South Carolina Obtain S Corporation Status — Corporate Resolutions Forms refer to the legal process and documents required for a business in South Carolina to obtain S Corporation status. An S Corporation, also known as a subchapter S corporation, is a type of business entity that provides certain tax advantages to its shareholders. To obtain S Corporation status in South Carolina, a business must fulfill certain requirements and follow specific procedures. This includes filing the necessary paperwork with both the South Carolina Secretary of State and the Internal Revenue Service (IRS). The primary document needed to obtain S Corporation status in South Carolina is the corporate resolution form. A corporate resolution is a written document adopted by the shareholders and directors of the corporation, which establishes and approves important decisions and actions of the company. The specific content of the corporate resolution form may vary depending on the needs and circumstances of the business. It typically includes details such as the company's name, registered office address, adopted S Corporation status, authorization for officers to sign tax returns, and any other relevant provisions required by the South Carolina Secretary of State or the IRS. In addition to the corporate resolution form, there may be other forms or documents required to complete the process of obtaining S Corporation status in South Carolina. These may include the Articles of Incorporation, which is the initial formation document filed with the South Carolina Secretary of State, as well as the IRS Form 2553, which is the specific form used to elect S Corporation status with the IRS. It is essential to ensure that all the required forms and documents are accurately completed and submitted in a timely manner to avoid any delays or complications in obtaining S Corporation status. It is advisable to consult with a legal professional or a certified public accountant (CPA) familiar with South Carolina business laws and taxation requirements to ensure compliance and maximize the benefits of S Corporation status. There are no different types of South Carolina Obtain S Corporation Status — Corporate Resolutions Forms. However, the content of the corporate resolution form may vary depending on the specific details and decisions of the business.

South Carolina Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out South Carolina Obtain S Corporation Status - Corporate Resolutions Forms?

You can spend hours online searching for the valid document format that satisfies the state and federal requirements you need.

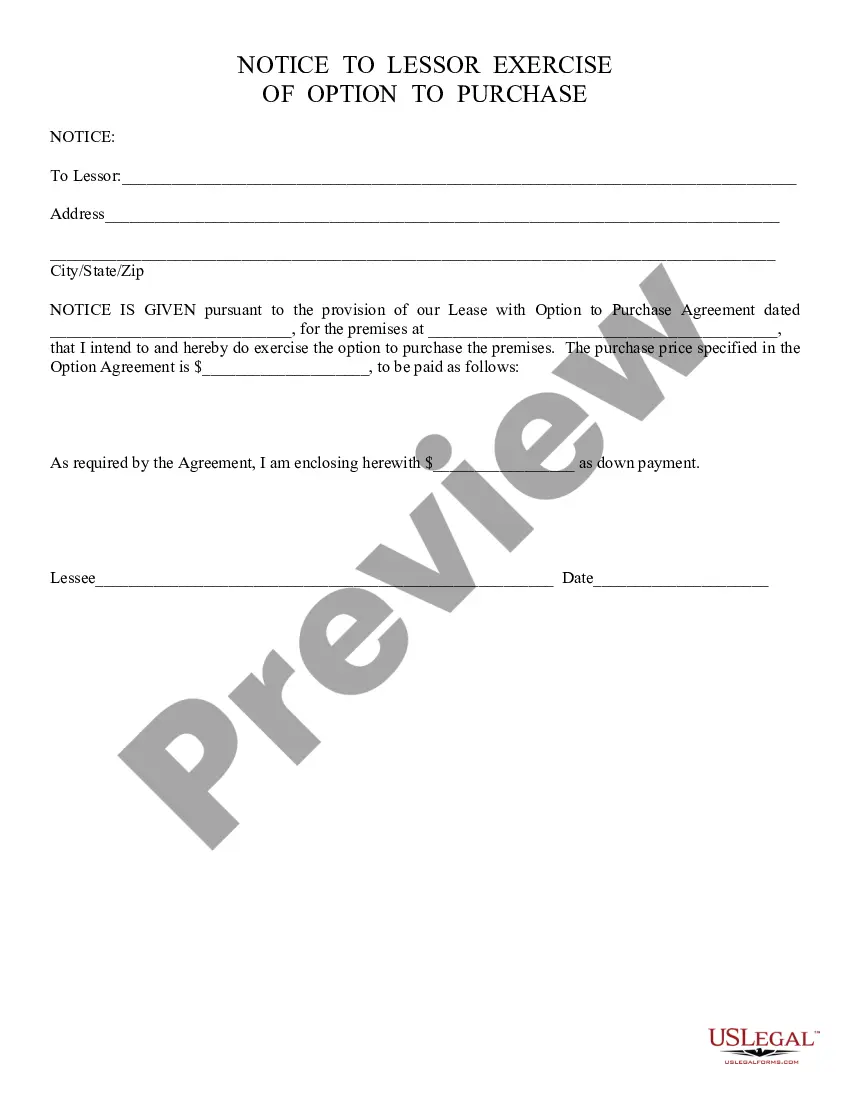

US Legal Forms offers thousands of valid templates that can be reviewed by professionals.

You can conveniently download or create the South Carolina Obtain S Corporation Status - Corporate Resolutions Forms from the service.

If available, use the Review button to look through the document format as well.

- If you have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the South Carolina Obtain S Corporation Status - Corporate Resolutions Forms.

- Every legal document format you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

When completing a W-9 for a small business, start by entering your business name and the trade name if it differs. Next, indicate your business structure, whether it is a sole proprietorship, partnership, or corporation. Lastly, provide your TIN accurately. Ensure all information is correct to avoid issues with tax reporting. For detailed instructions, consider using templates available from ulegalforms.

To obtain proof of your S Corporation status, you can reference the IRS's acceptance of your Form 2553, as they provide a confirmation once your election is approved. You can also review your corporate records or consult your state's Secretary of State for any documentation they may provide. If you need support, ulegalforms offers services that can guide you through obtaining necessary documentation.

When filling out a W-9 form for your S Corporation, start by entering the legal name and business name, as applicable. Provide your business entity type, choosing 'S Corporation.' Additionally, include your Taxpayer Identification Number (TIN) accurately. With ulegalforms, you can find a step-by-step guide and templates to ensure your form is filled out correctly.

For a corporation, the W-9 form should be signed by an authorized officer or a representative of the corporation, such as the President, Vice President, Secretary, or Treasurer. This signature validates the information provided on the form. It is important to ensure the details are accurate because they affect tax reporting and compliance. Utilize ulegalforms to access sample W-9 forms suitable for your S Corporation.

An S Corporation is generally not exempt from backup withholding, but it can reduce the likelihood of this requirement if it has provided a valid W-9 to clients. Backup withholding typically applies if the IRS receives incorrect taxpayer information. Therefore, ensure all records are current and accurate to maintain compliance. Using ulegalforms' resources can help you keep your documentation in order.

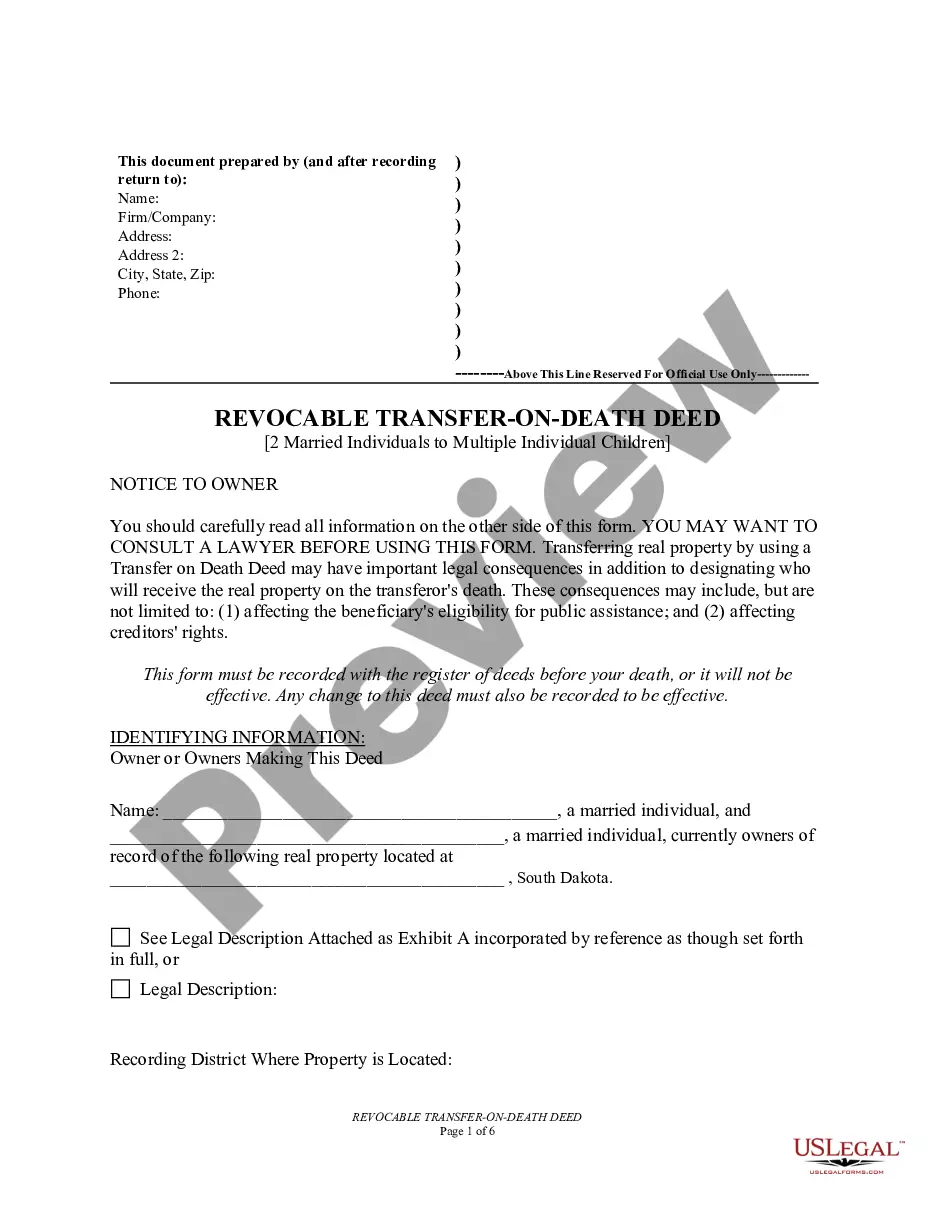

To form an S Corp in South Carolina, begin by establishing a standard corporation by filing Articles of Incorporation with the Secretary of State. After approval, you can file IRS Form 2553 to elect S Corporation status. Ensure to meet any state requirements, including obtaining necessary permits and licenses. For more guidance, ulegalforms offers templates and insights tailored for South Carolina businesses.

Filing taxes for an S Corporation in South Carolina is straightforward yet requires attention to detail. You will file Form 1120S, U.S. Income Tax Return for an S Corporation, which reports income, deductions, and credits. Each shareholder will then report their share of income on their personal tax return through Schedule K-1. Consider using ulegalforms for tools and templates to simplify this process.

To obtain S Corporation status in South Carolina, you must file IRS Form 2553, Election by a Small Business Corporation. This form alerts the IRS of your company’s election to be taxed as an S Corporation. Additionally, ensure to comply with South Carolina state requirements to solidify your status. Using ulegalforms can streamline this process with easily accessible and guided resources.

You can obtain a copy of your S Corp status by visiting the IRS website, where you will find options to request your tax documents. Alternatively, some states offer online portals for accessing business-related records, including S corp status. For convenience, you can also turn to US Legal Forms, which provides reliable services tailored to help you maintain and verify your South Carolina Obtain S Corporation Status - Corporate Resolutions Forms.

To prove your S corp status, maintain the S corp election letter from the IRS and your annual tax filings. These documents confirm that your corporation meets all requirements set by the IRS. Additionally, retaining meeting minutes and corporate resolutions can further substantiate your status. Using US Legal Forms may simplify the process of gathering and organizing important documents related to South Carolina Obtain S Corporation Status - Corporate Resolutions Forms.

Interesting Questions

More info

Wikipedia is a project whose goal is to be an open source reference for all things related to any subject. The basic idea is to allow anyone to develop, add, edit, translate and create any article using free-and-open-source software, thus making it a free resource for all. Anybody who wishes can provide valuable contributions to the project. The software is licensed under the terms of the GNU General Public License. Some people believe that Wikipedia is a free-for-all and that anyone with an Internet connection can edit it. Others believe that the process is too risky and slow, and that it is better to have a group of trusted editors to control the flow of information in the Wiki. The fact that most of the articles on Wikipedia have been developed and edited by unpaid volunteers without any profit motive is a significant benefit for the projects, which is one way to ensure its integrity.