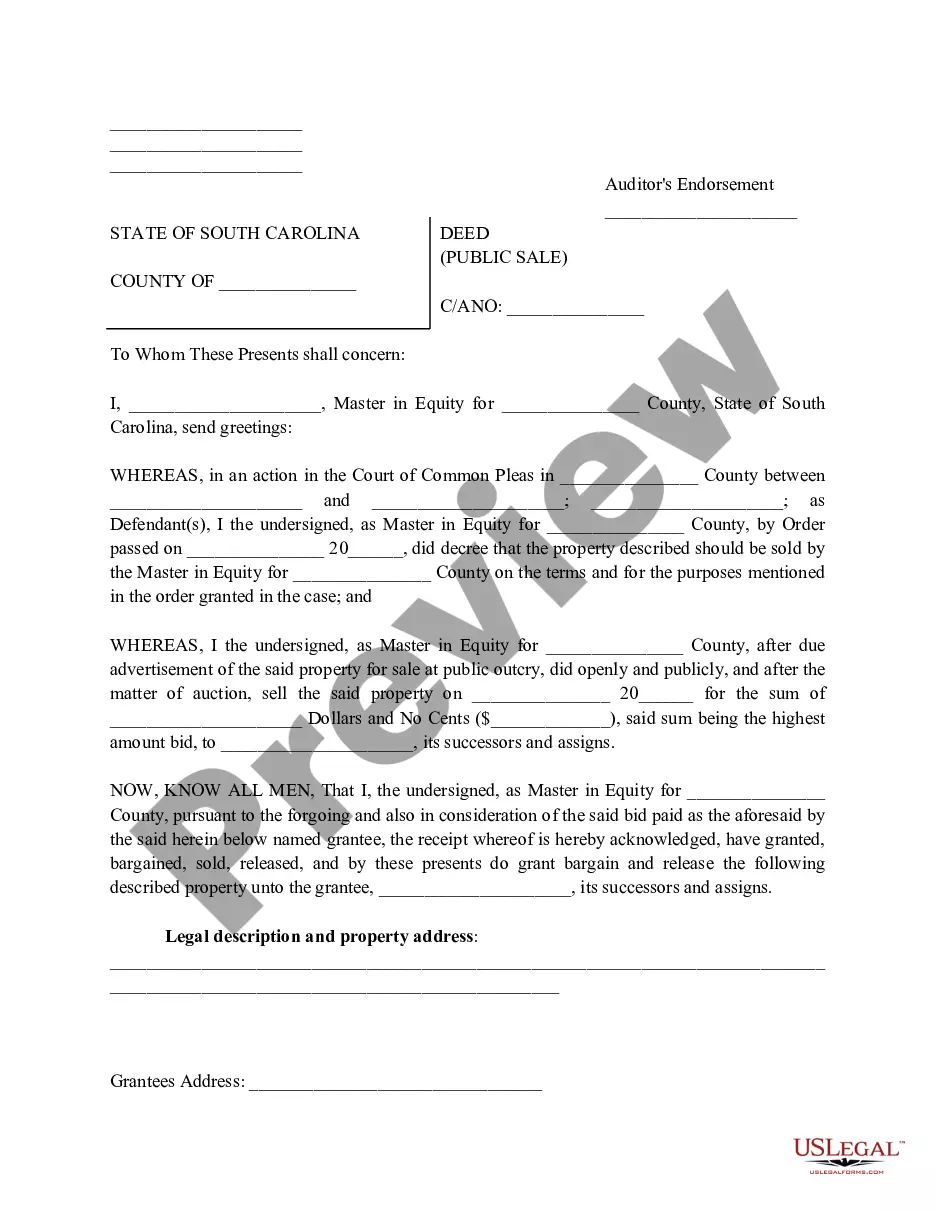

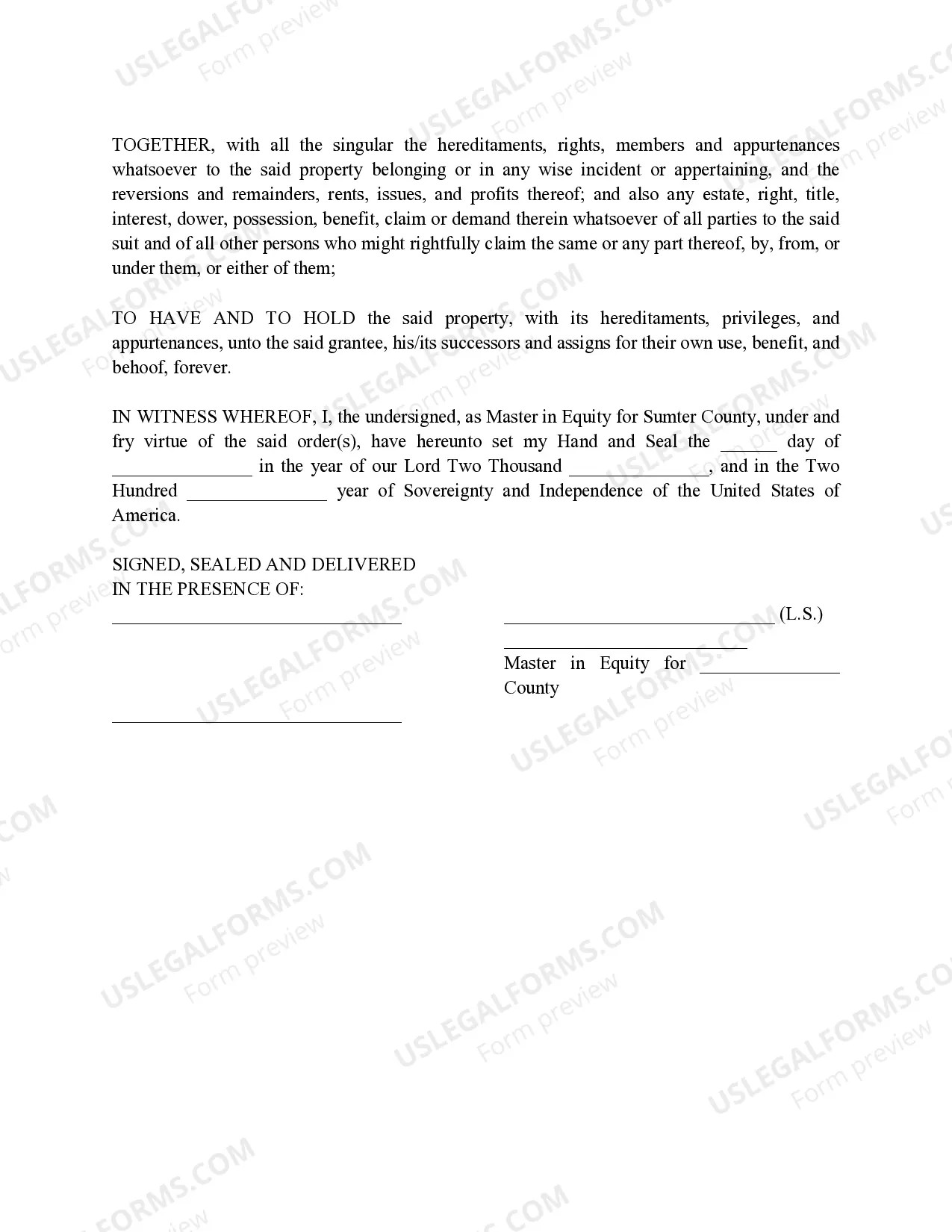

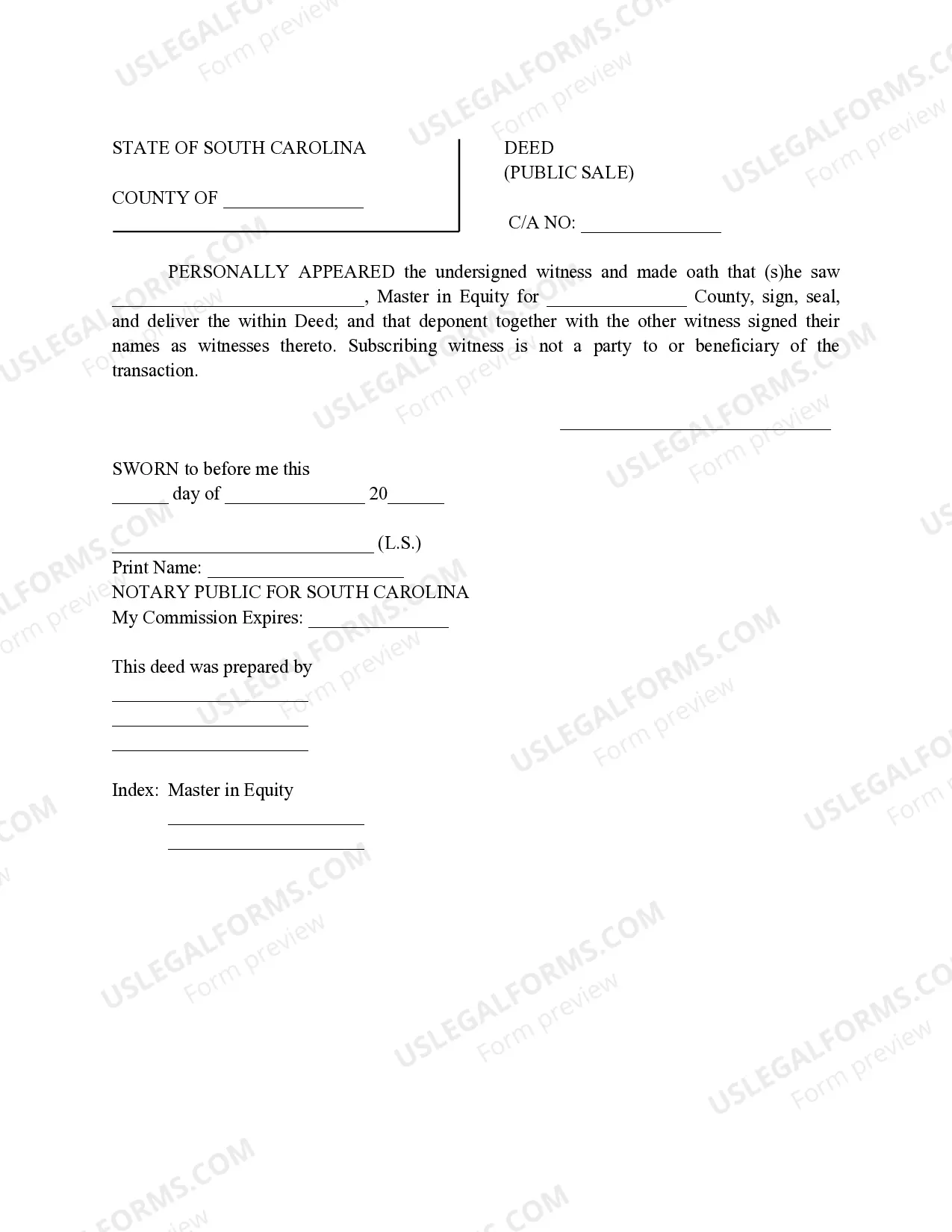

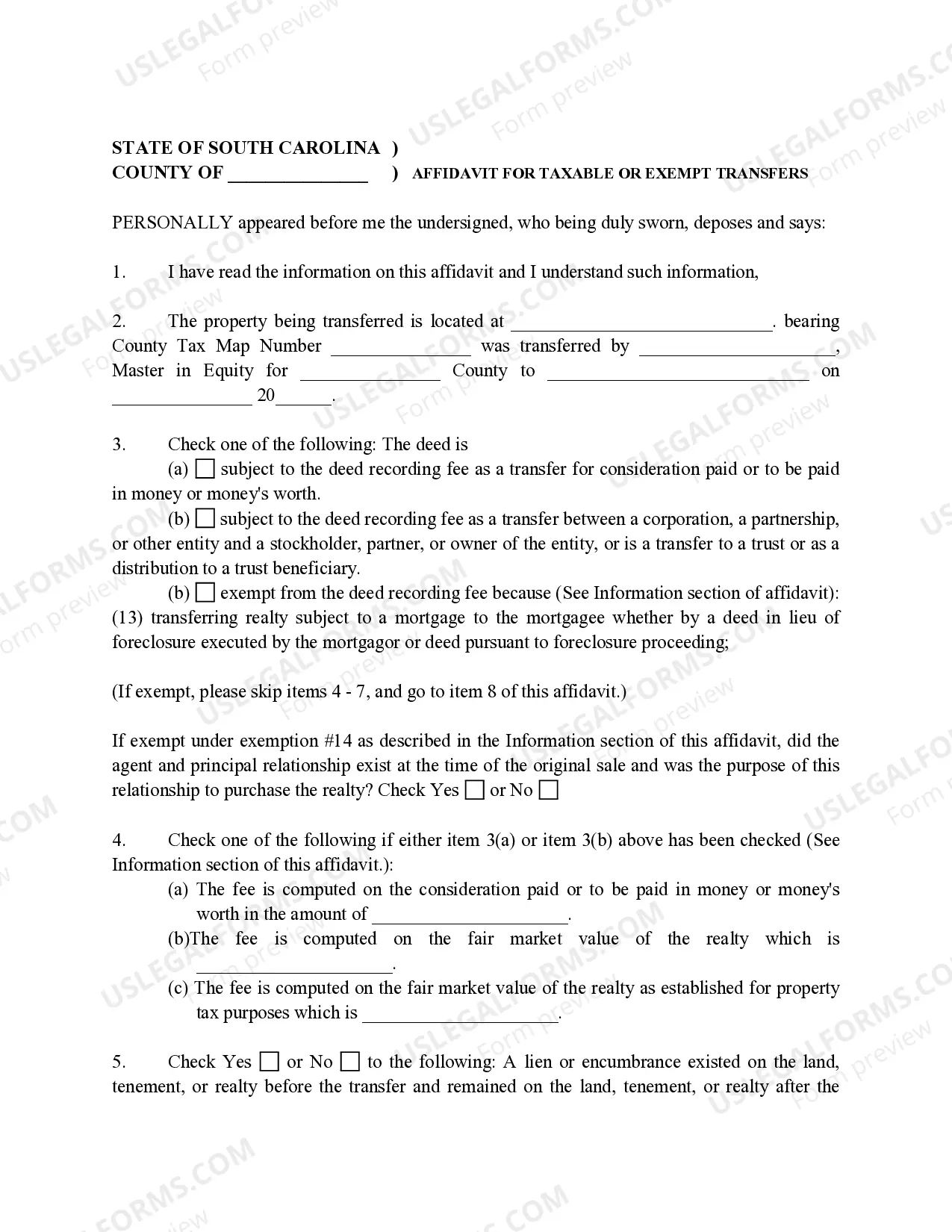

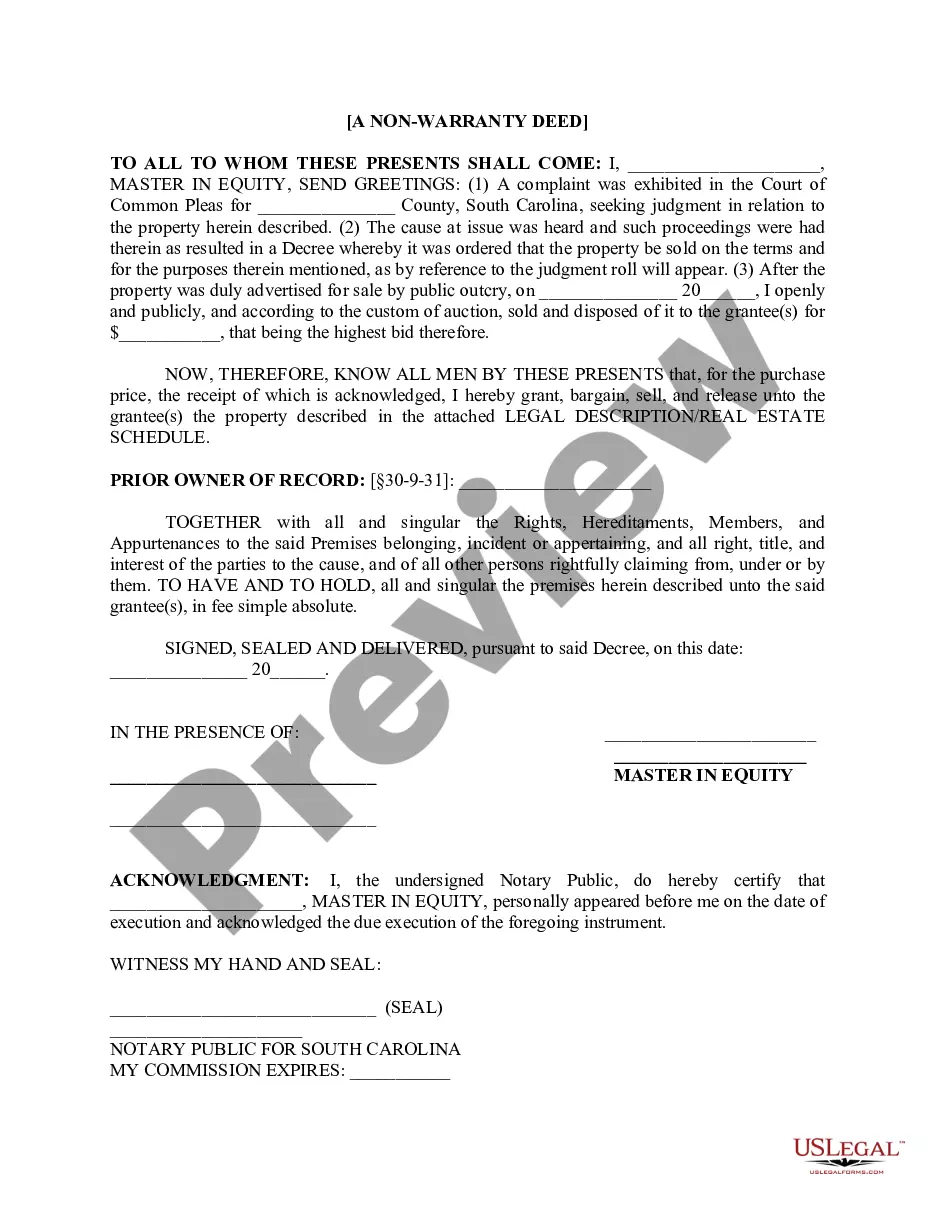

South Carolina Deed - Public Sale

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Deed - Public Sale?

Creating documents isn't the most simple process, especially for those who rarely work with legal paperwork. That's why we recommend utilizing accurate South Carolina Deed - Public Sale samples made by professional attorneys. It allows you to eliminate difficulties when in court or dealing with official organizations. Find the documents you require on our website for high-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will automatically appear on the file webpage. Soon after getting the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can easily create an account. Use this simple step-by-step help guide to get your South Carolina Deed - Public Sale:

- Make certain that the form you found is eligible for use in the state it’s needed in.

- Verify the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this file is what you need or return to the Search field to find another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After doing these straightforward actions, it is possible to fill out the form in a preferred editor. Double-check filled in information and consider requesting a legal professional to review your South Carolina Deed - Public Sale for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

In South Carolina, if you become delinquent in paying your property taxes, the late amounts become a lien on your home. The tax collector can then sell your home a tax sale to satisfy the lien.

Collect all information about your property first. Go through your house records. Research title insurance companies. Compare the fees presented by each company in the state. Choose a title insurance company. Wait for the completed report.

The South Carolina deed recording fee is imposed for the privilege of recording a deed, and is based on the transfer of real property from one person or business entity to another. The fee is generally imposed on the grantor of the real property, although the grantee may be secondarily liable for the fee.

As South Carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Investors usually receive anywhere from 3% - 12% back in interest or receive the deed outright on the property. For those looking for ROI in a short time period, tax sales are certainly something to consider.

In a tax deed sale, the property itself is sold. The sale takes place through an auction, with a minimum bid of the amount of back taxes owed plus interest, as well as costs associated with selling the property. The highest bidder wins the property.

An original, wet signed document. Signature of the Party of the First Part. Two witnesses to the signature. A South Carolina Probate or Acknowledgement. A property description to include a recorded plat reference or metes and bounds description.

Alaska. Arkansas. California. Connecticut. Delaware. Florida. Georgia. Hawaii.

South Carolina is a redeemable tax deed state. In a redeemable tax deed state the actual property is sold after tax foreclosure and then the former owner has one last opportunity to redeem the property (pay the delinquent taxes). If the taxes aren't paid the investor becomes the owner.

But you won't lose your property without getting fair warning; you'll get the chance to reclaim your home after the sale because, under South Carolina law, you can "redeem" your propertyeven after someone else buys it at a tax sale.