Rhode Island Pipeline Service Contract - Self-Employed

Description

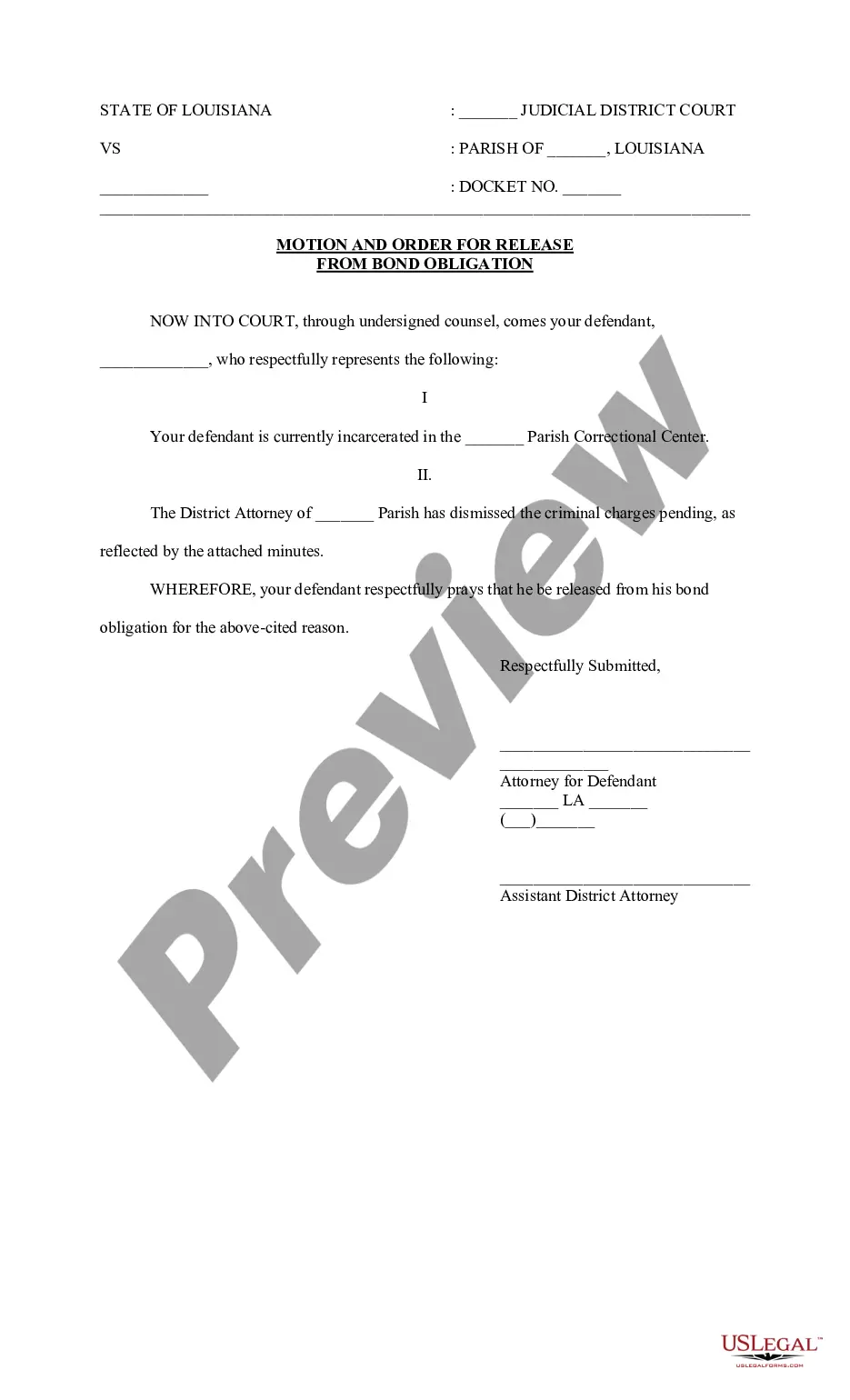

How to fill out Pipeline Service Contract - Self-Employed?

If you need to summarize, acquire, or create authorized document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Utilize the website's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or search terms.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, revise, and print or sign the Rhode Island Pipeline Service Contract - Self-Employed.

- Use US Legal Forms to acquire the Rhode Island Pipeline Service Contract - Self-Employed in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and then click the Obtain button to find the Rhode Island Pipeline Service Contract - Self-Employed.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to evaluate the document's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Being a 1099 contractor means you operate as an independent entity, receiving 1099 forms for your income instead of W-2 forms. To be hired as a 1099 contractor, you must develop a clear business structure and engage potential clients effectively. If you pursue a Rhode Island Pipeline Service Contract - Self-Employed, understanding this status will aid in navigating your tax responsibilities.

To become an independent contractor in Rhode Island, first define the services you intend to offer and ensure you comply with any necessary local regulations. Next, consider registering your business name and obtaining any required licenses. With a Rhode Island Pipeline Service Contract - Self-Employed, you will have a foundation for establishing your independent status.

The common law test determines whether a worker is an independent contractor or an employee based on the degree of control you have over your work. This includes assessing the nature of the work, how it's performed, and your relationship with the hiring company. If you are entering into a Rhode Island Pipeline Service Contract - Self-Employed, being aware of these criteria is essential for ensuring your classification is accurate.

To qualify as an independent contractor in Rhode Island, you must demonstrate a certain level of control over your work. Factors include managing your schedule, setting your rates, and deciding how to perform the tasks. If you want to work under a Rhode Island Pipeline Service Contract - Self-Employed, understanding these qualifications will help you position yourself correctly in the job market.

Yes, Rhode Island requires certain contractors to obtain a license, depending on their trade and the services they provide. If you plan to work on larger projects or in specific fields under a Rhode Island Pipeline Service Contract - Self-Employed, be prepared to check the necessary licensing requirements to ensure compliance and avoid penalties.

Choosing between forming an LLC or operating as an independent contractor largely depends on your business needs. An LLC provides liability protection and potential tax benefits, while an independent contractor status generally incurs fewer administrative requirements. However, if you are working under a Rhode Island Pipeline Service Contract - Self-Employed, it might help to evaluate which structure best aligns with your goals.

In Rhode Island, self-employment tax includes Social Security and Medicare taxes. Currently, the total self-employment tax rate is 15.3%, which is applied to your net earnings. It's essential to calculate this to understand your financial obligations as a self-employed individual, especially when working with a Rhode Island Pipeline Service Contract - Self-Employed.

The new federal rule on independent contractors focuses on the criteria for determining independent contractor status under labor laws. This guideline emphasizes the degree of control and independence in the work relationship. If you are entering a Rhode Island Pipeline Service Contract - Self-Employed, remain informed about these regulations to ensure compliance and protect your rights.

Contract workers are generally viewed as self-employed, particularly if they provide services independently and work for multiple clients. This arrangement allows for greater flexibility and control over one’s work schedule. If you’re considering a Rhode Island Pipeline Service Contract - Self-Employed, enjoy the benefits of independence alongside the responsibility of managing your business.

In many cases, contract employees are considered self-employed, especially if they control their work and have the autonomy to make decisions. However, some might still be classified as employees based on the relationship with the hiring party. When entering a Rhode Island Pipeline Service Contract - Self-Employed, it's crucial to clarify your status to know your rights and obligations.