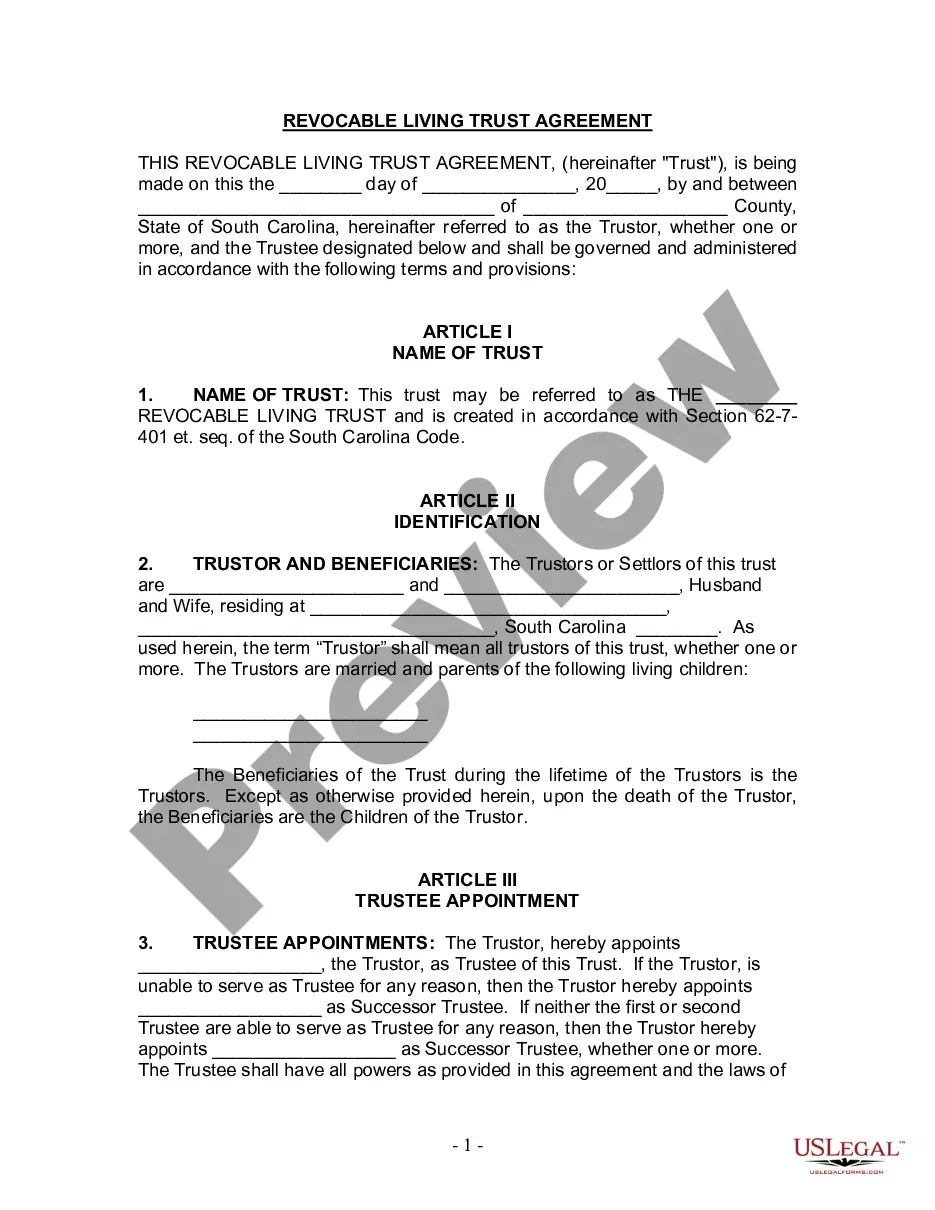

South Carolina Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out South Carolina Living Trust For Husband And Wife With Minor And Or Adult Children?

The work with documents isn't the most straightforward task, especially for those who rarely work with legal paperwork. That's why we recommend making use of accurate South Carolina Living Trust for Husband and Wife with Minor and or Adult Children templates created by professional attorneys. It gives you the ability to stay away from troubles when in court or dealing with official institutions. Find the documents you need on our website for high-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template web page. Soon after getting the sample, it will be stored in the My Forms menu.

Customers without a subscription can quickly get an account. Look at this brief step-by-step help guide to get the South Carolina Living Trust for Husband and Wife with Minor and or Adult Children:

- Make sure that the sample you found is eligible for use in the state it is needed in.

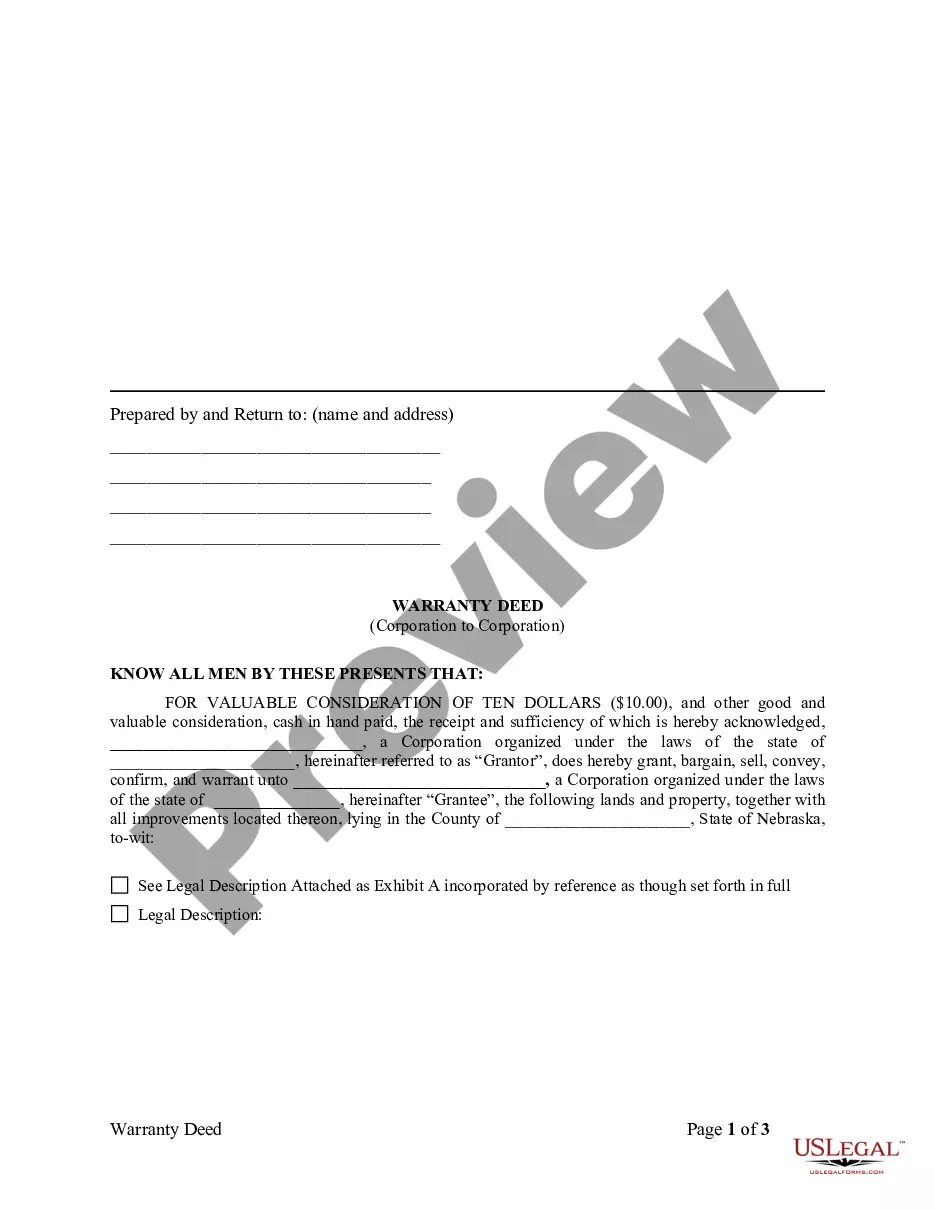

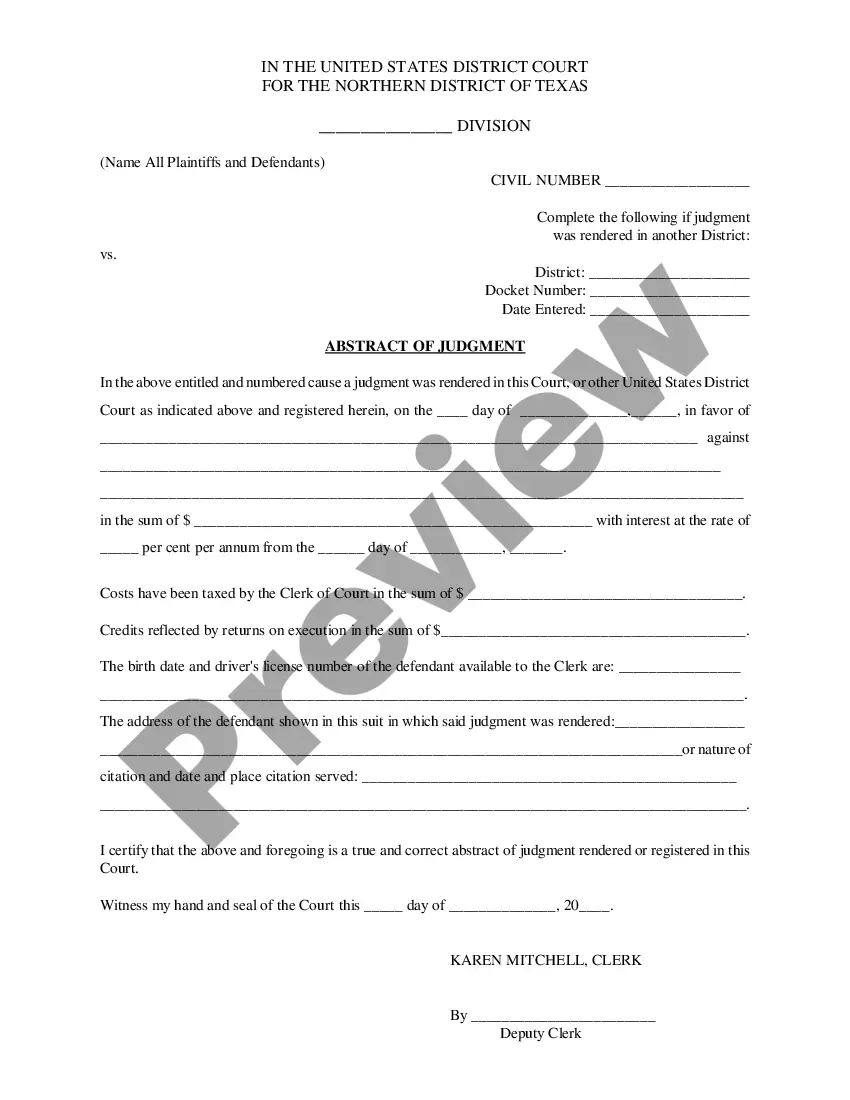

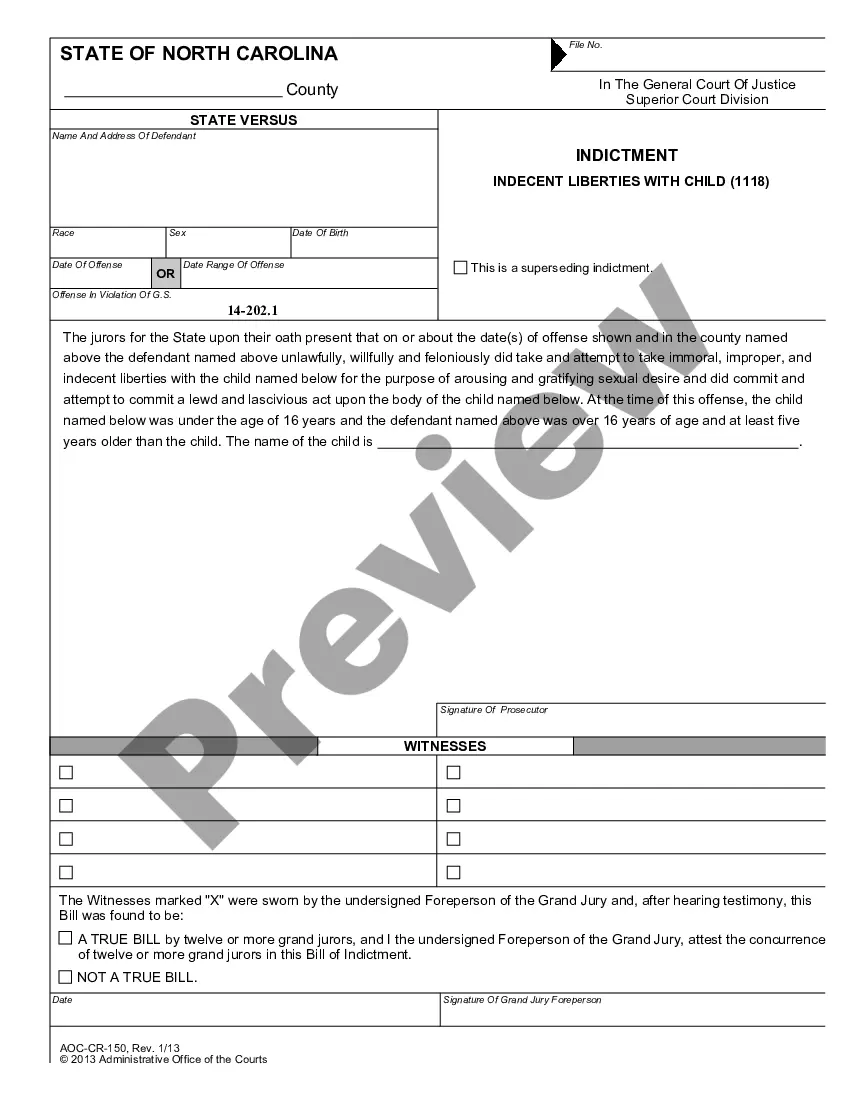

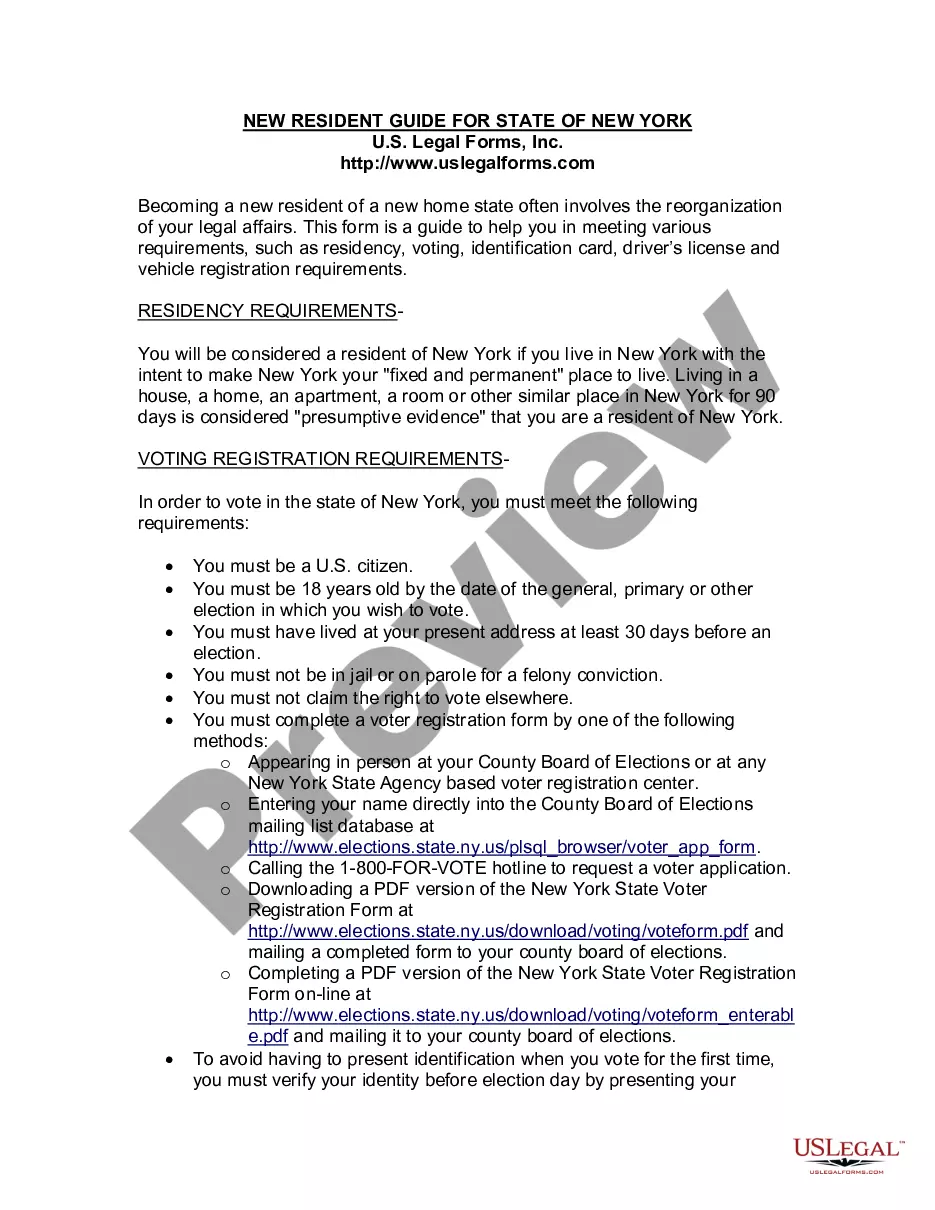

- Confirm the file. Use the Preview option or read its description (if offered).

- Click Buy Now if this sample is what you need or use the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these straightforward actions, it is possible to complete the form in an appropriate editor. Double-check filled in data and consider requesting a legal professional to review your South Carolina Living Trust for Husband and Wife with Minor and or Adult Children for correctness. With US Legal Forms, everything gets much simpler. Give it a try now!

Form popularity

FAQ

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.

A living trust isn't absolutely necessary for everyone but it will certainly help if, for instance, you have a lot of assets, you own property in more than one state, or you have an extended family where things could be more complicated. Also, it's not just a question of how much money or property you have.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

A living trust is designed to allow for the easy transfer of the trust creator or settlor's assets while bypassing the often complex and expensive legal process of probate. Living trust agreements designate a trustee who holds legal possession of assets and property that flow into the trust.

Figure out which type of trust is best for you. Take inventory of your property. Choose your trustee. Create the trust document. Sign the trust in front of a notary public. Fund the trust by transferring your assets into it.