Rhode Island Disability Services Contract - Self-Employed

Description

How to fill out Disability Services Contract - Self-Employed?

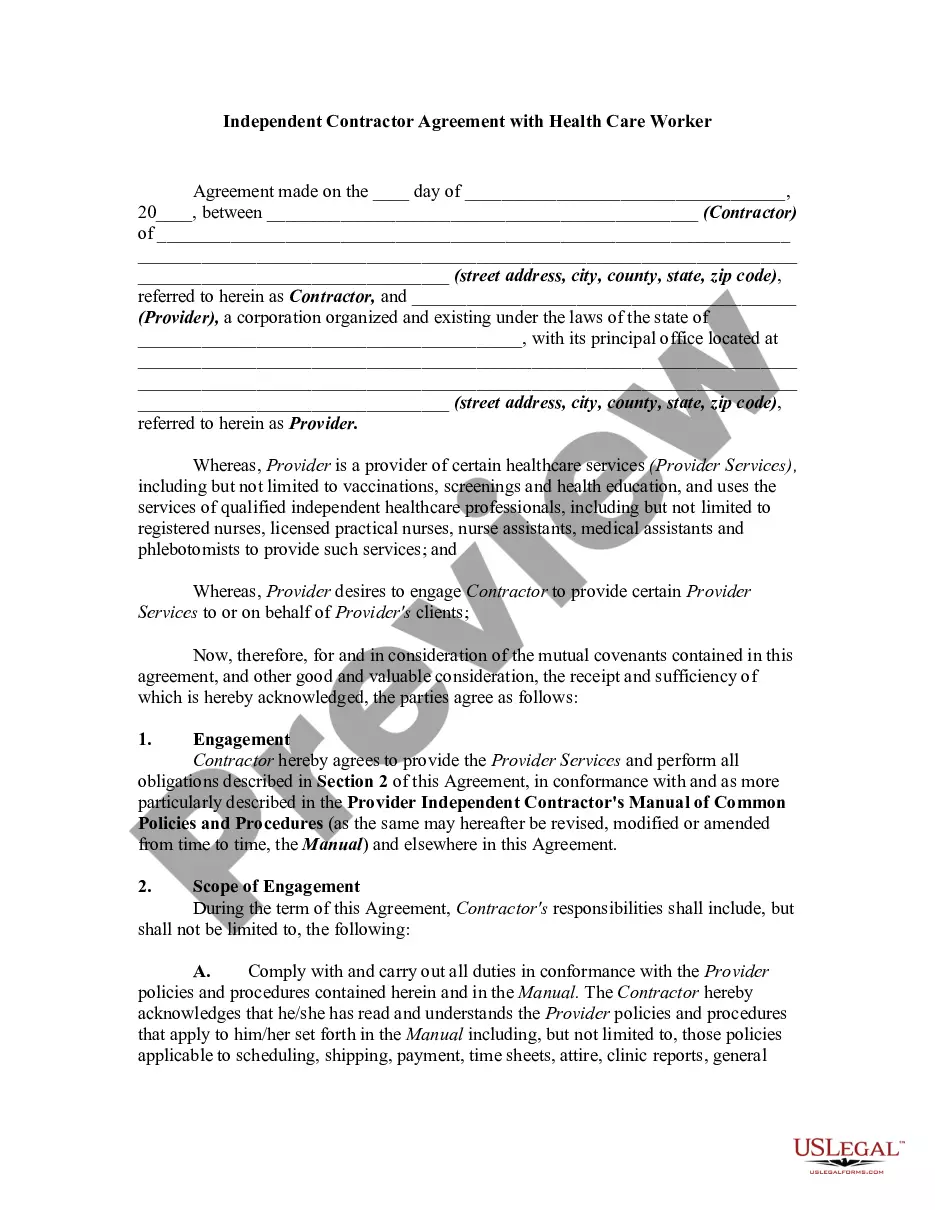

Finding the correct legal document template can be a challenge. Clearly, there are numerous formats available online, but how can you obtain the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Rhode Island Disability Services Contract - Self-Employed, which you can use for business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Rhode Island Disability Services Contract - Self-Employed. Use your account to browse the legal forms you have previously purchased. Go to the My documents tab in your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your area/region. You can preview the form using the Preview button and review the form outline to ensure it is suitable for you. If the form does not meet your requirements, use the Search field to find the right form. Once you are confident that the form is appropriate, click the Get now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and pay for the order using your PayPal account or Visa or MasterCard. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Rhode Island Disability Services Contract - Self-Employed.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to obtain professionally created paperwork that adheres to state requirements.

- Utilize the US Legal Forms website for thousands of templates.

- Ensure compliance with federal and state regulations.

- Log in to access previously purchased forms.

- Follow simple steps for new users to find the right form.

- Download the legal document to your device.

- Complete and sign the document as needed.

Form popularity

FAQ

To set yourself up as an independent contractor in the context of a Rhode Island Disability Services Contract - Self-Employed, start by choosing a business name and registering it with the state. Next, obtain any necessary licenses or permits required for your specific services. You should also consider getting liability insurance to protect yourself and your business. Finally, using platforms like uslegalforms can help you draft the necessary contracts and agreements to formalize your independent contractor status.

You can claim a disability allowance if you are self-employed, as long as you meet the necessary qualifications. This includes providing proof that your disability hinders your ability to work. The Rhode Island Disability Services Contract - Self-Employed is designed to help you understand your rights and responsibilities. To make the process easier, consider leveraging the services available on the US Legal Forms platform.

Yes, self-employed individuals can qualify for disability benefits, provided they meet specific criteria set by Social Security. You must have a sufficient work history and have made proper tax contributions from your self-employment income. The Rhode Island Disability Services Contract - Self-Employed outlines the eligibility requirements and helps streamline your application. For additional support, the US Legal Forms platform offers valuable tools and information.

Disability benefits for self-employed individuals operate similarly to those for employees, but there are unique considerations. You must demonstrate that your disability prevents you from performing substantial gainful activity. The Rhode Island Disability Services Contract - Self-Employed can guide you through the necessary steps and paperwork. Utilizing the US Legal Forms platform can simplify this process and ensure you meet all requirements.

While disability insurance offers valuable protection, it does have some disadvantages. Premiums can be high, especially for self-employed individuals, and there may be waiting periods before benefits start. Additionally, some policies may have limitations on coverage. Understanding these factors is essential, and resources like the Rhode Island Disability Services Contract - Self-Employed can clarify your options.

Yes, 1099 employees can obtain disability insurance. As independent contractors, they have the same rights to financial protection as traditional employees. It's crucial to explore options tailored for self-employed individuals, such as those provided in a Rhode Island Disability Services Contract - Self-Employed, to ensure adequate coverage.

Disability insurance is often worth it for self-employed individuals. This type of coverage can prevent financial hardship if you become unable to work. By securing a Rhode Island Disability Services Contract - Self-Employed, you invest in your financial future, allowing you to focus on your recovery without the added stress of income loss.

Dave Ramsey emphasizes the importance of disability insurance for all workers, including the self-employed. He advocates for protecting your income against unforeseen circumstances. According to him, having a solid plan in place, such as a Rhode Island Disability Services Contract - Self-Employed, can provide peace of mind and financial security.

Yes, you can qualify for disability benefits even if you are self-employed. Eligibility often depends on your ability to demonstrate that your condition limits your capacity to work. It is essential to maintain accurate records of your income and medical history. A Rhode Island Disability Services Contract - Self-Employed can guide you through the qualification process.

Yes, self-employed individuals should consider disability insurance. This coverage provides financial protection in case you cannot work due to illness or injury. Without a steady paycheck, managing expenses can become challenging. Investing in a Rhode Island Disability Services Contract - Self-Employed can safeguard your income and ensure stability.