Rhode Island Self-Employed Special Events Driver Services Contract

Description

How to fill out Self-Employed Special Events Driver Services Contract?

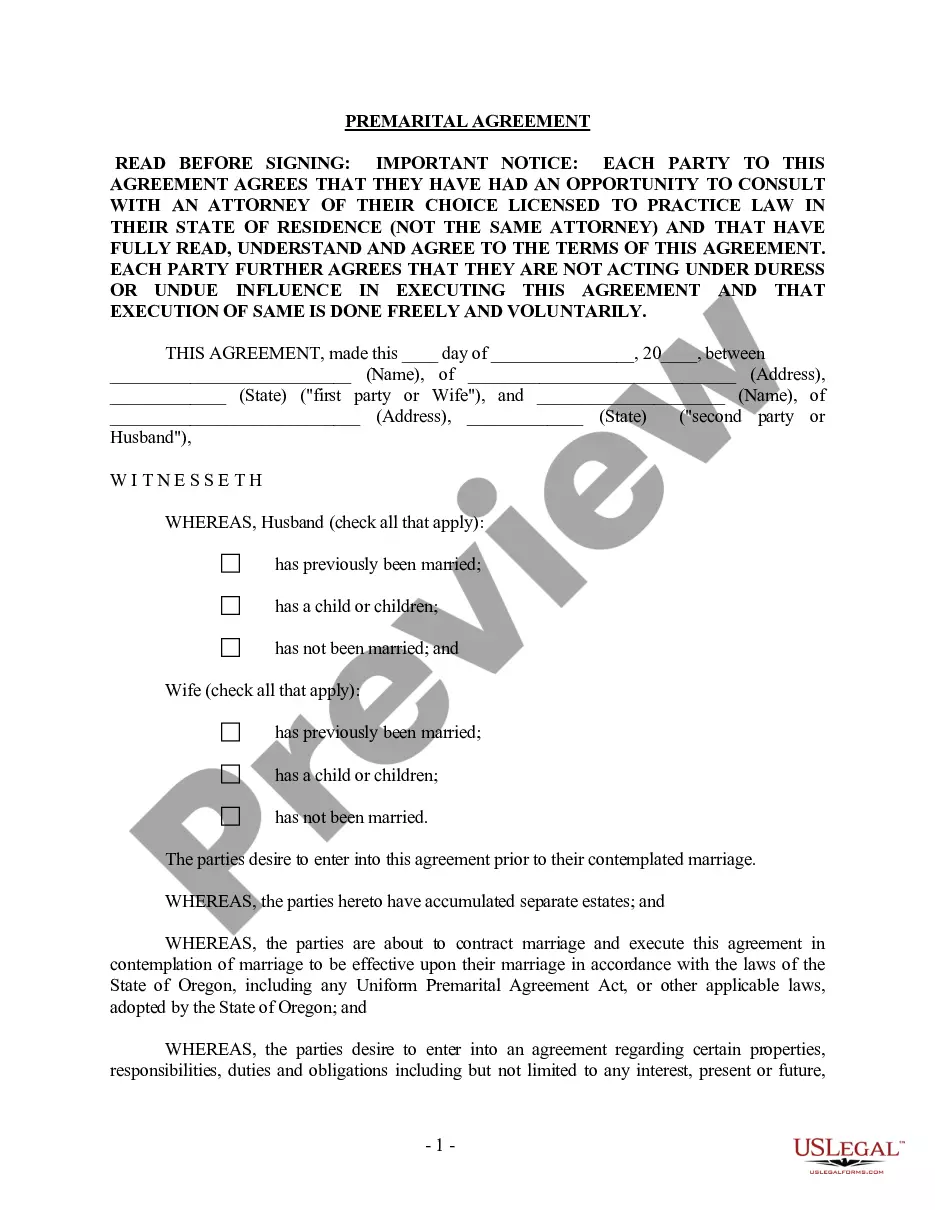

Selecting the optimal authorized document template can be rather challenging. Obviously, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website. The service offers a multitude of templates, including the Rhode Island Self-Employed Special Events Driver Services Contract, which you can use for business and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If you are currently authorized, Log In to your account and click the Obtain button to get the Rhode Island Self-Employed Special Events Driver Services Contract. Use your account to browse the legal forms you have purchased previously. Navigate to the My documents tab in your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/county. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not satisfy your requirements, use the Search field to find the appropriate form. Once you are confident the form is accurate, click the Get now button to acquire the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Finally, complete, modify, print, and sign the acquired Rhode Island Self-Employed Special Events Driver Services Contract.

Overall, US Legal Forms provides a comprehensive solution for obtaining legal documents tailored to your needs.

- US Legal Forms is the largest repository of legal forms where you will find numerous document templates.

- Utilize the service to download professionally crafted documents that comply with state regulations.

- Ensure you have the right document for your specific needs.

- Take advantage of the preview feature to assess the form before purchasing.

- Make sure to select your preferred payment method for a smooth transaction.

- Access your previously acquired forms easily through your account.

Form popularity

FAQ

Yes, having a contract as an independent contractor is essential for defining the scope of work and protecting your rights. A well-structured contract, such as the Rhode Island Self-Employed Special Events Driver Services Contract, clarifies expectations between you and the client. This agreement can prevent misunderstandings and provide legal recourse if issues arise during your service.

As an independent contractor, you typically need to complete several forms to ensure proper tax reporting and compliance. Common documents include a W-9 form for tax identification and any specific contracts, like the Rhode Island Self-Employed Special Events Driver Services Contract, that outline your services and payment terms. Additionally, maintaining your own records will help you manage payments and expenses effectively.

The new federal rule for independent contractors emphasizes a stricter classification to determine whether a worker is an independent contractor or an employee. This rule focuses on the degree of control a company has over the worker's tasks and schedule. If you are a self-employed individual providing services, such as those outlined in the Rhode Island Self-Employed Special Events Driver Services Contract, understanding these changes is crucial for compliance and tax purposes.

The new federal rule on independent contractors emphasizes the need for a clear distinction between employees and independent contractors. This rule aims to protect workers by ensuring they are classified correctly and receive appropriate benefits. Understanding this rule is vital for those entering agreements like the Rhode Island Self-Employed Special Events Driver Services Contract, as it impacts how you operate and report your work.

Yes, independent contractors need work authorization in the U.S. This means ensuring that you are legally allowed to work in your industry and region. For instance, if you're pursuing the Rhode Island Self-Employed Special Events Driver Services Contract, you must comply with local regulations and obtain any necessary permits.

Becoming an independent contractor in the USA involves several steps, such as identifying your skills and services, registering your business, and obtaining any required licenses. You should also create a solid business plan and consider using contracts, like the Rhode Island Self-Employed Special Events Driver Services Contract, to outline your agreements clearly and protect your interests.

The primary difference between contract labor and employees lies in the nature of the relationship. Contractors typically work independently and have more control over how they complete their tasks, while employees work under the direct supervision of an employer. Understanding this distinction is crucial, especially when drafting a Rhode Island Self-Employed Special Events Driver Services Contract, which should clearly define your role and responsibilities.

To be authorized to perform services as an independent contractor, you should research the specific requirements for your field of work. This may include obtaining licenses, insurance, and completing any necessary registrations. The Rhode Island Self-Employed Special Events Driver Services Contract is an excellent resource for understanding these requirements in the context of your local regulations.

Filing taxes as an independent contractor involves reporting your income on a Schedule C form when you file your federal tax return. You will need to keep track of your expenses to deduct them from your taxable income. Utilizing the Rhode Island Self-Employed Special Events Driver Services Contract can help you understand your tax obligations and ensure you include all relevant income and expenses.

To get authorized as an independent contractor, you must first obtain any necessary licenses and permits specific to your industry. You will also need to register your business with the appropriate state authorities. For those in Rhode Island, the Rhode Island Self-Employed Special Events Driver Services Contract can provide you with essential guidelines to ensure compliance with state regulations.