South Carolina General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability

What is this form?

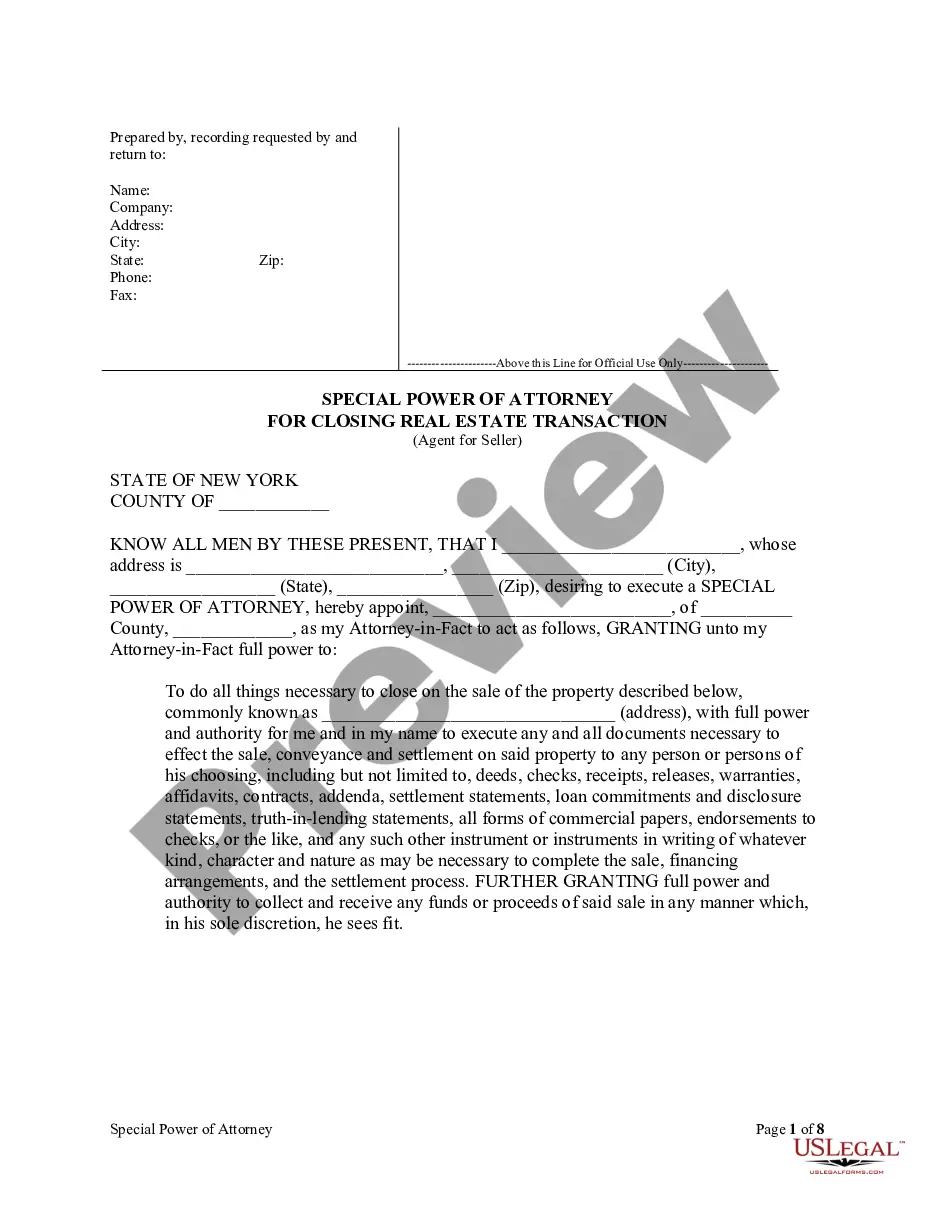

The General Durable Power of Attorney for Property and Finances Effective upon Disability is a legal document that grants authority to an appointed agent to manage your financial and property-related decisions in the event of your disability, incompetency, or incapacity. Unlike a regular power of attorney, this form only comes into effect under specific conditions, ensuring your affairs are managed when you cannot do so yourself. However, it does not authorize the agent to make health care decisions on your behalf.

Form components explained

- Principal's information: The name and address of the individual granting authority.

- Agent's information: The name and address of the appointed agent or attorney-in-fact.

- Powers granted: Detailed descriptions of the financial and property-related powers authorized to the agent.

- Effectiveness clause: Specifies that the power of attorney is effective only upon the principal's disability or incapacity.

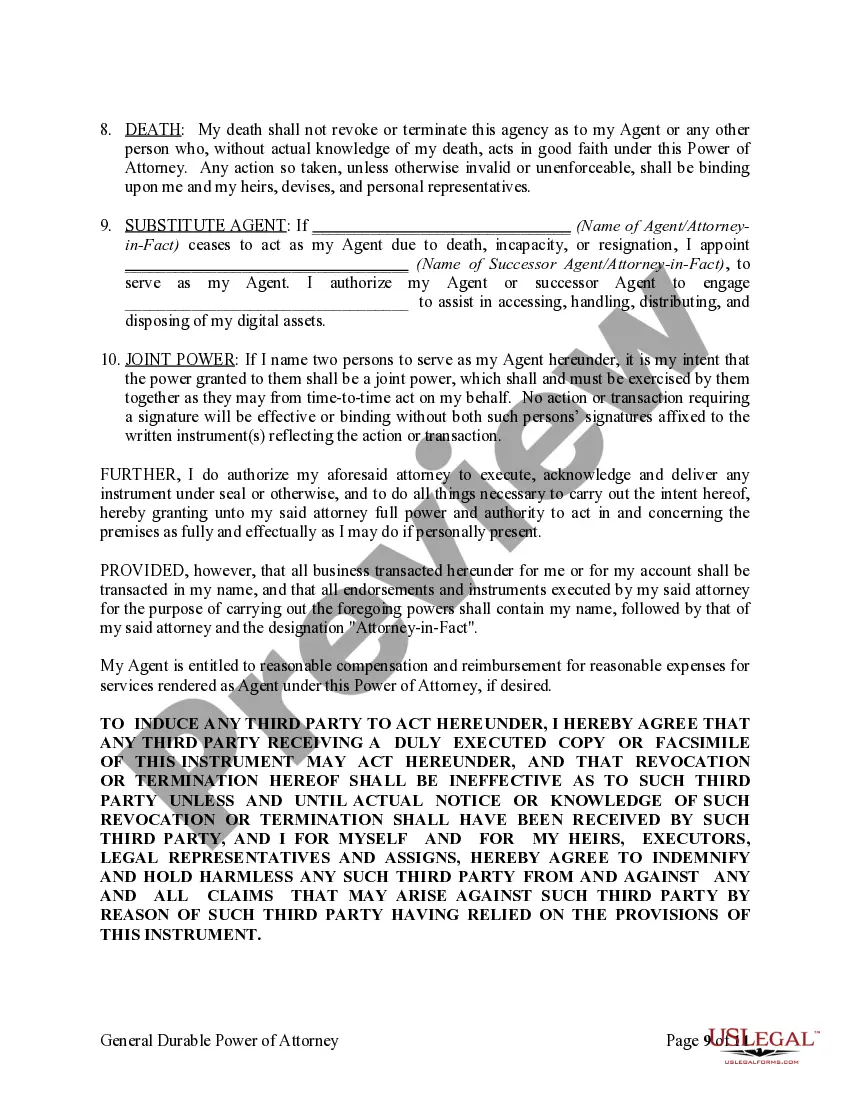

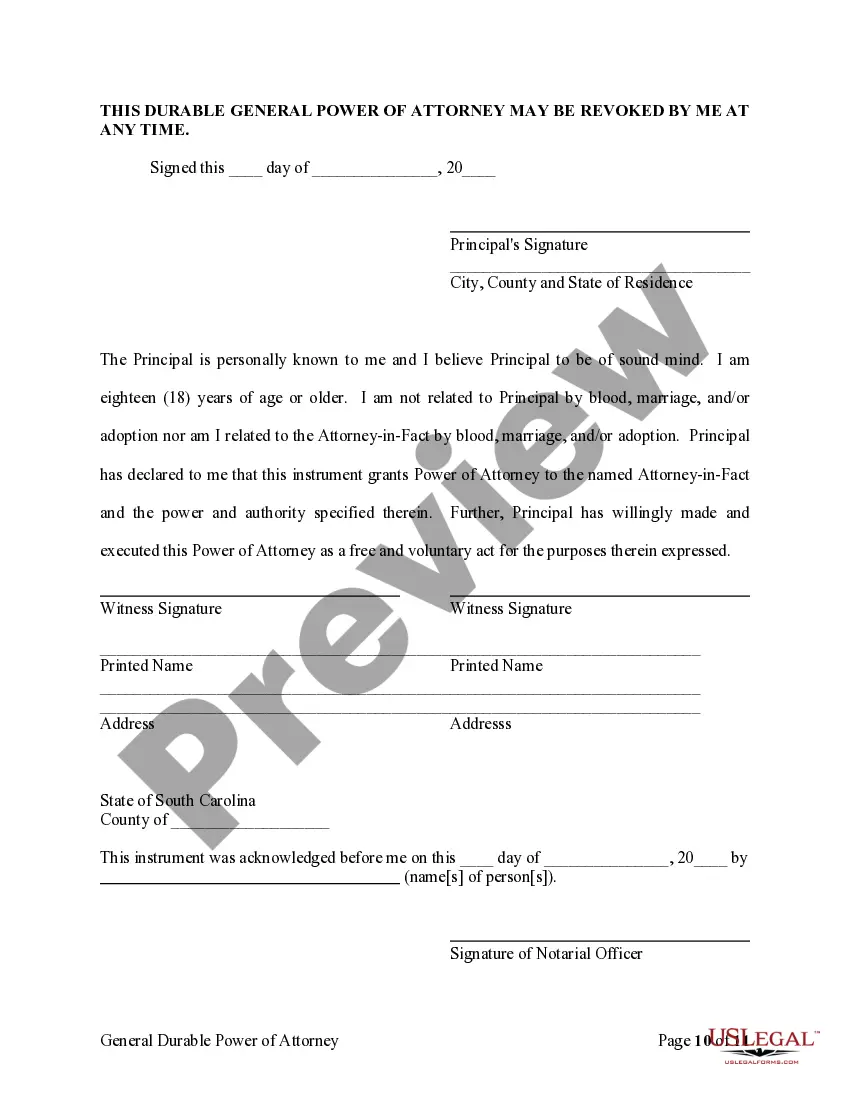

- Signature and notarization: Requirements for signing and witnessing the document, including potential notarization.

- Revocation clause: Information on how the document can be revoked by the principal.

When this form is needed

This form is necessary when you want to ensure that your financial and property matters are handled by a trusted individual if you become unable to make those decisions yourself. Common situations include serious medical conditions, mental health issues, or age-related incapacities that may impair your ability to manage your affairs.

Who needs this form

- Individuals seeking to prepare for future incapacity regarding their finances.

- Adults with chronic health conditions or those anticipating potential incapacity due to medical reasons.

- Anyone who wishes to ensure that a trusted person can manage their property and financial affairs if they can no longer do so.

How to complete this form

- Identify the parties: Enter the full names and addresses of both the principal and the agent.

- Define the powers: Clearly outline the financial and property powers you wish to grant to your agent.

- Sign the document: The principal must sign and date the form in the presence of a witness or notary.

- Provide additional instructions: If desired, include specific instructions or limitations on agent authority.

- Keep copies: Retain copies of the signed document for your records and provide a copy to your agent.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Avoid these common issues

- Failing to specify the powers granted to the agent clearly.

- Not having the document signed or witnessed as required by law.

- Neglecting to inform the agent about their role and responsibilities.

- Forgetting to revoke the document when it is no longer needed.

Benefits of completing this form online

- Convenience: Easily complete and download the form from the comfort of your home.

- Editability: Customize the document to fit your specific financial situation and preferences.

- Reliability: Ensure that the form meets legal standards set by licensed attorneys, reducing the risk of errors.

Legal use & context

- This document is designed to provide legal authority to the agent regarding financial matters only, not health care.

- It protects the principal's interests by appointing a trusted individual to act on their behalf during incapacity.

- Legal enforceability depends on proper execution in accordance with state laws.

What to keep in mind

- The General Durable Power of Attorney is crucial for ensuring your financial affairs are managed in case of incapacity.

- Be clear about the powers you grant to your agent and carefully follow execution requirements.

- This form is adaptable for use in many jurisdictions with varying local laws.

Form popularity

FAQ

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages long. Some states have their own forms, but it's not mandatory that you use them. Some banks and brokerage companies have their own durable power of attorney forms.

Determine if one is needed. Under a few circumstances, a power of attorney isn't necessary. Identify an agent. Take a look at the standard forms. Notarize the written POA, keep it stored safely, and provide copies to important people. Review the POA periodically.

Choose an agent. Before you begin to fill out the form, you have some decisions to make. Decide on the type of authority. You can choose whether you want your POA to be broad or narrow. Identify the length of time the POA will be in effect. Fill out the form. Execute the document.

1. About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents.It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Include their address, relationship to you, phone number, or email address. Also specify whether the durable power of attorney applies to financial decisions, health care decisions, legal decisions, or all three areas. Include any instructions you would like to leave for your agent.

Determine if one is needed. Under a few circumstances, a power of attorney isn't necessary. Identify an agent. Take a look at the standard forms. Notarize the written POA, keep it stored safely, and provide copies to important people. Review the POA periodically.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.