South Carolina Articles of Conversion - Corporation To Partnership Or Limited Partnership

Description

How to fill out South Carolina Articles Of Conversion - Corporation To Partnership Or Limited Partnership?

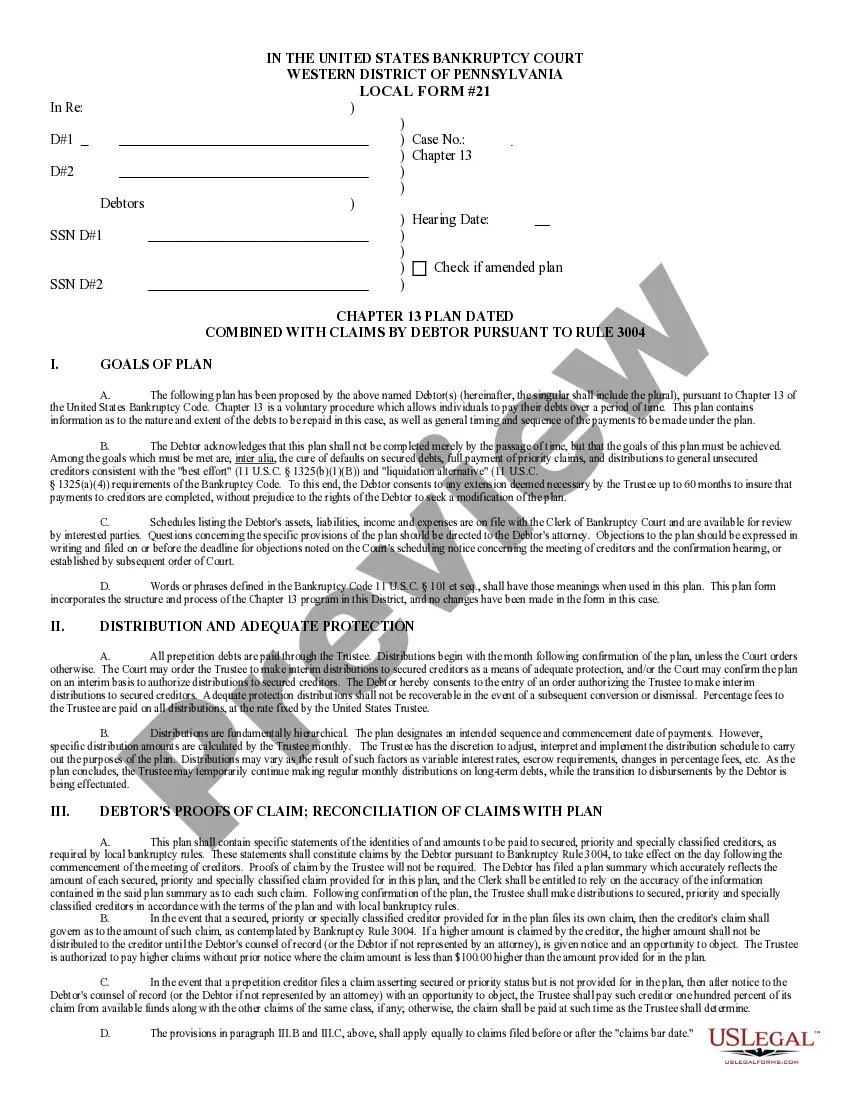

Coping with legal documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your South Carolina Articles of Conversion - Corporation To Partnership Or Limited Partnership template from our service, you can be certain it complies with federal and state regulations.

Working with our service is simple and fast. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your South Carolina Articles of Conversion - Corporation To Partnership Or Limited Partnership within minutes:

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Articles of Conversion - Corporation To Partnership Or Limited Partnership in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the South Carolina Articles of Conversion - Corporation To Partnership Or Limited Partnership you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Because of pass-through taxation, the S corporation doesn't pay federal income tax on its business income the way a C corporation does. Instead, business income, deductions, losses, and other tax items flow through (or pass through) to the business owners (e.g., the shareholders).

S corporations have the option to change their business operations and run as a partnership.

In situations when tax-free contribution of property can be accomplished by using an S corporation, partnership is still the more favorable option because a tax-free distribution out of the entity is allowed only in a partnership.

Steps for Converting an S Corp to an LLC Start the Conversation.Create a Plan of Conversion.Gain the Appropriate Approval.Prepare and File the Required Documents.Take It to a Vote.Pause Business Operations.Notify Your Creditors.Liquidate All Your Assets.

Can an S Corp be a partner in a partnership? Yes! In fact, it's quite common for business owners to layer business entities to provide them with privacy, enhance protection from personal liability, and take advantage of tax breaks.

If the S Corp's assets are then transferred to an LLC in exchange for LLC membership units, the S corp can convert itself into an LLC and avoid the associated capital gains tax. An S corporation is taxed as a pass-through entity and passes any income or losses through to its shareholders' individual tax returns.

File a Statement of Partnership Authority ? Conversion (Form GP-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person; The filing fee is $150 if a California Corp is involved; and $70 for all others.

Updated November 19, 2020: The difference between partnership and S Corps (or S corporations) is the limited-liability protection for owners of businesses taxed as S-corps. Such liability protection is not available for owners of general partnerships and can only be claimed by some partners in a limited partnership.