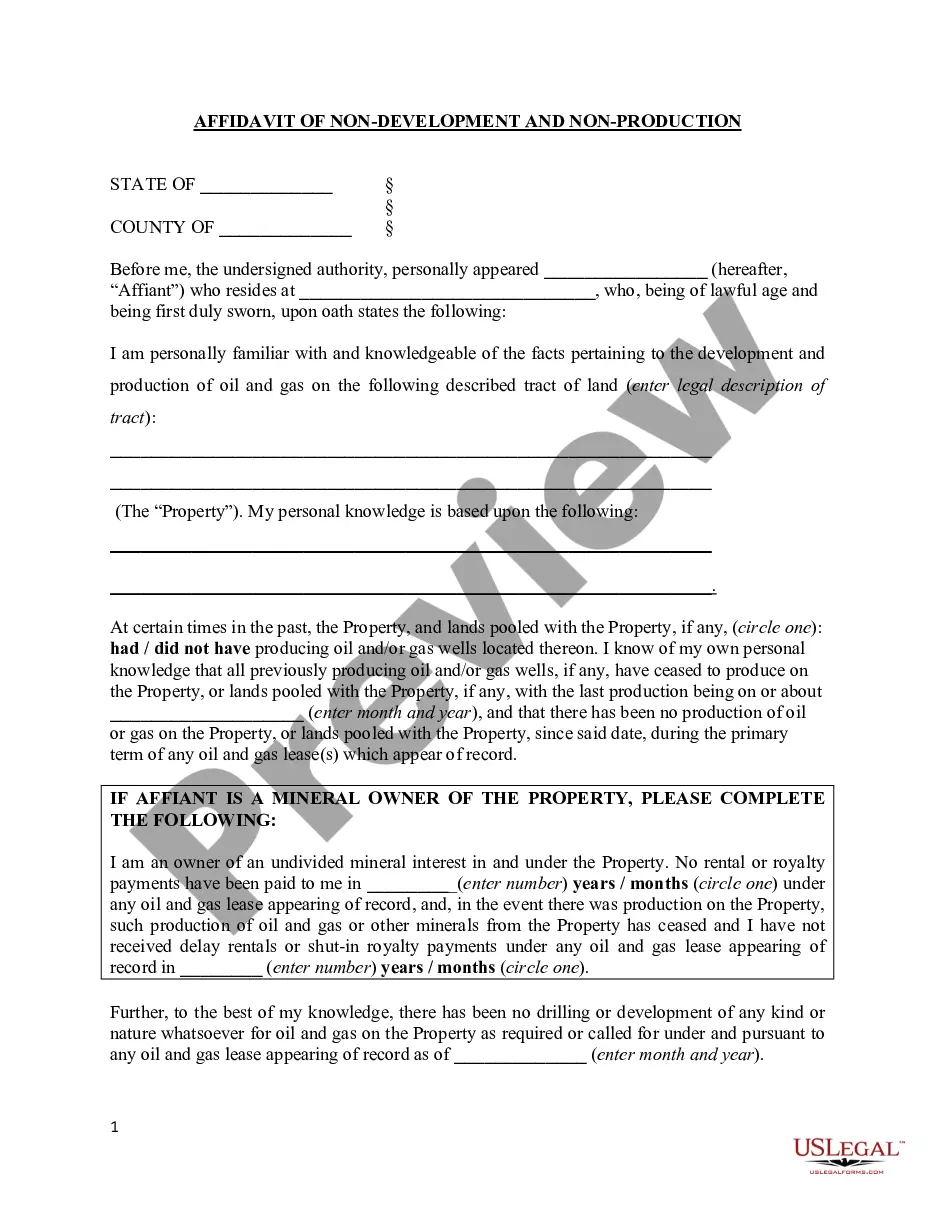

Rhode Island Affidavit of Nonproduction

Description

How to fill out Affidavit Of Nonproduction?

US Legal Forms - one of several largest libraries of legitimate kinds in the USA - gives an array of legitimate papers templates you are able to obtain or produce. Utilizing the site, you can find thousands of kinds for business and individual uses, categorized by groups, suggests, or search phrases.You can get the newest versions of kinds much like the Rhode Island Affidavit of Nonproduction within minutes.

If you currently have a registration, log in and obtain Rhode Island Affidavit of Nonproduction from your US Legal Forms library. The Download button can look on each form you view. You gain access to all previously downloaded kinds in the My Forms tab of your own account.

In order to use US Legal Forms the very first time, listed below are straightforward recommendations to help you started off:

- Be sure you have picked the proper form to your city/county. Click the Review button to examine the form`s content. See the form outline to actually have chosen the appropriate form.

- In the event the form doesn`t suit your specifications, make use of the Research field on top of the monitor to discover the one that does.

- When you are pleased with the shape, affirm your option by visiting the Purchase now button. Then, pick the pricing prepare you want and give your qualifications to register to have an account.

- Process the purchase. Utilize your bank card or PayPal account to finish the purchase.

- Select the file format and obtain the shape on your device.

- Make changes. Load, revise and produce and indicator the downloaded Rhode Island Affidavit of Nonproduction.

Each and every web template you added to your money does not have an expiration particular date and is also your own for a long time. So, if you would like obtain or produce yet another version, just go to the My Forms area and click around the form you require.

Obtain access to the Rhode Island Affidavit of Nonproduction with US Legal Forms, the most substantial library of legitimate papers templates. Use thousands of skilled and express-distinct templates that satisfy your small business or individual requirements and specifications.

Form popularity

FAQ

(a) In a sale of real property and associated tangible personal property owned by a nonresident, the buyer shall deduct and withhold on the payments an amount equal to six percent (6%) of the total payment to nonresident individuals, estates, partnerships, or trusts, and seven percent (7%) of the total payment to ...

Every part-year individual who was a resident for a period of less than 12 months is required to file a Rhode Island return if he or she is required to file a federal return.

The Rhode Island non-resident withholding law mandates that anytime a non-resident of Rhode Island sells real estate, the buyer must withhold a certain amount of the purchase price from the net proceeds of the sale and turn the withholdings over to the Rhode Island Division of Taxation.

?Resident? means an individual who is domiciled in the State of Rhode Island or an individual who maintains a permanent place of abode in Rhode Island and spends more than 183 days of the year in Rhode Island.

If an approved Certificate of Withholding Due has not been obtained prior to the closing, the buyer must withhold 6% of the seller's net proceeds (7% if seller is a nonresident corporation).

Rhode Island has three income tax brackets, which increased for the 2023 tax season: 3.75% for $73,450, up from $68,200 in 2022. 4.75% for $73,450 to $166,950, up from $155,050 in 2022. 5.99% for over $166,950, up from $155,050 in 2022.

Part-year resident: A part-year resident is a person who changed legal residence by moving into or out of Rhode Island at any time during the year. Part-year residents will file Form RI-1040NR.

Withholding Tax on Gambling Winnings: If a must withhold for federal purposes, RI must withhold federal tax withheld multiplied by the Rhode Island personal income tax withholding rate in effect on the date of the payment.