Rhode Island Window Contractor Agreement - Self-Employed

Description

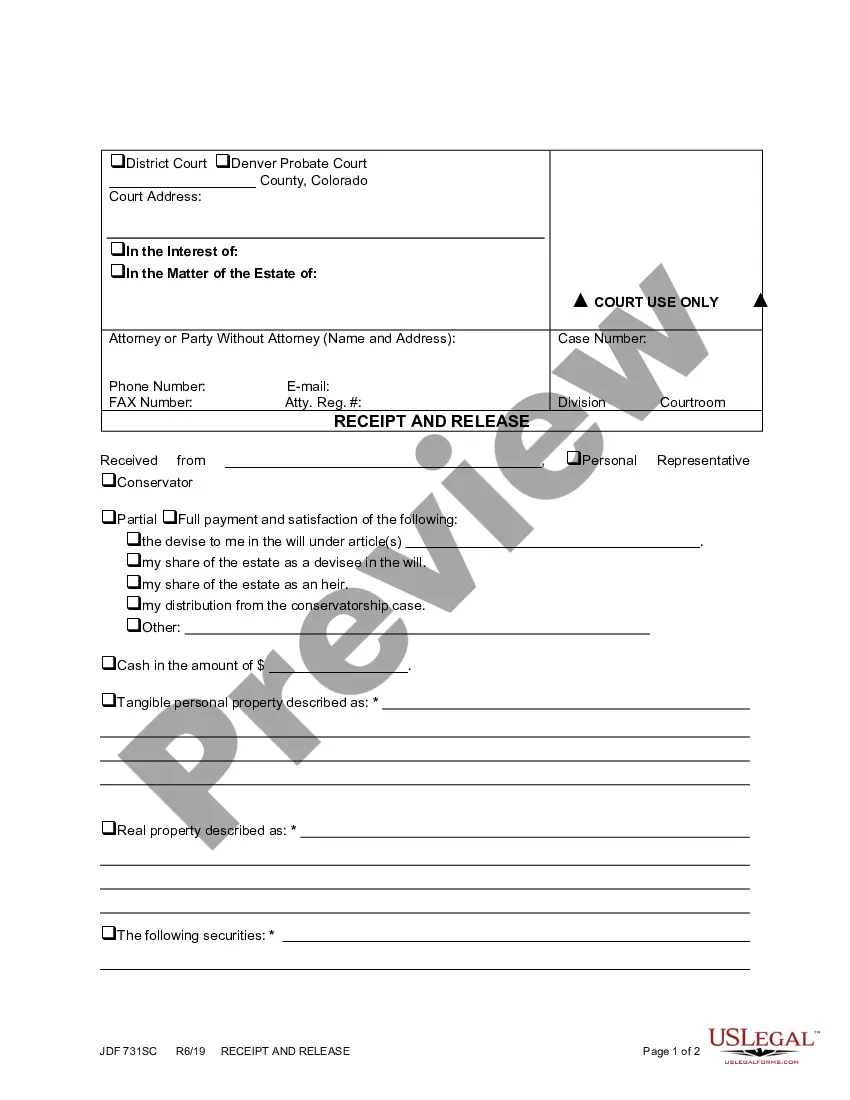

How to fill out Window Contractor Agreement - Self-Employed?

If you need to obtain, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the website's simple and user-friendly search to locate the documents you require. Numerous templates for business and personal purposes are categorized by types and jurisdictions, or keywords. Use US Legal Forms to find the Rhode Island Window Contractor Agreement - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Rhode Island Window Contractor Agreement - Self-Employed. You can also access forms you have previously saved under the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have chosen the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Don't forget to check the details. Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative variations in the legal form template. Step 4. Once you have found the form you need, click the Purchase now button. Select the payment option you prefer and provide your credentials to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Rhode Island Window Contractor Agreement - Self-Employed.

- Every legal document template you purchase is yours permanently.

- You will have access to every form you saved in your account.

- Click the My documents section and select a form to print or download again.

- Stay competitive and download, and print the Rhode Island Window Contractor Agreement - Self-Employed with US Legal Forms.

- There are countless professional and state-specific forms you can utilize for your business or personal needs.

- US Legal Forms provides a comprehensive solution for your legal documentation.

- Easily navigate through numerous templates designed for various purposes.

Form popularity

FAQ

Yes, Rhode Island requires most contractors to obtain a license for legal operation, including window contractors. This requirement helps ensure that professionals meet certain standards for safety and quality. To streamline the process of obtaining your Rhode Island Window Contractor Agreement - Self-Employed, consider utilizing uslegalforms, which provides user-friendly templates and guidance for creating compliant documents.

In Rhode Island, contractor law outlines the responsibilities and legal obligations of contractors, including those involved in window installation. These laws focus on licensing and insurance requirements to protect both contractors and clients. Understanding the Rhode Island Window Contractor Agreement - Self-Employed is crucial for compliance with these legal standards. Consulting with a legal expert or using resources from uslegalforms can help clarify these laws.

To write an independent contractor agreement for a Rhode Island Window Contractor Agreement - Self-Employed, start by clearly defining the scope of work. Include details such as payment terms, deadlines, and responsibilities. It is essential to outline any specific requirements that pertain to Rhode Island law to ensure validity. Using a template from uslegalforms can simplify this process, guiding you to create a comprehensive agreement tailored to your needs.

To fill out an independent contractor agreement, start by entering your information and the contractor's details, followed by a thorough description of the work. Ensure to reference the Rhode Island Window Contractor Agreement - Self-Employed to tailor the contract to your specific needs. Clearly outline payment arrangements, timelines, and any obligations to both parties. Using services like USLegalForms can provide a reliable framework to complete your agreement.

Filling out an independent contractor form requires you to include essential information such as your personal details, the services you provide, and payment expectations. Be sure to reference the Rhode Island Window Contractor Agreement - Self-Employed when detailing the terms of your work. It is important to double-check your entries for accuracy to avoid any potential legal issues down the line.

To become an independent contractor in Rhode Island, first, assess your skills and the services you plan to offer, especially in the context of a Rhode Island Window Contractor Agreement - Self-Employed. Next, register your business with the state and obtain any required licenses. Additionally, maintain good records of your projects and finances to streamline your operations as an independent contractor.

To write an independent contractor agreement, start by clearly defining the scope of work and the expected deliverables. Include payment terms, deadlines, and any specific responsibilities related to the Rhode Island Window Contractor Agreement - Self-Employed. Also, outline the terms regarding confidentiality and dispute resolution. Consider using platforms like USLegalForms for templates that can simplify this process.

In Rhode Island, an independent contractor agreement does not typically need to be notarized to be legally binding. However, having a notarized agreement can provide additional security and help prevent disputes. To ensure you have a solid Rhode Island Window Contractor Agreement - Self-Employed, consider using US Legal Forms to obtain a well-crafted document that meets your specific requirements.

To create an independent contractor agreement, start by outlining the scope of work and the compensation structure. Include important details such as timelines, responsibilities, and confidentiality clauses. Utilizing resources from US Legal Forms can simplify this process by offering customizable templates for a Rhode Island Window Contractor Agreement - Self-Employed.

Typically, the party hiring the contractor drafts the independent contractor agreement. However, both parties can collaborate to ensure it meets their needs. For those seeking a professional touch, using a service like US Legal Forms can help you create a comprehensive Rhode Island Window Contractor Agreement - Self-Employed that covers all necessary terms.