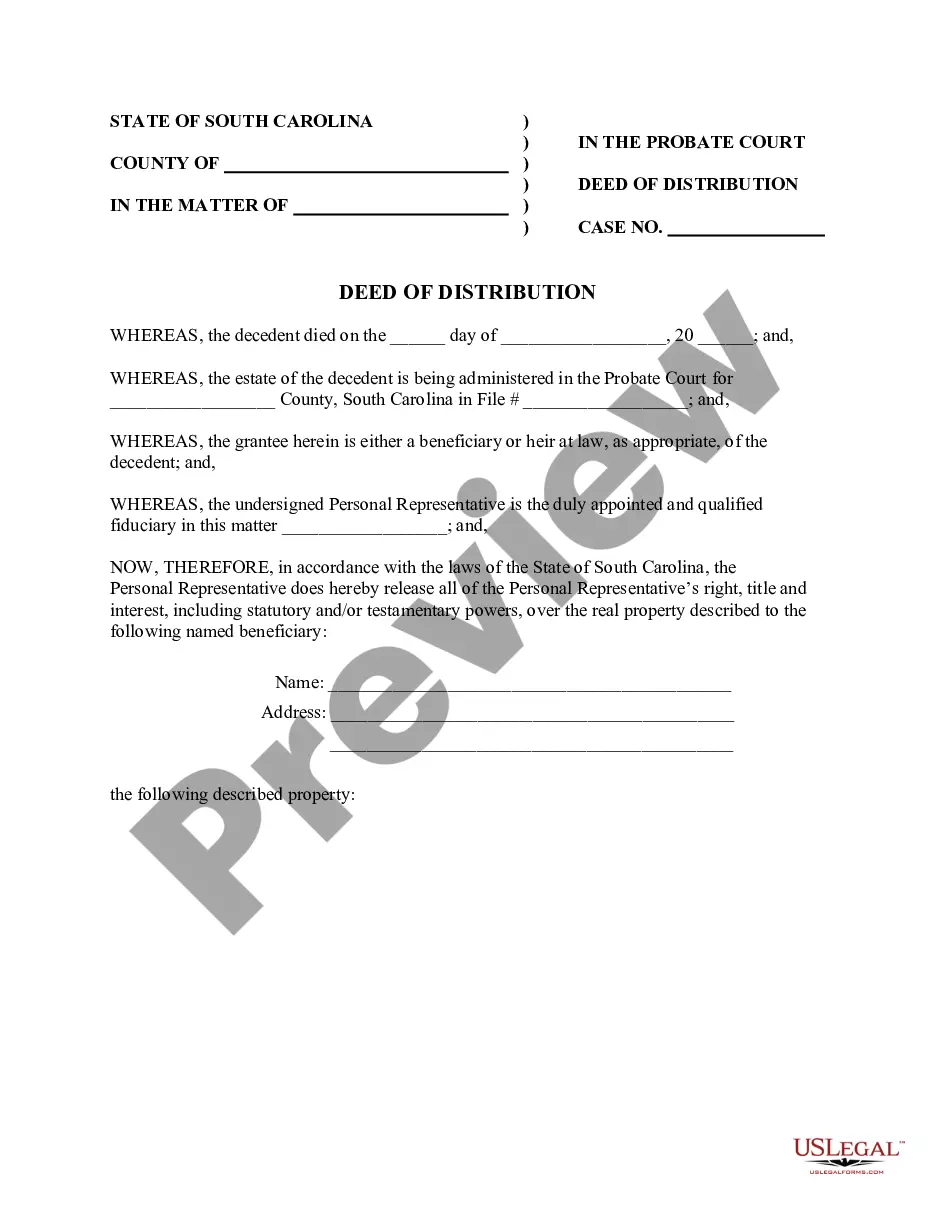

South Carolina Deed of Distribution - Personal Representative to Beneficiary

Definition and meaning

The South Carolina Deed of Distribution is a legal document used when a Personal Representative transfers property from the decedent’s estate to the beneficiaries or heirs. This form serves to formally document the distribution of the estate's assets, affirming that the Personal Representative has the legal authority to allocate the property according to the decedent's wishes or state law.

Who should use this form

This form is intended for Personal Representatives who have been legally appointed to handle the estate of a deceased individual in South Carolina. Beneficiaries or heirs who expect to receive assets from the estate will also need this form for the distribution process to be formally recognized and executed.

How to complete a form

To complete the South Carolina Deed of Distribution, follow these steps:

- Fill in the decedent's date of death and the county where the estate is being administered.

- Include your name as the Personal Representative along with your appointed authority.

- List the names and addresses of all beneficiaries receiving property from the estate.

- Describe the property being distributed in detail, ensuring accuracy.

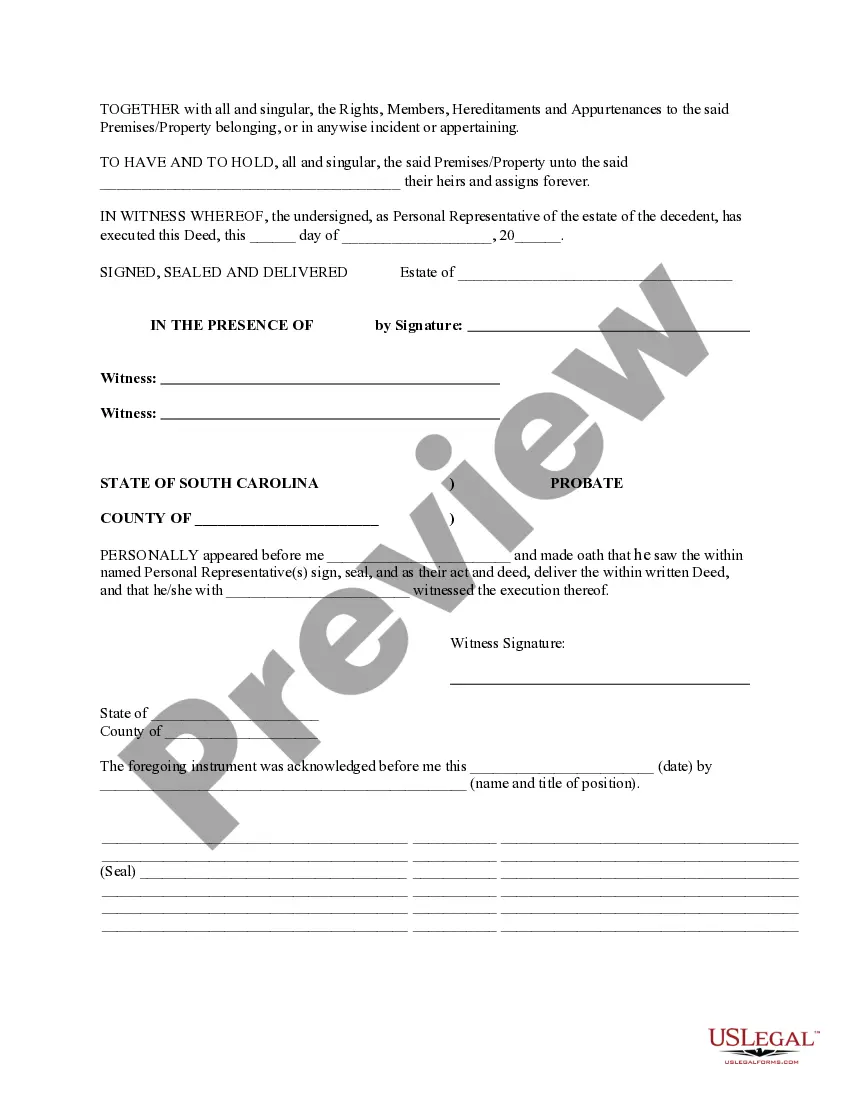

- Sign the document in the presence of witnesses and a Notary Public, if required.

After completing the form, ensure that all parties involved receive a copy for their records.

State-specific requirements

In South Carolina, specific requirements must be met for a Deed of Distribution to be valid. The Personal Representative must ensure that the estate is properly administered through the Probate Court. Additionally, the document must be witnessed by at least two individuals and notarized to confirm the identity and signature of the Personal Representative.

Common mistakes to avoid when using this form

While completing the South Carolina Deed of Distribution, be mindful of these common pitfalls:

- Failing to accurately describe the property being distributed.

- Not including the correct names and addresses of all beneficiaries.

- Incomplete signatures or absence of witnesses and notarization.

- Omitting the date of the transaction, which can lead to confusion.

Avoiding these mistakes can facilitate a smoother distribution process.

Form popularity

FAQ

In South Carolina, it will take a minimum of eight months to probate because the law requires it to remain open to allow creditors to file claims. Beyond the minimum eight months, several factors determine how long probate takes to conclude.

First, the relevant statute limits personal representative fees to 5% of the value of personal property, plus 5% of the sale of real property.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

The deed of distribution is evidence of the beneficiary's title to the house, land or other real property interest of the decedent. An ancillary probate is often opened in South Carolina for the purpose of preparing a deed of distribution when an out-of-state decedent died owning real property in South Carolina.

South Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A distribution deed is a way to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will. In most cases, the distribution of a deceased person's estate will be done in accordance with the directions contained in the terms of their will.