Rhode Island Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest

Description

How to fill out Assignment Of After Payout Working Interest And The Right To Convert Overriding Royalty Interest To A Working Interest?

If you wish to complete, acquire, or produce lawful file templates, use US Legal Forms, the largest collection of lawful forms, which can be found on the web. Use the site`s basic and convenient search to obtain the paperwork you want. Different templates for company and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to obtain the Rhode Island Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest in just a couple of clicks.

In case you are previously a US Legal Forms customer, log in to the profile and then click the Obtain key to get the Rhode Island Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest. You can even gain access to forms you in the past downloaded in the My Forms tab of your profile.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the right area/nation.

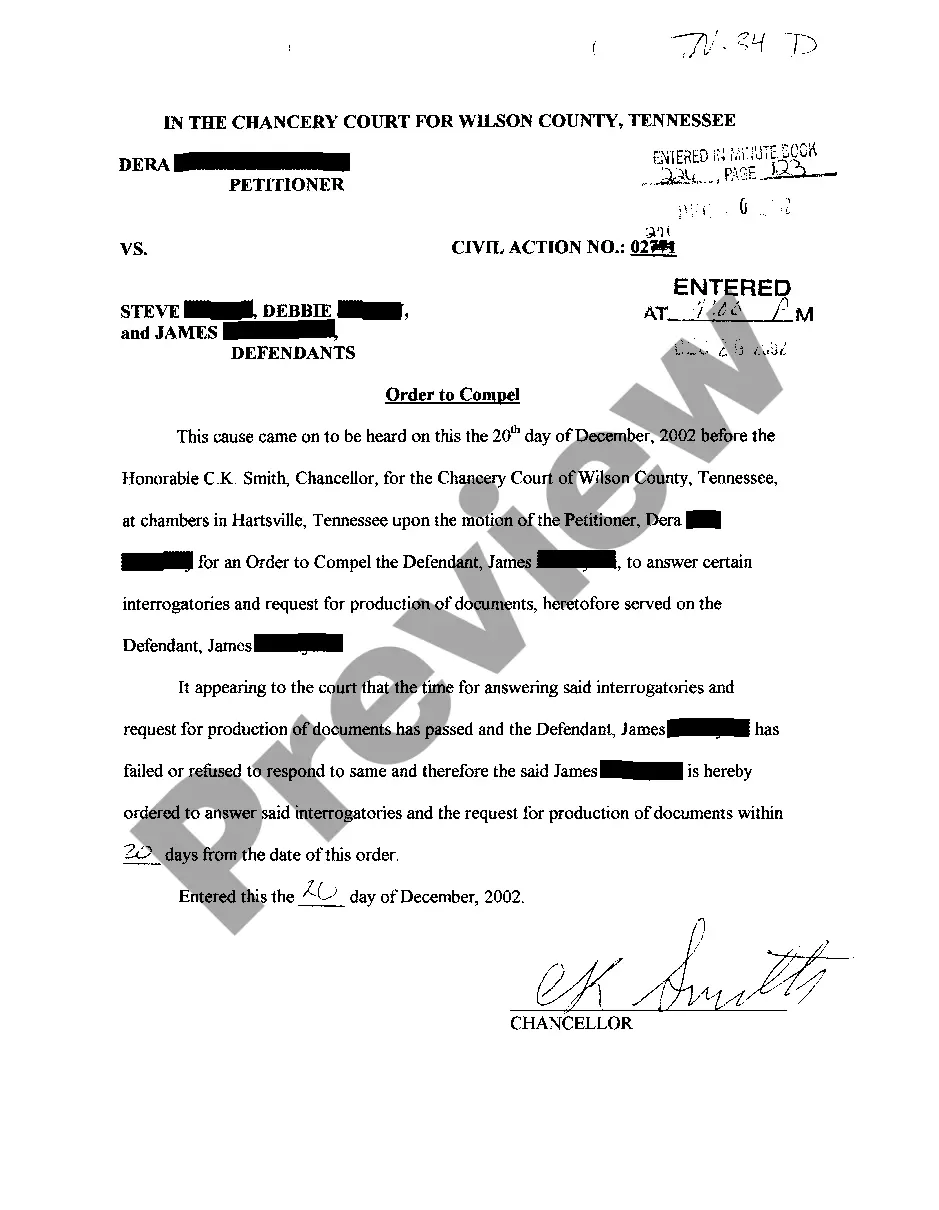

- Step 2. Make use of the Preview choice to check out the form`s articles. Never overlook to read the outline.

- Step 3. In case you are not satisfied with the kind, utilize the Search area at the top of the display to discover other models in the lawful kind design.

- Step 4. Once you have located the shape you want, click on the Buy now key. Choose the prices plan you favor and include your references to register on an profile.

- Step 5. Procedure the transaction. You should use your bank card or PayPal profile to complete the transaction.

- Step 6. Find the format in the lawful kind and acquire it in your gadget.

- Step 7. Complete, change and produce or indicator the Rhode Island Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest.

Every single lawful file design you buy is the one you have for a long time. You have acces to every single kind you downloaded within your acccount. Select the My Forms area and decide on a kind to produce or acquire once more.

Contend and acquire, and produce the Rhode Island Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest with US Legal Forms. There are thousands of expert and status-certain forms you may use for the company or personal demands.

Form popularity

FAQ

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale. Structuring Mining Royalties: What you need to know to protect your ... dentonsmininglaw.com ? structuring-mining... dentonsmininglaw.com ? structuring-mining...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease. What is Overriding Royalty Interest and How to Value it? Pheasant Energy ? overriding-royalt... Pheasant Energy ? overriding-royalt...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well. Overriding Royalty Interest (ORRI) (US) - Westlaw westlaw.com ? Glossary ? PracticalLaw westlaw.com ? Glossary ? PracticalLaw

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.