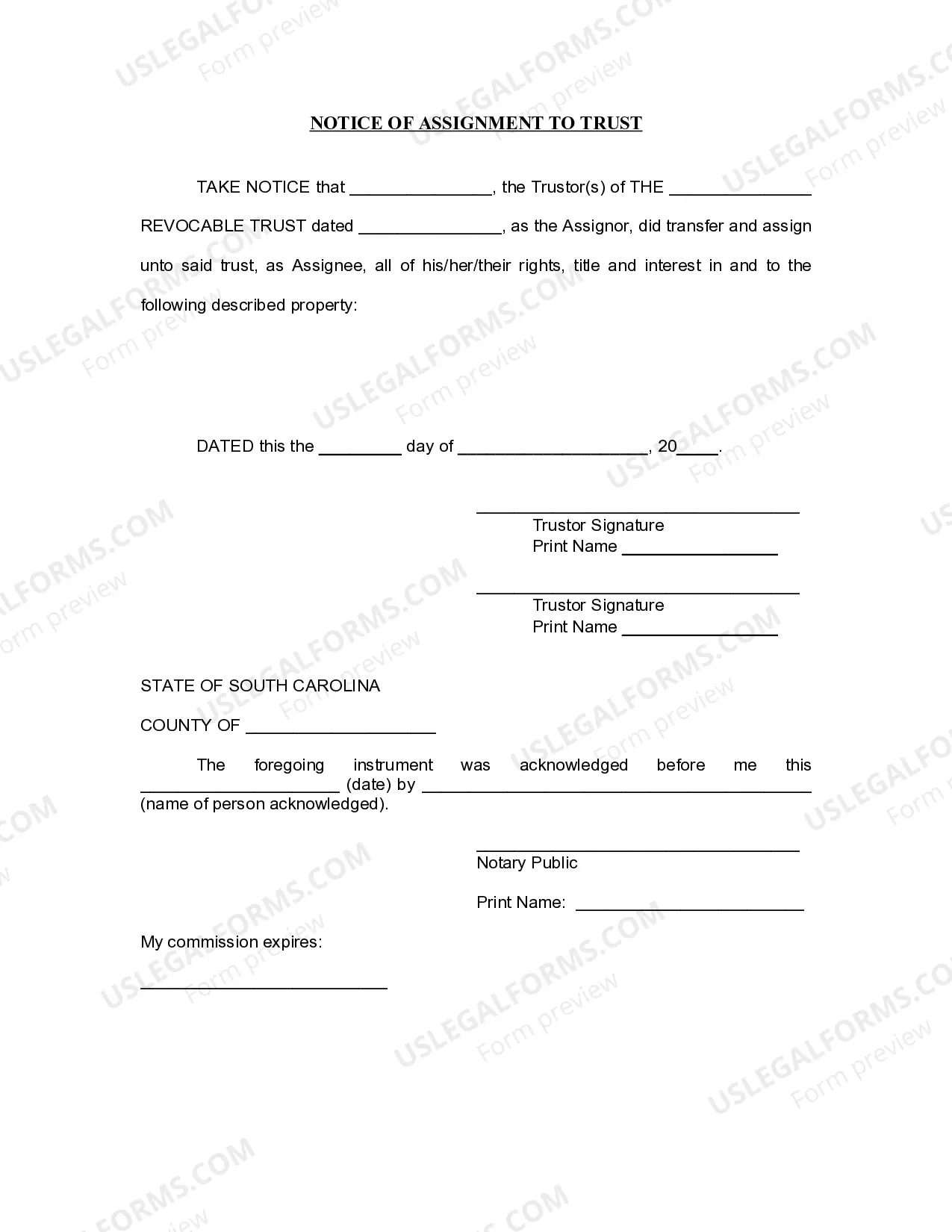

South Carolina Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out South Carolina Notice Of Assignment To Living Trust?

Creating papers isn't the most uncomplicated task, especially for those who almost never deal with legal paperwork. That's why we advise making use of accurate South Carolina Notice of Assignment to Living Trust samples made by professional lawyers. It gives you the ability to stay away from troubles when in court or working with formal institutions. Find the files you require on our site for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the template web page. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Users with no an active subscription can easily create an account. Utilize this short step-by-step guide to get the South Carolina Notice of Assignment to Living Trust:

- Be sure that the document you found is eligible for use in the state it’s necessary in.

- Confirm the document. Use the Preview option or read its description (if available).

- Buy Now if this form is what you need or use the Search field to find another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these straightforward actions, it is possible to complete the sample in an appropriate editor. Check the completed information and consider requesting a legal professional to examine your South Carolina Notice of Assignment to Living Trust for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Figure out which type of trust is best for you. Take inventory of your property. Choose your trustee. Create the trust document. Sign the trust in front of a notary public. Fund the trust by transferring your assets into it.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.