Rhode Island Board Member Agreement

Description

How to fill out Board Member Agreement?

Are you within a placement in which you need files for either enterprise or specific purposes just about every time? There are plenty of legal record themes available on the net, but discovering versions you can depend on isn`t straightforward. US Legal Forms delivers a huge number of develop themes, like the Rhode Island Board Member Agreement, that happen to be created to satisfy state and federal needs.

In case you are already familiar with US Legal Forms web site and have a merchant account, basically log in. Next, you can acquire the Rhode Island Board Member Agreement web template.

If you do not have an bank account and want to begin to use US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is for your correct city/area.

- Utilize the Preview button to check the shape.

- Read the description to actually have selected the appropriate develop.

- In case the develop isn`t what you are looking for, make use of the Search industry to obtain the develop that meets your needs and needs.

- Once you find the correct develop, click on Buy now.

- Choose the pricing program you desire, fill out the desired details to generate your money, and buy the transaction using your PayPal or credit card.

- Pick a convenient paper file format and acquire your copy.

Locate all the record themes you may have purchased in the My Forms menus. You can get a further copy of Rhode Island Board Member Agreement whenever, if required. Just click on the needed develop to acquire or printing the record web template.

Use US Legal Forms, probably the most considerable collection of legal types, in order to save some time and prevent errors. The services delivers skillfully manufactured legal record themes that can be used for an array of purposes. Generate a merchant account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

What are the Rhode Island Continuing Professional Education (CPE) requirements? Rhode Island licensed CPAs must complete at least one hundred twenty (120) hours during each three (3) year renewal cycle. CPAs must certify their compliance on each renewal application.

Does a bill of sale have to be notarized in Rhode Island? No. A vehicle bill of sale for a private party transfer does not need to be notarized.

CPE credit is what you receive for completing Continuing Professional Education (CPE). Certified Public Accountants (CPAs) are required to earn a minimum amount of CPE credits to maintain an active license and remain in good standing with the board.

The National Registry of CPE Sponsors is a program offered by the National Association of State Boards of Accountancy (NASBA) to recognize organizations or individuals who provide continuing professional education (CPE) programs in ance with nationally recognized standards.

What are the AICPA CPE Requirements? AICPA CPAs must complete 120 hours of CPE every 3 years.

What are the RI CPE Requirements? Rhode Island CPAs must complete 120 hours of CPE every 3 years including at least 6 hours in Ethics and no more than 24 hours in Personal Development.

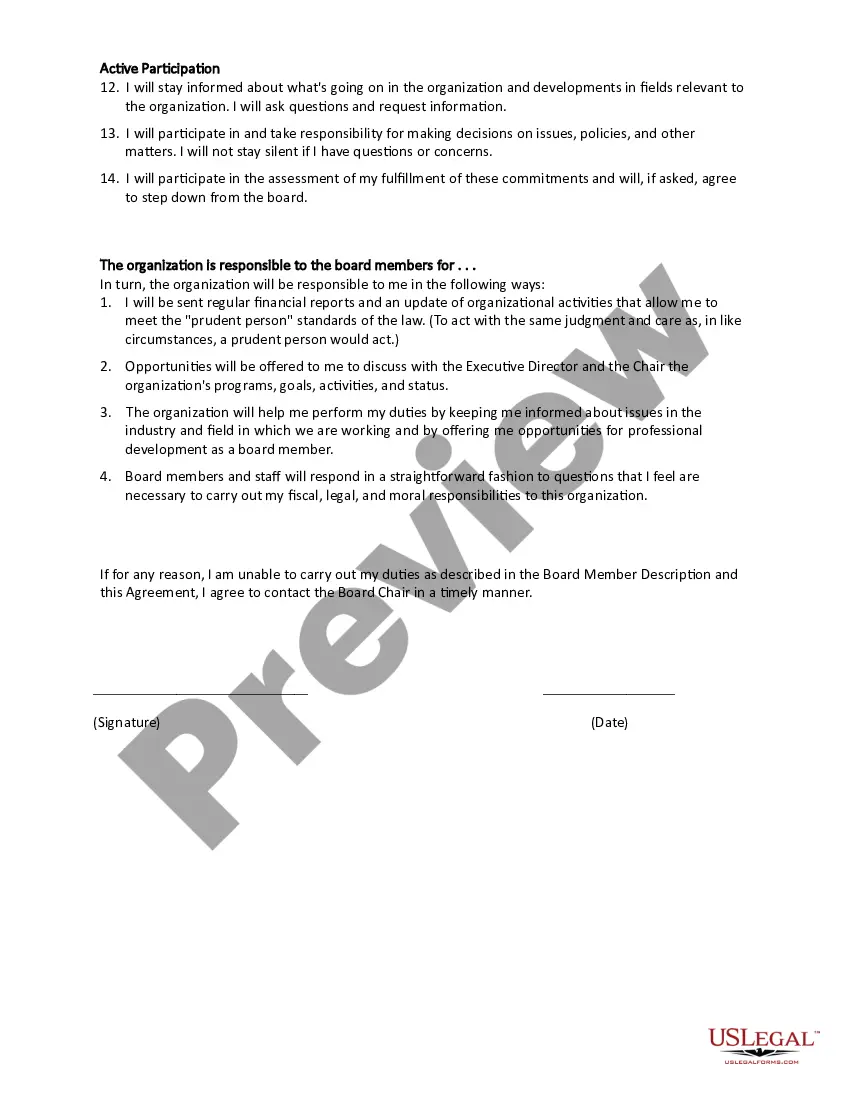

A board member agreement is an internal document that clarifies the obligations, roles and responsibilities of board members, as well as their rights and the company's expectations of them. It also formalises the agreement of the director to abide by these requirements. Table of content hide.

How to start a Rhode Island Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.