Rhode Island Independent Consultant Programming Services General Agreement - User Oriented

Description

How to fill out Independent Consultant Programming Services General Agreement - User Oriented?

If you need to full, download, or printing lawful record web templates, use US Legal Forms, the biggest selection of lawful kinds, that can be found online. Take advantage of the site`s simple and easy convenient search to obtain the files you will need. Different web templates for enterprise and person uses are categorized by classes and suggests, or search phrases. Use US Legal Forms to obtain the Rhode Island Independent Consultant Programming Services General Agreement - User Oriented with a couple of mouse clicks.

If you are previously a US Legal Forms consumer, log in for your account and then click the Acquire button to obtain the Rhode Island Independent Consultant Programming Services General Agreement - User Oriented. You can also accessibility kinds you earlier acquired from the My Forms tab of the account.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for your right area/country.

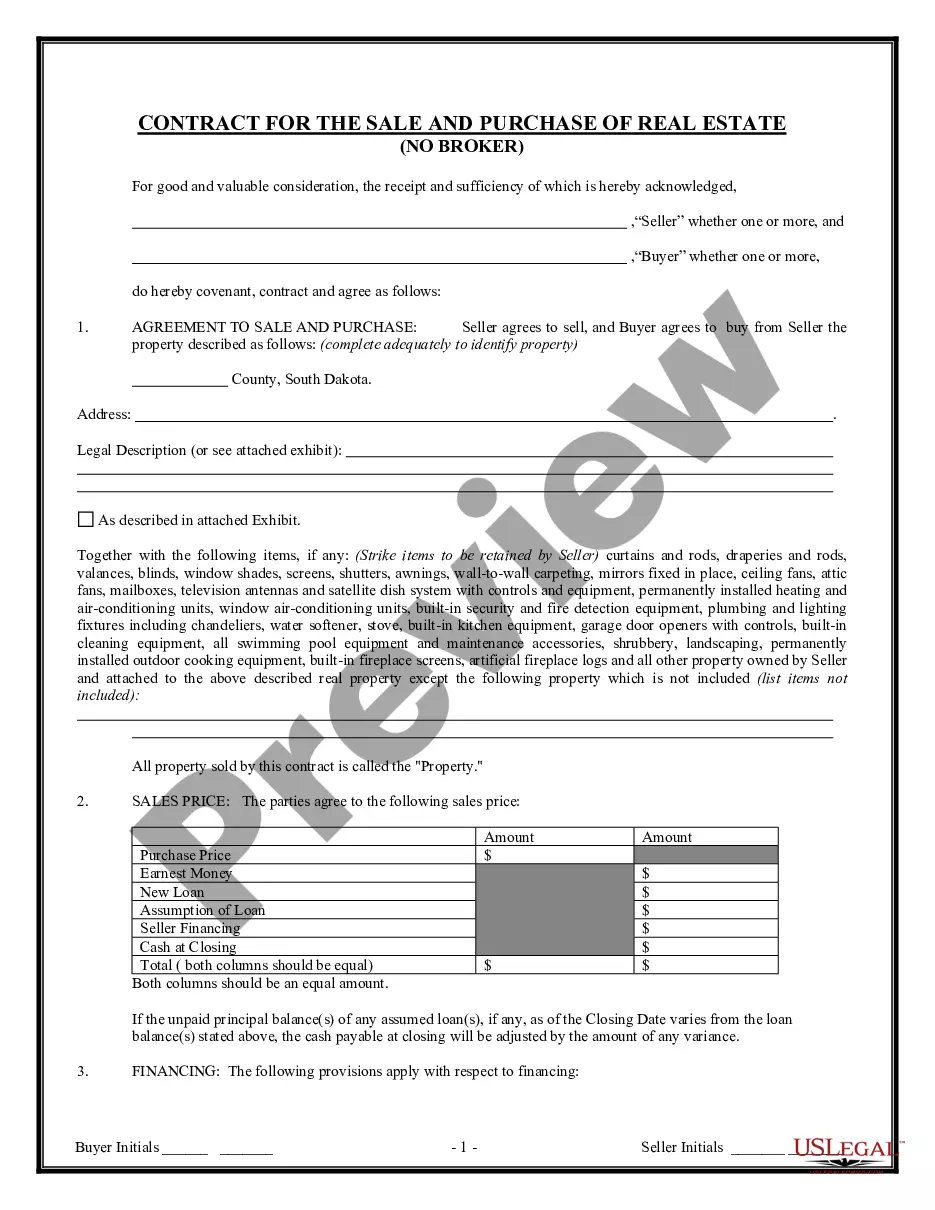

- Step 2. Take advantage of the Review solution to examine the form`s content. Don`t forget about to read the description.

- Step 3. If you are unsatisfied together with the develop, use the Research discipline on top of the display to locate other types of the lawful develop template.

- Step 4. When you have found the shape you will need, go through the Acquire now button. Opt for the pricing strategy you prefer and include your accreditations to register to have an account.

- Step 5. Approach the deal. You can use your charge card or PayPal account to complete the deal.

- Step 6. Choose the formatting of the lawful develop and download it on the product.

- Step 7. Comprehensive, change and printing or indicator the Rhode Island Independent Consultant Programming Services General Agreement - User Oriented.

Each and every lawful record template you buy is yours eternally. You possess acces to each and every develop you acquired inside your acccount. Select the My Forms section and decide on a develop to printing or download once again.

Remain competitive and download, and printing the Rhode Island Independent Consultant Programming Services General Agreement - User Oriented with US Legal Forms. There are many expert and condition-distinct kinds you may use for your enterprise or person needs.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. Independent Contractor Defined | Internal Revenue Service irs.gov ? small-businesses-self-employed ? i... irs.gov ? small-businesses-self-employed ? i...

What are the RI CPE Requirements? Rhode Island CPAs must complete 120 hours of CPE every 3 years including at least 6 hours in Ethics and no more than 24 hours in Personal Development.

What are the AICPA CPE Requirements? AICPA CPAs must complete 120 hours of CPE every 3 years.

CPE credit is what you receive for completing Continuing Professional Education (CPE). Certified Public Accountants (CPAs) are required to earn a minimum amount of CPE credits to maintain an active license and remain in good standing with the board.

The National Registry of CPE Sponsors is a program offered by the National Association of State Boards of Accountancy (NASBA) to recognize organizations or individuals who provide continuing professional education (CPE) programs in ance with nationally recognized standards.

What are the Rhode Island Continuing Professional Education (CPE) requirements? Rhode Island licensed CPAs must complete at least one hundred twenty (120) hours during each three (3) year renewal cycle. CPAs must certify their compliance on each renewal application. Rhode Island Board of Accountancy RI DBR (.gov) ? files ? divisions ? accountancy RI DBR (.gov) ? files ? divisions ? accountancy PDF