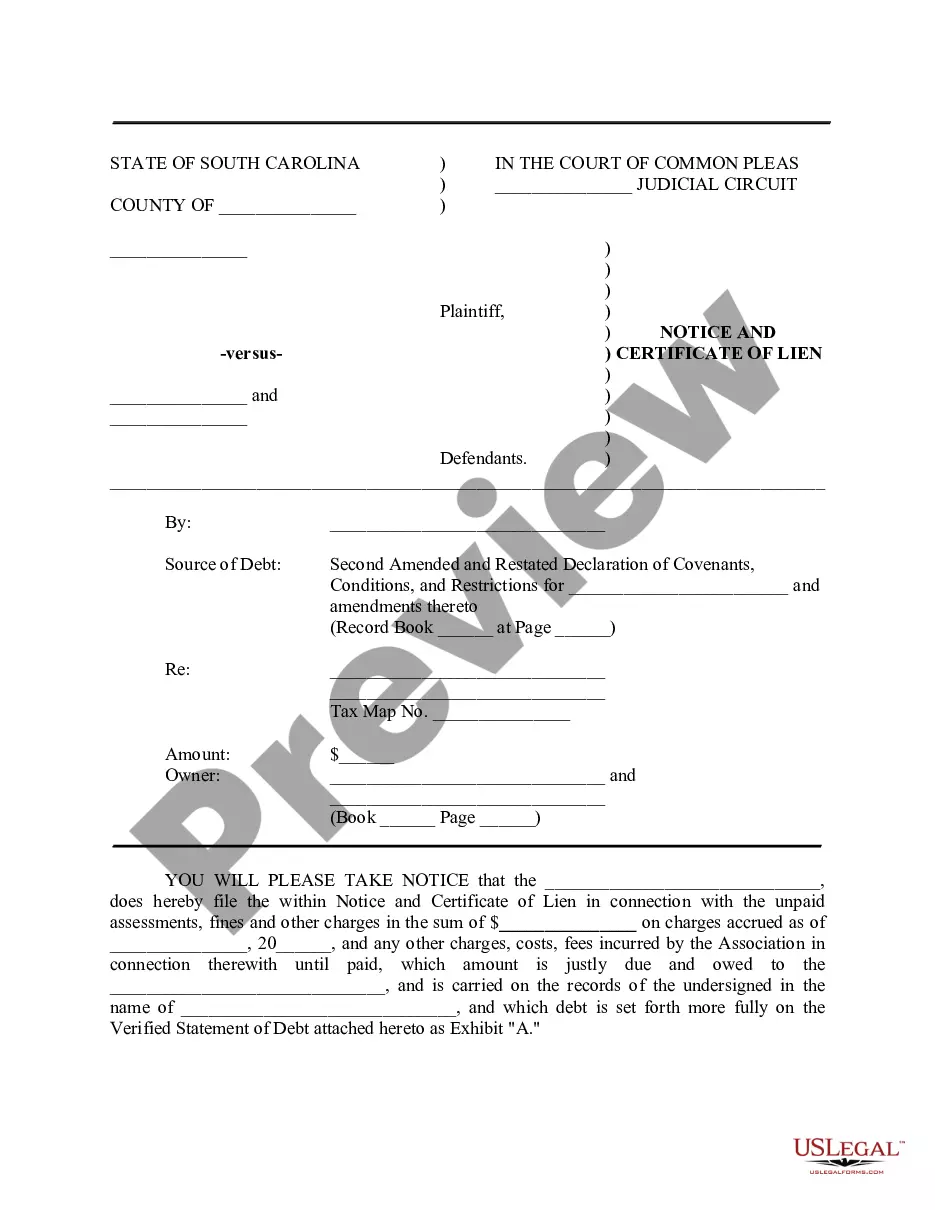

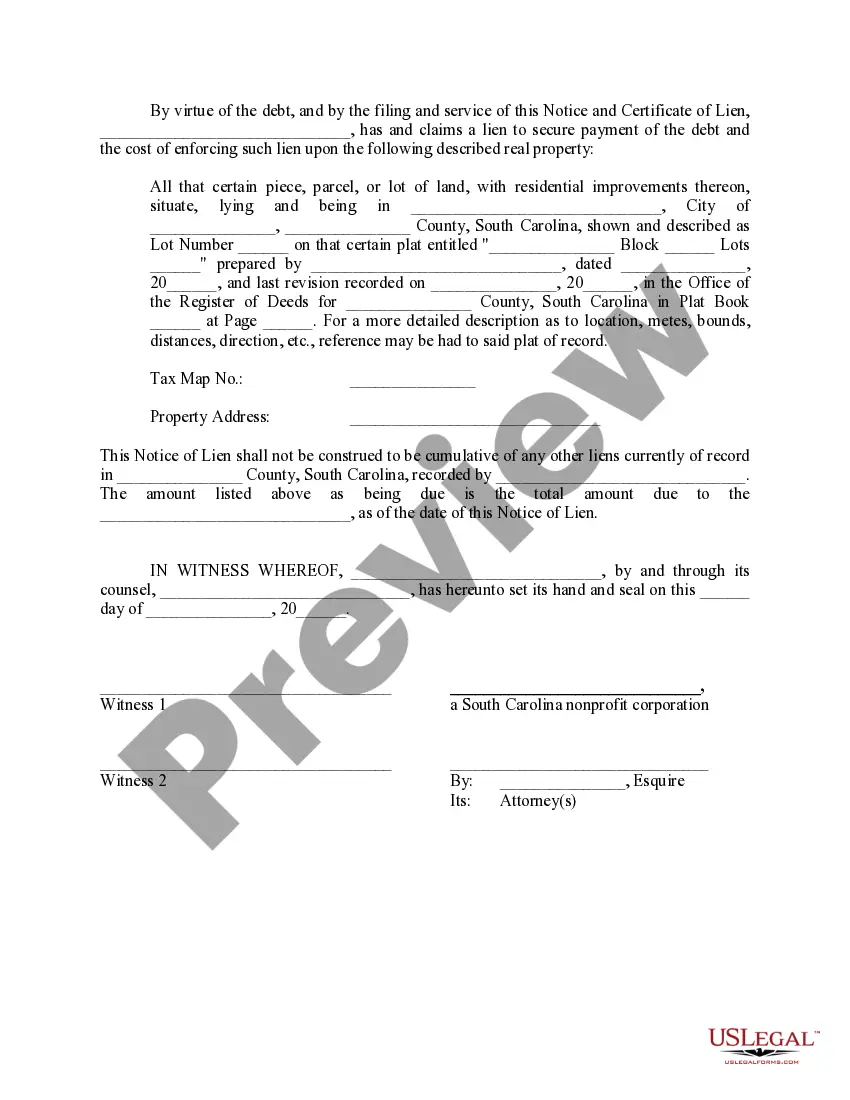

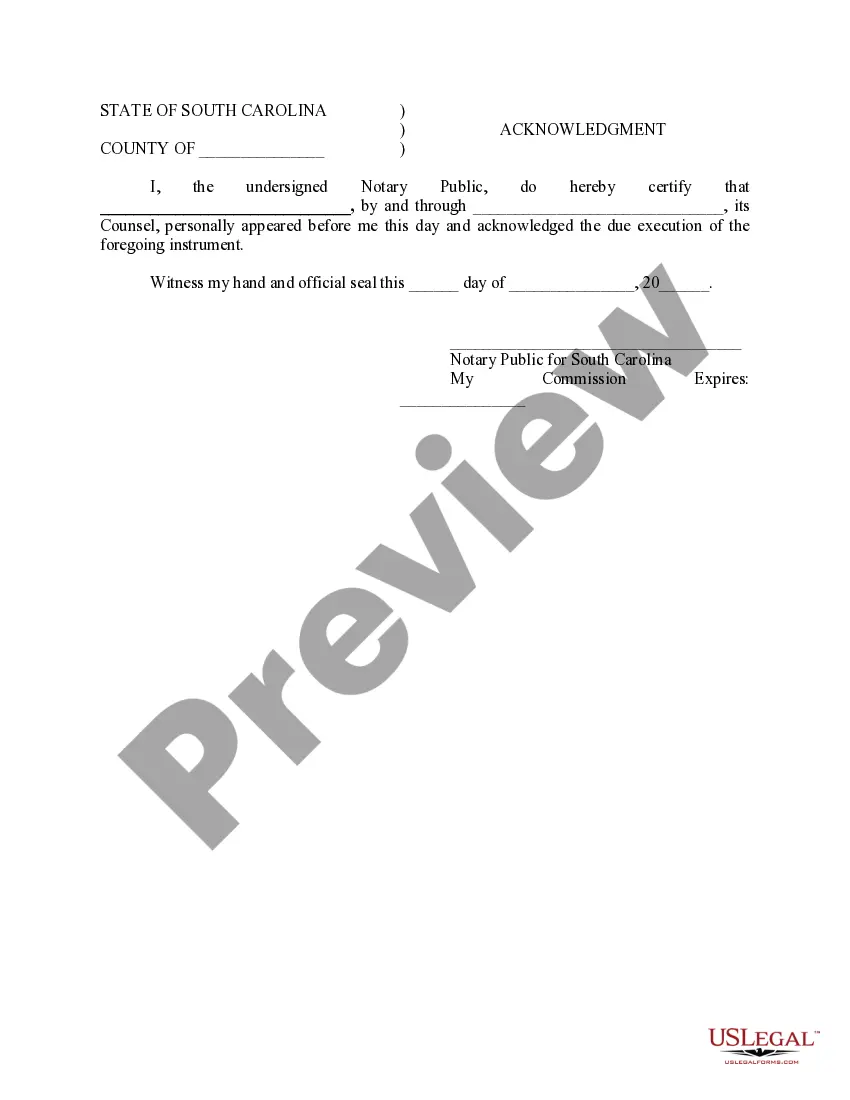

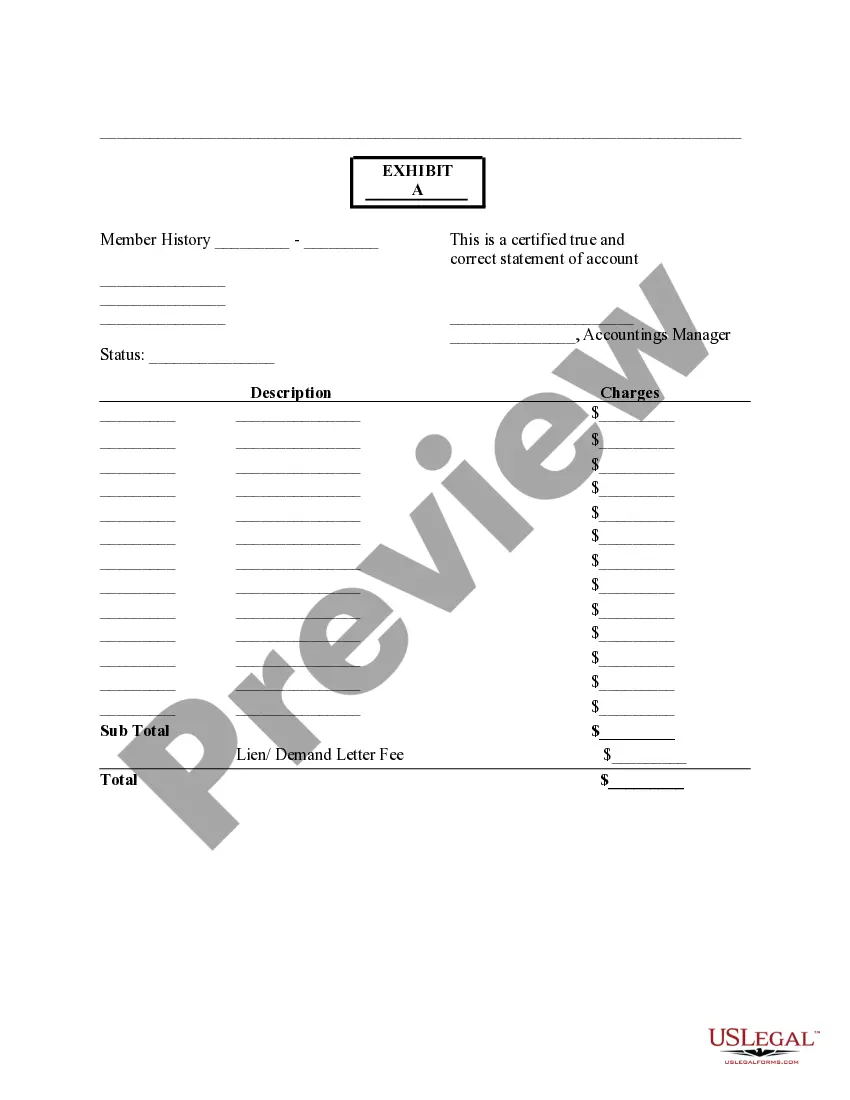

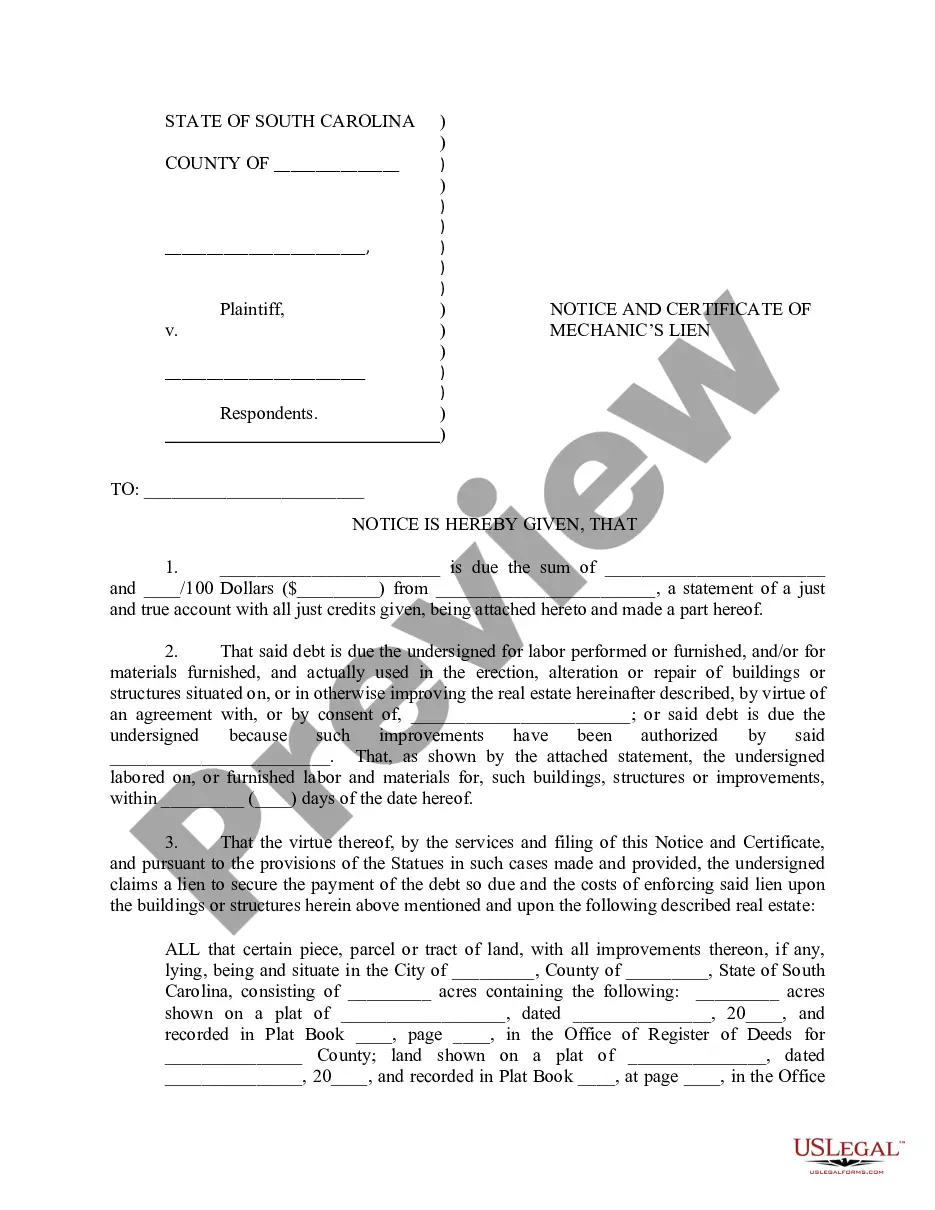

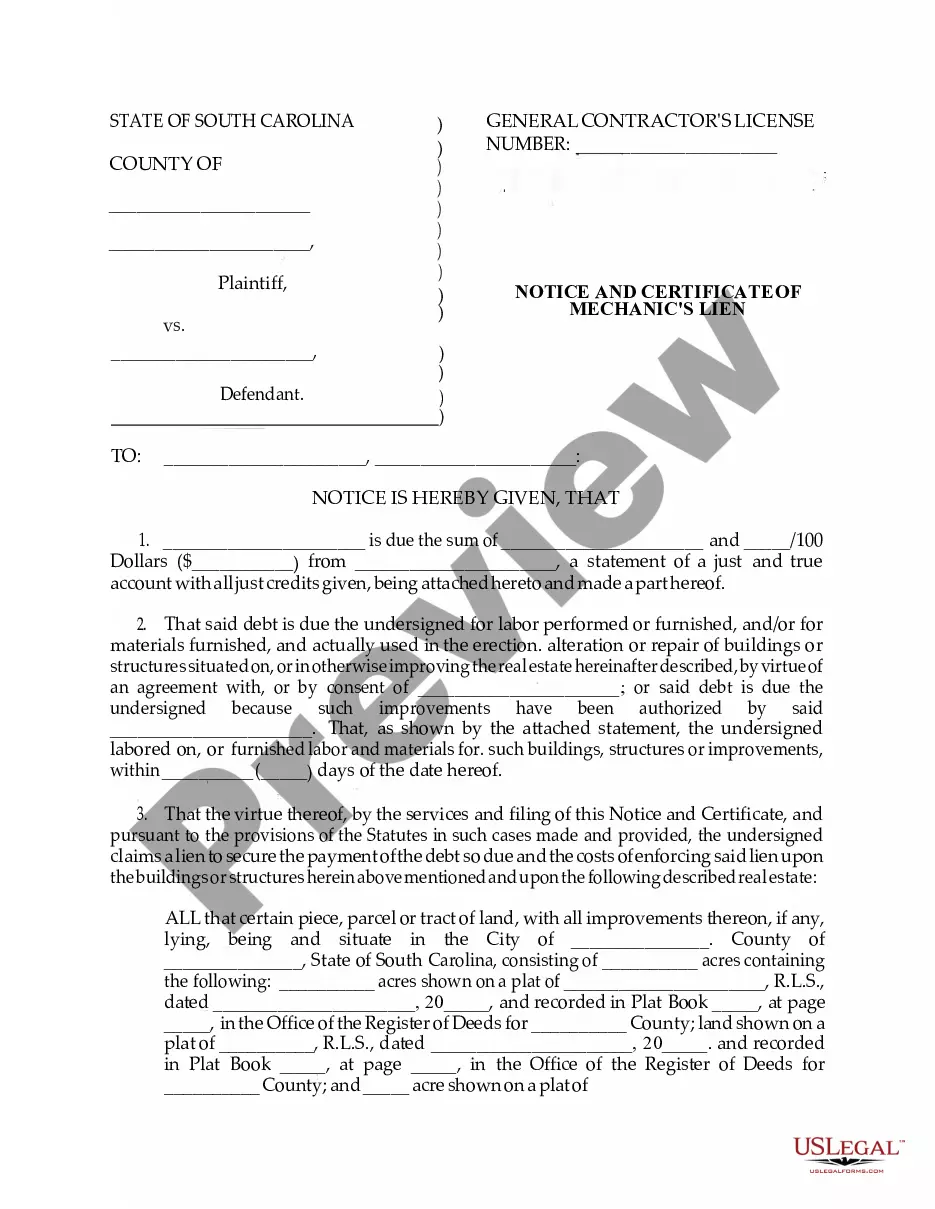

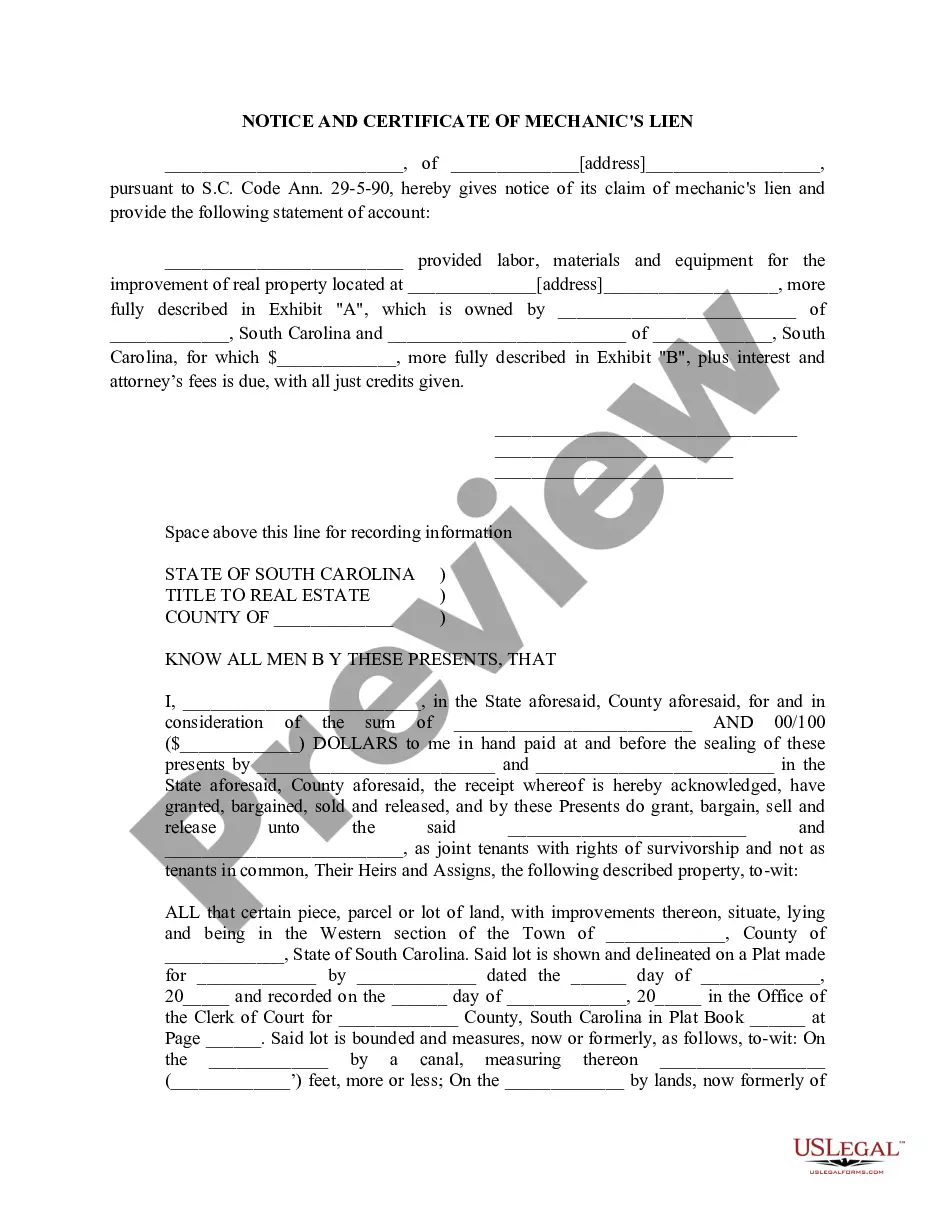

South Carolina Notice and Certificate of Lien

Description

How to fill out South Carolina Notice And Certificate Of Lien?

Creating documents isn't the most simple task, especially for those who almost never deal with legal paperwork. That's why we advise utilizing accurate South Carolina Notice and Certificate of Lien templates created by skilled lawyers. It gives you the ability to eliminate troubles when in court or handling official institutions. Find the documents you need on our site for high-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the file webpage. After getting the sample, it’ll be saved in the My Forms menu.

Customers with no an activated subscription can easily get an account. Follow this brief step-by-step guide to get your South Carolina Notice and Certificate of Lien:

- Make certain that file you found is eligible for use in the state it is needed in.

- Verify the document. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this sample is what you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these easy steps, you are able to fill out the sample in a preferred editor. Check the completed information and consider requesting a legal professional to examine your South Carolina Notice and Certificate of Lien for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Form popularity

FAQ

To perfect a mechanic's lien, the contractor, subcontractor, or supplier must file a notice of mechanic's lien with the Register of Deeds or Clerk of Court of the county where the real property is located and serve the property owner with notice and a copy of the lien within 90 days of the completion of the work. S.C.

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

To perfect a mechanic's lien, the contractor, subcontractor, or supplier must file a notice of mechanic's lien with the Register of Deeds or Clerk of Court of the county where the real property is located and serve the property owner with notice and a copy of the lien within 90 days of the completion of the work. S.C.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

A South Carolina mechanics' lien claim must be filed within 90 days after completion of the contractors work. A lawsuit to foreclose upon the South Carolina construction lien must be brought no later than 6 months after the claimant ceases to furnish labor or materials.

Under South Carolina law, if this is your homestead, you can exemptor keep$53,375 in equity. And you have less than that amount, so you're golden as far as your homestead exemption goes.

In South Carolina, a claimant who has filed a mechanics lien will have 6 months from the last day on which the claimant furnished labor and/or materials to the project to enforce their lien.

As South Carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Investors usually receive anywhere from 3% - 12% back in interest or receive the deed outright on the property. For those looking for ROI in a short time period, tax sales are certainly something to consider.