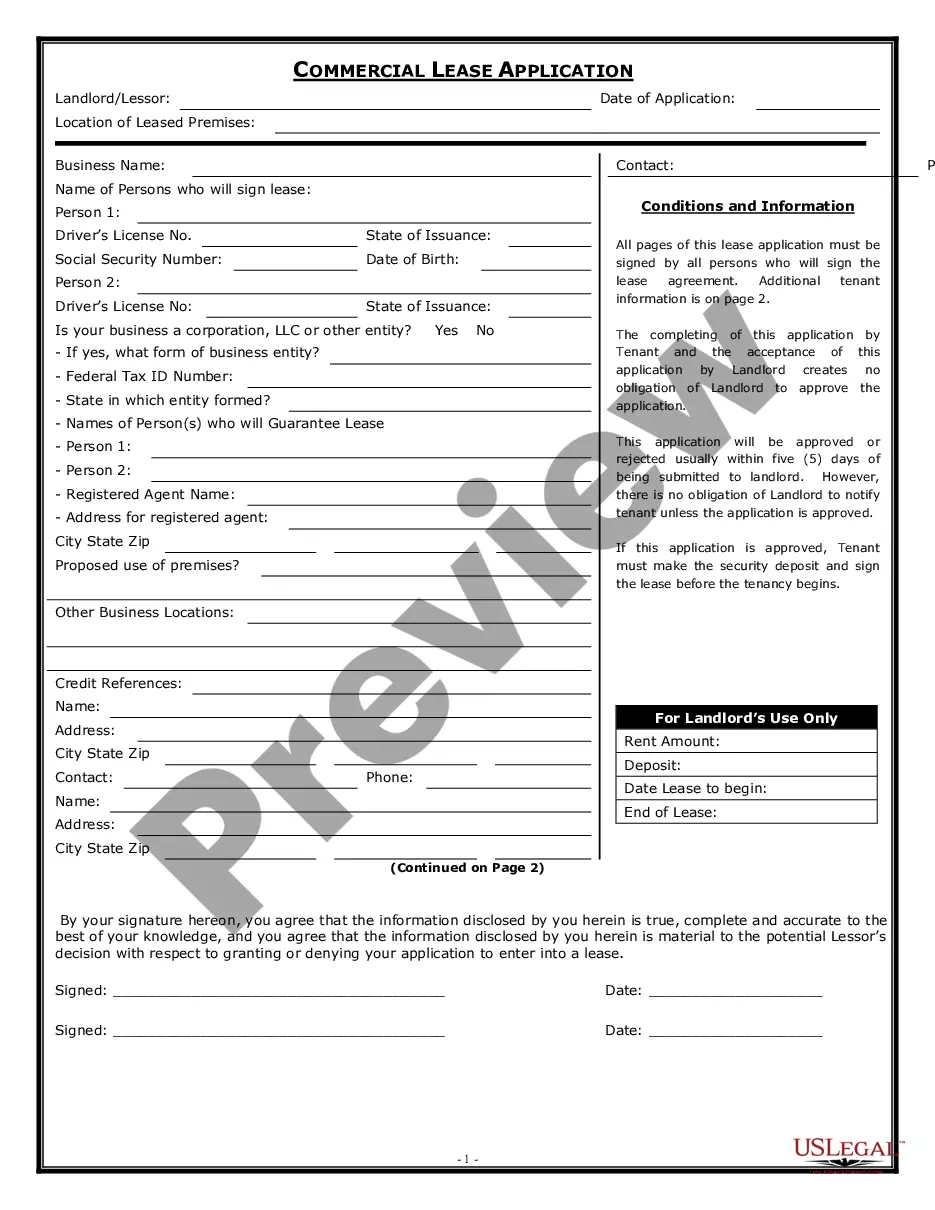

South Carolina Commercial Rental Lease Application Questionnaire

Description

How to fill out South Carolina Commercial Rental Lease Application Questionnaire?

The work with documents isn't the most straightforward job, especially for those who almost never work with legal paperwork. That's why we advise utilizing correct South Carolina Commercial Rental Lease Application Questionnaire samples made by skilled attorneys. It gives you the ability to avoid problems when in court or working with official institutions. Find the templates you need on our website for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will automatically appear on the file web page. Right after accessing the sample, it will be saved in the My Forms menu.

Users without an activated subscription can easily get an account. Utilize this short step-by-step help guide to get the South Carolina Commercial Rental Lease Application Questionnaire:

- Ensure that the document you found is eligible for use in the state it is required in.

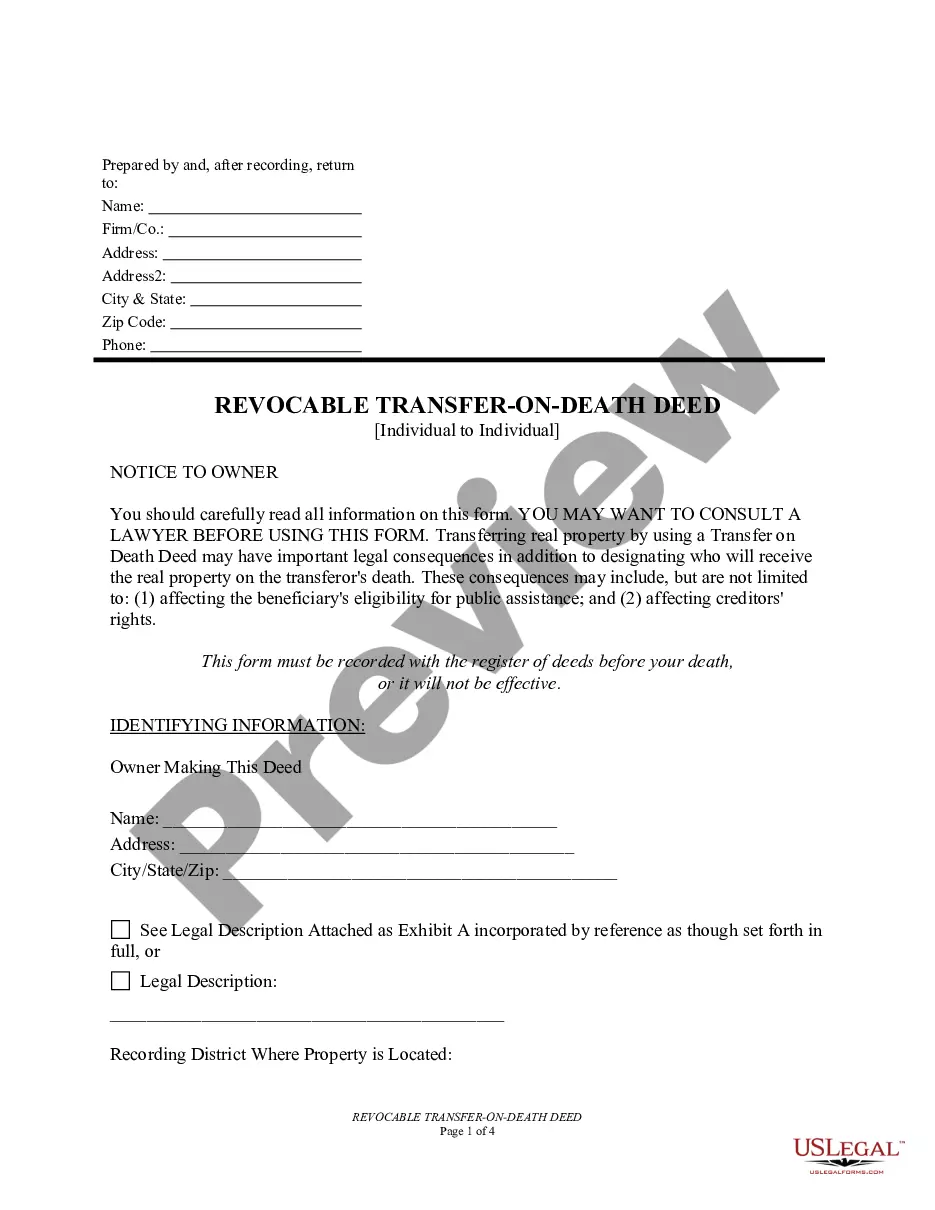

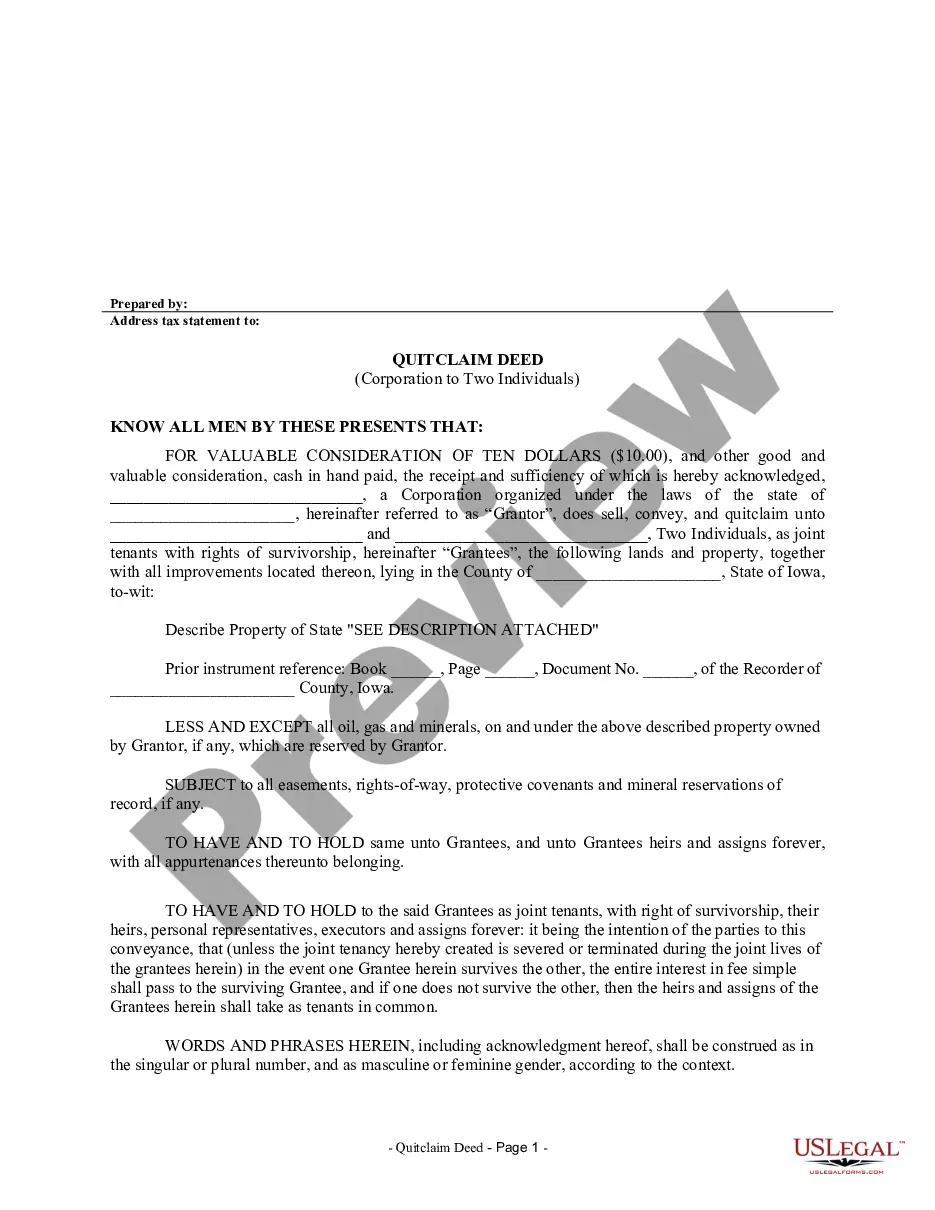

- Verify the file. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this sample is the thing you need or utilize the Search field to find another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these easy actions, it is possible to fill out the sample in a preferred editor. Check the completed data and consider asking a legal representative to examine your South Carolina Commercial Rental Lease Application Questionnaire for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

Commercial leases generally fall into one of three major categories based on how the building's operating expenses are passed on to tenants: Gross or full-service lease. You pay a flat monthly rate from which the landlord pays all operating expenses, including utilities, property taxes and maintenance.

A letter of intent is used to alert a property owner that you're interested in leasing or purchasing a commercial real estate property. Also, it provides the landlord with a more concrete view of how you'll use the property should they commit to a lease agreement with you.

A security deposit is typically an amount equivalent to one or two month's rent, which is deposited by the tenant to secure, as far as money can, the tenant's performance of the tenant's obligations under the Lease.

The Consumer Protection Act (CPA) does NOT apply to all lease agreements (or rental agreements). This is really important to know because the Consumer Protection Act has a big influence on the lease and changes the legal position between the landlord and tenant significantly.Tenants already have lots of protection.

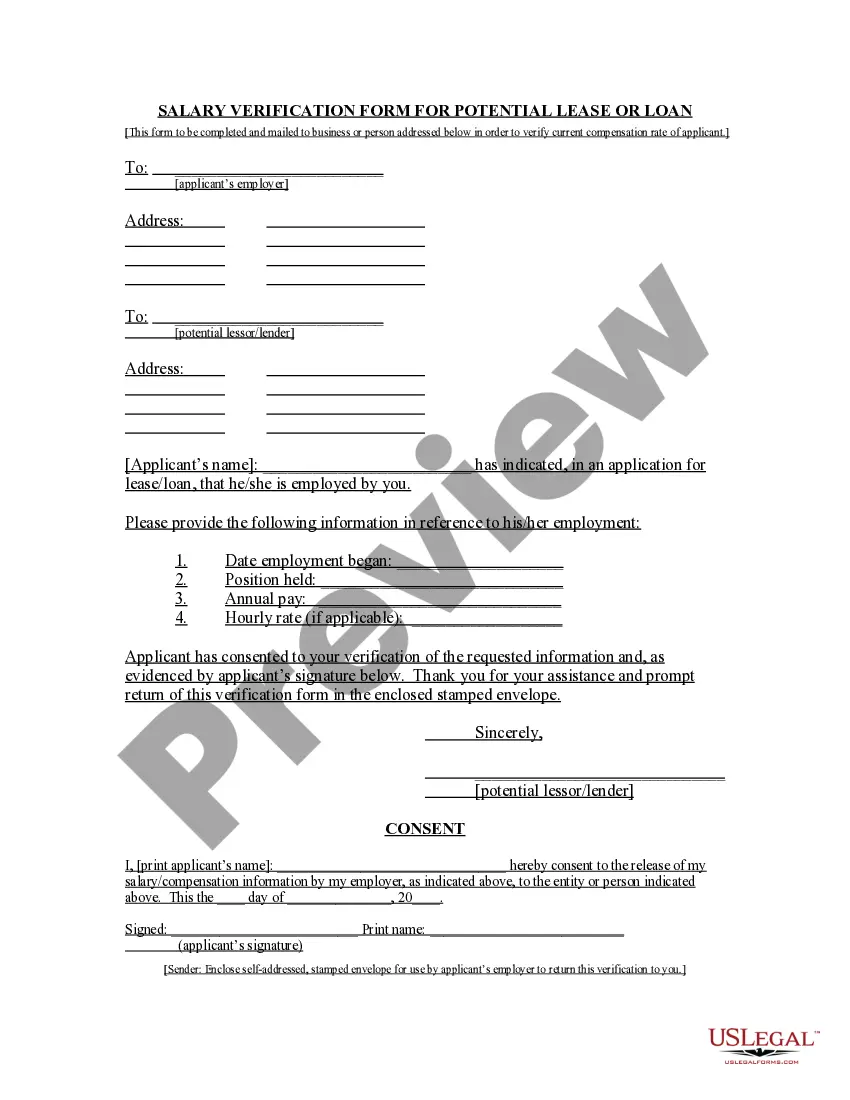

Bank references. Current credit reports/scores from all three reporting bureaus. Previous/current landlord references (for an existing business moving to a new location) Personal and corporate financial statement(s) A copy of your business plan. Business bank statement(s) Prior tax returns.

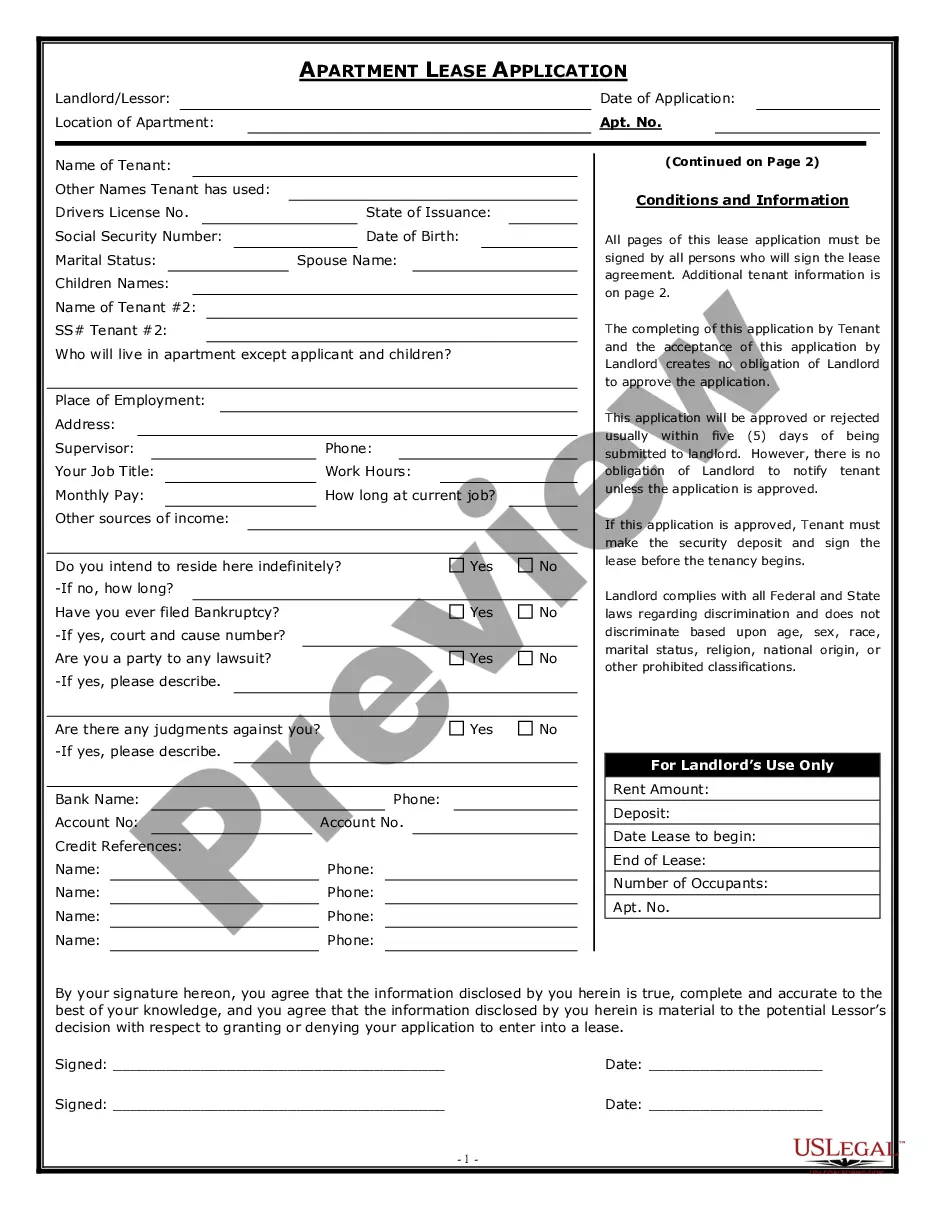

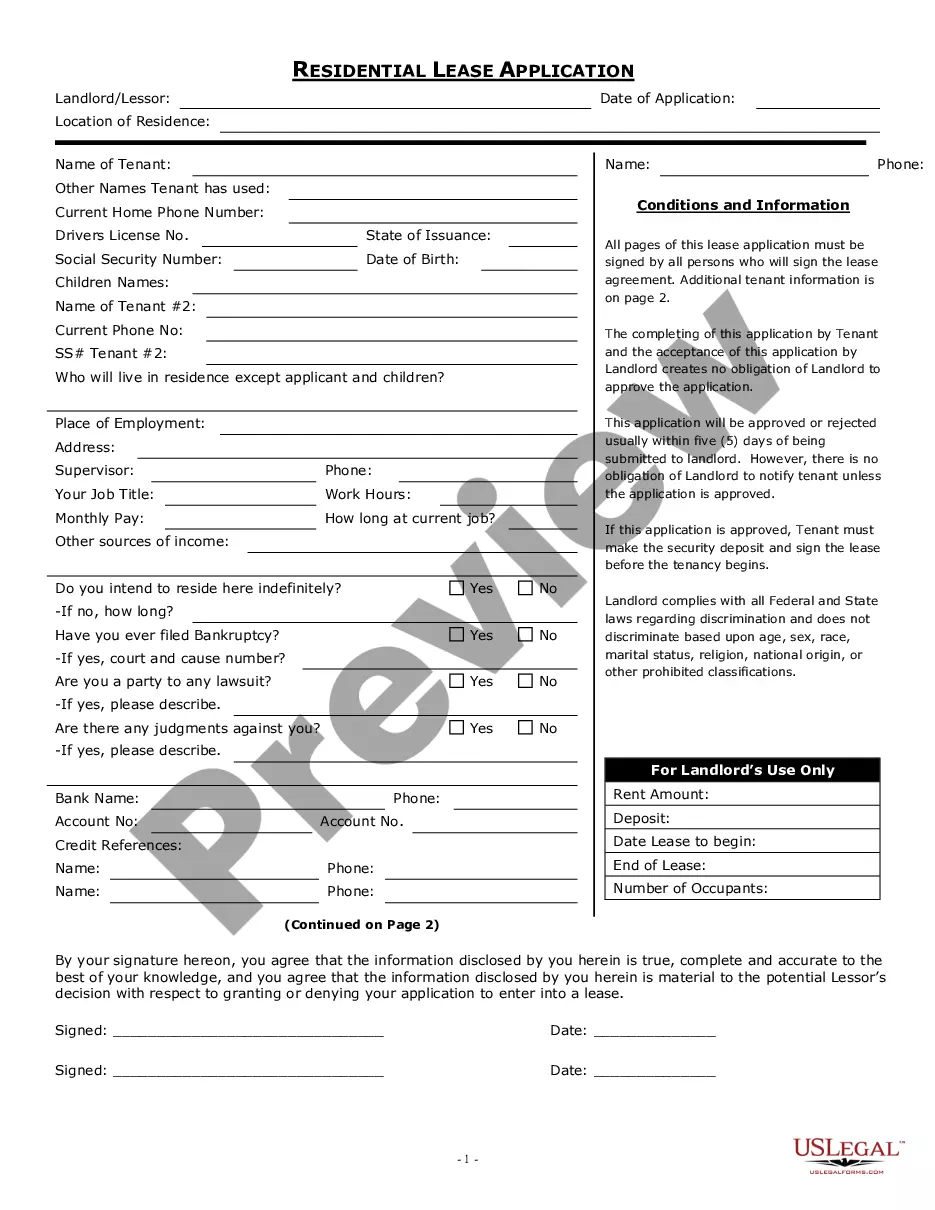

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Commercial leases fall within the ambit of the CPA and refer to an agreement between a landlord and a business setting out terms and conditions governing a property rental. The CPA applies to contracts entered with natural persons and juristic persons with an annual turnover or asset value of less than R2 million.

The process for retailers qualifying for a commercial lease can vary from landlord to landlord. Landlords consider several factors including tenant mix, personal credit history of the owner, company balance sheet, profit and loss statements, open credit lines, and growth projections.

Every commercial tenant doesn't necessarily need a sterling credit history to lease space from you. But it's good to know what you're getting into ahead of time. Assessing credit helps you know when to add appropriate protections into a tenant's lease agreement.