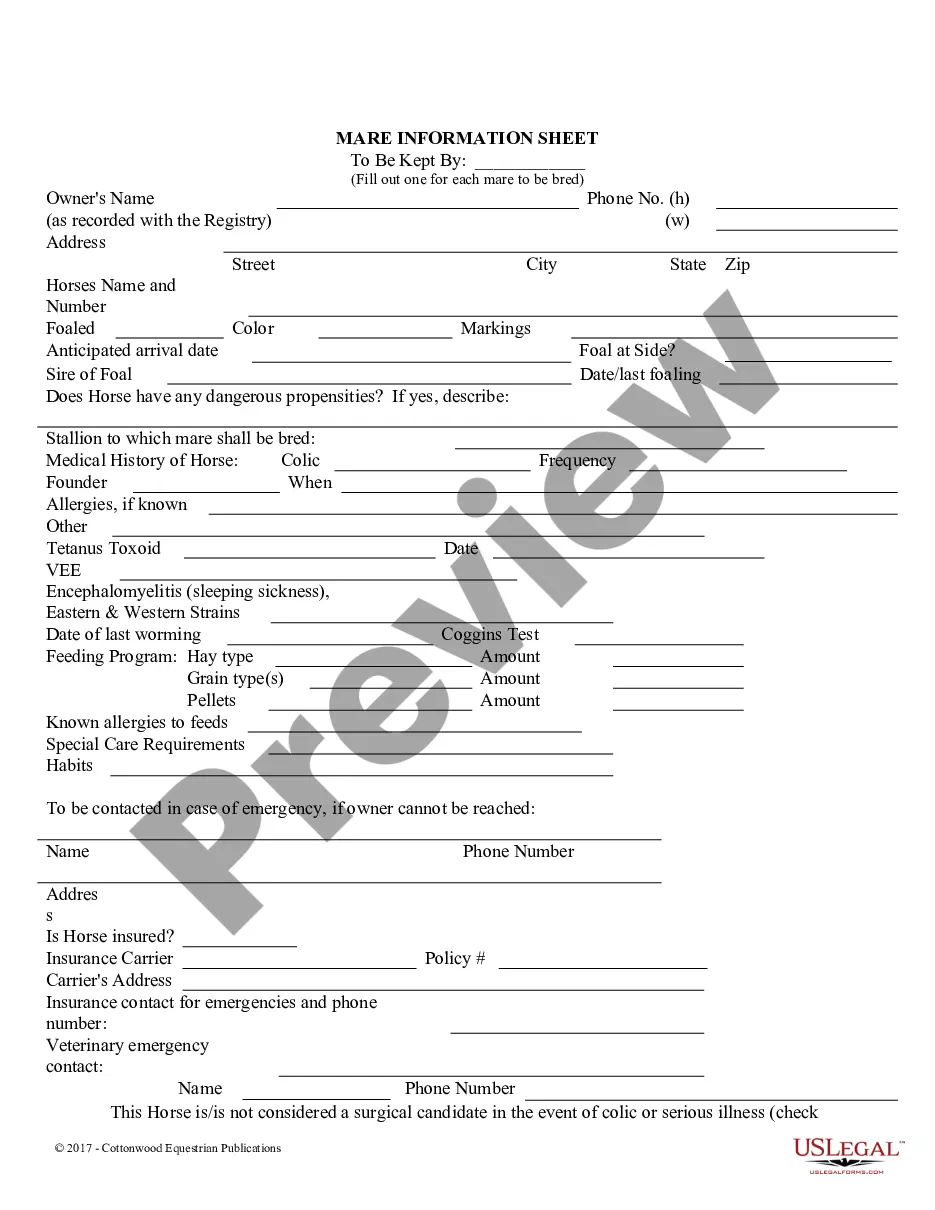

How to fill out Living Trust - Revocable?

You have the capability to allocate time online searching for the legal document format that meets the federal and state guidelines you require.

US Legal Forms offers a vast selection of legal templates that can be examined by experts.

It is easy to download or print the South Carolina Living Trust - Revocable from our services.

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, edit, print, or sign the South Carolina Living Trust - Revocable.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, make sure that you have selected the correct document format for the region/city of your choice.

- Check the form description to ensure that you have chosen the appropriate form.

Form popularity

FAQ

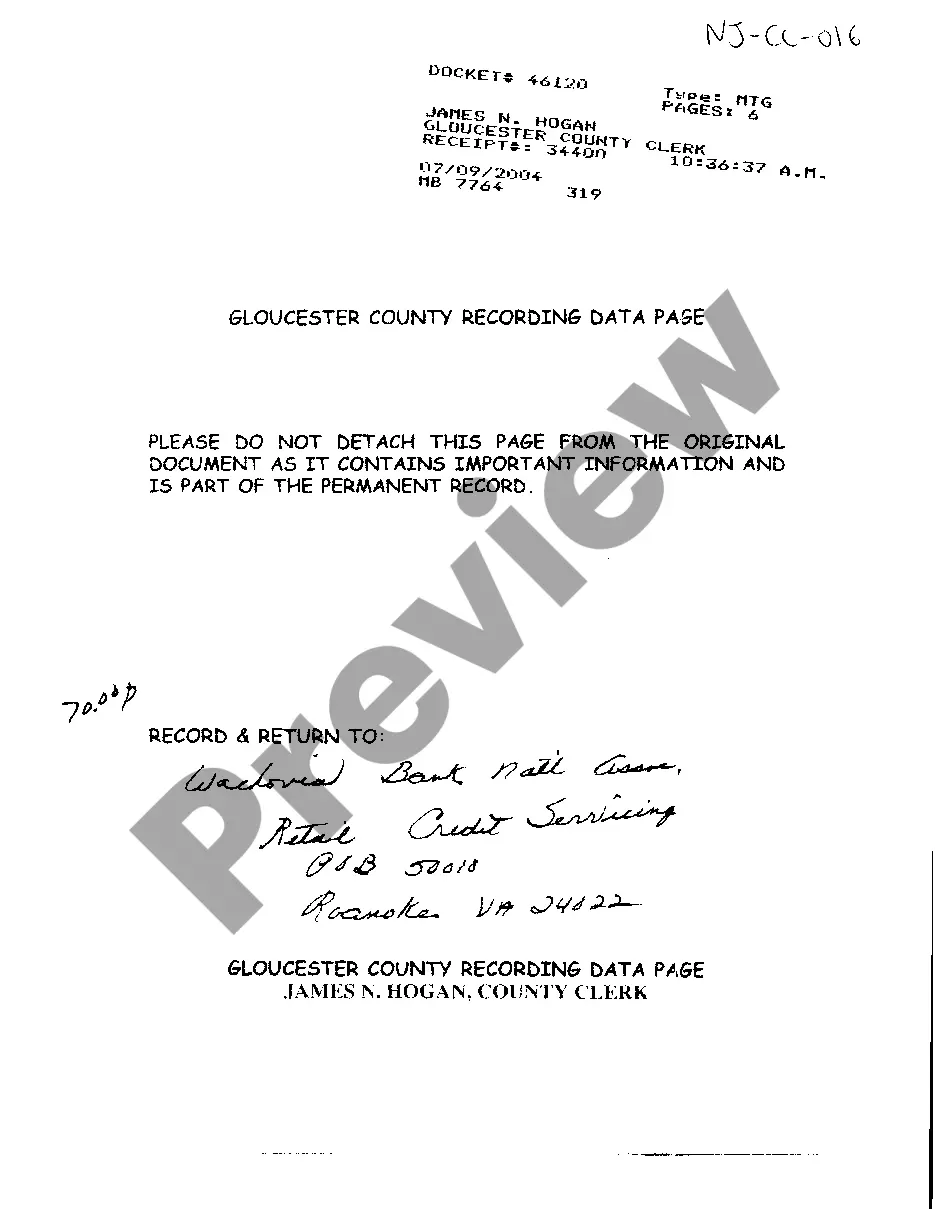

Trusts, including the South Carolina Living Trust - Revocable, are not recorded in a public registry. This allows for a level of privacy, as trust details remain confidential. However, certain documents, like deeds or mortgages associated with trust property, may require recording. Using a platform like uslegalforms can streamline the creation and management of your trust documents efficiently.

No, a trust does not need to be filed with the state in South Carolina. The South Carolina Living Trust - Revocable exists as a private agreement between the trustee and the beneficiaries. While there is no filing requirement, keeping detailed records and maintaining proper documentation is essential for effective management and future estate planning.

In South Carolina, a certificate of trust does not need to be recorded. However, if you wish to provide confirmation of the trust's existence or terms to third parties, you can create a certificate of trust. This document can help facilitate transactions involving your South Carolina Living Trust - Revocable without disclosing all trust details. It’s a useful tool for maintaining privacy.

Filing taxes for a revocable trust is straightforward, as the South Carolina Living Trust - Revocable is treated as a pass-through entity. This means you report the trust's income on your personal tax return. You will use IRS Form 1041 to report any income generated by the trust, and you must include your Social Security number. It's advisable to consult with a tax professional to ensure accurate filing.

Placing your house in a trust in South Carolina can offer various benefits, including avoiding probate and ensuring a smooth transfer of ownership. A South Carolina Living Trust - Revocable allows you to manage your property during your lifetime and dictate its distribution after your passing. It's wise to consult with an estate planning professional to explore how this option can suit your needs.

Several states do not impose income tax on trusts, including South Dakota and Nevada. However, South Carolina also provides favorable tax treatment for revocable trusts, allowing for efficient asset management. A South Carolina Living Trust - Revocable can be a strategic choice if you want to minimize tax implications.

The best place to open a trust account typically depends on your financial needs and goals. Many residents of South Carolina opt for local banks or credit unions that offer specialized services for trusts. Additionally, working with US Legal Forms can streamline your trust setup and help you understand the requirements for a South Carolina Living Trust - Revocable.

The best state for establishing a revocable living trust largely depends on individual circumstances. South Carolina ranks high due to its legal environment and supportive trust laws. A South Carolina Living Trust - Revocable provides peace of mind and efficient asset management, making it an attractive option for many.

One downside of a revocable trust is that it does not protect assets from creditors or legal judgments. Also, a South Carolina Living Trust - Revocable may incur management costs and require ongoing administration, which some find cumbersome. However, these drawbacks often lead to greater flexibility in managing your estate.

While many states offer suitable conditions for revocable trusts, South Carolina stands out due to its favorable laws and tax regulations. A South Carolina Living Trust - Revocable can help you manage your assets effectively, making it a popular choice among residents. Additionally, working with a qualified estate attorney in this state can further enhance your trust’s benefits.