South Carolina Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out South Carolina Complex Will With Credit Shelter Marital Trust For Large Estates?

Creating documents isn't the most simple job, especially for those who rarely deal with legal paperwork. That's why we advise using correct South Carolina Complex Will with Credit Shelter Marital Trust for Large Estates samples created by professional attorneys. It allows you to stay away from problems when in court or handling official institutions. Find the documents you want on our site for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the template web page. After accessing the sample, it will be saved in the My Forms menu.

Users with no a subscription can quickly create an account. Make use of this brief step-by-step guide to get your South Carolina Complex Will with Credit Shelter Marital Trust for Large Estates:

- Be sure that file you found is eligible for use in the state it is necessary in.

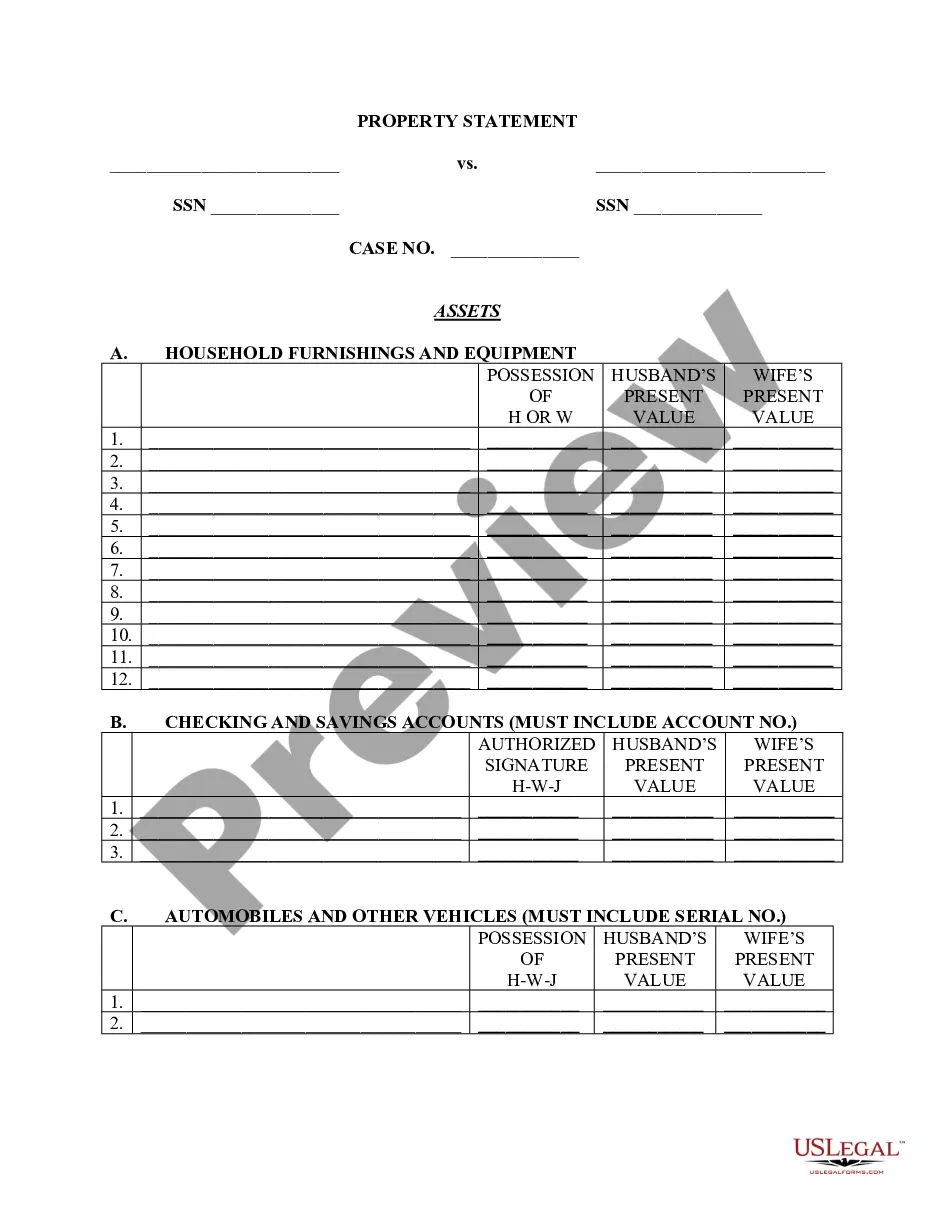

- Verify the document. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this form is the thing you need or go back to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these easy actions, you are able to complete the sample in a preferred editor. Double-check completed information and consider requesting a legal representative to review your South Carolina Complex Will with Credit Shelter Marital Trust for Large Estates for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Form popularity

FAQ

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouseunder some arrangements, the surviving spouse can also receive principal payments.

QTIP trusts are put to use in estate planning and are especially useful when beneficiaries exist from a previous marriage but the grantor dies before a subsequent spouse does. With a QTIP, estate tax is not assessed at the point of the first spouse's death, but is instead determined after the second spouse has passed.

Unlike with a QTIP trust, the surviving spouse typically has complete control over a marital trust, including use of the trust assets and final say on designating who the final beneficiaries are. A QTIP trust offers more control to the grantor but less control to the surviving spouse compared to marital trust.

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

Generally, a Property Trust Will costs between £350 and A£500 plus VAT. It will cost more for couples registering together than it does for individuals. Usually, this is a fixed fee a one-off payment for the setup and registration of the plan.

When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse. The surviving spouse is the trustee over both trusts.

A marital trust starts as a revocable living trust. A surviving spouse can be its trustee.

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.