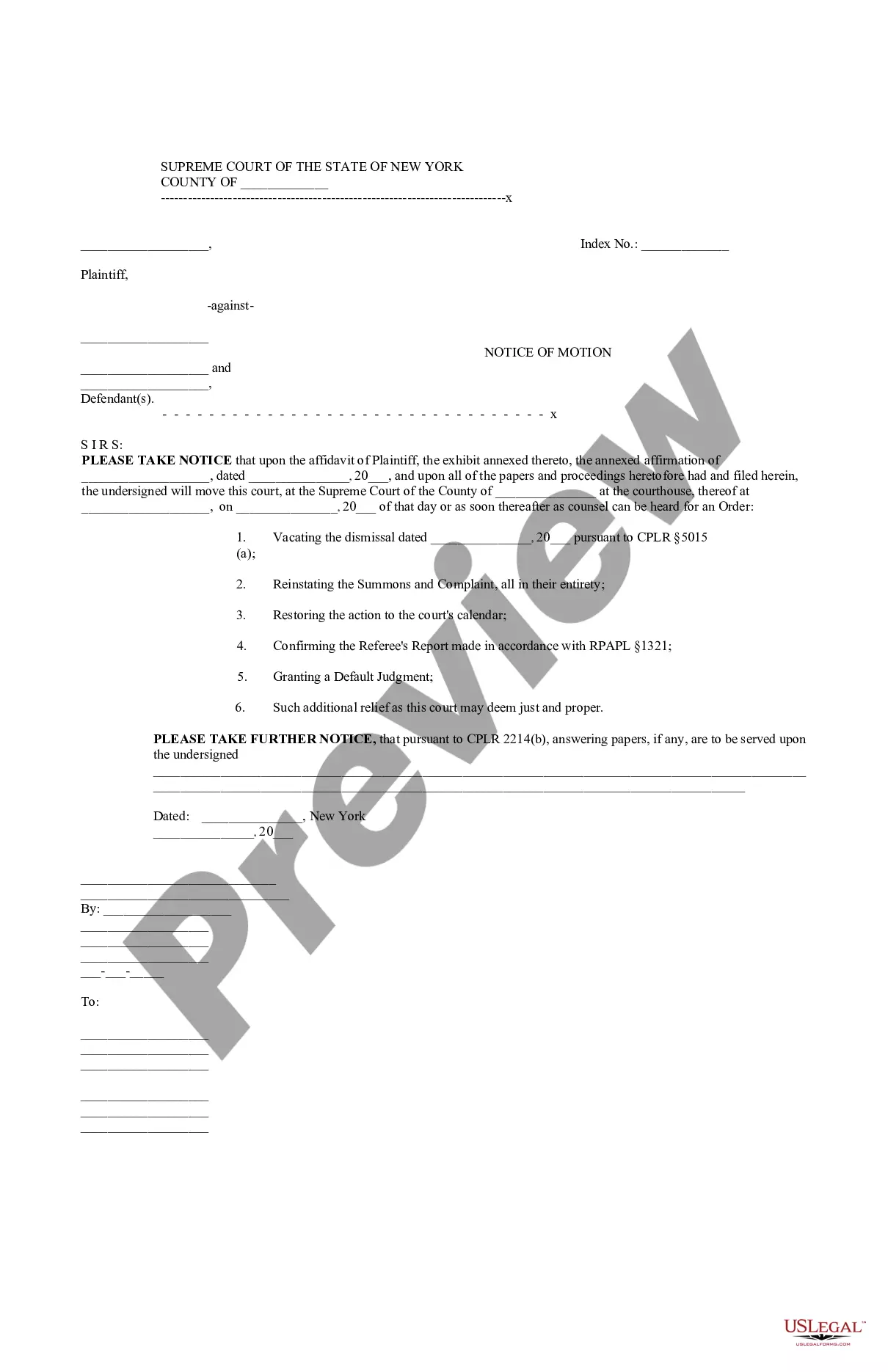

This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

South Carolina Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

Choosing the right legitimate record web template might be a have difficulties. Naturally, there are a variety of themes accessible on the Internet, but how will you obtain the legitimate form you want? Make use of the US Legal Forms website. The services delivers thousands of themes, like the South Carolina Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, which you can use for company and private demands. All the kinds are checked by specialists and satisfy state and federal demands.

In case you are already registered, log in for your account and then click the Obtain button to obtain the South Carolina Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Utilize your account to search from the legitimate kinds you possess acquired earlier. Check out the My Forms tab of your respective account and have another duplicate in the record you want.

In case you are a whole new consumer of US Legal Forms, here are easy guidelines that you should follow:

- Initially, be sure you have chosen the appropriate form for the area/state. You can check out the shape making use of the Review button and look at the shape outline to make sure this is basically the right one for you.

- In the event the form fails to satisfy your expectations, take advantage of the Seach area to discover the correct form.

- When you are certain that the shape is proper, click the Purchase now button to obtain the form.

- Opt for the rates prepare you need and enter in the required info. Design your account and buy the transaction utilizing your PayPal account or bank card.

- Choose the submit structure and download the legitimate record web template for your system.

- Full, change and produce and indication the acquired South Carolina Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand.

US Legal Forms is the largest collection of legitimate kinds where you can discover various record themes. Make use of the company to download expertly-manufactured paperwork that follow condition demands.

Form popularity

FAQ

Third-party bad faith cases typically fall under three categories: Failure to defend. Your insurance company has a duty to provide an adequate defense on your behalf in lawsuit. ... Failure to settle. Your provider has a duty to pay for any damages of which you are found liable in lawsuits. ... Negligent handling of the case.

Beginning a bad faith insurance claim begins with identifying the wrongful act that constitutes bad faith. South Carolina Code § 38-59-20 identifies a list of acts by an insurance company that constitute improper claim practices. Examples of bad faith may include: Knowingly misrepresenting facts or coverage.

Under South Carolina law, a person may recover damages and attorney's fees from their insurance company for a bad faith denial of insurance coverage if that person proves that the insurance company acted unreasonably and without a factual justification to support its decision to deny benefits under the insurance ...

Examples of Insurance Bad Faith: Delaying or denying decisions on claims or requests for approval for medical treatment. Refusing to pay a valid claim. Making threatening statements. Misrepresenting the law or policy language.

Under South Carolina law, a person may recover damages and attorney's fees from their insurance company for a bad faith denial of insurance coverage if that person proves that the insurance company acted unreasonably and without a factual justification to support its decision to deny benefits under the insurance ...